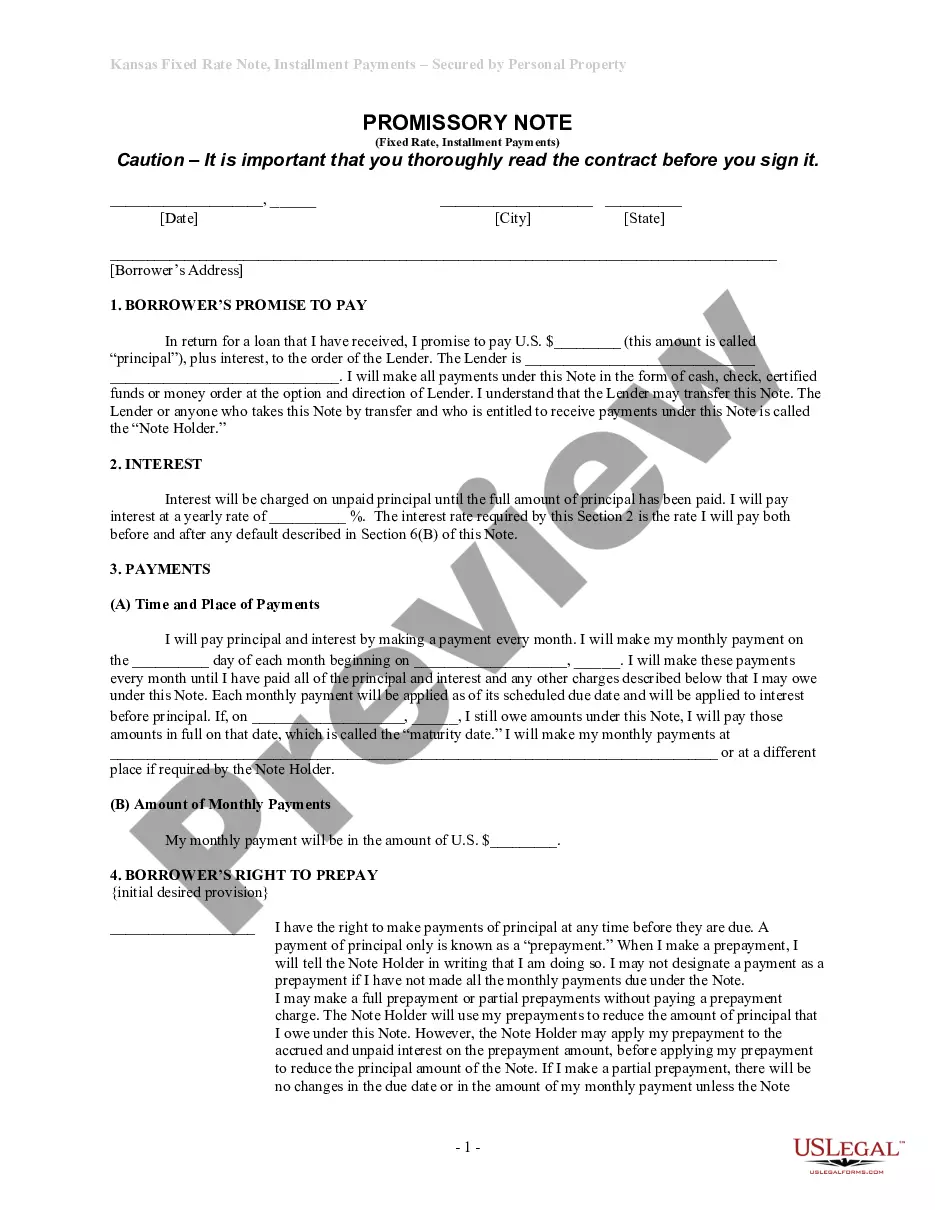

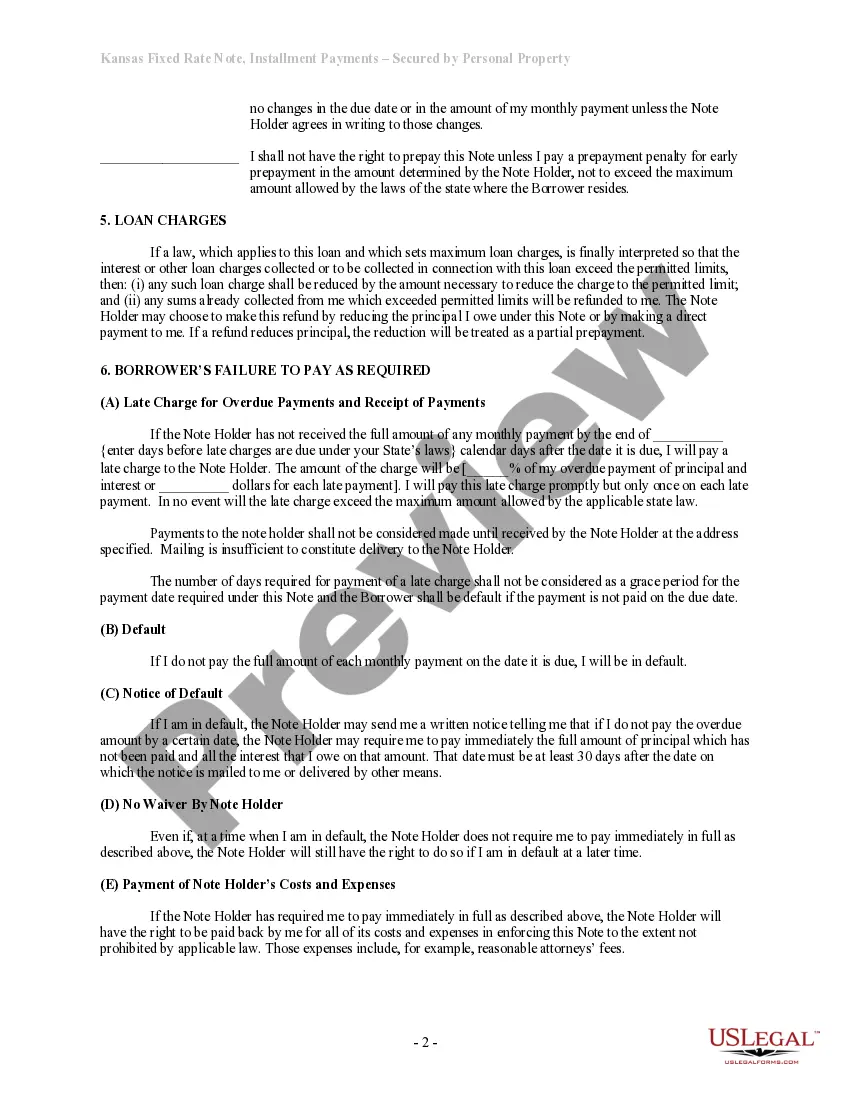

Kansas Installments Fixed Rate Promissory Note Secured by Personal Property

Description Promissory Note Personal

How to fill out Kansas Note Editable?

Trying to find Kansas Installments Fixed Rate Promissory Note Secured by Personal Property sample and completing them might be a problem. To save time, costs and energy, use US Legal Forms and find the right example specially for your state in a few clicks. Our legal professionals draft all documents, so you just need to fill them out. It really is so simple.

Log in to your account and return to the form's page and download the sample. All your saved samples are kept in My Forms and are available at all times for further use later. If you haven’t subscribed yet, you need to register.

Look at our thorough instructions regarding how to get the Kansas Installments Fixed Rate Promissory Note Secured by Personal Property form in a couple of minutes:

- To get an entitled form, check out its applicability for your state.

- Look at the sample utilizing the Preview function (if it’s accessible).

- If there's a description, read through it to understand the details.

- Click Buy Now if you found what you're seeking.

- Select your plan on the pricing page and make an account.

- Select you would like to pay by way of a card or by PayPal.

- Download the file in the favored file format.

Now you can print out the Kansas Installments Fixed Rate Promissory Note Secured by Personal Property form or fill it out making use of any web-based editor. Don’t concern yourself with making typos because your template may be utilized and sent, and printed as many times as you want. Check out US Legal Forms and get access to over 85,000 state-specific legal and tax documents.

Installments Promissory Note Form popularity

Kansas Note Personal Other Form Names

Kansas Rate Note FAQ

Although a promissory note is usually written on a computer and printed out or a pre-made form is filled out, a handwritten promissory note signed by both parties is legal and will stand up in court.

