Title: Exploring the Kansas Sample Letter for Promissory Note and Stock Pledge Agreement: A Comprehensive Guide Introduction: In Kansas, when entering into a financial transaction involving a promissory note and stock pledge agreement, it is crucial to understand the various aspects and procedures associated with these legal documents. This article aims to provide a detailed description and explanation of the different types of Kansas Sample Letters for Promissory Note and Stock Pledge Agreements, ensuring a better understanding of their purpose and utilization. 1. Promissory Note: A promissory note is a legally binding document that outlines the borrower's promise to repay a specific sum of money to the lender within a specified timeframe. When it comes to Kansas, there are various types of promissory notes suitable for specific situations: a) Simple Promissory Note: A straightforward, basic agreement that establishes the borrower's promise to repay the borrowed amount. b) Secured Promissory Note: This type of note includes collateral, such as real estate or personal property, which serves as security for the lender. c) Unsecured Promissory Note: Unlike secured notes, unsecured promissory notes lack collateral. Instead, they rely solely on the borrower's creditworthiness. 2. Stock Pledge Agreement: A stock pledge agreement is a contract where a borrower pledges their stock as collateral for a loan. In Kansas, different types of stock pledge agreements are commonly utilized: a) General Stock Pledge Agreement: This agreement secures a loan against the borrower's general portfolio of stocks and shares. b) Specific Stock Pledge Agreement: In this arrangement, a particular stock or set of stocks is pledged as collateral against the loan. Content of the Kansas Sample Letter for Promissory Note and Stock Pledge Agreement: 1. Parties Involved: The letter should clearly identify the lender and borrower, including their legal names and contact information. 2. Promissory Note Details: Provide specific details of the loan amount, interest rate, repayment terms, and any applicable fees or penalties. 3. Stock Pledge Agreement: Outline the stock(s) being pledged, including the number of shares, ticker symbols, and their estimated value. 4. Collateral and Security: Describe the collateral offered and specify how it will be held as security for the loan. Include any relevant conditions for release or foreclosure. 5. Default and Remedies: Clearly define the circumstances that constitute default, outlining the actions the lender can take in the event of default, such as selling the pledged stock. 6. Governing Law: Specify that the agreement is governed by the laws of Kansas, ensuring consistency with the state's legal framework. 7. Signatures and Notarization: Include space for the signatures of both parties, and notary certification, to validate the agreement's authenticity. Conclusion: Understanding the intricacies of Kansas Sample Letters for Promissory Note and Stock Pledge Agreements is crucial when engaging in financial transactions involving borrowing or lending. By familiarizing yourself with the various types of promissory notes and stock pledge agreements available and their components, you can make informed decisions and mitigate potential risks effectively. Always seek legal advice to ensure compliance with Kansas's specific laws and regulations regarding these agreements.

Kansas Sample Letter for Promissory Note and Stock Pledge Agreement

Description

How to fill out Kansas Sample Letter For Promissory Note And Stock Pledge Agreement?

