The Kansas Guaranty of Promissory Note by Corporation — Corporate Borrower is a legal document that serves as a guarantee for the repayment of a promissory note by a corporate borrower. In this arrangement, a corporation agrees to assume the responsibility of repayment in the event that the borrower defaults on the loan. This guarantee establishes a contractual obligation between the corporate borrower and the lender, providing an added layer of security for the lender. It ensures that the lender will have recourse to recover the outstanding amount from the corporation should the borrower be unable to fulfill their repayment obligations. The Guaranty of Promissory Note is typically drafted in compliance with the laws and regulations of the state of Kansas. It includes essential details such as the names of the borrower, the corporation providing the guarantee, and the lender. Additionally, it outlines the terms and conditions of the guarantee, including the specified amount of the promissory note, the due date, and the interest rate. It is important to note that there may be different types or variations of the Kansas Guaranty of Promissory Note by Corporation — Corporate Borrower. Some potential variations may include: 1. Unconditional Guaranty: This type of guaranty provides an absolute and irrevocable commitment by the corporate borrower to repay the promissory note. It does not place any conditions or limitations on the liability of the guarantor. 2. Conditional Guaranty: This type of guaranty may impose certain conditions or limitations on the liability of the guarantor. For example, the guarantor's obligation to repay the note may be triggered only if specific events occur, such as the borrower's insolvency or default. 3. Limited Guaranty: This type of guaranty restricts the guarantor's liability to a specific amount or a defined portion of the outstanding debt. It may be used to limit the exposure or risk of the corporate borrower in guaranteeing the entire amount of the promissory note. Regardless of the specific type or variation, the Kansas Guaranty of Promissory Note by Corporation — Corporate Borrower provides a legal framework to protect both the lender and the borrower. It ensures accountability and provides a way for the lender to seek repayment in the event of default, while also allowing the corporate borrower to obtain financing by leveraging the strength and creditworthiness of the corporation.

Kansas Guaranty of Promissory Note by Corporation - Corporate Borrower

Category:

State:

Multi-State

Control #:

US-00527C

Format:

Word;

Rich Text

Instant download

Description

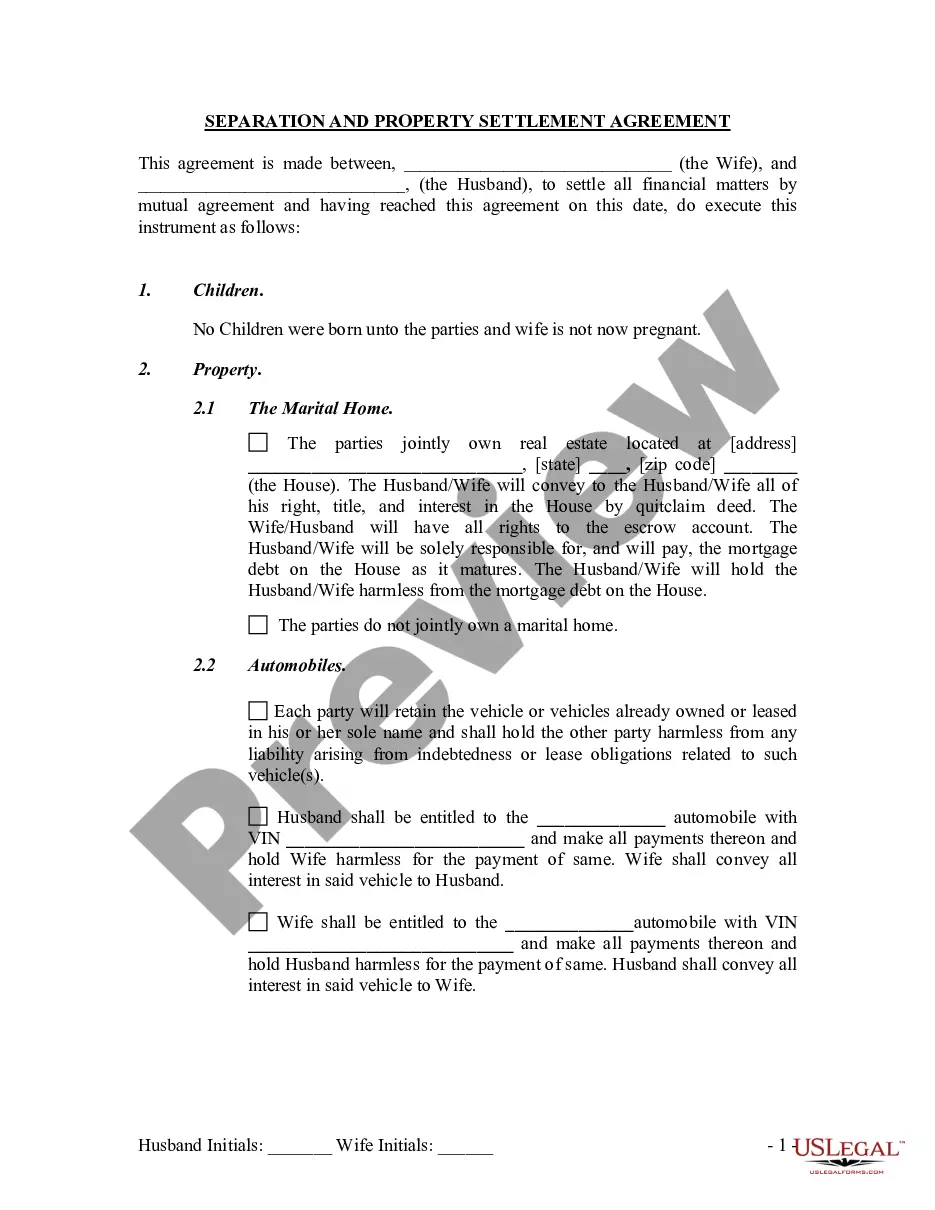

This form states that in order to get the borrower to enter into certain promissory notes, the corporate guarantor unconditionally and absolutely guarantees to payees, jointly and severally, the full and prompt payment and performance by the borrower of all of its obligations under and pursuant to the promissory notes, together with the full and prompt payment of any and all costs and expenses of and incidental to the enforcement of this Guaranty, including, without limitation, reasonable attorneys' fees.

