Kansas Agreement for Sale of Business by Sole Proprietorship with Purchase Price Contingent on Audit is a legal document that outlines the terms and conditions of selling a sole proprietorship business in the state of Kansas. This agreement is specifically designed for situations where the purchase price is contingent upon the results of a detailed audit of the business before the sale is finalized. In this type of agreement, both the seller (sole proprietor) and the buyer agree to the terms and conditions set forth in the document. The agreement covers various aspects of the sale, including the purchase price, payment terms, responsibilities of the parties involved, and the importance of conducting an audit before finalizing the sale. The main purpose of the Kansas Agreement for Sale of Business by Sole Proprietorship with Purchase Price Contingent on Audit is to protect the interests of both the seller and the buyer. By contingent on a thorough audit, the parties ensure that the purchase price is based on accurate and reliable financial information about the business. Some of the key elements that may be included in this agreement are: 1. Purchase Price: The agreement specifies the total purchase price for the business, which is subject to adjustment based on the results of the audit. 2. Audit Process: It outlines the process of conducting the audit, such as who will perform the audit, the timeline for completion, and the specific financial information and records that will be reviewed. 3. Contingencies: This type of agreement typically includes specific contingencies that allow the buyer to back out of the sale if the audit reveals significant discrepancies or issues that were not previously disclosed by the seller. 4. Seller's Representations and Warranties: The seller is required to provide certain representations and warranties regarding the accuracy and completeness of the financial information provided for the audit. 5. Purchase Price Adjustment: If the audit reveals discrepancies or issues, the agreement may include provisions for adjusting the purchase price accordingly. This adjustment ensures that the buyer pays a fair price for the business based on its actual financial condition. 6. Closing and Transition: The agreement may outline the steps and timeline for the closing of the sale, including the transfer of ownership, assets, and any necessary licenses or permits. It may also address the seller's responsibilities during the transition period. Kansas Agreement for Sale of Business by Sole Proprietorship with Purchase Price Contingent on Audit serves as a legally binding contract that protects both parties involved in the sale of a sole proprietorship business. It promotes transparency, fairness, and ensures that the buyer is making an informed decision based on accurate financial information. It is strongly advised that both parties seek legal counsel when drafting and executing this agreement to ensure compliance with Kansas state laws. Other variations or types of agreements for the sale of a sole proprietorship in Kansas may include agreements without an audit contingency, agreements with fixed purchase prices, or agreements that include additional clauses specific to the needs of the buyer and seller.

Kansas Agreement for Sale of Business by Sole Proprietorship with Purchase Price Contingent on Audit

