The Kansas Agreement for Sale of Business by Sole Proprietorship with Seller to Finance Part of Purchase Price is a legally binding document that outlines the terms and conditions for the sale of a business from a sole proprietor to a buyer, with a portion of the purchase price being financed by the seller. This agreement is specific to the state of Kansas and is designed to protect the rights and interests of both parties involved in the transaction. Keywords: Kansas, Agreement for Sale of Business, Sole Proprietorship, Seller, Finance, Purchase Price. Types of Kansas Agreement for Sale of Business by Sole Proprietorship with Seller to Finance Part of Purchase Price: 1. Kansas Agreement for Sale of Business by Sole Proprietorship with Seller Financing: This type of agreement involves the seller offering financing to the buyer for the purchase of the business. The terms and conditions of the financing, including interest rates, repayment schedule, and any collateral required, are clearly outlined in the agreement. 2. Kansas Agreement for Sale of Business by Sole Proprietorship with Installment Payments: In this type of agreement, the buyer agrees to make installment payments to the seller over a specified period. The seller may finance a portion of the purchase price, and the agreement will detail the terms of the installments, including amounts, frequency, and duration. 3. Kansas Agreement for Sale of Business by Sole Proprietorship with Promissory Note: This type of agreement involves the seller providing a promissory note to the buyer, which represents a promise to pay a specific sum of money at a predetermined time or on-demand. The note constitutes a legally binding document that outlines the terms of repayment, interest rates, and any additional terms agreed upon by the parties. 4. Kansas Agreement for Sale of Business by Sole Proprietorship with Balloon Payment: This type of agreement includes a provision where the buyer agrees to make regular payments to the seller for a specified period, followed by a larger lump sum payment, known as a balloon payment, due at the end of the term. The seller finances part of the purchase price, and the agreement outlines the amount and due date of the balloon payment. It is important to note that each of these types of agreements may vary in their specific terms and conditions, and it is crucial for both the seller and buyer to carefully review the agreement and consult legal professionals to ensure their understanding and protection of their rights during the sale of the business.

Kansas Agreement for Sale of Business by Sole Proprietorship with Seller to Finance Part of Purchase Price

Description

How to fill out Kansas Agreement For Sale Of Business By Sole Proprietorship With Seller To Finance Part Of Purchase Price?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a variety of legal document templates you can download or print.

By using the website, you will find thousands of forms for business and personal use, organized by categories, states, or keywords.

You can find the latest versions of forms such as the Kansas Agreement for Sale of Business by Sole Proprietorship with Seller to Finance Part of Purchase Price in minutes.

