Kansas Oil, Gas, and Mineral Royalty Transfer is a process in which the ownership rights and financial compensation for the production of oil, gas, and mineral resources in the state of Kansas are transferred from one party to another. This transfer typically occurs through legal agreements, contracts, and deeds. Keywords: Kansas, Oil, Gas, Mineral, Royalty Transfer The state of Kansas is known for its rich reserves of oil, gas, and minerals. These natural resources play a vital role in the state's economy, attracting investors and businesses interested in extracting and profiting from these resources. When these resources are discovered and extracted, individuals or companies can obtain ownership rights and receive financial compensation, known as royalties, for the production of these resources. Kansas oil, gas, and mineral royalty transfers are complex transactions that involve legal, financial, and technical aspects. Different types of royalty transfers can take place based on the nature of the resource and the terms of the agreement. Some common types of Kansas oil, gas, and mineral royalty transfers include: 1. Absolute Transfer: In this type of transfer, the ownership rights and royalties associated with oil, gas, or mineral production are permanently and completely transferred from the current owner to a new party. The new owner assumes all rights, responsibilities, and financial benefits associated with the transferred royalty interest. 2. Partial Transfer: A partial transfer occurs when only a portion of the ownership rights and royalties for oil, gas, or mineral production are transferred. This type of transfer allows for shared ownership or profit-sharing arrangements between multiple parties. 3. Assignment of Royalty Interests: This type of transfer involves the assignment of specific royalty interests related to oil, gas, or mineral production. The assigning party transfers their rights to receive royalties from a particular lease or well to another party, who then assumes the owner's obligations and benefits. 4. Lease Assignment: Lease assignment refers to the transfer of an existing lease that grants the rights to explore, extract, and produce oil, gas, or minerals on a specific property. Through a lease assignment, all associated rights, obligations, and royalties can be transferred from one party to another. 5. Working Interest Transfer: Working interest refers to the ownership interest in the operation and expenses associated with oil, gas, or mineral production. A working interest transfer involves the transfer of these ownership rights and responsibilities, including the right to receive a share of the production revenues, from one party to another. Kansas oil, gas, and mineral royalty transfers are essential for individuals, companies, and investors looking to diversify their portfolios, expand their resource holdings, or monetize their existing royalty interests. These transfers play a vital role in facilitating the exploration, production, and overall development of oil, gas, and mineral resources in Kansas, contributing to the state's economic growth and prosperity.

