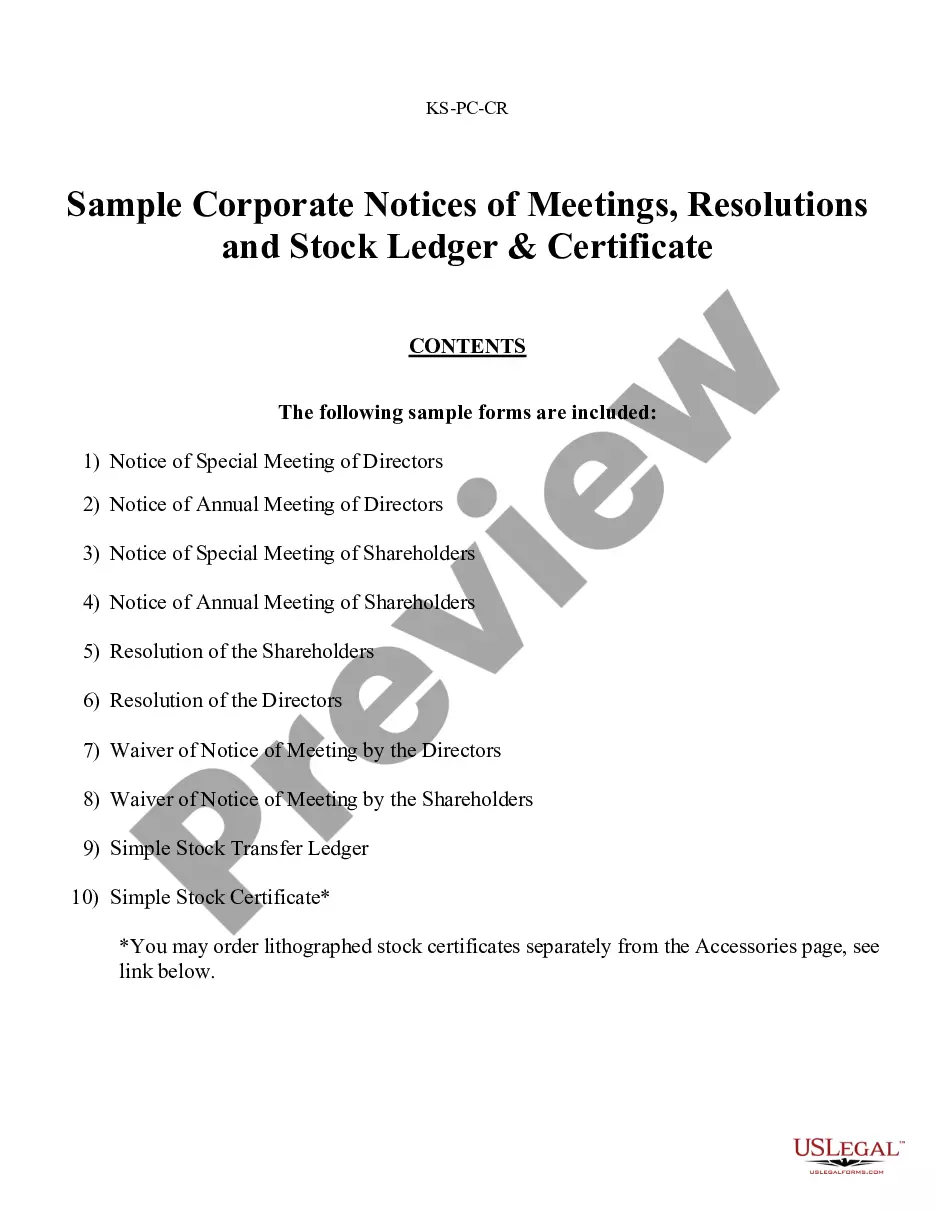

Sample Corporate Records for a Kansas Professional Corporation

Description

How to fill out Sample Corporate Records For A Kansas Professional Corporation?

Trying to find Sample Corporate Records for a Kansas Professional Corporation templates and completing them might be a challenge. To save time, costs and effort, use US Legal Forms and find the right template specifically for your state in a few clicks. Our legal professionals draft every document, so you just need to fill them out. It really is so simple.

Log in to your account and come back to the form's page and download the document. Your saved examples are stored in My Forms and therefore are accessible at all times for further use later. If you haven’t subscribed yet, you need to sign up.

