Satisfaction, Release or Cancellation of Mortgage by Individual

Assignments Generally: Lenders, or holders of mortgages or deeds of trust, often assign mortgages or deeds of trust to other lenders, or third parties. When this is done the assignee (person who received the assignment) steps into the place of the original lender or assignor. To effectuate an assignment, the general rules is that the assignment must be in proper written format and recorded to provide notice of the assignment.

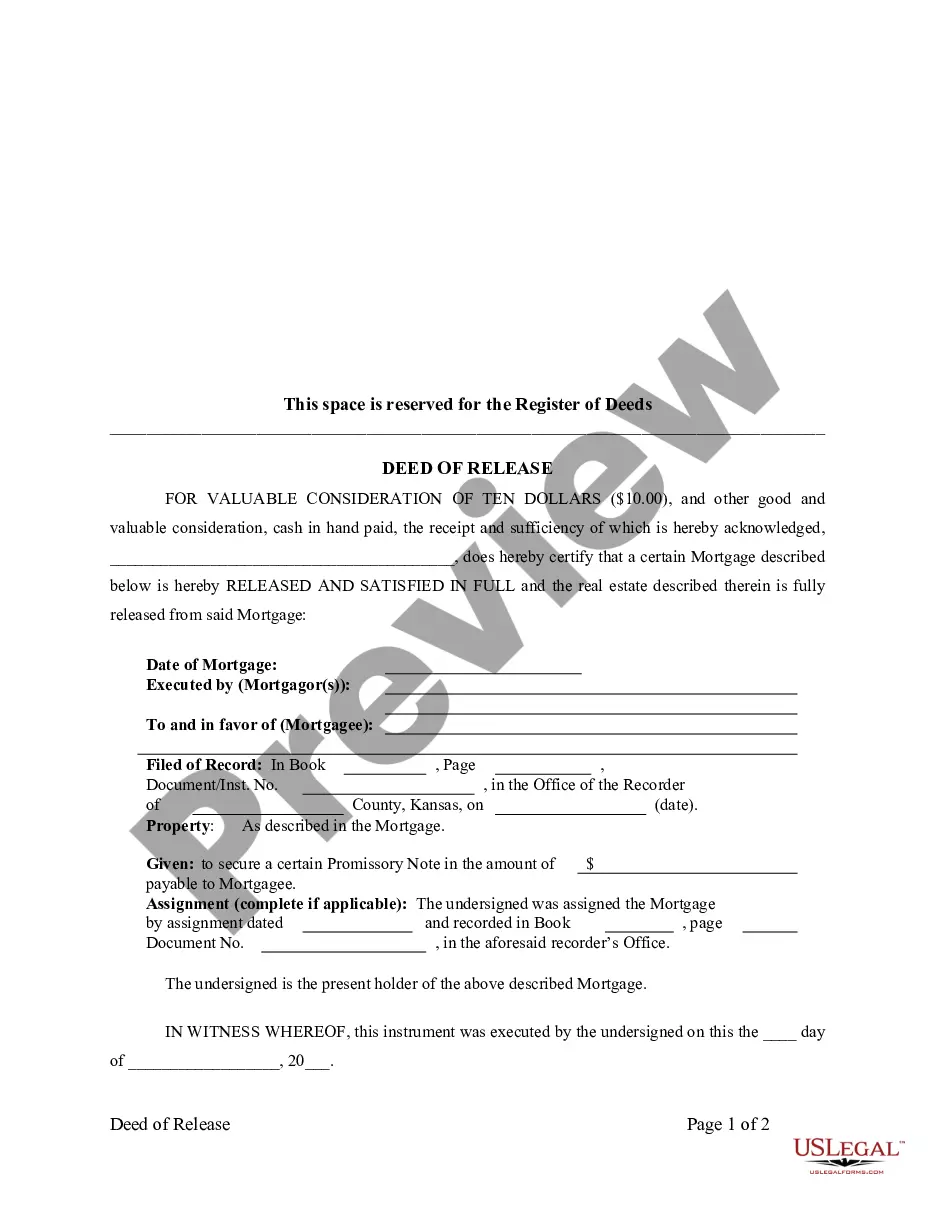

Satisfactions Generally: Once a mortgage or deed of trust is paid, the holder of the mortgage is required to satisfy the mortgage or deed of trust of record to show that the mortgage or deed of trust is no longer a lien on the property. The general rule is that the satisfaction must be in proper written format and recorded to provide notice of the satisfaction. If the lender fails to record a satisfaction within set time limits, the lender may be responsible for damages set by statute for failure to timely cancel the lien. Depending on your state, a satisfaction may be called a Satisfaction, Cancellation, or Reconveyance. Some states still recognize marginal satisfaction but this is slowly being phased out. A marginal satisfaction is where the holder of the mortgage physically goes to the recording office and enters a satisfaction on the face of the the recorded mortgage, which is attested by the clerk.

Kansas Law

Execution of Assignment or Satisfaction: Must be signed by the mortgagee.

Assignment: An assignment must be in writing and recorded.

Demand to Satisfy: Upon full payoff, mortgagor may make written demand by certified or registered mail requesting mortgagee to record satisfaction of mortgage, whereupon mortgagee has 20 days to comply or face liability.

Recording Satisfaction: Any mortgage of real property that has been or may hereafter be recorded shall be assigned or discharged by an instrument acknowledging the assignment or satisfaction of such mortgage, signed by the mortgagee, and duly acknowledged and certified as other instruments affecting real estate.

Marginal Satisfaction: Not allowed- Satisfaction must be by separate instrument.

Penalty: If mortgagee fails to have mortgage satisfied of record within 20 days of receipt of demand therefore, mortgagee shall be liable in damages to the person for whom the demand was made in the sum of $500, together with a reasonable attorney's fee for preparing and prosecuting the action. The plaintiff in such action may recover any additional damages that the evidence in the case warrants.

Acknowledgment: An assignment or satisfaction must contain a proper Kansas acknowledgment, or other acknowledgment approved by Statute.

Kansas Statutes

58-2306. Discharge or assignment of recorded mortgage; procedure.

