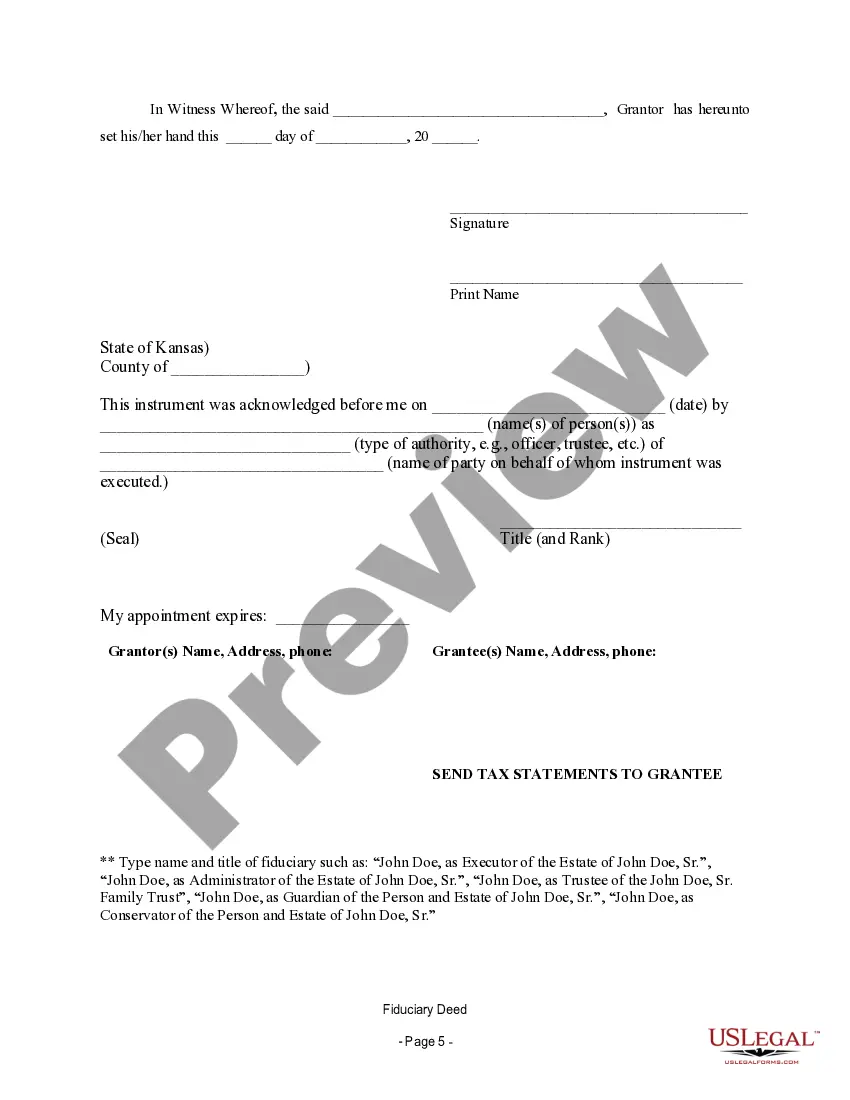

Kansas Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators and other Fiduciaries

