Title: Kansas Letter to Creditors Notifying Them of Identity Theft for New Accounts — Detailed Guide and Templates Introduction: Identity theft is a serious concern affecting individuals in Kansas and across the United States. To address this issue, Kansas has established guidelines for victims of identity theft to inform creditors about fraudulent accounts opened under their names. This article will provide a detailed description of a Kansas Letter to Creditors Notifying Them of Identity Theft for New Accounts, including important keywords and variations of such letters. 1. Kansas Letter to Creditors Notifying Them of Identity Theft: When victims discover fraudulent accounts opened under their names, it is crucial to take immediate action. Kansas residents can use a Letter to Creditors to inform relevant entities about their identity theft situation. This letter must be sent to the creditor responsible for the fraudulent account. Keywords: Kansas, identity theft, letter to creditors, notifying, new accounts, fraud, fraudulent account. 2. Kansas Letter to Creditors Notifying Them of Identity Theft — Overview: This section will briefly explain the purpose of the letter and cover essential elements required to inform creditors about the identity theft incident, including personal details, account information, and request for action. 3. Key Sections and Content: a. Victim's Information: Funnymanam— - Address - Contact details (phone number and email) b. Creditor's Information: CreditorsNa mamam— - Creditor's addres— - Creditor's contact details (phone number and email) c. Account Information: — Date of discovery of identittheef— - Type of fraudulent account (credit card, loan, etc.) — Account number (if available— - Date of account opening (if known) d. Explanation of Identity Theft: — Description of how the victim became aware of the fraudulent activity — Any relevant details or evidence supporting the claim (e.g., police reports, credit monitoring statements) e. Request for Action: — Request to close the fraudulent account immediately — Request to remove the account from the victim's credit report — Request to freeze the victim's credit to prevent future fraudulent accounts 4. Variations of Kansas Letter to Creditors Notifying Them of Identity Theft for New Accounts: a. Individual vs. Joint Accounts: — Addressing the letter for individual fraudulent accounts (victim's name only). — Addressing the letter for joint fraudulent accounts (victim's name and joint account holder's name). b. Creditors' Response: — Follow-up letters if the creditor fails to acknowledge or respond to the initial notification. — Letter template for creditors requesting proof of identity theft and fraudulent account closure. Conclusion: Protecting oneself from identity theft and immediately notifying creditors are critical steps in safeguarding one's financial security. This article provided a detailed description of a Kansas Letter to Creditors Notifying Them of Identity Theft for New Accounts, including important keywords and variations. Utilizing the provided information and templates will help Kansas residents effectively communicate with creditors and address identity theft incidents promptly.