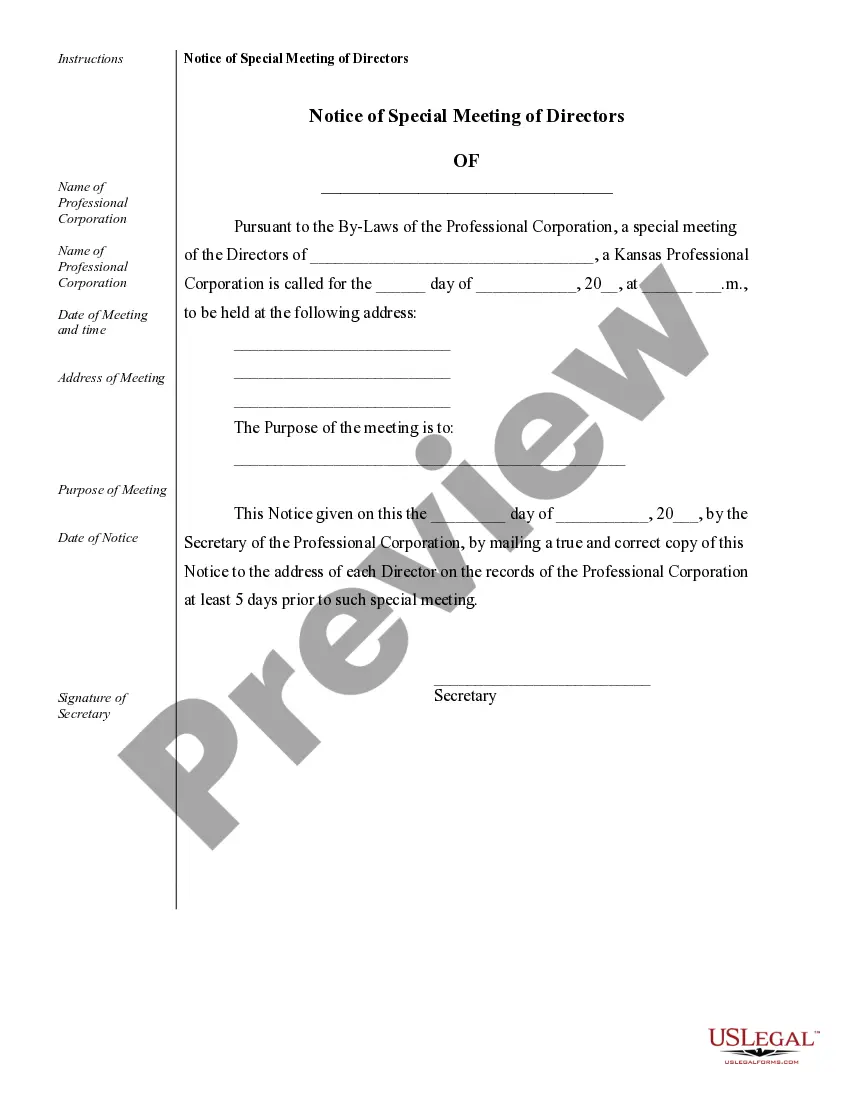

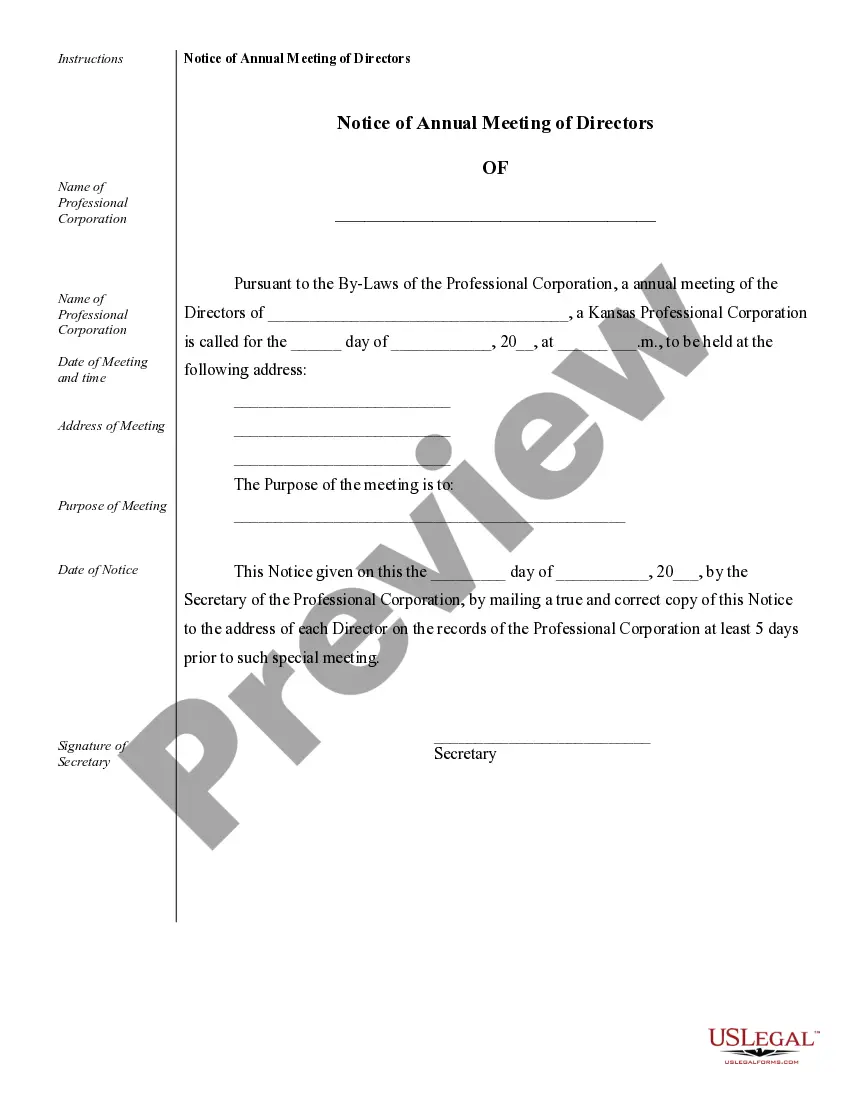

Check out our thorough instructions regarding how to get your Sample Corporate Records for a Kansas Professional Corporation sample in a few minutes:

- To get an qualified example, check its validity for your state.