(a) Except as otherwise provided by this section, any mortgage of real property that has been or may hereafter be recorded shall be assigned or discharged by an instrument acknowledging the assignment or satisfaction of such mortgage, signed by the mortgagee or such mortgagee's duly authorized attorney in fact, assignee of record, personal representative or by the lender or a designated closing agent acting as a closing agent in the sale, financing or refinancing of the real estate subject to such mortgage who has caused the indebtedness to be paid in full upon compliance with K.S.A. 58-2309a, and amendments thereto, and duly acknowledged and certified as other instruments affecting real estate. Such instrument shall contain the name of the mortgagor and mortgagee, a legal description of the property and the volume and page in which the mortgage is recorded.

(b) Where the mortgagee or assignee of record is deceased, and where the estate of such deceased mortgagee or assignee of record is in process of administration, in this or any other state, an assignment or a full release of such mortgage may be made by the executor or administrator without any showing as to the provisions of the will of the deceased, but there must accompany such assignment or release, as a part thereof, a certificate from a court of competent jurisdiction appointing such executor or administrator, under the hand of its proper officer, and attested by its seal, certifying as to such appointment, and that such executor or administrator is, at the date of such assignment or release, still so acting under the authority of such court. Such certificate shall not be required when the executor or administrator is acting under appointment of the district court of the county where the real estate mortgaged is located. Where the estate of such deceased has not been administered upon, or where the estate of such deceased has been administered and settled and the executor or administrator discharged, such assignment or release may be made by the heirs at law or legatee of such deceased mortgagee or assignee, and competent evidence must be furnished by them of the fact.

(c) Where the mortgagee or assignee of record is a firm or partnership, such mortgage shall be assigned or discharged by an instrument acknowledging the assignment or satisfaction of such mortgage as hereinbefore provided. Such instrument shall be signed either by each member of the firm or partnership, or by the firm or partnership, or by the firm or partnership by one of the members thereof.

(d) Any mortgage which, prior to July 1, 1977, has been released by a notation on the original mortgage instrument and signed by the mortgagee or the mortgagee's duly authorized attorney in fact, assignee of record or personal representative may be recorded in the office of the register of deeds of the county where the mortgaged property is located. When recorded, such release shall have the same force and effect as mortgages discharged in accordance with subsection (a).