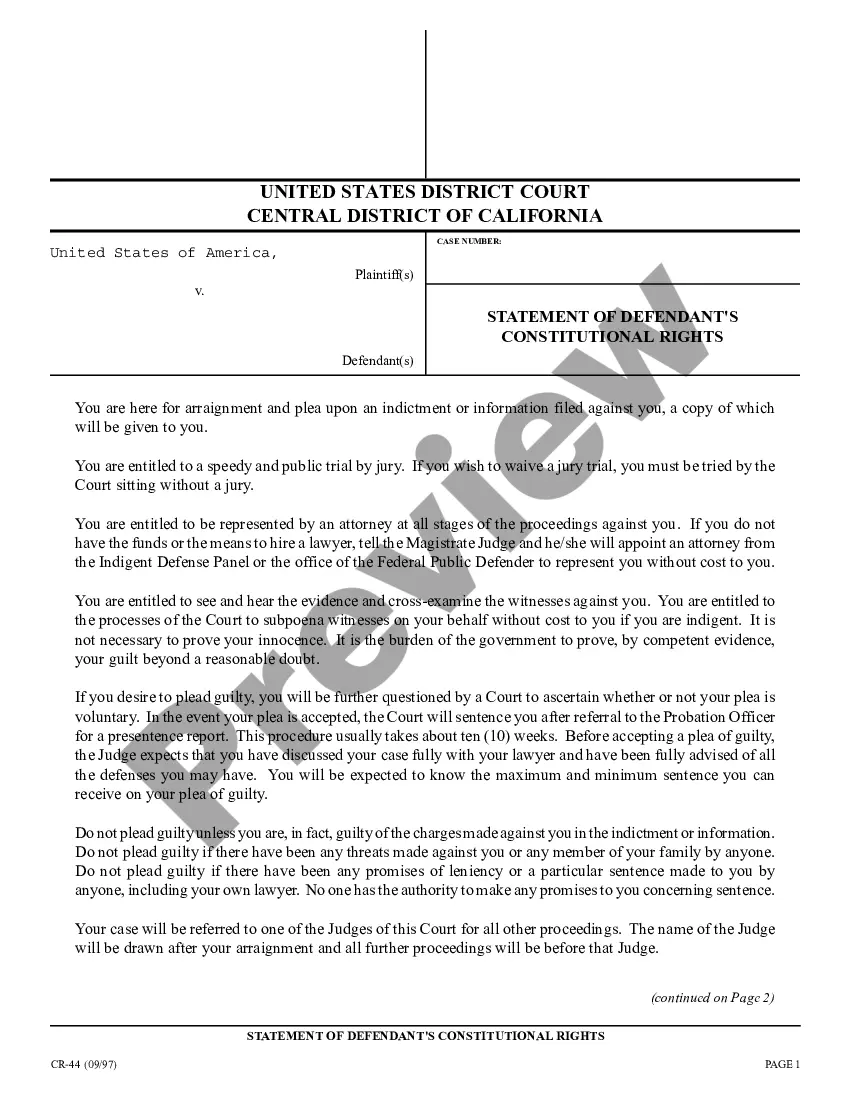

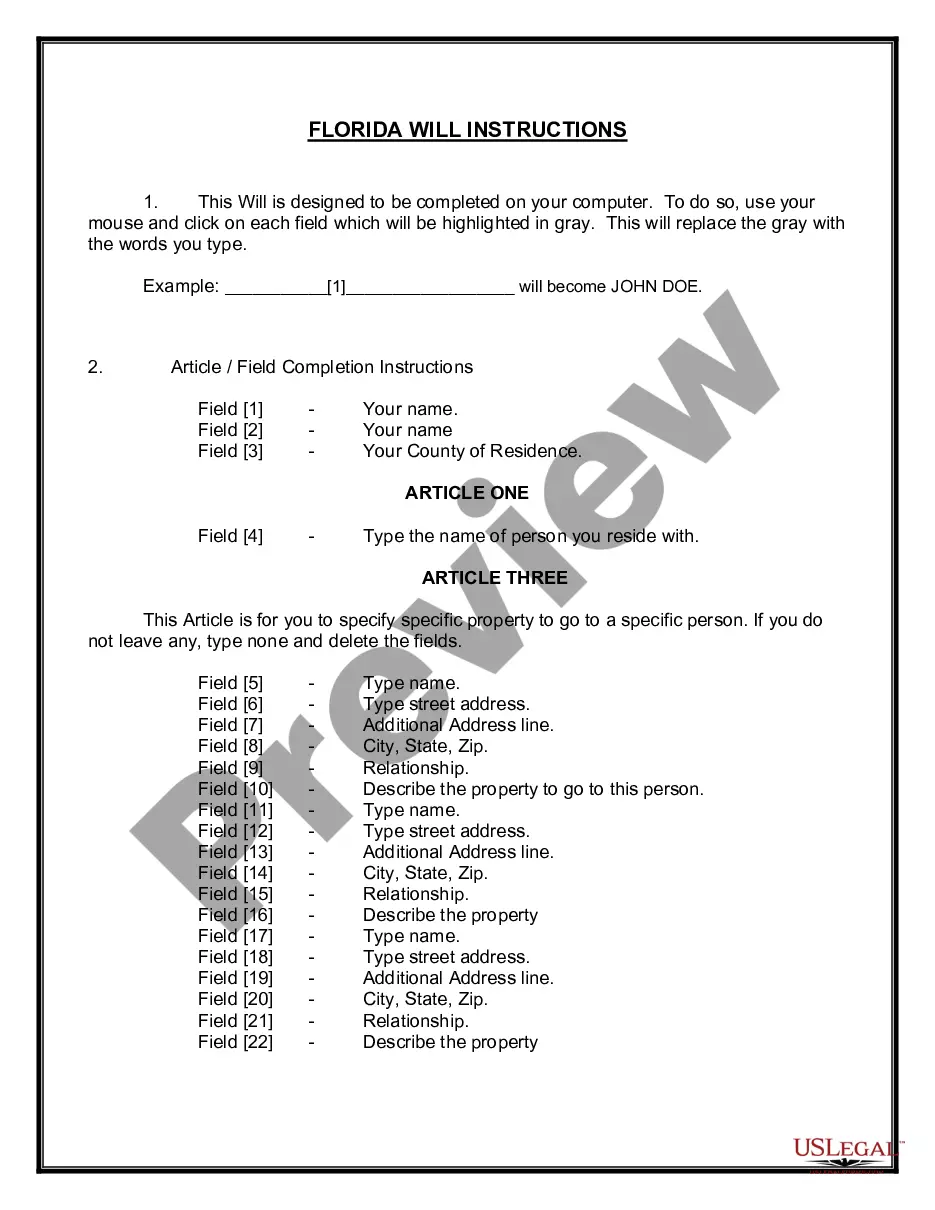

Discovering the right legitimate document format might be a have difficulties. Needless to say, there are plenty of web templates available on the Internet, but how do you obtain the legitimate form you will need? Make use of the US Legal Forms web site. The service provides 1000s of web templates, such as the Kansas Sample Letter for Promissory Note and Stock Pledge Agreement, which can be used for company and personal needs. Each of the forms are checked out by specialists and fulfill state and federal needs.

When you are currently authorized, log in to the bank account and click on the Acquire option to find the Kansas Sample Letter for Promissory Note and Stock Pledge Agreement. Use your bank account to check throughout the legitimate forms you have ordered earlier. Proceed to the My Forms tab of your bank account and get yet another copy from the document you will need.

When you are a whole new consumer of US Legal Forms, listed below are straightforward recommendations so that you can comply with:

- Initially, ensure you have chosen the correct form for your personal metropolis/state. It is possible to check out the form making use of the Review option and study the form description to make certain it is the best for you.

- If the form fails to fulfill your preferences, make use of the Seach field to get the correct form.

- Once you are sure that the form is acceptable, go through the Acquire now option to find the form.

- Choose the rates strategy you would like and enter in the required details. Design your bank account and pay money for the transaction making use of your PayPal bank account or Visa or Mastercard.

- Opt for the submit format and down load the legitimate document format to the device.

- Comprehensive, change and printing and sign the acquired Kansas Sample Letter for Promissory Note and Stock Pledge Agreement.

US Legal Forms is definitely the largest library of legitimate forms where you can see different document web templates. Make use of the service to down load skillfully-produced files that comply with status needs.

