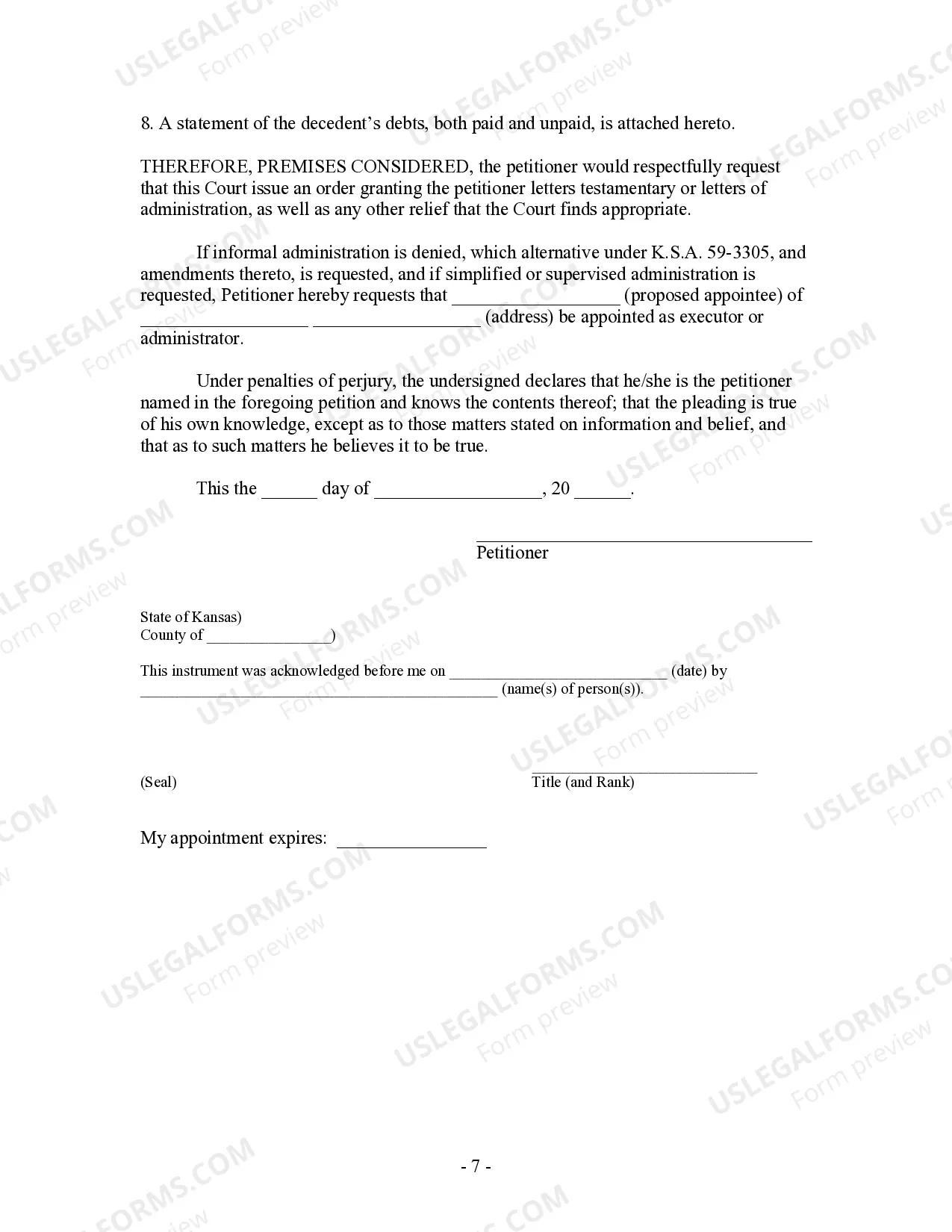

Kansas Summary Administration Package for Small Estates

Description Kansas Probate Forms

How to fill out Kansas Summary Administration Package For Small Estates?

In search of Kansas Summary Administration or Simplified Estate Package for Small Estates sample and completing them could be a problem. To save time, costs and energy, use US Legal Forms and choose the right example specifically for your state in a couple of clicks. Our legal professionals draw up each and every document, so you simply need to fill them out. It truly is so easy.

Log in to your account and come back to the form's page and save the sample. All of your saved samples are kept in My Forms and they are available at all times for further use later. If you haven’t subscribed yet, you have to sign up.

Look at our comprehensive recommendations on how to get your Kansas Summary Administration or Simplified Estate Package for Small Estates form in a couple of minutes:

- To get an eligible example, check out its applicability for your state.

- Take a look at the example using the Preview function (if it’s available).