58-2308. Discharge or assignment of mortgage to be recorded at length.

Every such instrument, and the proof or acknowledgment thereof, shall be recorded at full length by the register of deeds, and a reference shall be made to the book and page containing such record or to the microphotograph number in the general or numerical indexes under the notation that such mortgage has been assigned or satisfied.

58-2309a. Entry of satisfaction of mortgage; duties and liability of mortgagee or assignee of mortgage; entry of satisfaction of mortgage by lender or closing agent, when.

(a) When the indebtedness secured by a recorded mortgage is paid and there is no agreement for the making of future advances to be secured by the mortgage, the mortgagee or the mortgagee's assignee shall enter satisfaction or cause satisfaction of such mortgage to be entered of record forthwith, paying the required fee. The fee may be collected from the mortgagor pursuant to K.S.A. 16-207, and amendments thereto, except that the failure of the mortgagor to pay such fee shall not relieve the mortgagee or the mortgagee's assignee from entering satisfaction of such mortgage in compliance with the provisions of this section. In the event the mortgagee or the mortgagee's assignee fails to enter satisfaction or cause satisfaction of such mortgage to be entered within 20 days after written demand by certified or registered mail, the lender or a designated closing agent acting as a closing agent in the sale, financing or refinancing of the real estate subject to such mortgage, who upon reliance of written payoff information provided by the mortgagee, and which payoff information shall be deemed as the correct and full amount due and owing under such mortgage, has caused the indebtedness to be paid in full may cause satisfaction of the mortgage to be entered. If in fact the mortgagee or mortgagee's assignee was not paid in accordance with the aforesaid payoff information when the mortgage was released the lender or the closing agent in the sale, financing or refinancing of the real estate subject to such mortgage who signed the false release shall be liable in damages to the mortgagee or mortgagee's assignee for the entire indebtedness together with interest thereon, attorney fees, and any additional damages that the mortgagee or mortgagee's assignee has incurred. Upon recording of such satisfaction by the lender or closing agent in the sale, financing or refinancing of the real estate subject to such mortgage, who has caused the indebtedness to be paid in full, such mortgage shall be deemed fully released as if discharged by the mortgagee or mortgagee's assignee.

(b) When a mortgage is recorded covering real estate in which the mortgagor has no interest, the mortgagee or the mortgagee's assignee shall enter satisfaction or cause satisfaction of such mortgage to be entered of record, paying the required fee without charge to the mortgagor or the mortgagor's assigns.

(c) The following persons may make demand upon a mortgagee or assignee of a mortgagee for the entering of satisfaction of the mortgage, as provided for in subsections (a) and (b):

(1) A mortgagor, a mortgagor's heirs or assigns or anyone acting for such mortgagor, heirs or assigns;

(2) an owner of real estate upon which a mortgage has been recorded by someone having no interest in the real estate; or

(3) a lender or designated closing agent acting as a closing agent in the sale, financing or refinancing of the real estate subject to such mortgage.

(d) Any mortgagee or assignee of a mortgagee who refuses or neglects to enter satisfaction of such mortgage within 20 days after demand has been made as provided in subsection (c) shall be liable in damages to the person for whom the demand was made in the sum of $500, together with a reasonable attorney's fee for preparing and prosecuting the action. The plaintiff in such action may recover any additional damages that the evidence in the case warrants. Civil actions may be brought under this act before any court of competent jurisdiction, and attachments may be had as in other cases.

(e) The mortgagee or assignee of a mortgagee entering satisfaction or causing to be entered satisfaction of a mortgage under the provisions of subsection (a) shall furnish to the office of the register of deeds the full name and last known post office address of the mortgagor or the mortgagor's assignee. The register of deeds shall forward such information to the county clerk who shall make any necessary changes in address records for mailing tax statements.

58-2318. Execution of assignments and releases of mortgages by corporations.

All assignments and releases of mortgages by a corporation shall be valid when executed by the president, vice-president, secretary, cashier, treasurer or any other officer of such corporation so authorized by corporate resolution. Any assignment or release of a mortgage by a corporation which was executed on or after March 8, 1974, and prior to the effective date of this act, by one of the corporate officers designated herein, with or without attestation by the corporate seal, is hereby declared to be a legal and valid act of such corporation.