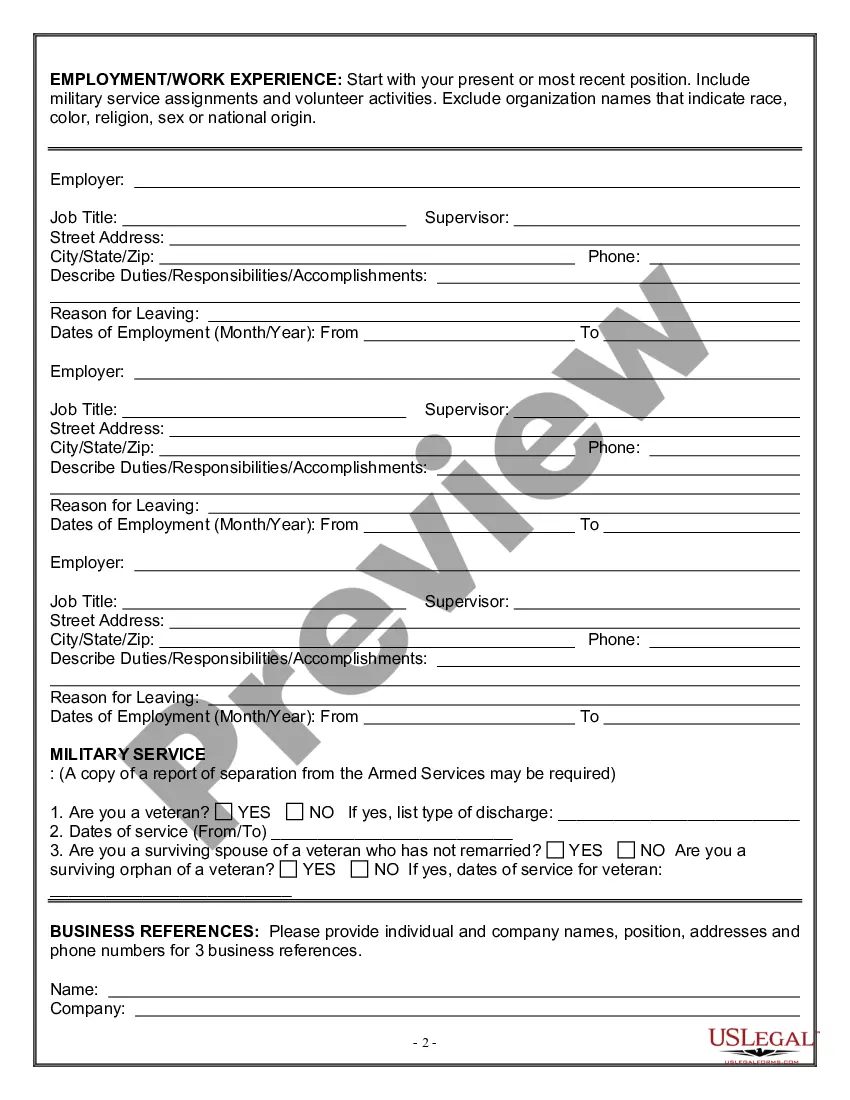

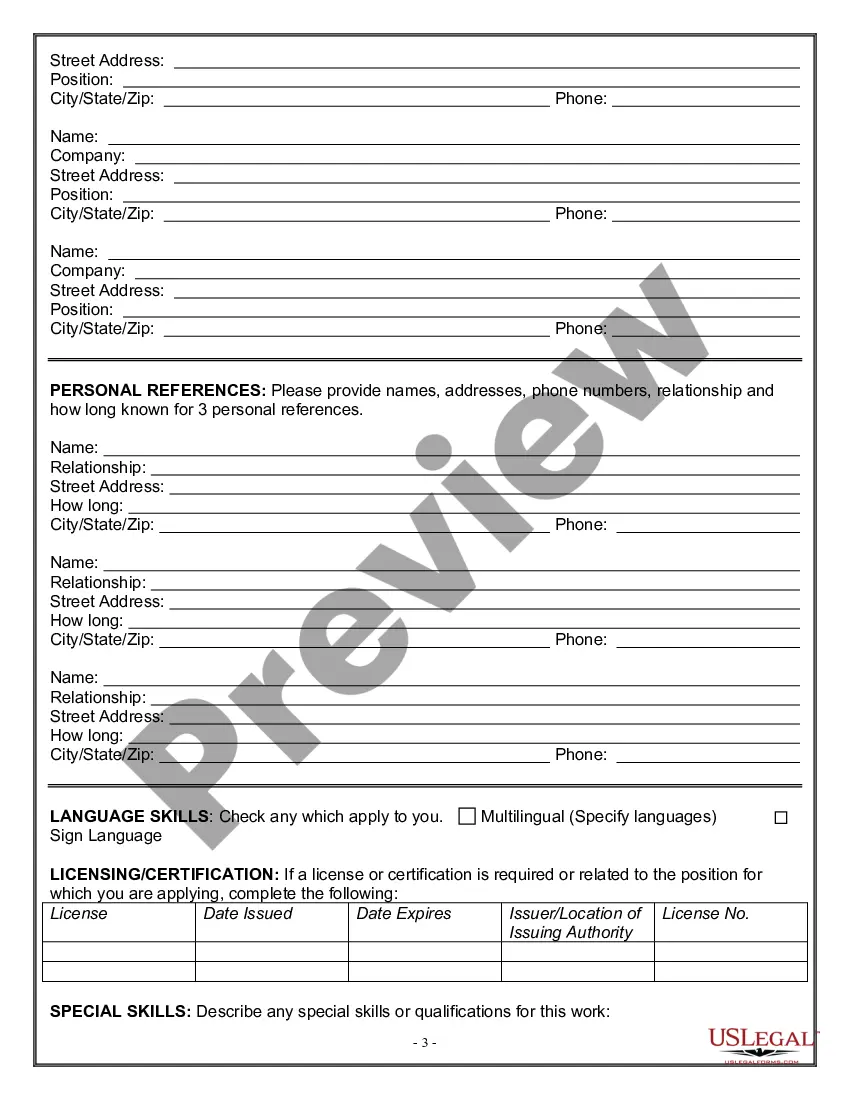

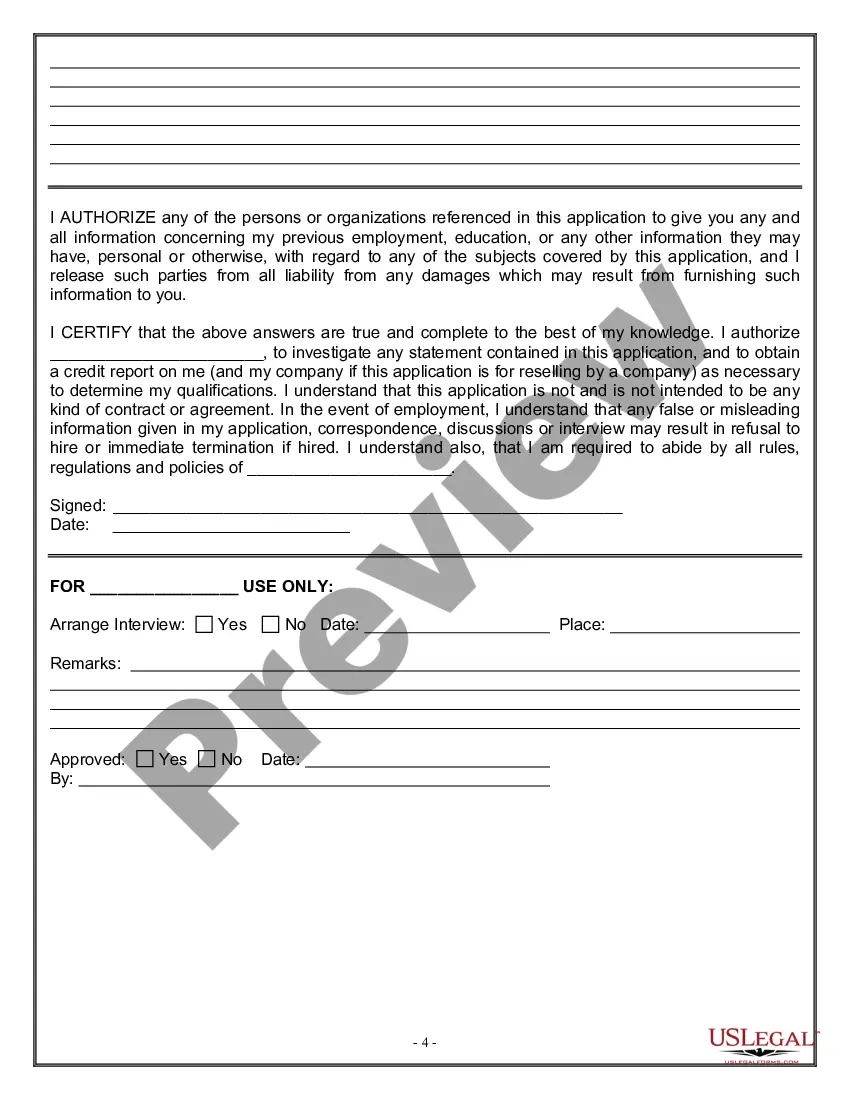

Kansas Employment Application for Waiting Staff

Description

How to fill out Employment Application For Waiting Staff?

Are you in a position where you require documents for various organizational or particular purposes daily.

There are numerous legal document templates available online, but finding reliable ones can be challenging.

US Legal Forms offers thousands of form templates, such as the Kansas Employment Application for Waitstaff, designed to comply with state and federal regulations.

Once you have the right form, simply click Purchase now.

Choose the pricing plan you prefer, fill in the required information to set up your account, and purchase your order using PayPal or Visa or Mastercard.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the Kansas Employment Application for Waitstaff template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Acquire the form you need and verify that it is for the correct city/state.

- Use the Review option to evaluate the form.

- Check the description to ensure that you selected the appropriate document.

