[Your Name] [Your Address] [City, State, ZIP] [Email Address] [Phone Number] [Date] [Kansas Department of Revenue] [Tax Clearance Unit] [Address] [City, State, ZIP] Subject: Request for Tax Clearance Letter Dear tax clearance unit, I am writing this letter to request a Tax Clearance Letter from the Kansas Department of Revenue. I require this document for [specific reason: e.g., closing a business, changing ownership, applying for a loan, selling assets, etc.]. Please find the necessary details and documentation enclosed with this request. [If applicable, mention the specific type of Tax Clearance Letter you require, such as]: 1. General Tax Clearance Letter: This letter certifies that all state taxes, including sales tax, withholding tax, corporate income tax, etc., have been paid in full and there are no outstanding tax liabilities. 2. Sales Tax Clearance Letter: This type of clearance letter specifically validates that all sales taxes for retail operations have been appropriately reported, collected, and remitted to the Kansas Department of Revenue. 3. Employee Withholding Clearance Letter: This clearance letter confirms that all employee withholding taxes have been accurately withheld and submitted to the Kansas Department of Revenue. 4. Corporation Income Tax Clearance Letter: This specific clearance letter confirms compliance with state corporation income tax obligations, including the filing of returns and payment of taxes owed. I have completed all necessary tax filings and made all required tax payments up to the present date. Enclosed with this letter, you will find the following supporting documents: 1. Fully completed and signed Tax Clearance Request Form (available on the Kansas Department of Revenue website). 2. Copies of all relevant tax returns filed for the applicable periods. 3. Proof of tax payments made, including receipts or bank statements. 4. Any additional supporting documentation, if required for the specific type of tax clearance letter requested. I kindly request you to process this request as quickly as possible, as [explain the urgency, if applicable]. Should you require any further information or documentation, please do not hesitate to contact me at [phone number] or [email address]. Thank you for your prompt attention to this matter. I look forward to receiving the requested Tax Clearance Letter at the earliest convenience. Yours sincerely, [Your Name]

