Kansas Agreement to Incorporate Close Corporation is a legal document that outlines the essential elements and provisions required to form a close corporation in the state of Kansas. This agreement serves as a foundational document that governs the operation, management, and other important aspects of the close corporation. A close corporation, also known as a closely-held corporation, is a business entity that functions similarly to a traditional corporation but has certain limitations and benefits. It is typically a privately-held corporation with a smaller number of shareholders, who often actively participate in the company's decision-making, management, and daily operations. The Kansas Agreement to Incorporate Close Corporation includes the following key provisions: 1. Name and Purpose: The agreement will specify the proposed name of the close corporation, ensuring it complies with state requirements and is not already in use by another entity. It also outlines the primary purpose or business activities of the corporation. 2. Shareholders: This section defines the initial shareholders of the corporation and the total number of authorized shares. It may also cover restrictions on share transfers, preemptive rights, and shareholder's rights and obligations. 3. Directors and Officers: The agreement establishes the composition and powers of the board of directors, including the initial directors and their respective terms. It further outlines the roles, responsibilities, and authority of officers, such as the president, vice-president, treasurer, and secretary. 4. Shareholder Meetings: The agreement specifies the frequency, procedures, and requirements for conducting shareholder meetings and voting on important corporate matters. It may cover provisions for proxies, written consents, and notice requirements. 5. Confidentiality and Non-Disclosure: This section ensures the protection of sensitive corporate information and trade secrets, outlining the obligations of shareholders, directors, and officers in maintaining confidentiality. 6. Transfer Restrictions: The agreement may include provisions restricting the transfer of shares to non-shareholders or outside parties without the approval of the corporation or other shareholders. These clauses often protect the close corporation's stability and ensure that shares remain within a limited group of individuals. 7. Dissolution and Liquidation: The agreement details the process and circumstances under which the close corporation may be dissolved, including the distribution of assets and liabilities upon dissolution. Example types of Kansas Agreement to Incorporate Close Corporation include: 1. Basic Kansas Agreement to Incorporate Close Corporation: A standard template that includes the basic provisions required to form a close corporation, covering the essential elements mentioned earlier. 2. Customized Kansas Agreement to Incorporate Close Corporation: An agreement tailored to meet the unique requirements, objectives, and goals of the specific close corporation. 3. Professional Services Kansas Agreement to Incorporate Close Corporation: A specialized agreement for professional service businesses, such as law firms, medical practices, or accounting firms, which may include additional clauses related to professional liability and governance. 4. Buy-Sell Agreement to Incorporate Close Corporation: A separate agreement that can be attached to the initial agreement, outlining procedures and terms for the purchase and sale of shares among shareholders, ensuring an orderly transfer of ownership. In conclusion, the Kansas Agreement to Incorporate Close Corporation is a comprehensive document that sets out the necessary provisions for forming and governing a close corporation in Kansas. It establishes the rights, responsibilities, and obligations of shareholders, directors, and officers, creating a strong legal framework for the operation of the business.