Kansas Oil, Gas and Mineral Royalty Transfer

Description

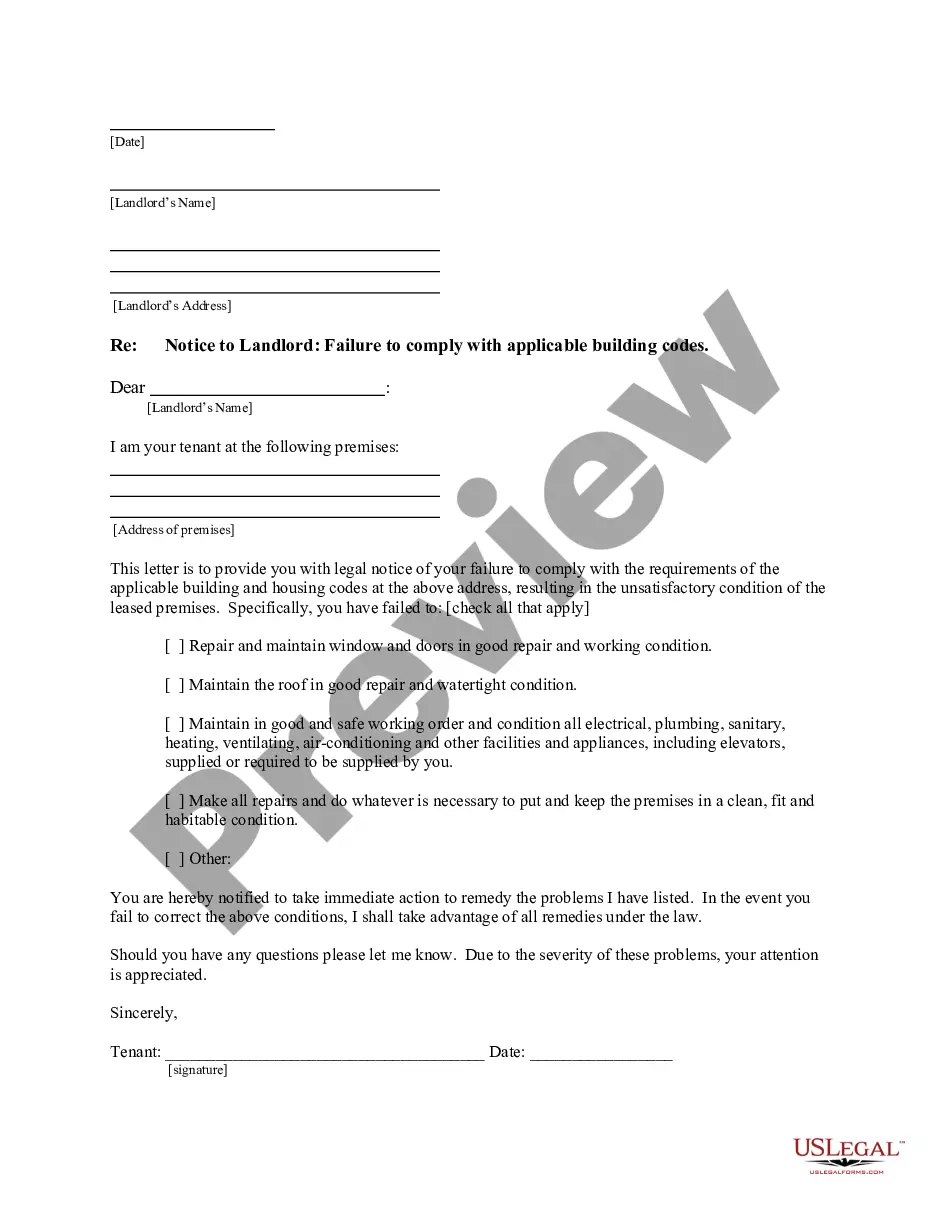

How to fill out Oil, Gas And Mineral Royalty Transfer?

It is possible to commit time on the web searching for the lawful record design that fits the federal and state requirements you want. US Legal Forms provides a large number of lawful forms which can be analyzed by professionals. You can actually down load or print the Kansas Oil, Gas and Mineral Royalty Transfer from your assistance.

If you already possess a US Legal Forms accounts, you can log in and click the Acquire button. Next, you can comprehensive, change, print, or signal the Kansas Oil, Gas and Mineral Royalty Transfer. Each lawful record design you get is the one you have forever. To obtain yet another duplicate of any obtained develop, check out the My Forms tab and click the related button.

Should you use the US Legal Forms internet site for the first time, stick to the simple guidelines under:

- Initial, be sure that you have selected the right record design to the county/city of your liking. See the develop information to make sure you have chosen the appropriate develop. If readily available, make use of the Preview button to check throughout the record design as well.

- If you want to discover yet another model of your develop, make use of the Lookup area to get the design that meets your requirements and requirements.

- Once you have found the design you desire, just click Acquire now to continue.

- Find the pricing prepare you desire, enter your credentials, and sign up for an account on US Legal Forms.

- Full the deal. You can utilize your charge card or PayPal accounts to cover the lawful develop.

- Find the format of your record and down load it to your device.

- Make alterations to your record if needed. It is possible to comprehensive, change and signal and print Kansas Oil, Gas and Mineral Royalty Transfer.

Acquire and print a large number of record templates while using US Legal Forms web site, that provides the biggest selection of lawful forms. Use skilled and express-certain templates to deal with your organization or specific requires.

Form popularity

FAQ

Ingly, crude oil royalties for onshore area and shallow water area will be 15% and 12.5%, respectively. For deep offshore area and frontier basin area, the royalty rate will be 7.5%. Royalty based on production for natural gas and natural gas liquids will be at a rate of 5% of the chargeable volume.

Both onshore and offshore leasing statutes require a royalty rate of at least 12.5% of the value of production. The royalty rate is stated in the lease document. Regulations may reduce that rate in certain limited circumstances.

Royalty interest in the oil and gas industry refers to ownership of a portion of a resource or the revenue it produces. A company or person that owns a royalty interest does not bear any operational costs needed to produce the resource, yet they still own a portion of the resource or revenue it produces.

If you sign a mineral rights lease, then you are on your way to earning oil and gas royalties. As a mineral rights owner, you can receive royalty compensation. This is from the sale of crude oil, natural gas, and other valuable resources found on your property.

In Kansas, the landowner usually owns the subsurface rights, but sometimes these rights have been severed, or separated from the surface ownership. Severance of mineral rights occurs when the owner of both the surface and mineral rights sells or grants by deed the mineral rights underlying their property.

The royalty percentage is usually 12.5% to 15% but can change based on regional regulations or negotiations. Types of Leases: There are different types of oil and gas leases, and they affect royalty calculations differently.

The legal process for inheriting royalties involves obtaining a deed from the deceased's estate and transferring ownership.

Most states and many private landowners require companies to pay royalty rates higher than 12.5%, with some states charging 20% or more, ing to federal officials. The royalty rate for oil produced from federal reserves in deep waters in the Gulf of Mexico is 18.75%.