Title: Kansas Sample Letter Regarding Application for Employer Identification Number Introduction: Kansas Sample Letter regarding Application for Employer Identification Number (EIN) is a formal document used by businesses operating in Kansas to apply for an EIN from the Internal Revenue Service (IRS). This letter is an essential part of the process, as it serves as a written request to establish a unique identification number for tax reporting purposes. Keywords: Kansas, sample letter, Application for Employer Identification Number, EIN, tax reporting, Internal Revenue Service, businesses. Sample Content: 1. Understanding the Importance of an EIN: An Employer Identification Number (EIN) is a unique nine-digit code assigned by the IRS to identify businesses for tax purposes. It is required by most businesses operating in Kansas to open bank accounts, hire employees, file taxes, and conduct various transactions. This sample letter will guide you through the process of acquiring an EIN. 2. Format and Structure of the Kansas Sample Letter: The Kansas Sample Letter regarding Application for Employer Identification Number should be written in a formal and professional tone. It typically includes the name of the business, the business's address, a brief explanation of the need for an EIN, and the contact information of the business representative responsible for tax matters. 3. Reasons to Apply for an EIN: — Establishing a business entity: If you have recently formed a limited liability company (LLC), corporation, partnership, or non-profit organization in Kansas, you need to apply for an EIN. — Hiring employees: Any business planning to hire one or more employees must obtain an EIN to facilitate payroll taxes and reporting. — Opening a business bank account: Most banks require an EIN to open a business account or credit line. — Filing tax returns: An EIN is necessary for filing federal and state tax returns, including income tax, sales tax, and employment taxes. 4. Steps to Complete the Kansas Sample Letter: — Begin by addressing the IRS properly, including the correct mailing address. — Provide your business's legal name, business address, and contact information. — Clearly state the reason for the application, emphasizing the need for the EIN. — Mention the business structure (LLC, corporation, partnership, etc.) and the date of formation. — Briefly describe the business activities and the expected number of employees. — Specify who will be responsible for handling tax matters within the organization. — Sign the letter with the authorized signature of the business representative, ensuring the attached documentation complies with IRS requirements. Types of Kansas Sample Letters regarding Application for Employer Identification Number (EIN): 1. Kansas Sample Letter for New Business Entity EIN Application 2. Kansas Sample Letter for EIN Application for an Existing Business 3. Kansas Sample Letter for EIN Application for Hiring Employees 4. Kansas Sample Letter for EIN Application for Non-Profit Organizations 5. Kansas Sample Letter for EIN Application for Business Bank Account. Conclusion: Acquiring an Employer Identification Number (EIN) is an essential step for businesses operating in Kansas. This Kansas Sample Letter regarding Application for EIN provides a comprehensive guide to completing the necessary paperwork and allows for a smooth and efficient process. Remember to customize the content of your letter based on your specific business needs to maximize its effectiveness and comply with IRS regulations.