Kansas Letter to Creditors Notifying Them of Identity Theft for New Accounts

Description

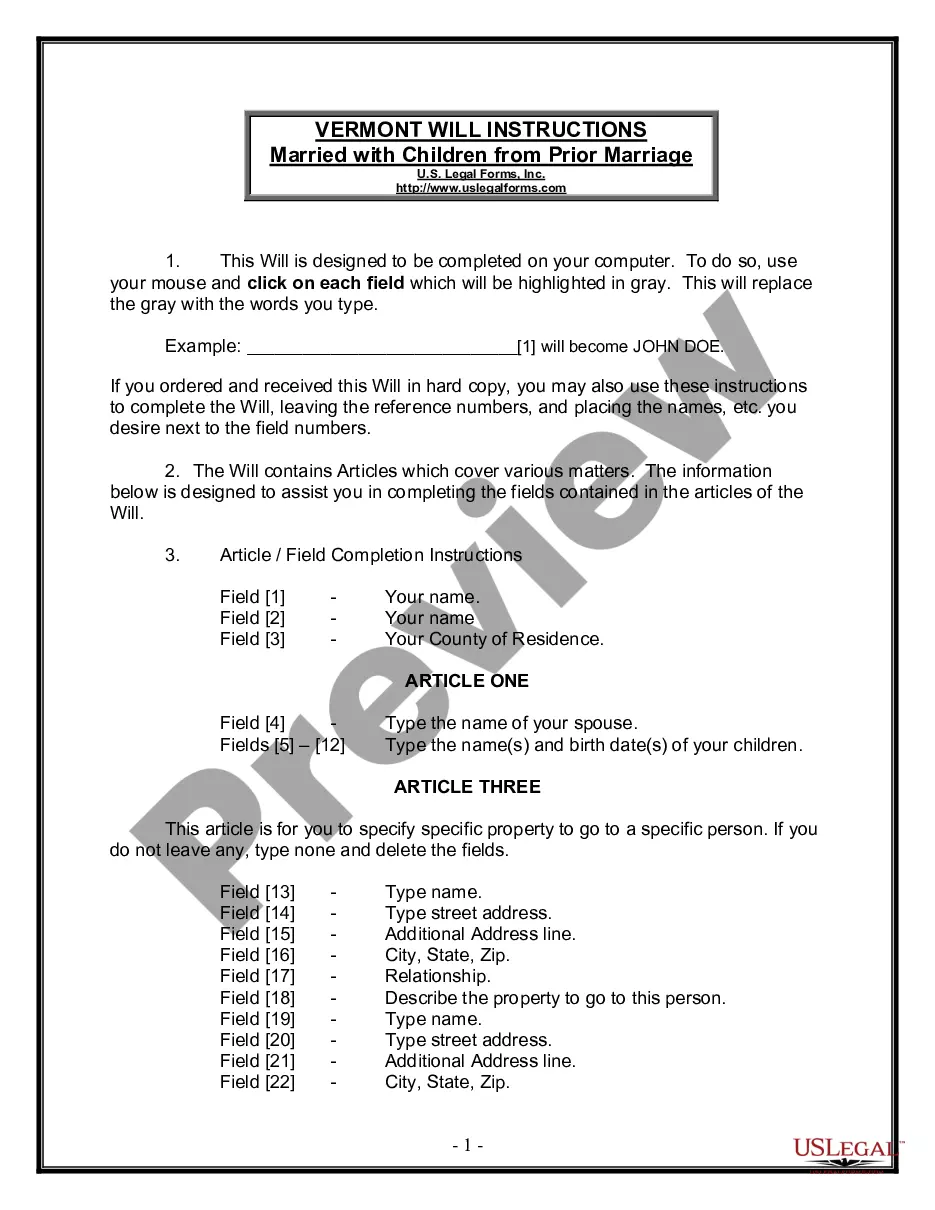

How to fill out Kansas Letter To Creditors Notifying Them Of Identity Theft For New Accounts?

Are you currently in the position where you will need documents for either organization or individual reasons almost every day time? There are a variety of legal document templates available on the Internet, but finding ones you can rely on isn`t effortless. US Legal Forms delivers a huge number of kind templates, just like the Kansas Letter to Creditors Notifying Them of Identity Theft for New Accounts, that happen to be published to satisfy federal and state demands.

When you are currently informed about US Legal Forms site and have a merchant account, merely log in. Following that, you are able to down load the Kansas Letter to Creditors Notifying Them of Identity Theft for New Accounts template.

If you do not provide an bank account and wish to start using US Legal Forms, abide by these steps:

- Discover the kind you need and make sure it is for your right town/region.

- Make use of the Preview button to examine the form.

- Look at the outline to actually have chosen the right kind.

- In case the kind isn`t what you are searching for, make use of the Search field to find the kind that meets your requirements and demands.

- If you get the right kind, just click Buy now.

- Choose the costs prepare you would like, fill out the specified info to create your account, and purchase your order utilizing your PayPal or charge card.

- Select a practical data file formatting and down load your duplicate.

Find all of the document templates you have purchased in the My Forms menus. You can obtain a extra duplicate of Kansas Letter to Creditors Notifying Them of Identity Theft for New Accounts at any time, if possible. Just click the needed kind to down load or printing the document template.

Use US Legal Forms, probably the most considerable assortment of legal kinds, to conserve efforts and stay away from faults. The support delivers appropriately produced legal document templates that can be used for a range of reasons. Create a merchant account on US Legal Forms and start creating your life a little easier.