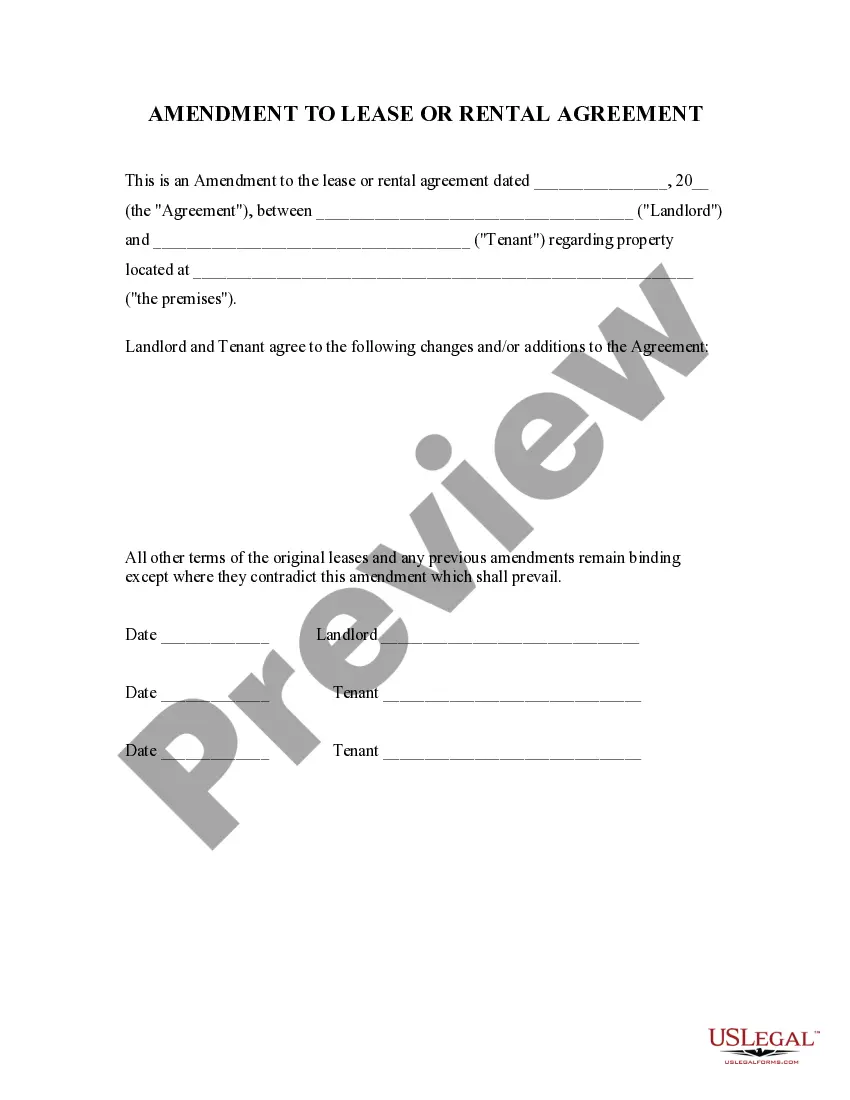

The Kansas Corporation — Transfer of Stock refers to the legal process involved in the transfer of ownership of stocks or shares in a corporation that is incorporated in the state of Kansas, USA. Stocks represent ownership interests in a corporation and can be bought, sold, or transferred between different individuals or entities. The transfer of stock process involves certain key steps. Firstly, the owner of the stock (the transferor) must initiate the transfer by completing a stock transfer form or a stock power document. This document typically includes details such as the name of the corporation, the class and number of shares being transferred, the transferor's name, the transferee's name, and the date of the transfer. Once the stock transfer form is completed, it is submitted to the corporation's transfer agent or registrar. The transfer agent is a third-party entity designated by the corporation to handle the stock transfer process. The transfer agent verifies the transferor's signature and processes the transfer request. The transfer agent then updates the corporation's stock ledger, which is a record of all the shareholders and their respective stock holdings. The transfer agent notes the transfer by removing the shares from the transferor's account and adding them to the transferee's account. The stock ledger is an important record that reflects the current ownership structure of the corporation. It is often used for purposes such as issuing dividends, voting rights, and communication with shareholders. In the state of Kansas, there are no specific types of transfers unique to the Kansas Corporation — Transfer of Stock process. However, common types of stock transfers include outright sales, gifts, inheritance, and transfers due to corporate reorganizations or mergers. Each type of transfer may have specific legal and tax implications, and individuals are advised to consult with legal and financial professionals to ensure compliance with relevant laws and regulations. Overall, the Kansas Corporation — Transfer of Stock is a crucial process that allows for the buying, selling, and transfer of ownership interests in corporations incorporated in Kansas. This process ensures transparency and accuracy in tracking ownership changes, and it plays a vital role in the functioning of the stock market and the corporate governance of Kansas corporations.

