A Kansas Limited Partnership Agreement between a Limited Liability Company (LLC) and a Limited Partner is a legal contract that defines the rights, responsibilities, and obligations of the parties involved in forming a limited partnership in the state of Kansas. This agreement is essential for establishing a structure that outlines the management and operation of the partnership, as well as the contributions and distributions of profits or losses. The agreement typically begins with an introductory section that outlines the names of the LLC and the Limited Partner, their respective roles, and the effective date of the agreement. It also sets forth the purpose and objectives of the limited partnership, which can vary depending on the specific business venture. One key aspect of the Kansas Limited Partnership Agreement is the role of the LLC, which acts as the general partner responsible for managing the partnership's day-to-day operations. The LLC assumes liability for the partnership's obligations and is typically accountable for making management decisions on behalf of the partnership. On the other hand, the Limited Partner is an investor who primarily contributes capital to the business but has limited involvement in its operations and management. Limited Partners are shielded from personal liability for the partnership's debts beyond their initial investment. The agreement also addresses important financial aspects, such as the capital contributions required from the Limited Partner and the LLC's initial and subsequent capital contributions. It outlines how profits and losses will be allocated among partners and whether the LLC or Limited Partner will receive guaranteed payments or preferential distributions. Additionally, the Kansas Limited Partnership Agreement provides guidelines for decision-making processes within the partnership. It may require certain decisions to be made by unanimous consent, while others may only require a majority vote. The agreement can also establish rules for admitting new partners or withdrawing existing ones and may include provisions for resolving disputes between partners. Different types of Limited Partnership Agreements can exist in Kansas, based on the nature of the business venture or the specific requirements of the parties involved. For example, there may be agreements tailored for real estate investments, oil and gas ventures, or private equity projects. These agreements may include additional clauses or provisions specific to the industry involved, such as special distribution rights or specific termination conditions. In conclusion, a Kansas Limited Partnership Agreement between a Limited Liability Company and a Limited Partner is a comprehensive legal document that delineates the rights, obligations, and financial aspects of a limited partnership. This agreement sets the foundation for a successful partnership, providing clarity and structure to promote cooperation and protect the interests of all parties involved.

Kansas Limited Partnership Agreement Between Limited Liability Company and Limited Partner

