Title: Kansas Letter Agreement Between Known Imposter and Victim to Work Out Repayment Plan Introduction: A Kansas Letter Agreement Between Known Imposter and Victim to Work Out Repayment Plan is a legal document that outlines an agreement between an individual who has fallen victim to identity theft or fraud (the victim) and the person responsible for the fraudulent activities (the imposter). This agreement aims to establish a repayment plan to rectify the financial damages caused by the imposter's actions. Keywords: Kansas, Letter Agreement, Known Imposter, Victim, Work Out, Repayment Plan. 1. Importance of a Kansas Letter Agreement: — Understanding the significance of a Kansas Letter Agreement in addressing identity theft or fraud cases. — The legal framework provided by this agreement ensures a transparent and binding commitment to resolving financial damages. 2. Key Elements of a Kansas Letter Agreement Between Known Imposter and Victim: — Explanation of the victim's rights and the imposter's acknowledgement of their fraudulent actions. — A clear description of the financial losses incurred by the victim due to the imposter's activities. — Stipulations of the repayment plan agreed upon by both parties. — Timelines, installment amounts, and interest rates (if applicable) for the repayment schedule. — Potential consequences for non-compliance with the agreement terms. 3. Types of Kansas Letter Agreement Between Known Imposter and Victim to Work Out Repayment Plan: a. Consumer Fraud Repayment Plan: Specifies terms and conditions for repayment of fraudulently incurred debts. b. Identity Theft Reparation Agreement: Focuses on the restitution of stolen funds and efforts to repair the victim's credit standing. c. Unauthorized Transactions Resolution Plan: Addresses cases where the known imposter illegally engaged in financial transactions using the victim's identity. 4. Legal Considerations in Drafting a Kansas Letter Agreement: — Compliance with Kansas state laws, regulations, and consumer protection statutes. — Consultation with legal professionals or attorneys to ensure the agreement's validity and adherence to local requirements. — The inclusion of a clause addressing confidentiality and non-disclosure to prevent further misuse of personal information. 5. Steps to Drafting a Kansas Letter Agreement Between Known Imposter and Victim: a. Comprehensive documentation of the fraudulent activities, including evidence and potential witnesses. b. Consultation with a legal professional to understand the legal options available. c. Discussion between the victim and imposter to negotiate the repayment plan terms. d. Drafting the letter agreement with clear, concise language and accurate information. e. Signing and notarizing the document to validate its authenticity and commitment from both parties. Conclusion: A Kansas Letter Agreement Between Known Imposter and Victim to Work Out Repayment Plan offers a structured approach to address the consequences and damages caused by identity theft or fraud. By establishing a repayment plan, victims can seek financial recovery, while imposters can take responsibility for their actions and work towards rectification.

Kansas Letter Agreement Between Known Imposter and Victim to Work Out Repayment Plan