Kansas Corporation - Transfer of Stock

Description

How to fill out Corporation - Transfer Of Stock?

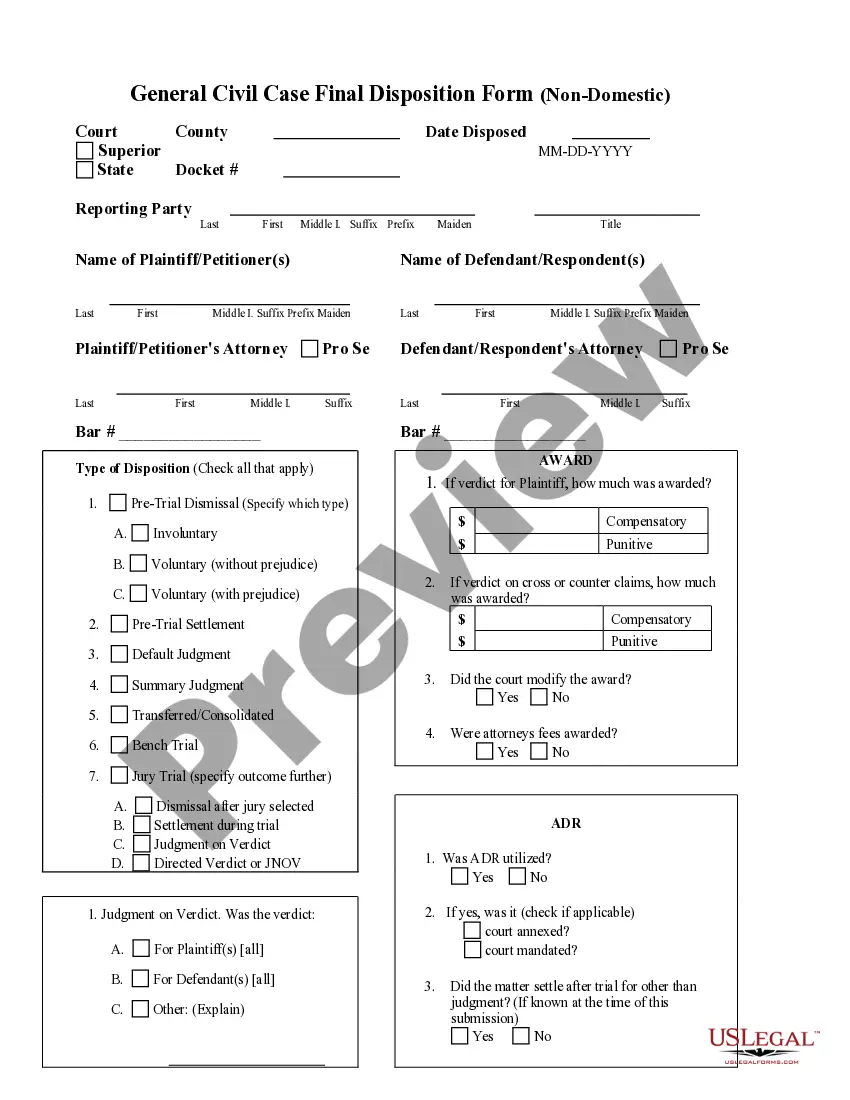

Finding the appropriate legal document template can be challenging. Naturally, there are numerous templates accessible online, but how can you locate the legal form you need? Utilize the US Legal Forms website. This service offers a wide array of templates, including the Kansas Corporation - Transfer of Stock, which you can use for both business and personal purposes. Each of the forms is verified by professionals and complies with federal and state regulations.