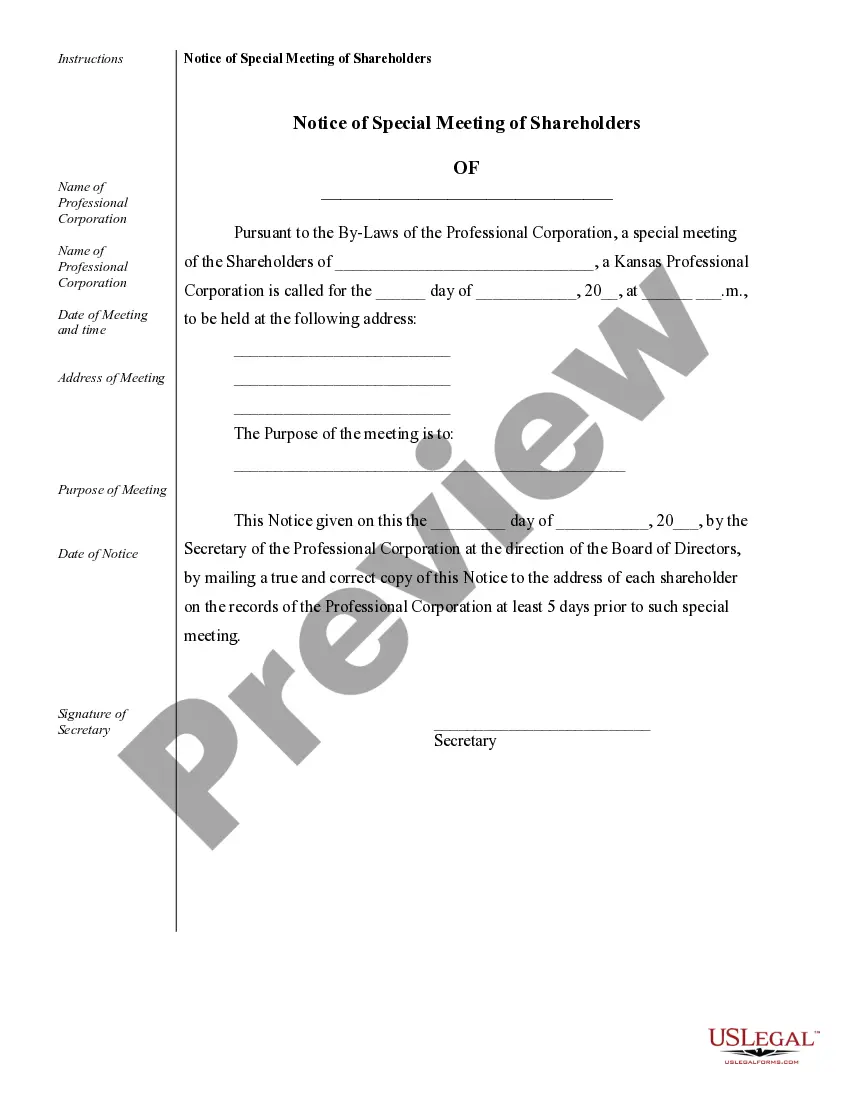

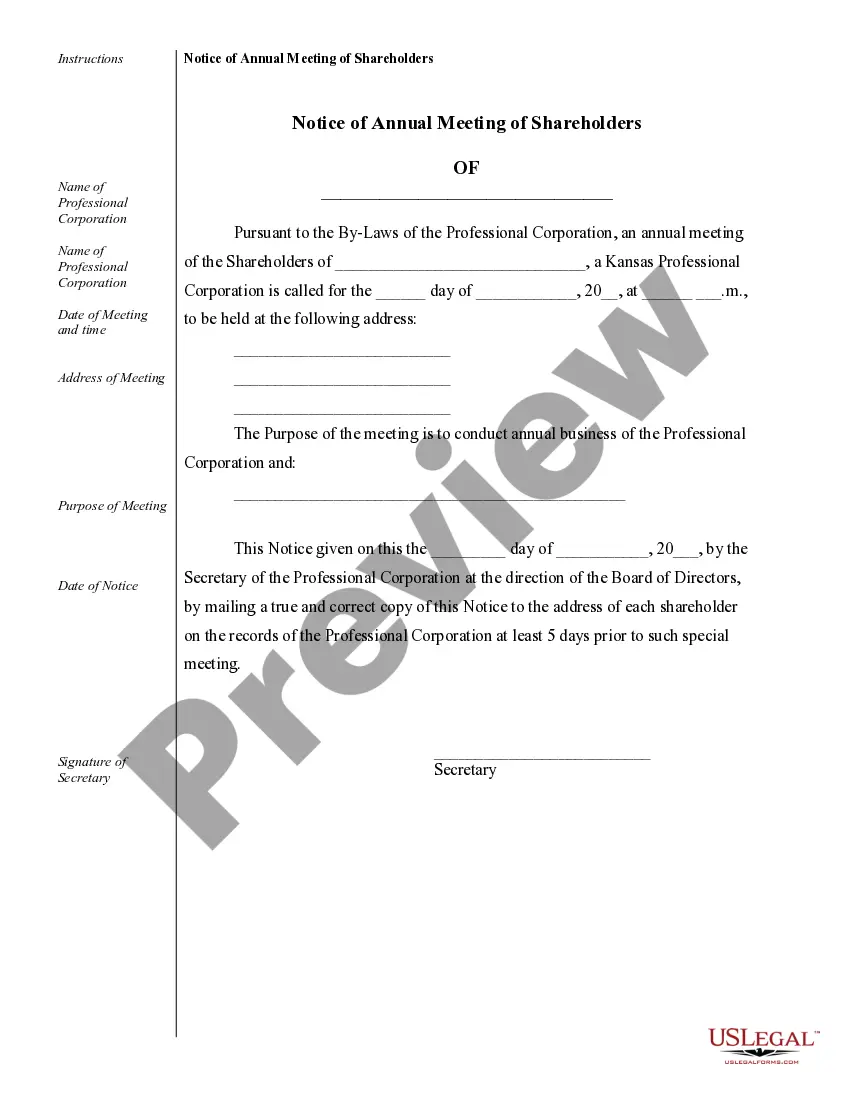

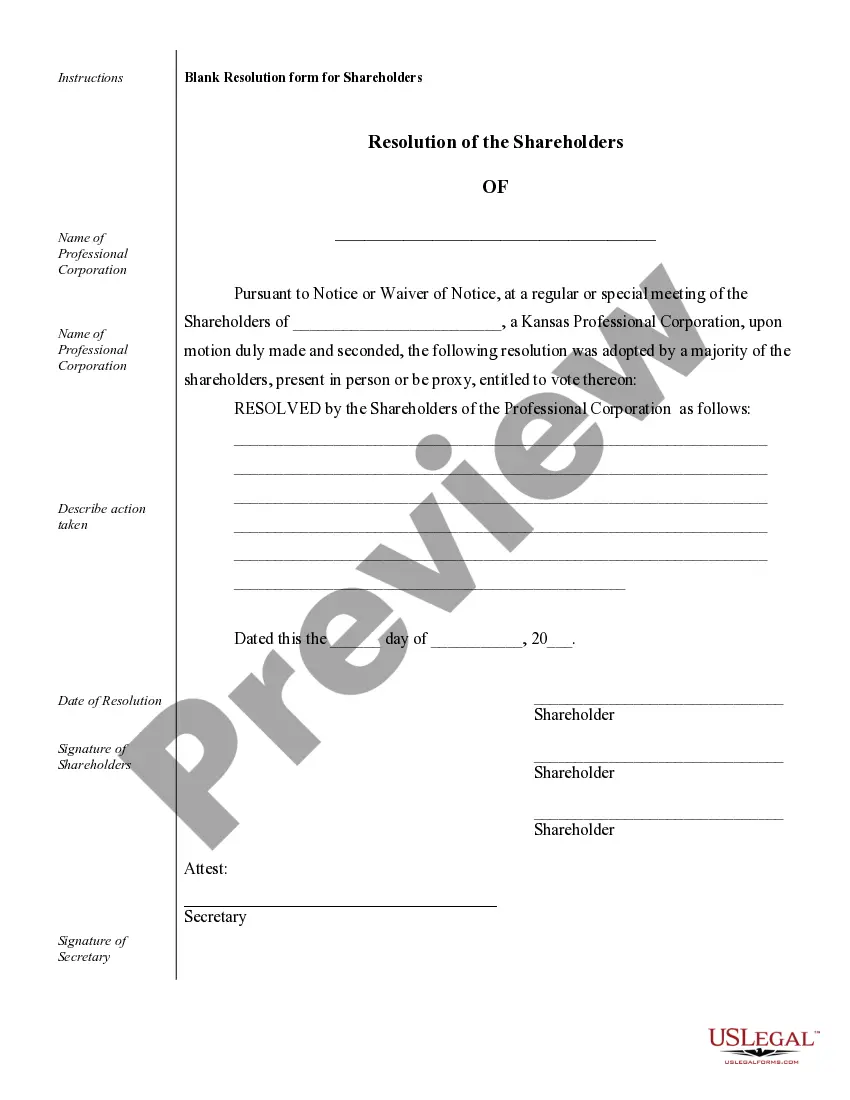

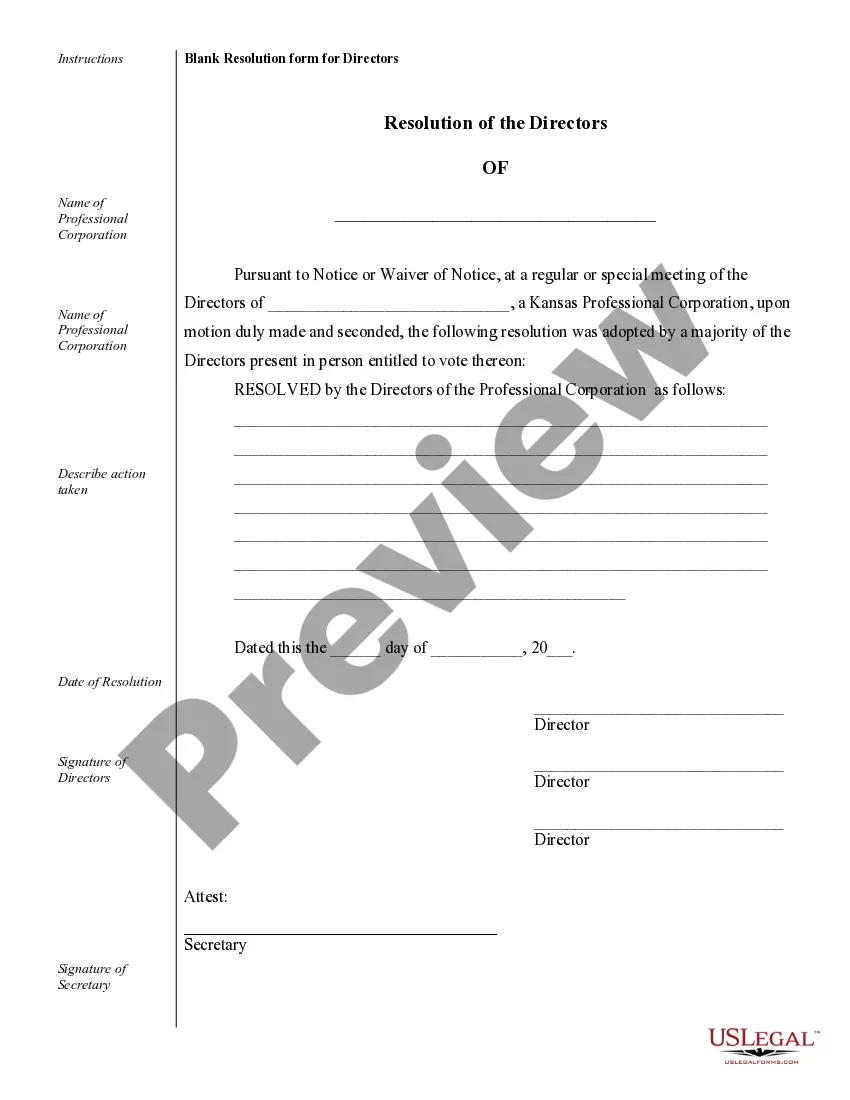

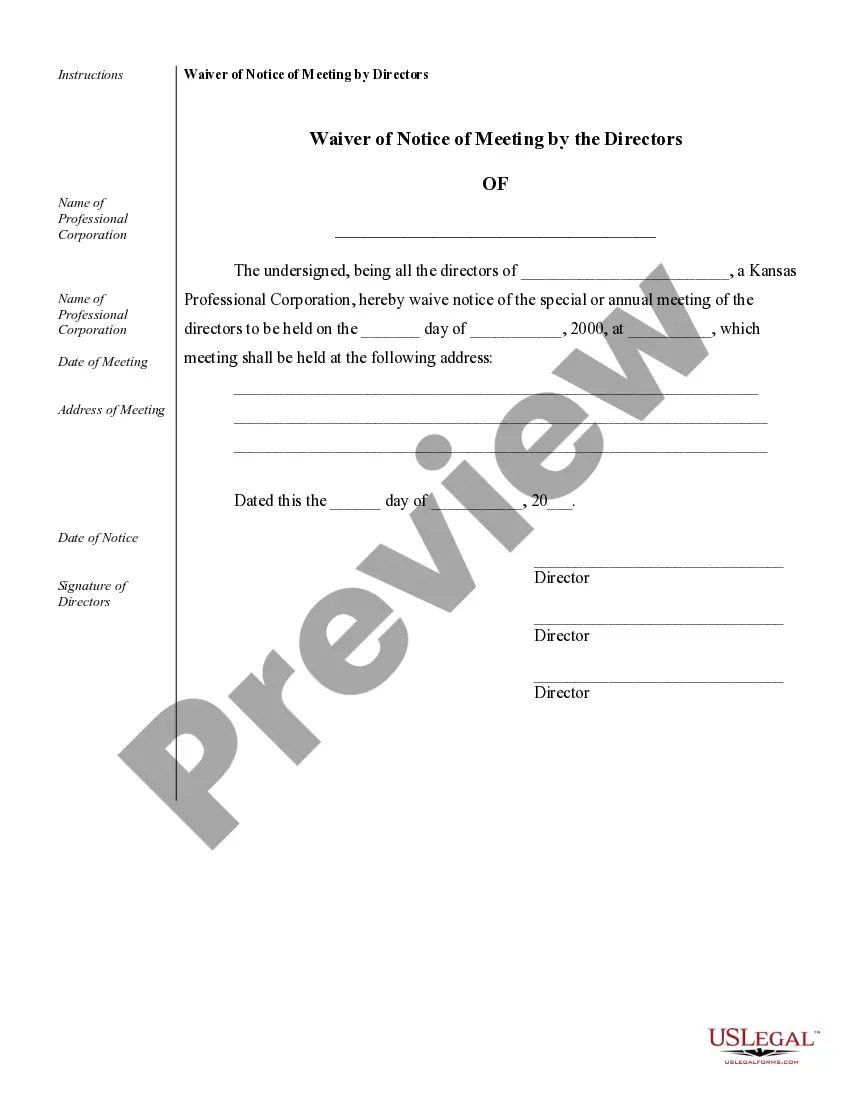

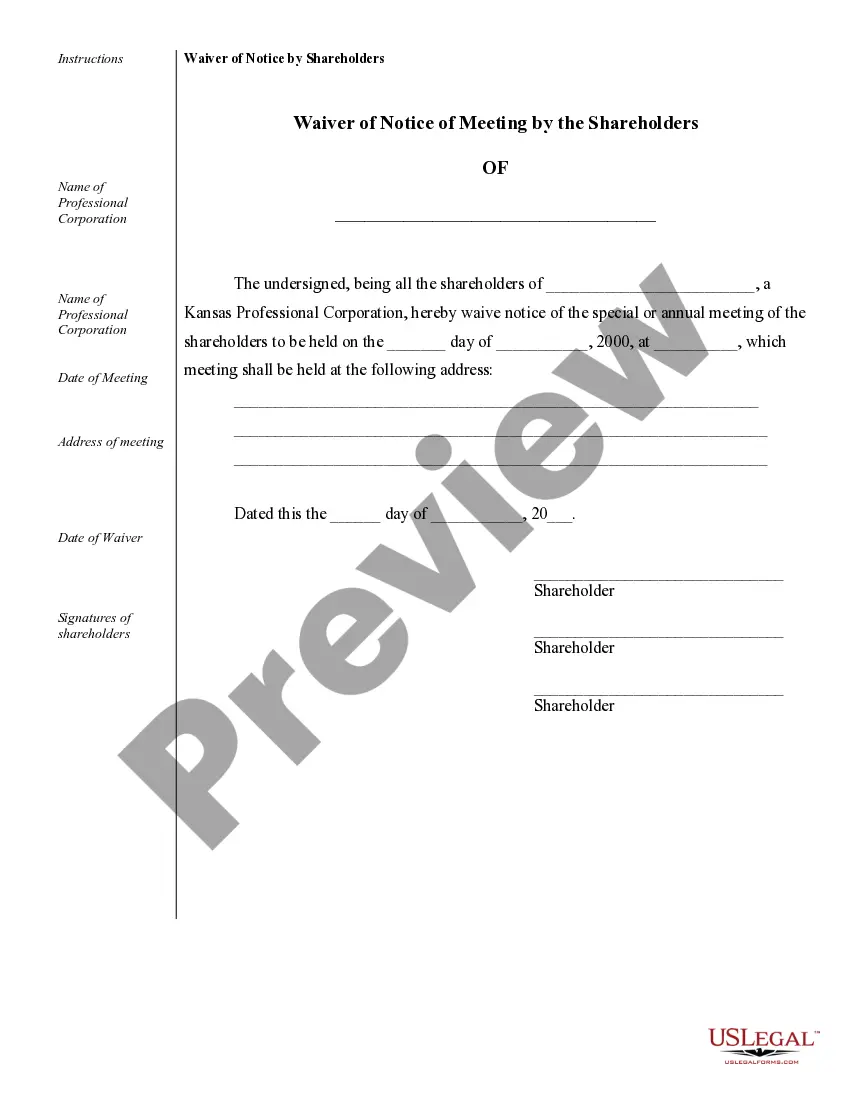

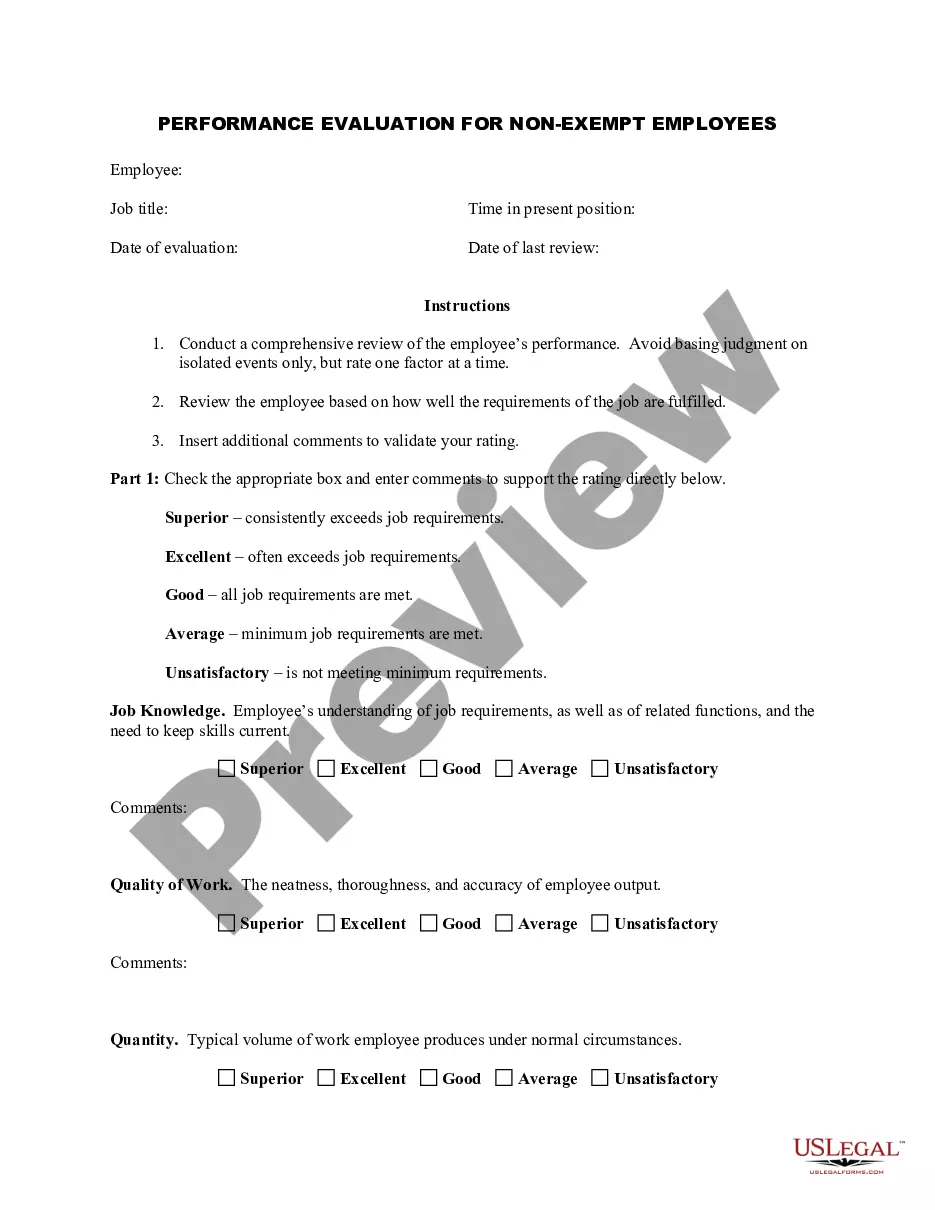

- Have a look at the example using the Preview function (if it’s available).

- If there's a description, read through it to know the specifics.

- Click Buy Now if you identified what you're searching for.

- Select your plan on the pricing page and create an account.

