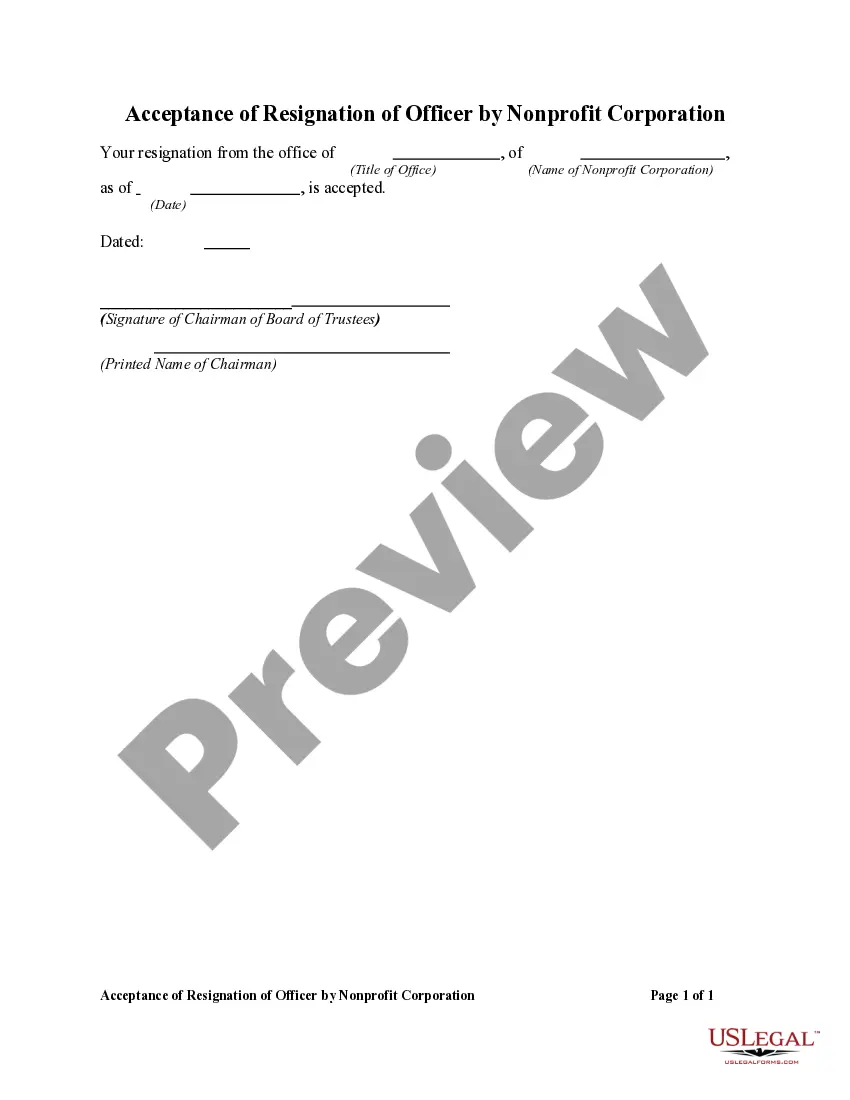

This form is a sample letter in Word format covering the subject matter of the title of the form.

Kansas Sample Letter for Acknowledgment of Receipt of Gift or Donation — Neutral is a formal letter that expresses gratitude and acknowledges the receipt of a gift or donation in a respectful and professional manner. This letter is specifically designed to conform to the guidelines and requirements of Kansas state. It can be used by individuals, non-profit organizations, charity foundations, or any other entity that receives gifts or donations. The purpose of this letter is to show appreciation to the donor and to confirm the receipt of the gift or donation. It serves as a legal record to demonstrate that the donation has been received by the intended recipient. The letter includes several key elements to ensure clarity and completeness. The letter begins with a neutral salutation, such as "Dear [Donor's Name]" or "To Whom It May Concern." This allows for a versatile template that can be used for various donors, regardless of their relationship with the recipient. The body of the letter starts by expressing sincere gratitude for the donation or gift received. It acknowledges the generosity of the donor and assures them that their contribution is valued. Generic phrases like "We are grateful for your kind support" or "Thank you for your thoughtful donation" are commonly used. Next, the letter provides details about the gift or donation, including the nature of the gift, its value (if applicable), and any specific conditions or restrictions attached. This information helps the donor confirm that their gift has been received correctly and can also serve as a reference for future correspondence. The letter should also mention the tax-exempt status of the recipient, if applicable. This is crucial for donors who might be seeking tax deductions for their charitable contributions. Providing the recipient's tax identification number and assuring that their donation is tax-deductible can be beneficial. Lastly, the letter concludes with a closing statement that reiterates gratitude and offers contact information for the recipient. Enclosing additional documents, such as a tax receipt or a brochure about the recipient's organization, may be considered as well. There are no specific variations or subtypes of this sample letter for acknowledgment of receipt of gift or donation for Kansas state. However, organizations may customize the letter according to their specific needs and circumstances, as long as it adheres to the general guidelines established by the state.Kansas Sample Letter for Acknowledgment of Receipt of Gift or Donation — Neutral is a formal letter that expresses gratitude and acknowledges the receipt of a gift or donation in a respectful and professional manner. This letter is specifically designed to conform to the guidelines and requirements of Kansas state. It can be used by individuals, non-profit organizations, charity foundations, or any other entity that receives gifts or donations. The purpose of this letter is to show appreciation to the donor and to confirm the receipt of the gift or donation. It serves as a legal record to demonstrate that the donation has been received by the intended recipient. The letter includes several key elements to ensure clarity and completeness. The letter begins with a neutral salutation, such as "Dear [Donor's Name]" or "To Whom It May Concern." This allows for a versatile template that can be used for various donors, regardless of their relationship with the recipient. The body of the letter starts by expressing sincere gratitude for the donation or gift received. It acknowledges the generosity of the donor and assures them that their contribution is valued. Generic phrases like "We are grateful for your kind support" or "Thank you for your thoughtful donation" are commonly used. Next, the letter provides details about the gift or donation, including the nature of the gift, its value (if applicable), and any specific conditions or restrictions attached. This information helps the donor confirm that their gift has been received correctly and can also serve as a reference for future correspondence. The letter should also mention the tax-exempt status of the recipient, if applicable. This is crucial for donors who might be seeking tax deductions for their charitable contributions. Providing the recipient's tax identification number and assuring that their donation is tax-deductible can be beneficial. Lastly, the letter concludes with a closing statement that reiterates gratitude and offers contact information for the recipient. Enclosing additional documents, such as a tax receipt or a brochure about the recipient's organization, may be considered as well. There are no specific variations or subtypes of this sample letter for acknowledgment of receipt of gift or donation for Kansas state. However, organizations may customize the letter according to their specific needs and circumstances, as long as it adheres to the general guidelines established by the state.