Kansas Sample Letter regarding Application for Employer Identification Number

Description

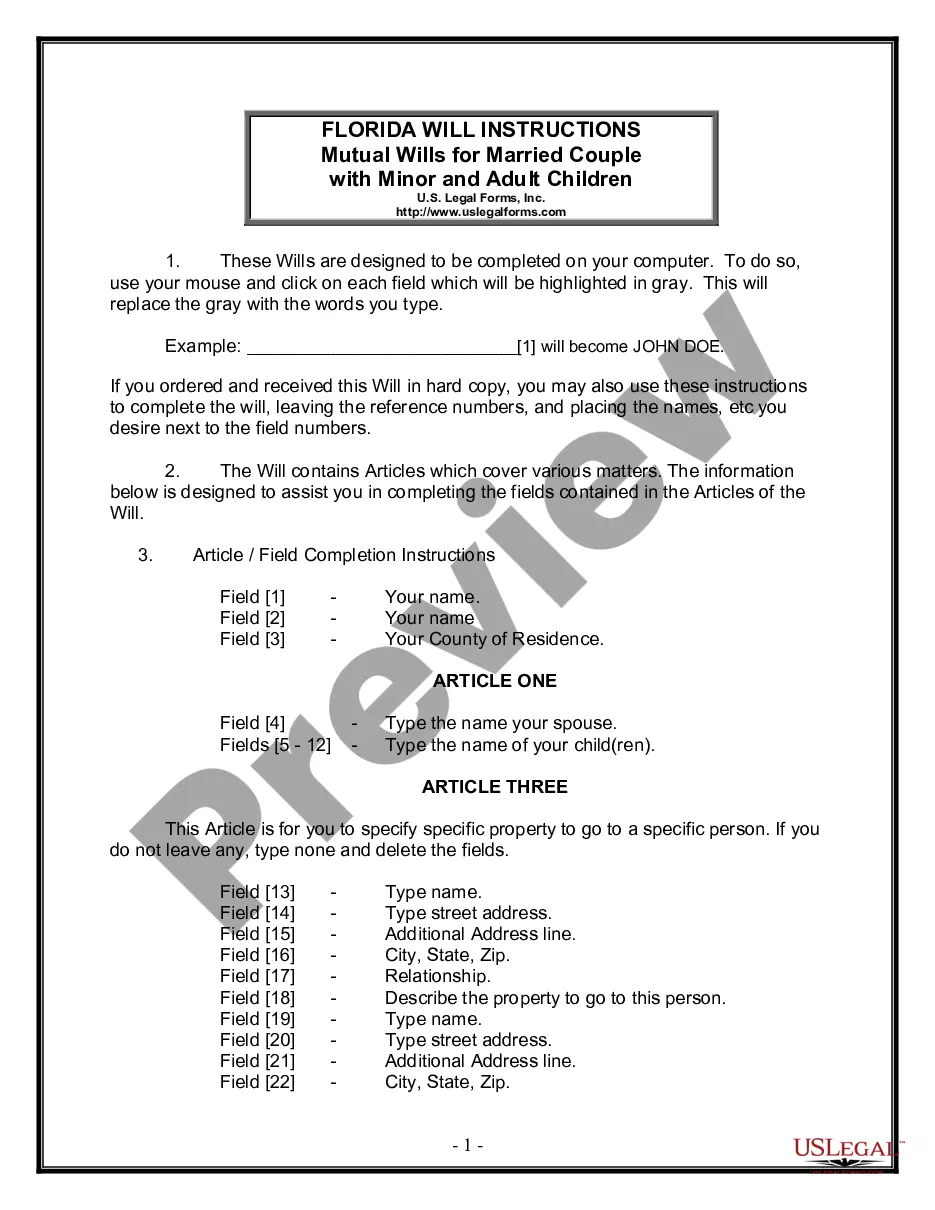

How to fill out Kansas Sample Letter Regarding Application For Employer Identification Number?

You are able to devote time on the Internet searching for the lawful document design which fits the federal and state needs you will need. US Legal Forms provides 1000s of lawful kinds that happen to be analyzed by professionals. It is possible to down load or printing the Kansas Sample Letter regarding Application for Employer Identification Number from our support.

If you already have a US Legal Forms account, you can log in and click the Obtain switch. Next, you can complete, edit, printing, or indication the Kansas Sample Letter regarding Application for Employer Identification Number. Every single lawful document design you get is your own forever. To acquire one more duplicate of the obtained develop, proceed to the My Forms tab and click the corresponding switch.

If you work with the US Legal Forms internet site initially, adhere to the straightforward guidelines below:

- Very first, make certain you have selected the correct document design for the county/area of your liking. Browse the develop explanation to make sure you have picked out the correct develop. If available, take advantage of the Preview switch to check with the document design as well.

- If you would like find one more version from the develop, take advantage of the Lookup field to get the design that fits your needs and needs.

- When you have identified the design you want, simply click Acquire now to carry on.

- Select the rates strategy you want, key in your credentials, and sign up for a free account on US Legal Forms.

- Comprehensive the deal. You may use your charge card or PayPal account to pay for the lawful develop.

- Select the file format from the document and down load it in your device.

- Make adjustments in your document if required. You are able to complete, edit and indication and printing Kansas Sample Letter regarding Application for Employer Identification Number.

Obtain and printing 1000s of document templates utilizing the US Legal Forms Internet site, which offers the greatest variety of lawful kinds. Use specialist and status-certain templates to handle your organization or specific requirements.

Form popularity

FAQ

We recommend applying for an EIN online if you have a SSN (Social Security Number) or ITIN (Individual Taxpayer Identification Number). This is the easiest filing method and it has the fastest approval time. Your EIN Number will be issued at the end of the online application, which takes about 15 minutes to complete.

An EIN is a 9-digit number (for example, 12-3456789) assigned to employers, sole proprietors, corporations, partnerships, estates, trusts, certain individuals, and other entities for tax filing and reporting purposes. Note: Keep the Form SS-4 information current.

You may apply for an EIN online if your principal business is located in the United States or U.S. Territories. The person applying online must have a valid Taxpayer Identification Number (SSN, ITIN, EIN). You are limited to one EIN per responsible party per day.

An EIN is an exclusive nine-digit number assigned to your business by the Internal Revenue Service and identifies your business for tax purposes. It's like your Social Security Number, except it's designed for businesses only. It's necessary for paying employees and managing your business taxes.

Companies who pay employees in Kansas must register with the KS Department of Revenue for a Withholding Account Number and the KS Department of Labor for an Employer Serial Number. Apply online at the DOR's Customer Service Center to receive a Withholding Account Number within 48 hours of completing the application.

To apply for an employer identification number, you should obtain Form SS-4PDF and its InstructionsPDF. You can apply for an EIN on-line, by mail, or by fax.

Step by Step: How to Apply for an EIN Go to the IRS website. ... Identify the legal and tax structure of your business entity. ... If your business is an LLC, provide information about the members. ... State why you are requesting an EIN. ... Identify and describe a contact person for the business. ... Provide the business' location.