Description Trust Executor Vs Trustee

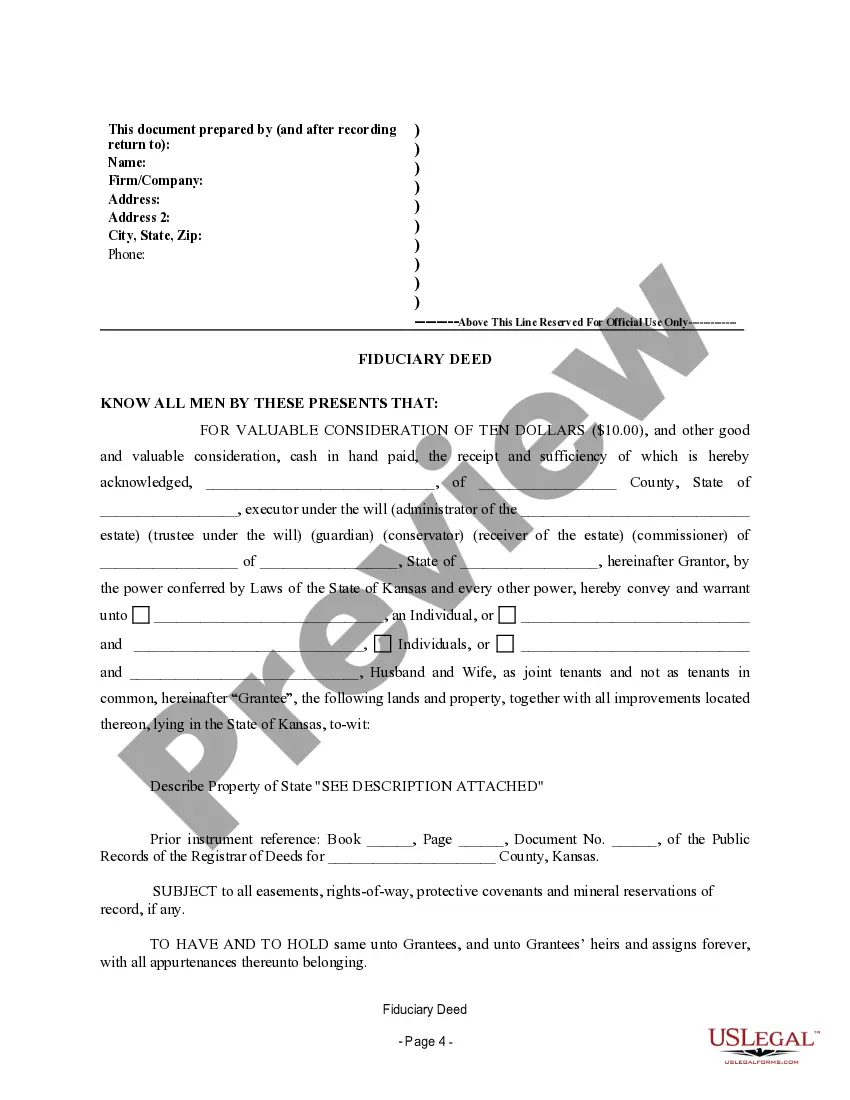

How to fill out Kansas Fiduciary Deed For Use By Executors, Trustees, Trustors, Administrators And Other Fiduciaries?

Among numerous free and paid examples that you find on the net, you can't be certain about their accuracy and reliability. For example, who created them or if they’re qualified enough to take care of what you require these to. Keep calm and make use of US Legal Forms! Locate Kansas Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators and other Fiduciaries samples made by professional legal representatives and avoid the high-priced and time-consuming process of looking for an lawyer or attorney and then paying them to write a document for you that you can easily find on your own.

If you have a subscription, log in to your account and find the Download button next to the form you are searching for. You'll also be able to access all your earlier acquired samples in the My Forms menu.

If you’re using our platform the very first time, follow the guidelines below to get your Kansas Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators and other Fiduciaries with ease:

- Make sure that the document you see applies in your state.

- Look at the template by reading the description for using the Preview function.

- Click Buy Now to begin the purchasing process or find another template using the Search field found in the header.

- Choose a pricing plan and create an account.

- Pay for the subscription using your credit/debit/debit/credit card or Paypal.

- Download the form in the wanted format.

When you’ve signed up and bought your subscription, you can use your Kansas Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators and other Fiduciaries as often as you need or for as long as it stays active in your state. Revise it with your favored editor, fill it out, sign it, and create a hard copy of it. Do much more for less with US Legal Forms!

Trustors Deed Form popularity

Executor's Deed Other Form Names

FAQ

(c) The Mortgagor has paid off all the dues of the Mortgagee under the said Deed in full and the Mortgage debt stands satisfied in full. (d) In the circumstances, the Mortgagor has requested the Mortgagee to execute the reconveyance of Mortgaged property to which the Mortgagee has agreed as appearing hereinafter.

A deed of reconveyance refers to a document that transfers the title of a property to the borrower from the bank or mortgage holder once a mortgage is paid off. It is used to clear the deed of trust from the title to the property.

Reconveyance is the transfer of a title to the borrower after a mortgage has been fully paid.

In order to clear the Deed of Trust from the title to the property, a Deed of Reconveyance must be recorded with the Country Recorder or Recorder of Deeds. If the Trustee/Beneficiary fails to record a satisfaction within the set time limits, the Trustee/Beneficiary may be responsible for damages as set out by statute.

When you sign a trust deed, you agree to make affordable monthly payments over a fixed period of up to four years to reduce your debts. At the end of the four-year period, any remaining debts will be written off. In other words, you will have nothing more to pay.

In financed real estate transactions, trust deeds transfer the legal title of a property to a third partysuch as a bank, escrow company, or title companyto hold until the borrower repays their debt to the lender. Trust deeds are used in place of mortgages in several states.

A satisfaction of mortgage is a signed document confirming that the borrower has paid off the mortgage in full and that the mortgage is no longer a lien on the property.

Upon the return receipt of the Address Verification Letter, the property reconveyance process will begin. Once all the paperwork has been received by the Administrative Office, it may take up to thirty (30) calendar days to process. The deeds of trust are processed in the sequence received.

In real estate in the United States, a deed of trust or trust deed is a legal instrument which is used to create a security interest in real property wherein legal title in real property is transferred to a trustee, which holds it as security for a loan (debt) between a borrower and lender.