If you are already registered, Log In to your account and click the Obtain button to access the Kansas Corporation - Transfer of Stock. Use your account to browse through the legal forms you have previously acquired. Navigate to the My documents tab of your account to obtain another copy of the document you need.

If you are a new user of US Legal Forms, here are some simple instructions for you to follow: First, ensure that you have selected the correct form for your city/state. You can review the form using the Review button and read the form description to confirm this is suitable for your needs. If the form does not meet your requirements, utilize the Search field to find the right form. Once you are confident that the form is appropriate, click the Purchase now button to obtain the document. Choose the pricing plan you prefer and input the necessary information. Create your account and process the purchase using your PayPal account or credit card. Select the file format and download the legal document template to your system. Complete, modify, print, and sign the acquired Kansas Corporation - Transfer of Stock.

US Legal Forms is the largest repository of legal documents where you can find a variety of document templates. Make use of this service to obtain professionally crafted documents that meet state requirements.

- Ensure correct form selection.

- Review the document for accuracy.

- Utilize the search feature if necessary.

- Confirm the form's suitability.

- Select preferred pricing plan.

- Download the required file format.

Form popularity

FAQ

Updating a business address requires filing the necessary forms with the appropriate state and local agencies. For a Kansas Corporation, you need to submit an address change to the Secretary of State. Additionally, communicate the change to your customers and creditors to keep everyone informed.

To transfer shares in a corporation, you need to execute a stock transfer agreement, which outlines the details of the transaction. After both parties sign the agreement, you must update the corporation's stock ledger to reflect the new shareholders. This process ensures that your stock ownership remains accurate within the Kansas Corporation.

Changing the address for your LLC in Kansas involves notifying the Secretary of State by filing a change of address form. This ensures all official communications reflect your new address. It’s also wise to update your records with the IRS and local agencies to prevent any disruption in correspondence.

Yes, corporations allow for easier transfer of ownership through the transfer of stock. This flexibility simplifies the process of transferring shares between parties without needing extensive paperwork or approvals. By facilitating stock transfers, Kansas Corporations provide a structured way to manage ownership transitions smoothly.

To change your business name in Kansas, you must file an amendment with the Secretary of State. This document should include your current business name, the proposed new name, and relevant details about your business structure. Remember to check if your desired business name is available to avoid any conflicts.

Yes, Kansas does require a DBA registration if your business operates under a name different from its legal name. This registration protects your business name and makes it easier for customers to find you. You can file a DBA with the local county office where your business operates.

To change your business address in Kansas, you must file a change of address form with the Secretary of State’s office. This typically includes updating your business entity’s registration information. Additionally, it’s crucial to inform the IRS and any local agencies to ensure all correspondence reaches you promptly.

You can change your business name at any time; however, it is advisable to do so during significant transitions, such as a merger or rebranding. Make sure not to delay this process, as a timely name change helps maintain clarity with your customers. Utilize the services of US Legal Forms to streamline the transition for your Kansas Corporation - Transfer of Stock.

Form K-120S is the Kansas S Corporation Tax Return. This form is essential for S Corporations operating in Kansas, allowing them to report income, deductions, and credits. Properly filing this form ensures your Kansas Corporation - Transfer of Stock meets federal and state tax obligations efficiently.

Yes, Kansas conforms to Section 163(j) of the Internal Revenue Code, which affects the treatment of interest expense deductions for your business. This conformity means that businesses in Kansas need to carefully consider how this regulation might impact their financial planning. Staying informed will help ensure your Kansas Corporation - Transfer of Stock remains compliant and financially efficient.

Interesting Questions

More info

Used Stock Transfer Management About us.