- If there's a description, read through it to learn the important points.

- Click Buy Now if you found what you're looking for.

- Pick your plan on the pricing page and make an account.

- Pick how you want to pay by way of a credit card or by PayPal.

- Download the form in the preferred file format.

Now you can print the Kansas Summary Administration or Simplified Estate Package for Small Estates template or fill it out using any online editor. Don’t worry about making typos because your template may be used and sent, and published as often as you want. Try out US Legal Forms and get access to around 85,000 state-specific legal and tax files.

Kansas Small Estate Affidavit Statute Form popularity

Kansas Summary Admin Form Other Form Names

FAQ

Visit the appropriate court office. Check the court's limits for the estate's value. Obtain the correct affidavit form. Fill out the affidavit in full. Sign the affidavit. Obtain a death certificate.

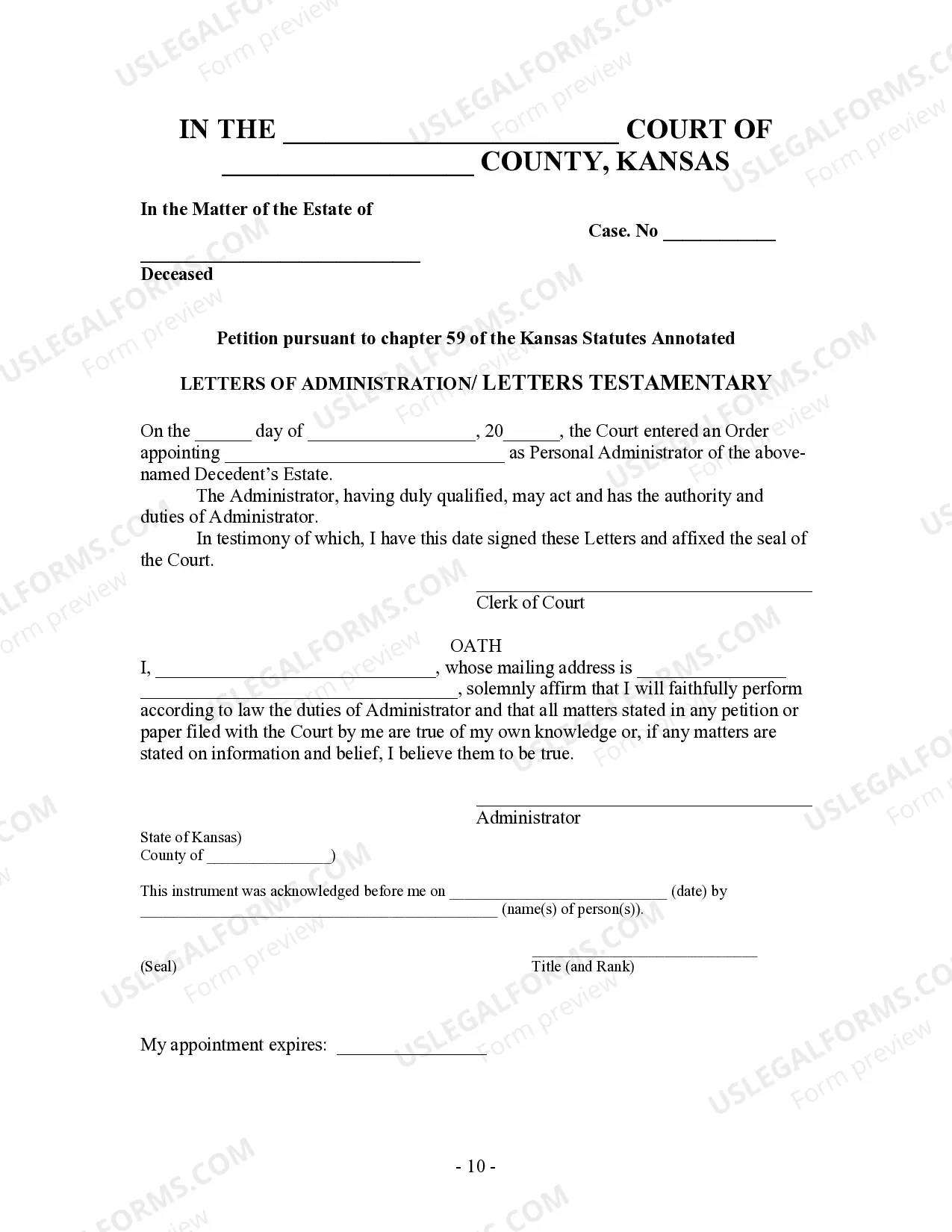

2019 Statute (a) The executor or administrator appointed under the Kansas simplified estates act shall collect the decedent's assets, file an inventory and valuation, pay claims of creditors, and pay taxes owed by the decedent or the decedent's estate in the manner provided by law.