Description

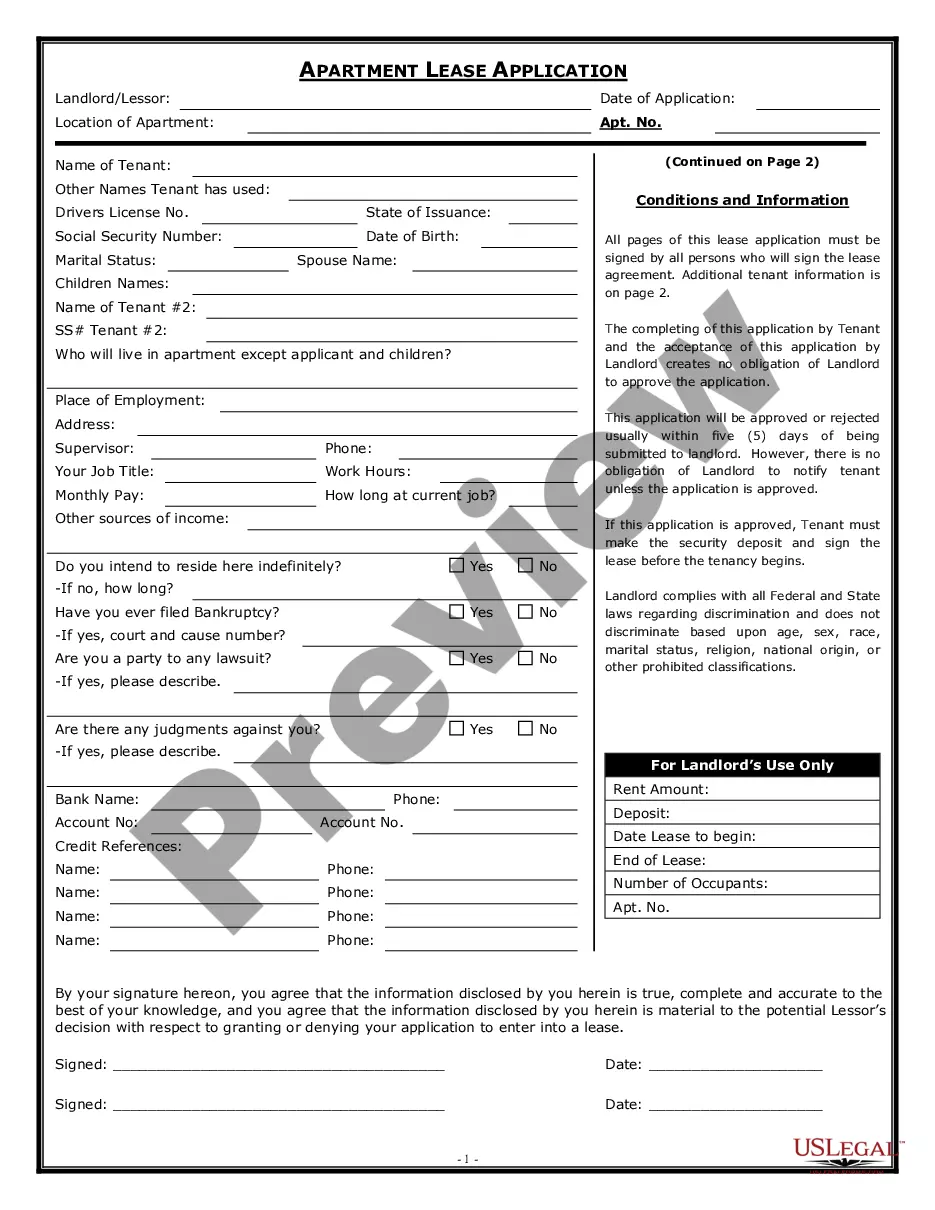

How to fill out Kansas Letter Agreement Between Known Imposter And Victim To Work Out Repayment Plan?

US Legal Forms - one of many biggest libraries of authorized types in the United States - provides a variety of authorized record web templates you are able to download or printing. Using the website, you will get a large number of types for organization and specific uses, sorted by types, states, or keywords.You will find the most up-to-date variations of types like the Kansas Letter Agreement Between Known Imposter and Victim to Work Out Repayment Plan in seconds.

If you have a subscription, log in and download Kansas Letter Agreement Between Known Imposter and Victim to Work Out Repayment Plan in the US Legal Forms collection. The Obtain switch will show up on each kind you see. You get access to all formerly delivered electronically types in the My Forms tab of the accounts.

If you would like use US Legal Forms for the first time, allow me to share basic instructions to get you started:

- Be sure to have selected the correct kind for your city/area. Click the Preview switch to analyze the form`s articles. See the kind outline to actually have selected the correct kind.

- When the kind doesn`t suit your needs, use the Look for discipline at the top of the display screen to get the one which does.

- Should you be happy with the shape, affirm your option by clicking the Get now switch. Then, opt for the costs program you favor and offer your references to register for an accounts.

- Procedure the financial transaction. Use your credit card or PayPal accounts to accomplish the financial transaction.

- Choose the format and download the shape in your system.

- Make changes. Complete, edit and printing and indicator the delivered electronically Kansas Letter Agreement Between Known Imposter and Victim to Work Out Repayment Plan.

Every single design you included with your money does not have an expiry date and it is your own eternally. So, if you want to download or printing yet another copy, just visit the My Forms area and then click in the kind you want.

Get access to the Kansas Letter Agreement Between Known Imposter and Victim to Work Out Repayment Plan with US Legal Forms, the most comprehensive collection of authorized record web templates. Use a large number of specialist and state-distinct web templates that fulfill your small business or specific demands and needs.

Form popularity

FAQ

If you are contacted by someone asking you to transfer money for them, it is most likely a scam. Never send money or provide credit card or online account information to anyone you do not know and trust.

Scammers are looking for people to help them move stolen money. They visit online dating, job search, and social media sites, create stories, and make up reasons to send you money, usually by check or Bitcoin. Then they tell you to send that money to someone else by using gift cards or wire transfers.

If you are still unsure about whether or not it is safe to receive money from a stranger on Cash App, it is always best to err on the side of caution and decline the payment. Here are some tips to help you stay safe when using Cash App: Only use Cash App with people you know and trust.

Once a scammer has you ?hooked? in an online relationship, they'll start asking you to send them money, gift cards, or expensive gifts. If you catch on, they'll delete their accounts and vanish.

? Take action: If you accidentally give scammers your financial data or account logins, they could take out loans in your name or empty your bank account. Try an identity theft protection service to monitor your finances and alert you to fraud.

You Think You've Been Scammed. Now What? STOP CONTACT WITH THE SCAMMER. Hang up the phone. ... SECURE YOUR FINANCES. CHECK YOUR COMPUTER. ... CHANGE YOUR ACCOUNT PASSWORDS. ... REPORT THE SCAM.

Get the Payment Plan Request for INDIVIDUAL INCOME (CM-15) here. Pay Plan Request Forms can be faxed to the Collections Department at: 1-785-291-3616. Pay Plan Request Forms can be emailed to: kdor_kstaxpayplanrequest@ks.gov.

Has a stranger 'accidentally' sent you money on a payment app? Beware ? it might be a payment app scam. As peer-to-peer payment apps have grown in popularity, scammers have devised new payment scams to take advantage of unsuspecting users.