Kansas Certificate of Heir to obtain Transfer of Title to Motor Vehicle without Probate (Vehicle not Bequeathed in Will)

Description

How to fill out Certificate Of Heir To Obtain Transfer Of Title To Motor Vehicle Without Probate (Vehicle Not Bequeathed In Will)?

US Legal Forms - one of many most significant libraries of lawful kinds in America - gives an array of lawful record layouts you may obtain or print. Using the website, you will get a huge number of kinds for company and person purposes, categorized by groups, suggests, or search phrases.You can get the most recent models of kinds such as the Kansas Certificate of Heir to obtain Transfer of Title to Motor Vehicle without Probate (Vehicle not Bequeathed in Will) within minutes.

If you already have a monthly subscription, log in and obtain Kansas Certificate of Heir to obtain Transfer of Title to Motor Vehicle without Probate (Vehicle not Bequeathed in Will) from your US Legal Forms collection. The Acquire key can look on each kind you look at. You have accessibility to all earlier acquired kinds inside the My Forms tab of your account.

If you want to use US Legal Forms initially, here are straightforward guidelines to help you began:

- Be sure to have selected the right kind for your town/area. Go through the Review key to analyze the form`s articles. Browse the kind description to actually have chosen the right kind.

- In case the kind does not satisfy your demands, utilize the Lookup industry near the top of the display screen to obtain the the one that does.

- If you are content with the shape, confirm your selection by visiting the Get now key. Then, pick the prices plan you like and supply your qualifications to register on an account.

- Process the financial transaction. Utilize your bank card or PayPal account to finish the financial transaction.

- Pick the formatting and obtain the shape on your product.

- Make adjustments. Fill up, revise and print and indication the acquired Kansas Certificate of Heir to obtain Transfer of Title to Motor Vehicle without Probate (Vehicle not Bequeathed in Will).

Every web template you put into your money lacks an expiry date and is your own forever. So, in order to obtain or print yet another backup, just visit the My Forms segment and click on about the kind you require.

Obtain access to the Kansas Certificate of Heir to obtain Transfer of Title to Motor Vehicle without Probate (Vehicle not Bequeathed in Will) with US Legal Forms, probably the most comprehensive collection of lawful record layouts. Use a huge number of expert and status-distinct layouts that satisfy your organization or person demands and demands.

Form popularity

FAQ

In Kansas, the following assets are subject to probate: Solely-owned property: Any asset that was solely owned by the deceased person with no designated beneficiary is subject to probate. This could include bank accounts, cars, houses, personal belongings, and business interests.

Take proof of insurance, copy of the MVE-1, title, and a current valid registration receipt from the state in which the vehicle was last registered to the county treasurer's motor vehicle office and make application for title and registration. If the paperwork is complete, a license plate will be issued at that time.

The most important document when selling a car is the certificate of title. If there is a lien on the title (usually this means the owner owes money on the car), the lienholder must release interest in the vehicle before the car is sold.

The new Kansas law passed will require the use of a DHSMV- approved ELT (Electronic Lien & Title) vendor to release your liens and/or request printed titles.

A new Kansas title will be issued and mailed back to leasing company, if there is no lienholder. If there is a lien on the vehicle, the Kansas Division of Vehicles will hold the title electronically until the lien is released.

Kansas is a ?lien holding? state. This means that the Kansas Department of Revenue holds the title on any vehicle that is bound by a lien. The lien is not available to the owner until payment is made in full on the purchase price or other loan in which the vehicle is a collateral.

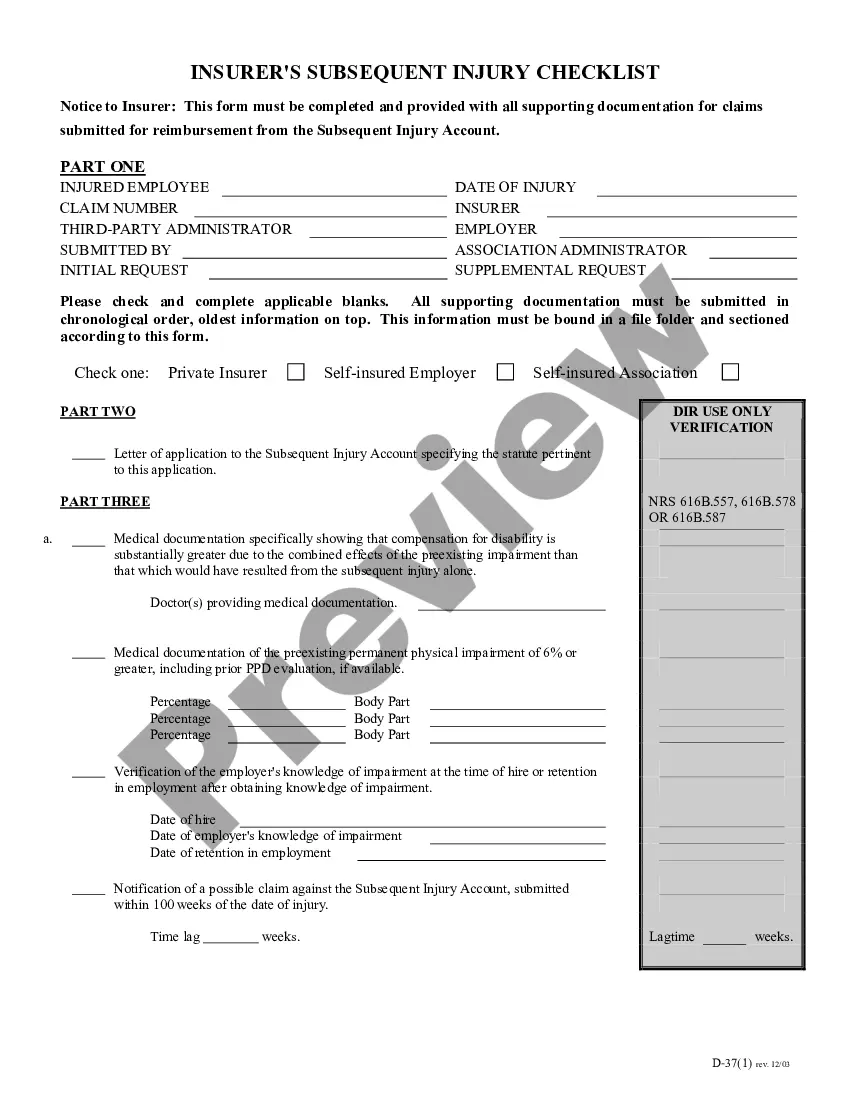

Legal heirs may apply for a Decedent's Title, Form TR-83a, or use the Claim of Heir Affidavit, Form TR-83b, by completing either of the forms and taking the completed form, the Lienholder Consent to Transfer Ownership, Form TR-128, and a copy of the current registration or verification of ownership to their local ...

? If the seller is not on the title, it is illegal to sell the vehicle or trailer without first having it in their name. This is called jumping title.