Small businesses frequently borrow money, or extend credit, in the course of their operations. A promissory note is the document that sets forth the terms of a loan's repayment. A promissory note can be secured with a pledge of collateral, which is something of value that can be seized if a borrower defaults.

You can use a template or create a promissory note online. But before you begin, you'll need to gather some information and make decisions about the way the loan will be structured. First, you'll need the names and addresses of both the lender (or "payee") and the borrower.

In general, the promissory note is your written promise to repay the loan and a security agreement is used when collateral is given for the loan.

Types of Property that can be used as collateral. Speak to them in person. Draft a Demand / Notice Letter. Write and send a Follow Up Letter. Enlisting a Professional Collection Agency. Filing a petition or complaint in court. Selling the Promissory Note. Final Tips.

Secured or unsecured? Generally, promissory notes are unsecured which means it is more like a formal IOU. However, lenders can request some security for the loan. For personal secured promissory notes, a house or car is often used as collateral.

To write a promissory note for a personal loan, you will need to include the names of both parties, the principal balance, the APR, and any fees that are part of the agreement. The promissory note should also clearly explain what will happen if the borrower pays late or does not pay the loan back at all.

In general, under the Securities Acts, promissory notes are defined as securities, but notes with a maturity of 9 months or less are not securities.The US Supreme Court in Reves recognizes that most notes are, in fact, not securities.

Promissory notes are a valuable legal tool that any individual can use to legally bind another individual to an agreement for purchasing goods or borrowing money. A well-executed promissory note has the full effect of law behind it and is legally binding on both parties.