In most states, however, there is the option to use a small estate affidavit when the assets of the estate are under a certain dollar amount, which varies by state. An attorney is not required to file a small estate affidavit, although it may be helpful to consult with one prior to filing the small estate affidavit.

Dying Without a Will in Kansas If there isn't a will, the court then appoints someone, usually an adult child or surviving spouse, to be the executor or personal representative. The executor or personal representative takes care of the decedent's estate.

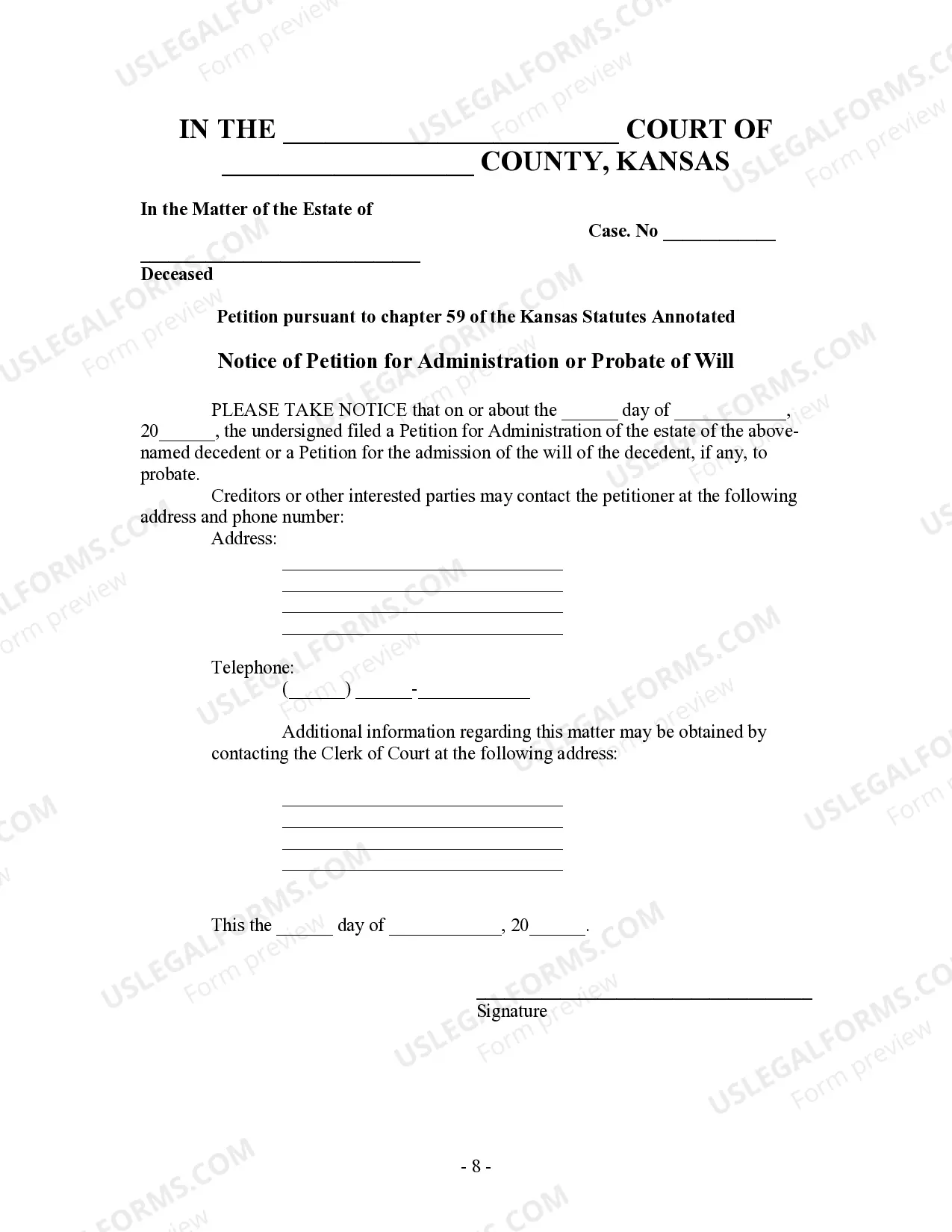

An estate is generally probated in the county where the deceased owned property. If property is located in another state, additional proceedings are sometimes necessary in that state. There is no natural right to inherit property.Kansas law provides for the probating of estates to protect all interested parties.