Form popularity

FAQ

An agreement typically used to create a security interest in equity interests (including capital stock, LLC interests, and partnership interests) and promissory notes.

At its most basic, a promissory note should include the following things: Date. Name of the lender and borrower. Loan amount. Whether the loan is secured or unsecured. If it's secured with collateral: What is the collateral? ... Payment amount and frequency. Payment due date. Whether the loan has a cosigner, and if so, who.

Pledge. v. to deposit personal property as security for a personal loan of money. If the loan is not repaid when due, the personal property pledged shall be forfeit to the lender. The property is known as collateral. To pledge is the same as to pawn.

Promissory notes are defined as securities under the Securities Act. However, notes that have a maturity of nine months or less are not considered securities.

Promissory notes are legally binding whether the note is secured by collateral or based only on the promise of repayment. If you lend money to someone who defaults on a promissory note and does not repay, you can legally possess any property that individual promised as collateral.

A pledge is a bailment that conveys possessory title to property owned by a debtor (the pledgor) to a creditor (the pledgee) to secure repayment for some debt or obligation and to the mutual benefit of both parties.

A Kansas promissory note is an agreement entered into by a lender and borrower. The promissory note outlines conditions of the loan, such as interest rates, payment types, and the amount of the given balance. In Kansas, there are two types of promissory notes: secured and unsecured.

Pledged Notes means all right, title and interest of each Borrower in the Instruments evidencing all Indebtedness owed to such Borrower, issued by the obligors named therein, and all interest, cash, Instruments and other property or Proceeds from time to time received, receivable or otherwise distributed in respect of ...