The Kansas Deferred Compensation Agreement — Short Form is a legal document that outlines the terms and conditions of a deferred compensation plan in the state of Kansas. This agreement is designed to provide employees the ability to set aside a portion of their salary or wages, which will be paid out at a later date, often at retirement. The Kansas Deferred Compensation Agreement — Short Form is specifically tailored for simplicity and ease of use. It contains all the essential elements required in a deferred compensation plan while avoiding complex language and lengthy provisions. Key components of the Kansas Deferred Compensation Agreement — Short Form include: 1. Participant Information: This section includes personal details of the employee, such as name, address, date of birth, and social security number. 2. Plan Enrollment: The agreement outlines the employee's decision to participate in the deferred compensation plan and the effective date of enrollment. 3. Contribution Amount: Employees can select a specific amount or percentage of their salary to contribute to the deferred compensation plan. The agreement states the chosen contribution rate and provides options for changes in the future. 4. Vesting Schedule: This section explains the vesting schedule, which determines when the employee will be entitled to receive the deferred compensation funds. Typically, a vesting period of several years is imposed to encourage long-term commitment to the plan. 5. Investment Options: The agreement provides a list of investment options available within the plan, allowing participants to grow their deferred compensation through investment vehicles such as mutual funds or index funds. It may also detail any restrictions on changing investment options. 6. Distribution Options: This section discusses the various distribution options available to the employee upon reaching the eligible payout date. Common options include lump-sum payments, systematic withdrawals, or annuity payments. Different types of Kansas Deferred Compensation Agreement — Short Form may exist based on specific variations in plan design or options offered by the employer. Some potential variations may include: 1. Traditional Deferred Compensation Agreement: With this type, employees make pre-tax contributions, reducing their taxable income during their working years and paying taxes at the time of distribution. 2. Roth Deferred Compensation Agreement: Under this agreement, employees make after-tax contributions, meaning contributions are not tax-deductible, but qualified distributions are tax-free. 3. Matching Contribution Agreement: Some employers may offer a matching contribution, wherein they contribute a portion of the employee's deferred compensation based on a specified formula. 4. Multi-Year Vesting Agreement: Instead of the standard vesting schedule, this variation may provide a gradual increase in the employee's vested percentage over several years, encouraging longer-term commitment to the plan. It is important for employees considering participation in a Kansas Deferred Compensation Agreement — Short Form to carefully review the document, seek advice if necessary, and understand all the terms and conditions before making any commitments. This ensures they can make informed decisions about saving for their future financial security.