Description

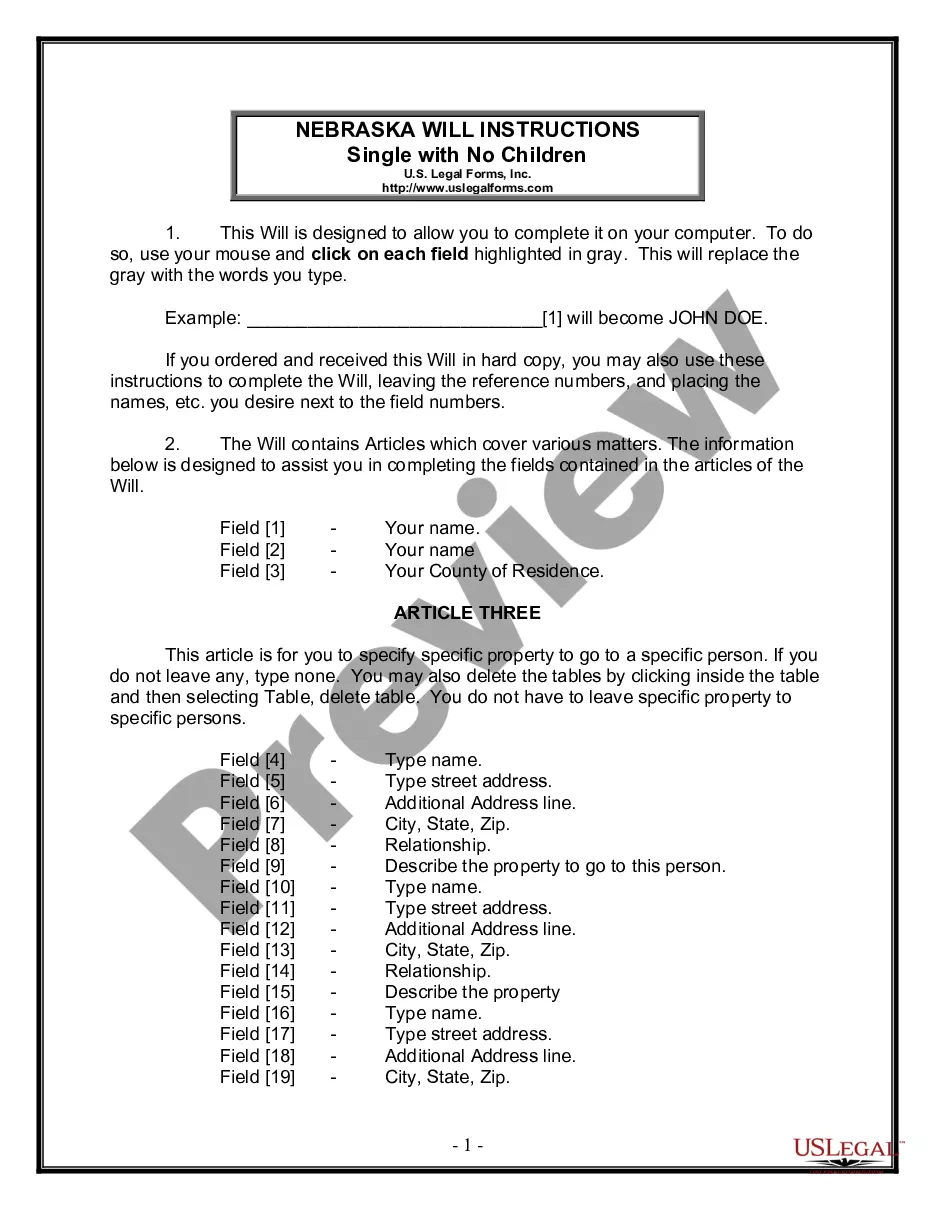

How to fill out Kansas Limited Partnership Agreement Between Limited Liability Company And Limited Partner?

Are you presently in a position where you need documents for either commercial or personal purposes nearly all the time.

There are numerous official form templates available online, but locating trustworthy versions is not an easy task.

US Legal Forms offers thousands of form templates, such as the Kansas Limited Partnership Agreement Between Limited Liability Company and Limited Partner, which are designed to comply with federal and state regulations.

Utilize US Legal Forms, the most extensive collection of official forms, to save time and avoid mistakes.

The service offers professionally crafted legal document templates that can be used for various purposes. Establish your account on US Legal Forms and begin simplifying your life.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Kansas Limited Partnership Agreement Between Limited Liability Company and Limited Partner template.

- If you do not have an account and wish to start using US Legal Forms, follow these instructions.

- Locate the form you need and confirm it is for the correct city/state.

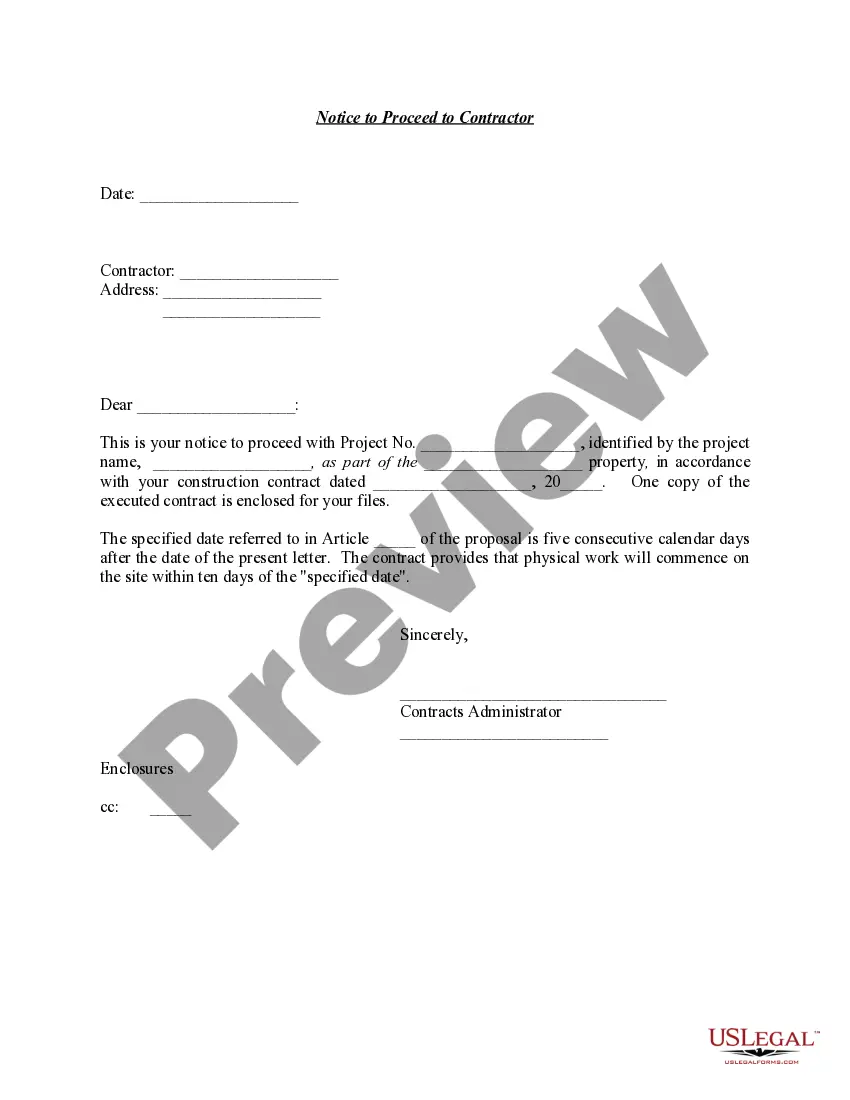

- Utilize the Preview feature to examine the document.