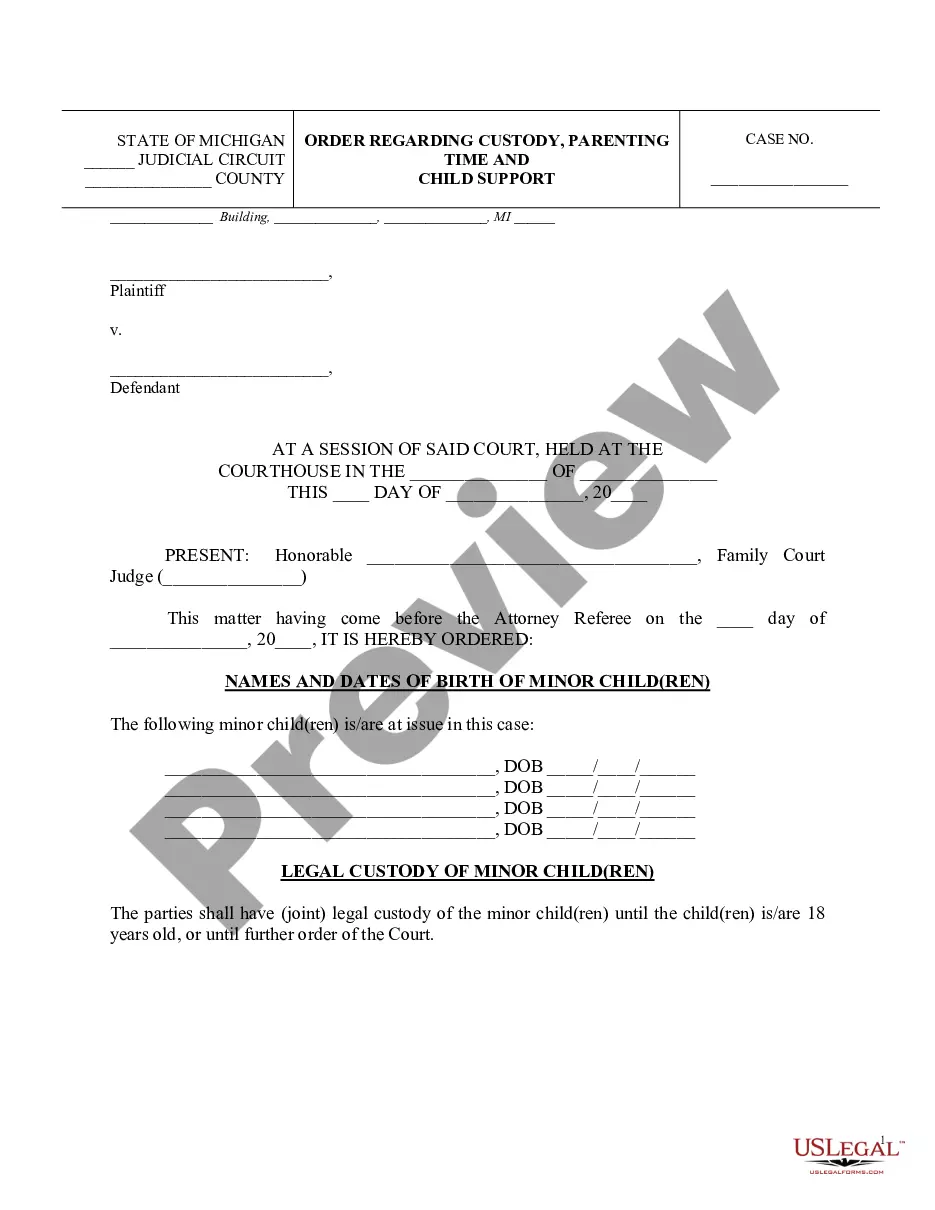

Kansas Sample Letter for Request for Tax Clearance Letter

Description

How to fill out Sample Letter For Request For Tax Clearance Letter?

If you wish to full, acquire, or print legal document layouts, use US Legal Forms, the biggest collection of legal forms, which can be found on the Internet. Use the site`s easy and hassle-free research to discover the files you require. A variety of layouts for company and person purposes are categorized by categories and states, or keywords and phrases. Use US Legal Forms to discover the Kansas Sample Letter for Request for Tax Clearance Letter within a handful of clicks.

In case you are already a US Legal Forms client, log in to the bank account and click the Obtain switch to get the Kansas Sample Letter for Request for Tax Clearance Letter. Also you can access forms you in the past saved in the My Forms tab of your bank account.

If you use US Legal Forms the first time, follow the instructions below:

- Step 1. Ensure you have chosen the form for your appropriate area/region.

- Step 2. Utilize the Review choice to check out the form`s content. Don`t neglect to read the information.

- Step 3. In case you are not happy using the develop, use the Search area towards the top of the monitor to discover other versions in the legal develop format.

- Step 4. Upon having discovered the form you require, go through the Buy now switch. Opt for the costs strategy you favor and add your qualifications to sign up to have an bank account.

- Step 5. Method the purchase. You can utilize your Мisa or Ьastercard or PayPal bank account to perform the purchase.

- Step 6. Find the format in the legal develop and acquire it on your own system.

- Step 7. Comprehensive, modify and print or indicator the Kansas Sample Letter for Request for Tax Clearance Letter.

Every single legal document format you get is your own forever. You may have acces to each and every develop you saved inside your acccount. Click the My Forms area and decide on a develop to print or acquire yet again.

Compete and acquire, and print the Kansas Sample Letter for Request for Tax Clearance Letter with US Legal Forms. There are many specialist and express-distinct forms you may use for your company or person needs.

Form popularity

FAQ

If you have a tax debt, the Kansas Department of Revenue will send you a bill and may contact you by phone, in person or by a recorded message.

Most commonly, states issue clearance certificates, demonstrating that an individual is compliant with all taxes and other obligations as of the date of the certificate. Those seeking clearance certificates will have to request them from state authorities, usually the state's Department of Revenue.

Obtain a State of Kansas Tax Clearance Request Online - Click here to complete an application through our secure website. Return to the website the following day to retrieve your "Certificate of Tax Clearance". Applications must be submitted by 5pm Monday ? Friday in order to be available the following business day.

In general, you'll need to supply the following information to get a tax clearance certificate: the name, address, and phone number of the buyer and seller. a business address or addresses if multiple locations are involved. the date of sale. a bill of sale or purchase agreement for the business.

Option 1: Sign in to your eFile.com account, modify your Return and download/print the KS Form K-40 under My Account. Mark the check box "Amended Return" sign the form and mail it to one of the addresses listed below.

To ask for a clearance certificate, you can submit the completed form TX19, Asking for a Clearance Certificate with the required documents which are listed on the form. The submission can be sent by mail, fax, or electronically via using the Submit Document feature within CRA Online Portals.