Kansas Deferred Compensation Agreement - Short Form

Description

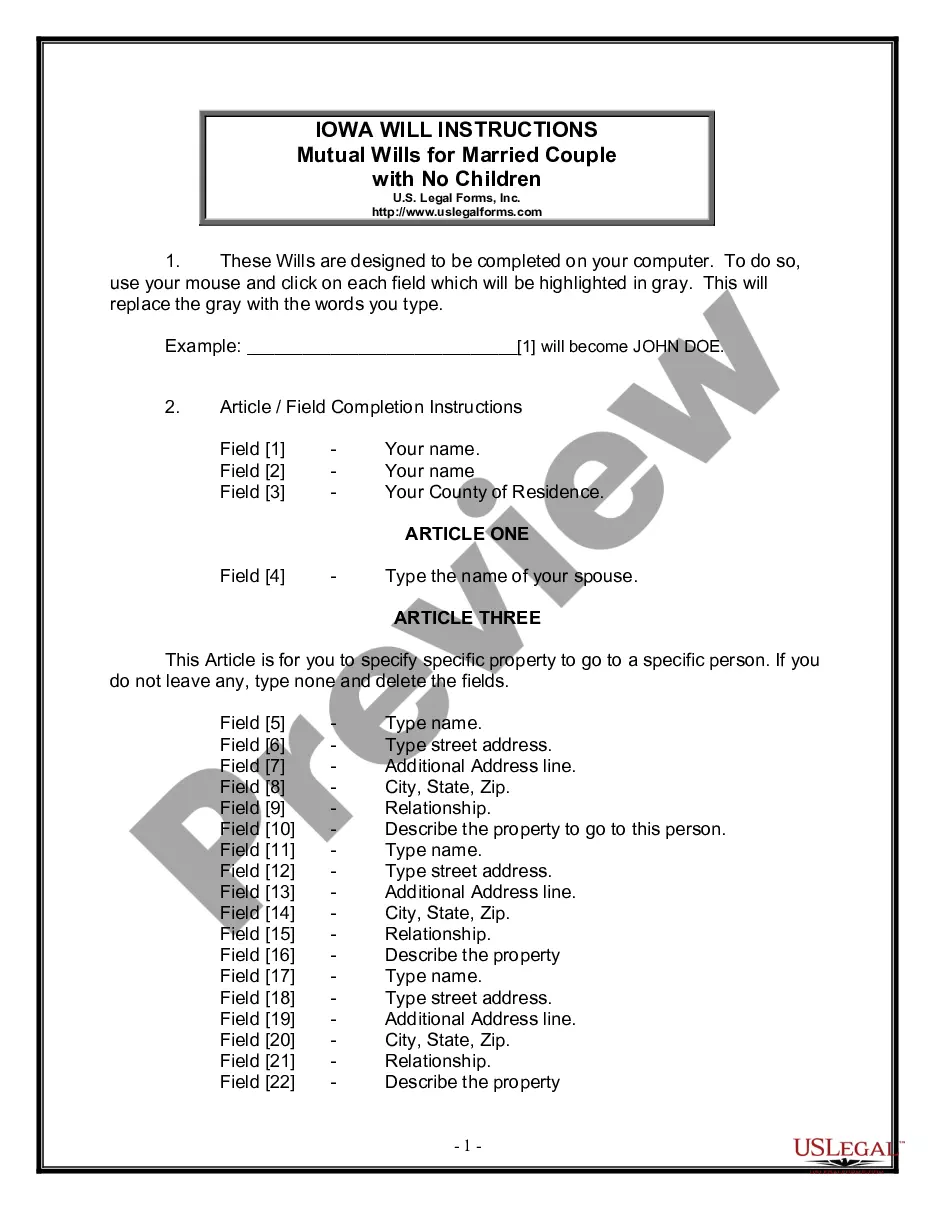

How to fill out Kansas Deferred Compensation Agreement - Short Form?

US Legal Forms - one of several largest libraries of authorized kinds in the USA - provides a wide array of authorized record layouts you may acquire or print. Utilizing the site, you can get a large number of kinds for company and personal uses, categorized by types, says, or key phrases.You will discover the newest models of kinds just like the Kansas Deferred Compensation Agreement - Short Form within minutes.

If you currently have a subscription, log in and acquire Kansas Deferred Compensation Agreement - Short Form from the US Legal Forms local library. The Obtain switch will show up on each develop you perspective. You gain access to all previously acquired kinds inside the My Forms tab of your profile.

If you wish to use US Legal Forms for the first time, listed here are easy directions to obtain started:

- Make sure you have picked the right develop for your city/state. Click on the Preview switch to analyze the form`s content material. Read the develop description to actually have chosen the right develop.

- In the event the develop does not match your specifications, use the Lookup discipline towards the top of the screen to discover the one which does.

- When you are content with the shape, verify your choice by clicking the Buy now switch. Then, opt for the prices prepare you like and provide your references to register to have an profile.

- Procedure the purchase. Utilize your bank card or PayPal profile to perform the purchase.

- Find the structure and acquire the shape on the device.

- Make modifications. Fill out, change and print and indication the acquired Kansas Deferred Compensation Agreement - Short Form.

Each and every template you included with your bank account lacks an expiry particular date and it is your own property eternally. So, if you wish to acquire or print an additional copy, just proceed to the My Forms section and then click on the develop you need.

Get access to the Kansas Deferred Compensation Agreement - Short Form with US Legal Forms, the most comprehensive local library of authorized record layouts. Use a large number of specialist and express-particular layouts that satisfy your organization or personal needs and specifications.