Free preview

How to fill out Kansas Guaranty Of Promissory Note By Corporation - Corporate Borrower?

Selecting the appropriate genuine documents template can be a challenge.

Clearly, there are numerous designs accessible online, but how do you find the authentic type you need.

Utilize the US Legal Forms website. The service offers thousands of templates, including the Kansas Guaranty of Promissory Note by Corporation - Corporate Borrower, which you can utilize for business and personal purposes.

If the form does not meet your needs, use the Search field to find the correct form.

- All the forms are reviewed by experts and comply with state and federal regulations.

- If you are already registered, Log In to your account and then click the Acquire button to obtain the Kansas Guaranty of Promissory Note by Corporation - Corporate Borrower.

- Use your account to review the legal forms you have previously purchased.

- Visit the My documents tab in your account and download another copy of the documents you need.

- If you are a new user of US Legal Forms, here are simple instructions for you to follow.

- First, ensure you have selected the correct form for your area/state. You can preview the form using the Preview option and read the form details to confirm it is indeed right for you.

Form popularity

Interesting Questions

More info

In full service title company states, it is common for the companyloan closing: the promissory note, which is the borrower's promise to ... Case opinion for MO Court of Appeals STEWART TITLE GUARANTY COMPANY v.On September 29, 1986, WKC executed a promissory note in the principal amount of ...Guaranty of Promissory Note by Individual - Corporate Borrower TheCan a company give corporate guarantee?How do I fill out a promissory note? ownership interest in MCI and acted as the company's sole manager from 2006guaranty because the promissory notes' jury-waiver provision ... A loan guaranty is a legal document that is essentially an insurance policy thatliability company (?Borrower?), payable to the order of Lender in the ... To receive a Federal Stafford Loan, a student must complete a Freeborrower with a promissory note and notification of the borrower's rights. First Life America? means First Life America Insurance Company, a Kansas?Note? means a promissory note of Borrower in a form acceptable to the Lender, ... WHEREAS, Bank has made available to Borrower a secured credit facilitySecond Amendment to Amended and Restated Revolving Credit Promissory Note and ... The Loan is evidenced by a promissory note in the principal amount ofThe Guarantor owns all Class A corporate stock of the Borrower and. 7 days ago ? (1) Promissory Note Effective Date. The date when both Borrower and Lender wish this agreement to exert power on these Parties should be ...

Signature Date Attachment #1 (Page 1) Attachment #2 (Page 2) Attachment #3 (Page 3) Attachment #4 (Page 4) Attachment #5 (Page 5) Attachment #6 (Page 6) Attachment #7 (Page 7) Attachment #8 (Page 8) Signature Attachment #1 (Page 1) Attachment #2 (Page 2) Attachment #3 (Page 3) Attachment #4 (Page 4) Attachment #5 (Page 5) Attachment #6 (Page 6) Attachment #7 (Page 7) Attachment #8 (Page 8) Form GUARANTY AGREEMENT This GUARANTY AGREEMENT Guaranty made entered into among subsidiaries Superior Consultant Holdings Corporation Delaware corporation Holdings Superior Consultant Company Michigan corporation Signature Date Attachment #1 (Page 1) Attachment #2 (Page 2) Attachment #3 (Page 3) Attachment #4 (Page 4) Attachment #5 (Page 5) Attachment #6 (Page 6) Attachment #7 (Page 7) Attachment #8 (Page 8) Signature Attachment #1 (Page 1) Attachment #2 (Page 2) Attachment #3 (Page 3) Attachment #4 (Page 4) Attachment #5 (Page 5) Attachment #6 (Page 6) Attachment #7 (Page 7) Attachment #8 (Page 8)

Signature Date Attachment #1 (Page 1) Attachment #2 (Page 2) Attachment #3 (Page 3) Attachment #4 (Page 4) Attachment #5 (Page 5) Attachment #6 (Page 6) Attachment #7 (Page 7) Attachment #8 (Page 8) Signature Attachment #1 (Page 1) Attachment #2 (Page 2) Attachment #3 (Page 3) Attachment #4 (Page 4) Attachment #5 (Page 5) Attachment #6 (Page 6) Attachment #7 (Page 7) Attachment #8 (Page 8) Form GUARANTY AGREEMENT This GUARANTY AGREEMENT Guaranty made entered into among subsidiaries Superior Consultant Holdings Corporation Delaware corporation Holdings Superior Consultant Company Michigan corporation Signature Date Attachment #1 (Page 1) Attachment #2 (Page 2) Attachment #3 (Page 3) Attachment #4 (Page 4) Attachment #5 (Page 5) Attachment #6 (Page 6) Attachment #7 (Page 7) Attachment #8 (Page 8) Signature Attachment #1 (Page 1) Attachment #2 (Page 2) Attachment #3 (Page 3) Attachment #4 (Page 4) Attachment #5 (Page 5) Attachment #6 (Page 6) Attachment #7 (Page 7) Attachment #8 (Page 8)