- Pick how you want to pay out with a card or by PayPal.

- Download the sample in the preferred file format.

You can print the Sample Corporate Records for a Kansas Professional Corporation form or fill it out using any web-based editor. Don’t worry about making typos because your form can be employed and sent, and published as many times as you want. Check out US Legal Forms and get access to around 85,000 state-specific legal and tax files.

Form popularity

FAQ

Professional corporations or professional service corporation (abbreviated as PC or PSC) are those corporate entities for which many corporation statutes make special provision, regulating the use of the corporate form by licensed professionals such as attorneys, architects, engineers, public accountants and physicians

Professional Associations and Professional Corporations Thus, most professional associations are, in-fact, merely professional corporations.S Corps are pass-through entities, meaning that owners need not pay corporate taxes, and instead can claim business profits/losses on their individual tax returns.

Qualifications to Elect S Corporation Status It must be a domestic (U.S.) corporation, with no foreign investors; It must have no more than 100 shareholders; It has only one class of stock; It must use a December 31 year-end.

Usually, the individuals who form and administer the affairs of the PA must be qualified professionals in the profession in which the association is operating. A PA is an independent legal entity which continues to exist for decades after its creation.

Professional corporationslike traditional corporationscan take two forms: S Corps or C Corps.However, owners typically have the option to elect for S Corp status by completing and submitting IRS form 2553: Election by a Small Business Corporation.

A professional corporation is a variation of the corporate form available to entrepreneurs who provide professional servicessuch as doctors, lawyers, accountants, consultants, and architects.In a professional corporation, the owners perform services for the business as employees.

Rule -1A(d) expressly authorizes a professional corporation actually and actively engaged in the practice of law to hold shares of stock in another professional corporation covered by this rule.

A professional corporation can be either a regular C corporation that is a separate taxpaying entity that files its own tax returns and pays taxes at corporate tax rates, or it can elect to be taxed as an S corporation in which profits or losses are passed through the corporation to be taxed on the shareholders'

A professional corporation is one that only performs services in one, single profession. It is a specific type of corporation for professionals like doctors, lawyers, accountants, etc. The professional is able to form a corporation, but the professional remains liable for his or her own actions.