- If the form is not what you're looking for, use the Lookup field to find the form that meets your needs.

Form popularity

FAQ

Do I have to serve a waiting week? The waiting week requirement for those unemployed due to COVID-19 is waived.

Kansas law requires that claimants generally serve a one-week waiting period before being eligible for benefits. This week will be the first week in which you meet all unemployment requirements for payment of benefits and for which you filed a weekly claim.

Each new employee will need to fill out the I-9 Employment Eligibility Verification Form from U.S. Citizenship and Immigration Services.

The New Hire Reporting form (K-CNS 436) is fillable and can be submitted via mail or fax to (888) 219-7798. Login to the KansasEmployer.gov site. Choose the Select button that corresponds to the "Enter new hire information" option. Enter the hiring company's FEIN and Kansas Serial Number.

As a general matter, you are likely to be eligible for PUA due to concerns about exposure to the coronavirus only if you have been advised by a healthcare provider to self-quarantine as a result of such concerns.

For those filing for unemployment in Missouri on or after July 5, 2020, a waiting week requirement will again be imposed. The waiting week is the first week of a claim for which the individual is eligible for unemployment benefits but during this week, such individual is not paid benefits.

Contact the Kansas Department of LaborKansas City (913) 596-3500.Topeka (785) 575-1460.Wichita (316) 383-9947.Toll-Free (800) 292-6333.

The most common types of employment forms to complete are:W-4 form (or W-9 for contractors)I-9 Employment Eligibility Verification form.State Tax Withholding form.Direct Deposit form.E-Verify system: This is not a form, but a way to verify employee eligibility in the U.S.

When will I be paid? If there are no issues on your claim, payments are normally received two to three business days after you file your weekly claim. Please note: If you file your weekly claim on Sunday or Monday, the payment is typically issued on Tuesday. Allow 2 - 3 business days for payments to be deposited.

You can check the status of your claim, including the payment issue date, in your online Get Kansas Benefits account. If your online account indicates that payment has been issued, but you have not received the funds, please contact your financial institution.