Description

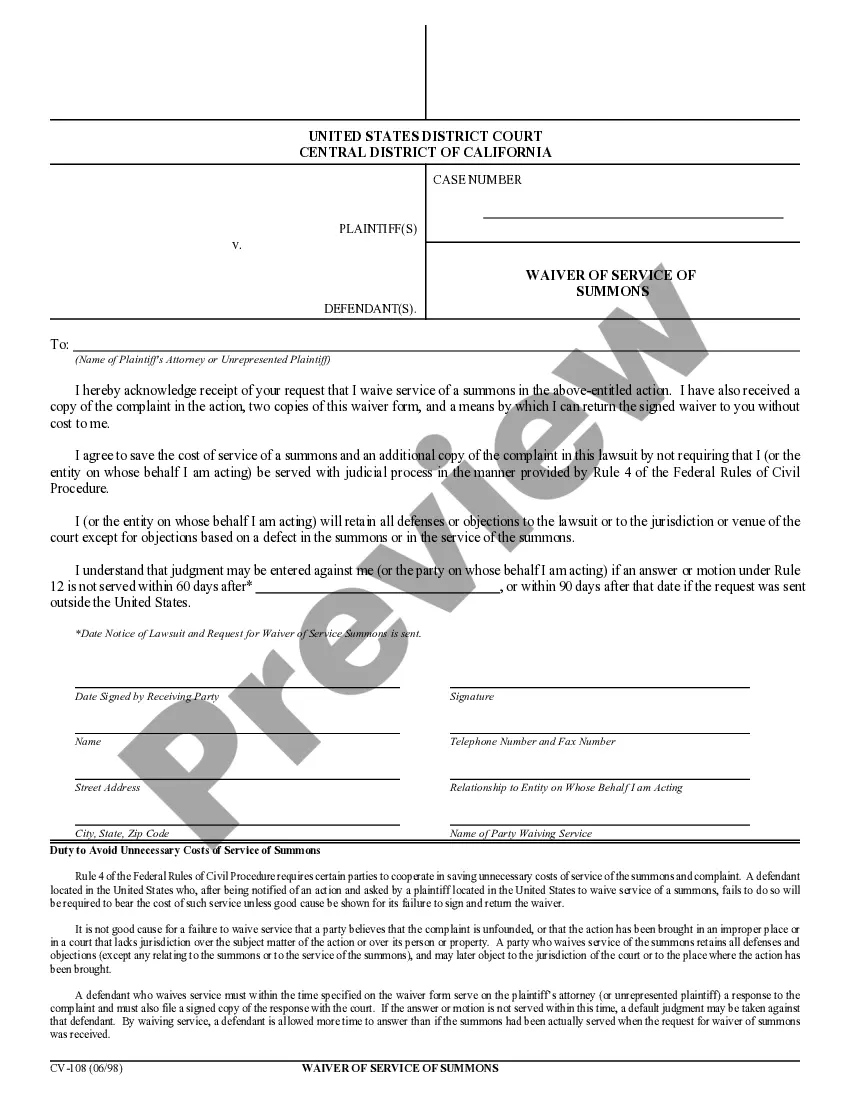

How to fill out Kansas Agreement For Sale Of Business By Sole Proprietorship With Purchase Price Contingent On Audit?

Selecting the optimal legal document template can be a challenge.

Of course, there are numerous templates accessible online, but how do you locate the legal form you require.

Utilize the US Legal Forms website. The platform offers thousands of templates, including the Kansas Agreement for Sale of Business by Sole Proprietorship with Purchase Price Contingent on Audit, suitable for both business and personal requirements.

You can view the form by clicking the Review button and checking the form description to confirm it is suitable for you.

- All templates are reviewed by experts and comply with federal and state regulations.

- If you are already registered, Log In to your account and hit the Download button to obtain the Kansas Agreement for Sale of Business by Sole Proprietorship with Purchase Price Contingent on Audit.

- Use your account to search through the legal forms you have obtained previously.

- Go to the My documents section of your account to get another copy of the document you need.

- If you are a new user of US Legal Forms, here are easy steps to follow.

- First, ensure you have selected the correct form for your city/state.

Form popularity

FAQ

Parts of an Asset Purchase AgreementRecitals. The opening paragraph of an asset purchase agreement includes the buyer and seller's name and address as well as the date of signing.Definitions.Purchase Price and Allocation.Closing Terms.Warranties.Covenants.Indemnification.Governance.More items...

What Should Be Included in a Sales Agreement?A detailed description of the goods or services for sale.The total payment due, along with the time and manner of payment.The responsible party for delivering the goods, along with the date and time of delivery.More items...

Any purchase agreement should include at least the following information:The identity of the buyer and seller.A description of the property being purchased.The purchase price.The terms as to how and when payment is to be made.The terms as to how, when, and where the goods will be delivered to the purchaser.More items...?

A Business Purchase Agreement is a contract used to transfer the ownership of a business from a seller to a buyer. It includes the terms of the sale, what is or is not included in the sale price, and optional clauses and warranties to protect both the seller and the purchaser after the transaction has been completed.

Know How to Fill Out the Business Bill of SaleDate of Sale.Buyer's name and address.Seller's name and address.Business name and details, which include: State of incorporation. Address of the business's main headquarters. Assets, shares, personal property and other interests included with the company.

Most Purchase Agreements Are Contingent On Which Two Items? The inspection and financing contingencies are the two most important contingencies home buyers should care about most. No home buyer wants to close on a transaction only to find hidden defects three months down the line.

How to Write a Business Purchase Agreement?Step 1 Parties and Business Information. A business purchase agreement should detail the names of the buyer and seller at the start of the agreement.Step 2 Business Assets.Step 3 Business Liabilities.Step 4 Purchase Price.Step 6 Signatures.

In an asset purchase, the buyer will only buy certain assets of the seller's company. The seller will continue to own the assets that were not included in the purchase agreement with the buyer. The transfer of ownership of certain assets may need to be confirmed with filings, such as titles to transfer real estate.

Provisions of an APA may include payment of purchase price, monthly installments, liens and encumbrances on the assets, condition precedent for the closing, etc. An APA differs from a stock purchase agreement (SPA) under which company shares, title to assets, and title to liabilities are also sold.

An asset purchase involves just the assets of a company. In either format, determining what is being acquired is critical. This article focuses on some of the important categories of assets to consider in a business purchase: real estate, personal property, and intellectual property.

Interesting Questions

More info

In return, they may require a certain percentage of gross sales on that property and agree to make an upfront cash deposit on the home's price. In order to provide the best possible home buying experience, each seller and buyer must understand how to negotiate a CIO and be able to communicate with their own lender in order to obtain a CIO offered. As the CIO process can change from seller to seller and even from region to region, you need to be aware of the specific requirements of both the seller and buyer in order to make the most of the process. While negotiating a CIO offer, both your seller's and buyer's account should be prepared in order to negotiate the best possible deal. There are many terms used in the context of a CIO and the negotiation process can be complex, but the rules and procedures described are basic and generally work well when both sellers and buyers are aware of them.