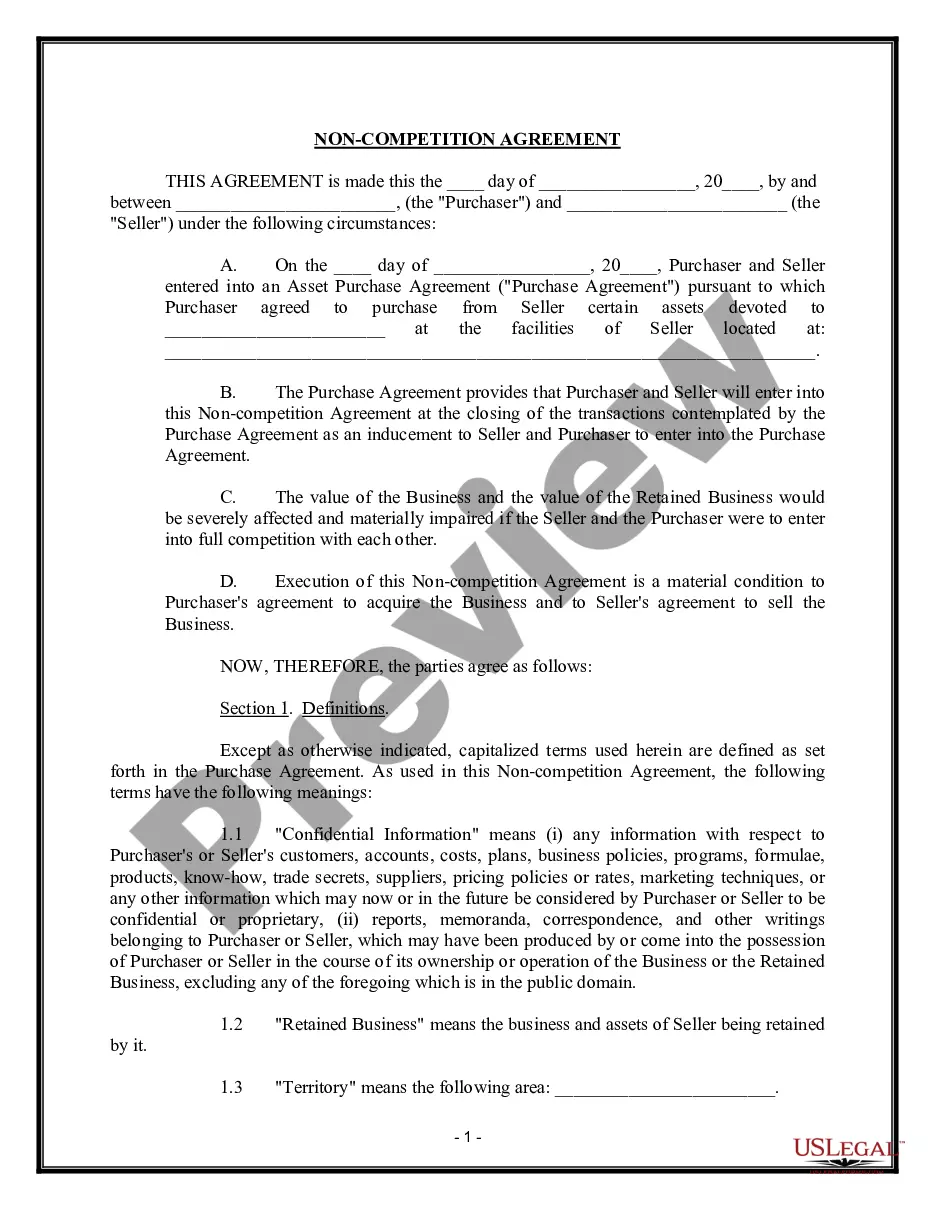

Click the Preview button to review the content of the form. Check the form summary to ensure you have selected the right document.

If the form does not meet your requirements, use the Search field at the top of the screen to find a suitable one.

- If you currently have a monthly subscription, Log In and download the Kansas Agreement for Sale of Business by Sole Proprietorship with Seller to Finance Part of Purchase Price from your US Legal Forms library.

- The Download button will appear on every form you view.

- You can access all previously downloaded forms in the My documents section of your account.

- If you are using US Legal Forms for the first time, here are simple instructions to help you begin.

- Make sure you have selected the correct form for your specific area/region.

Form popularity

FAQ

The acquired assets usually include all fixed assets (usually supported by a detailed list), all inventory, all supplies, tools, computers and related software, websites, all social media accounts used in connection with the Business, all permits, patents, trademarks, service marks, trade names (including but not

Any purchase agreement should include at least the following information:The identity of the buyer and seller.A description of the property being purchased.The purchase price.The terms as to how and when payment is to be made.The terms as to how, when, and where the goods will be delivered to the purchaser.More items...?

For valid sale agreement must be signed by both parties to be legally enforceable. Seller cannot file suit. Dear Client, On sale deed, signature of buyer and seller is must.

How to Draft a Sales ContractIdentity of the Parties/Date of Agreement. The first topic a sales contract should address is the identity of the parties.Description of Goods and/or Services. A sales contract should also address what is being bought or sold.Payment.Delivery.Miscellaneous Provisions.Samples.

A Business Purchase Agreement is a contract used to transfer the ownership of a business from a seller to a buyer. It includes the terms of the sale, what is or is not included in the sale price, and optional clauses and warranties to protect both the seller and the purchaser after the transaction has been completed.

Legal Documents Needed to Sell a BusinessNon-Disclosure Confidentiality Agreement.Personal Financial Statement Form for Buyer to Complete.Offer-to-Purchase Agreement.Note of Seller Financing.Financial Statements for Current and Past Two to Three Years.Statement of Seller's Discretionary Earnings and Cash Flow.More items...

How to Write a Business Purchase Agreement?Step 1 Parties and Business Information. A business purchase agreement should detail the names of the buyer and seller at the start of the agreement.Step 2 Business Assets.Step 3 Business Liabilities.Step 4 Purchase Price.Step 6 Signatures.

For a contract to be legally binding it must contain four essential elements:an offer.an acceptance.an intention to create a legal relationship.a consideration (usually money).

What to include in a business sales contract.Name the parties. Clearly state the names and locations of the buyer and seller.List the assets.Define liabilities.Set sale terms.Include other agreements.Make your sales agreement digital.

Parts of an Asset Purchase AgreementRecitals. The opening paragraph of an asset purchase agreement includes the buyer and seller's name and address as well as the date of signing.Definitions.Purchase Price and Allocation.Closing Terms.Warranties.Covenants.Indemnification.Governance.More items...