Small estate administration is a simplified court procedure that is an alternative to the longer probate process. It is available when the person who dies did not own that much in assets. There is often a limit to the value of the property, such as $25,000 or $100,000.

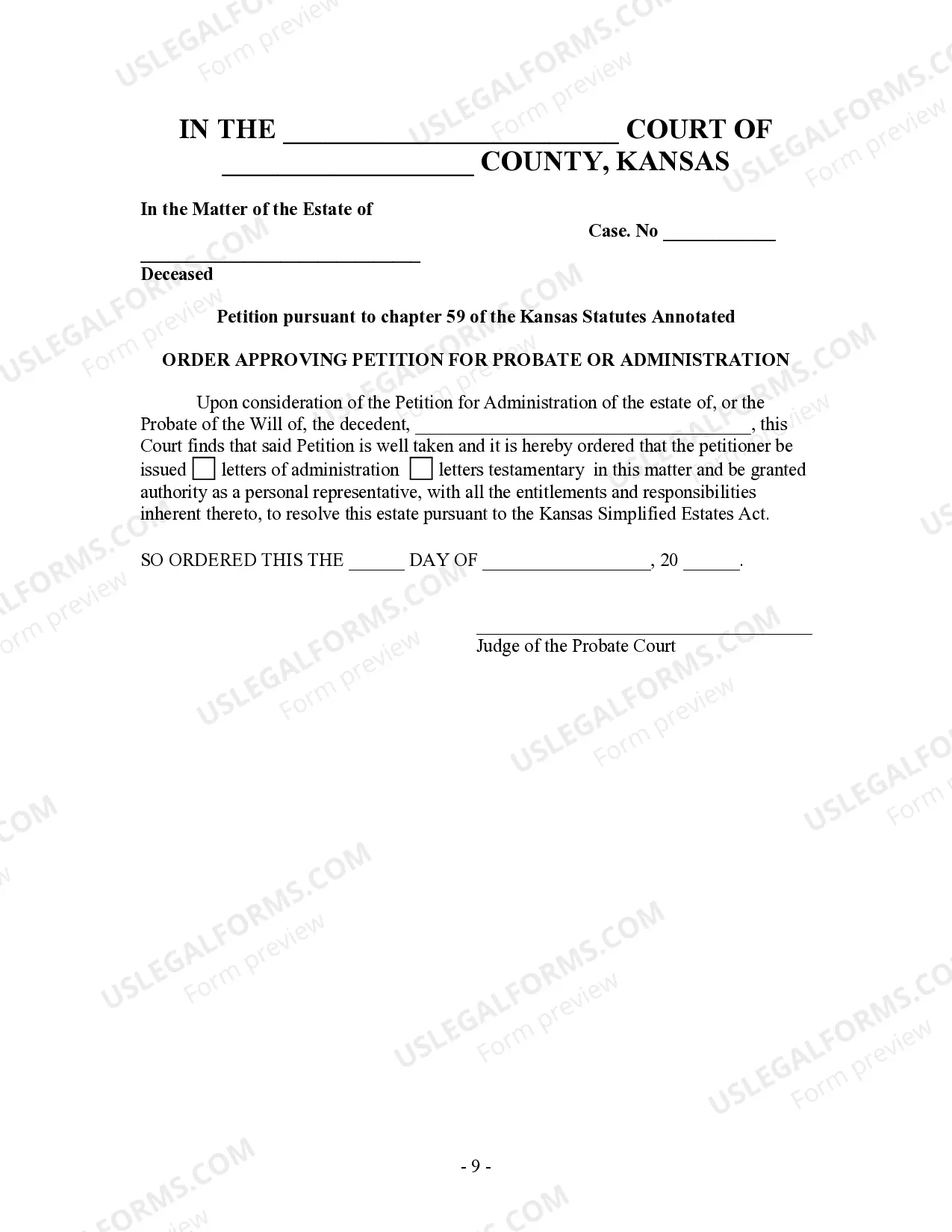

Kansas has a simplified probate process for small estates. To use it, an executor files a written request with the local probate court asking to use the simplified procedure. The court may authorize the executor to distribute the assets without having to jump through the hoops of regular probate.

In Kansas, you can make a living trust to avoid probate for virtually any asset you ownreal estate, bank accounts, vehicles, and so on. You need to create a trust document (it's similar to a will), naming someone to take over as trustee after your death (called a successor trustee).

When you use a small estate affidavit , you have to pay the decedent's bills before paying money to anyone else. For example, the decedent might have owed money to a credit card company when they died. If you use the small estate affidavit, you must give money from the estate to pay the credit card company.