- Check the details to ensure that you've selected the correct form.

- If the form isn't what you're searching for, use the Search field to find the form that suits your needs and requirements.

- Once you find the appropriate form, click Purchase now.

- Select the pricing plan you desire, enter the required information to create your account, and complete the purchase using your PayPal or Visa or Mastercard.

- Choose a convenient file format and download your copy.

- You can find all of the form templates you've purchased in the My documents section.

- You may obtain another copy of the Kansas Limited Partnership Agreement Between Limited Liability Company and Limited Partner at any time by clicking on the desired form to download or print the document template.

Form popularity

FAQ

Yes, a partnership can exist between two companies, often structured as a limited partnership. This allows both companies to collaborate while benefiting from limited liability. Establishing a Kansas Limited Partnership Agreement Between Limited Liability Company and Limited Partner is essential to address the roles and expectations of each entity involved.

A limited partnership includes both general and limited partners, with the latter having restricted liability and involvement in management. In contrast, a limited liability partnership allows all partners to have limited liability while actively participating in management. By creating a Kansas Limited Partnership Agreement Between Limited Liability Company and Limited Partner, you can navigate the distinctions and choose the best structure for your business needs.

Yes, you can have a partnership with a company, typically referred to as a limited partnership. In this arrangement, a limited liability company can serve as a partner with limited rights and responsibilities. To formalize this structure, a Kansas Limited Partnership Agreement Between Limited Liability Company and Limited Partner can clarify each party's role and obligations.

Choosing between a limited company and a partnership depends on your business goals and resources. Partnerships typically offer more straightforward tax treatment and operational flexibility, while limited companies provide liability protection. If you're considering creating a Kansas Limited Partnership Agreement Between Limited Liability Company and Limited Partner, it may provide a suitable balance between the two structures.

A limited company faces more regulatory requirements than a partnership, which can complicate its operation. Additionally, limited companies often have higher administrative costs and ongoing obligations. In contrast, a Kansas Limited Partnership Agreement Between Limited Liability Company and Limited Partner allows for simpler management between partners, making it a more flexible option for some business scenarios.

To form a partnership in Kansas, you need to draft and file a partnership agreement. This document outlines the terms of the partnership and the roles of each partner. You should also consider obtaining a Kansas Limited Partnership Agreement Between Limited Liability Company and Limited Partner for clarity on responsibilities. Consulting a professional can help ensure compliance with state regulations.

A limited liability partnership (LLP) is a form of partnership that provides limited liability to its partners. This means that each partner's personal assets are protected from the partnership's debts and liabilities. Distinguishing the nuances in your Kansas Limited Partnership Agreement Between Limited Liability Company and Limited Partner can help ensure that you understand the protections available to you as a partner.

Indeed, limited partnerships (LPs) have partnership agreements that serve as the foundation for the partnership's operations. This agreement specifies the rights and obligations of both general and limited partners. By implementing a solid Kansas Limited Partnership Agreement Between Limited Liability Company and Limited Partner, partners can safeguard their interests and establish robust business practices.

Yes, limited partnerships must have a partnership agreement to outline the roles, responsibilities, and liabilities of all partners involved. This document provides clarity and protection for each party, ensuring everyone understands their commitments. A well-defined Kansas Limited Partnership Agreement Between Limited Liability Company and Limited Partner is essential for legal and operational success.

A limited liability partnership (LLP) can indeed be a partner in another LLP. This structure allows multiple LLC’s to collaborate while enjoying limited liability protection. When drafting your Kansas Limited Partnership Agreement Between Limited Liability Company and Limited Partner, consider this aspect to maximize your partnership benefits.

Interesting Questions

More info

This means that the court will often consider a broad range of legislation, including civil-service laws, environmental protection, economic regulation, tax policy, and social welfare. The scope of rulings is broad, including decisions that could significantly affect the operation of government. To determine if the Supreme Court has ruled on a particular law before, a litigant must file a “motion to intervene” for the court to review and make a final determination on the laws at issue. The court will accept this motion regardless of whether a case has been decided, but the court must complete a formal review of the issues in a case before allowing a lawyer to intervene. The Court accepts this petition when the parties appear and do not dispute the facts upon which the motion was filed. This is so that the court can determine whether the Supreme Court should accept an intervention motion.