Kansas Agreement to Incorporate Close Corporation

Description

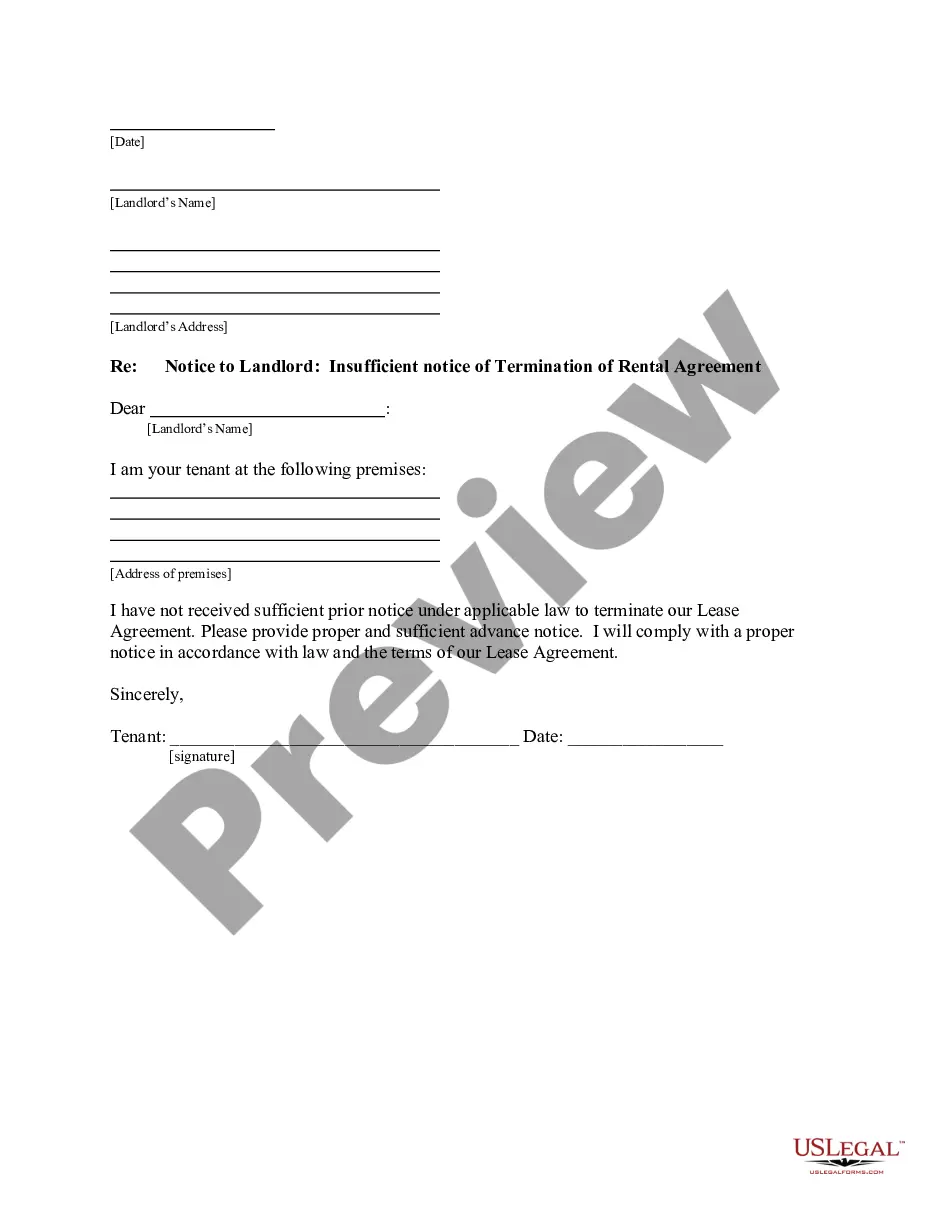

How to fill out Kansas Agreement To Incorporate Close Corporation?

Choosing the best lawful document format can be a have difficulties. Naturally, there are plenty of layouts available on the net, but how do you get the lawful kind you need? Use the US Legal Forms internet site. The service delivers 1000s of layouts, for example the Kansas Agreement to Incorporate Close Corporation, which can be used for company and personal requires. All of the varieties are checked out by pros and meet federal and state specifications.

When you are previously listed, log in to your profile and then click the Down load option to have the Kansas Agreement to Incorporate Close Corporation. Make use of profile to appear through the lawful varieties you possess acquired previously. Visit the My Forms tab of your profile and have an additional version of the document you need.

When you are a fresh consumer of US Legal Forms, allow me to share simple guidelines that you can stick to:

- Initially, make certain you have selected the proper kind for the metropolis/area. You are able to check out the form making use of the Preview option and look at the form information to guarantee it will be the right one for you.

- In case the kind will not meet your preferences, use the Seach area to find the proper kind.

- Once you are positive that the form is suitable, click on the Get now option to have the kind.

- Choose the costs strategy you need and enter the essential info. Build your profile and pay for an order with your PayPal profile or Visa or Mastercard.

- Opt for the file file format and acquire the lawful document format to your gadget.

- Total, modify and print and sign the obtained Kansas Agreement to Incorporate Close Corporation.

US Legal Forms may be the largest library of lawful varieties for which you can find different document layouts. Use the service to acquire skillfully-manufactured documents that stick to express specifications.

Form popularity

FAQ

A regular business corporation may become a close corporation if it has 35 or fewer shareholders and amends its articles to state that it is a close corporation and include the provisions of K.S.A.

Closed corporations have more flexibility compared to publicly traded companies as they are free from most reporting requirements and shareholder pressure. With fewer shareholders involved and shares not publicly traded, liquidity can be an issue for closed corporations.

With fewer shareholders and a relaxed corporate structure, a close corporation provides each shareholder with more control over shares. For example, if one owner wants to leave the company, the other shareholders can better control those shares. More freedom.

A CC is similar to a private company. It is a legal entity with its own legal personality and perpetual succession and must register as a taxpayer in its own right. A CC has no share capital and therefore no shareholders. The owners of a CC are the members of the CC.

A close corporation can generally be run directly by the shareholders (without a formal board of directors and without a formal annual meeting), and is exempt from a number of the formal rules which usually govern corporations. A close corporation is also commonly referred to as a closely held corporation.

A close corporation is a corporation which is held by a limited number of shareholders and is not publicly traded.

A close corporation often costs more money to organize. While shareholders have the benefit of greater control over the sale of shares, shareholders in a close corporation are also burdened with increased responsibility. A close corporation has to be governed by both a shareholders agreement and the company bylaws.