A common-law lien is the right of one person to retain in his possession property that belongs to another until a debt or claim secured by that property is satisfied. It pertains exclusively to personal property. This form is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Kansas Notice of Lien and of Sale of Personal Property Pursuant to Non-Statutory Lien

Description

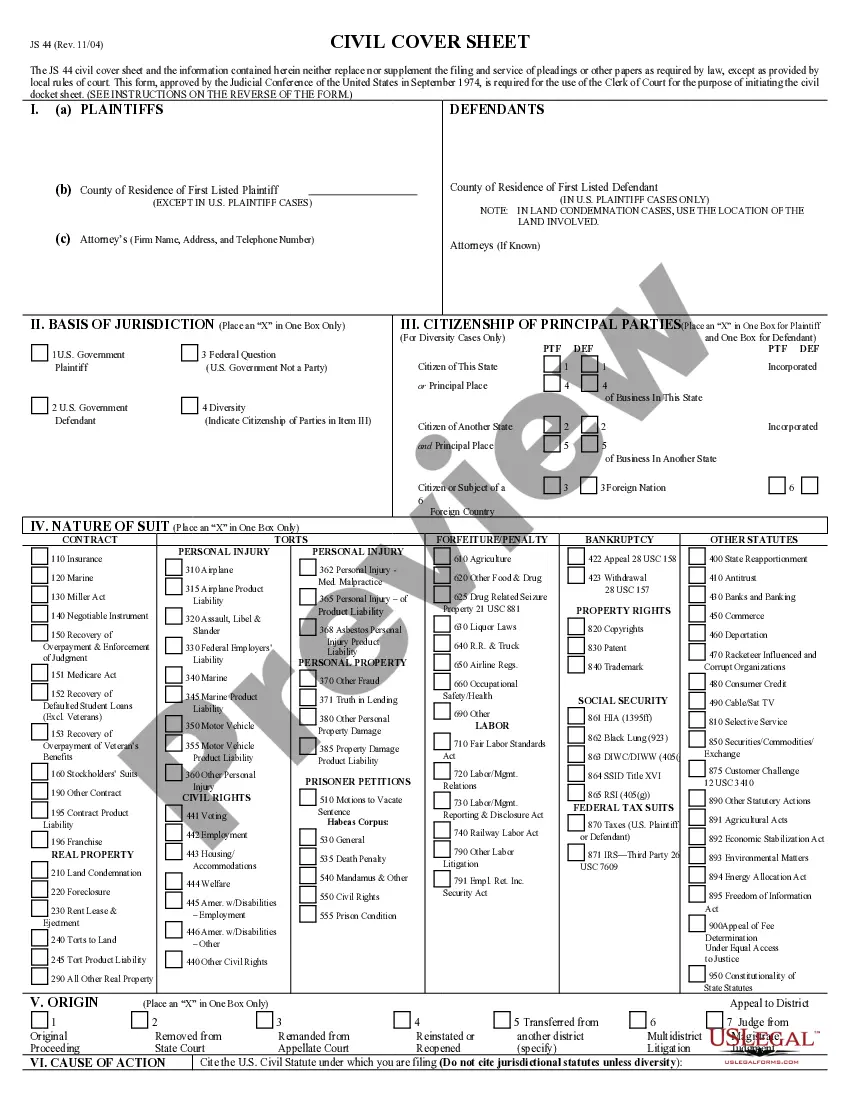

How to fill out Notice Of Lien And Of Sale Of Personal Property Pursuant To Non-Statutory Lien?

Are you presently inside a position that you need files for possibly organization or person reasons just about every working day? There are tons of lawful papers layouts available on the Internet, but finding types you can rely on is not effortless. US Legal Forms delivers a large number of kind layouts, such as the Kansas Notice of Lien and of Sale of Personal Property Pursuant to Non-Statutory Lien, which are composed to meet federal and state demands.

When you are already informed about US Legal Forms website and also have your account, simply log in. After that, you can download the Kansas Notice of Lien and of Sale of Personal Property Pursuant to Non-Statutory Lien web template.

Unless you provide an profile and would like to start using US Legal Forms, follow these steps:

- Obtain the kind you need and ensure it is to the proper metropolis/county.

- Use the Preview key to review the form.

- Read the explanation to actually have selected the correct kind.

- If the kind is not what you are looking for, use the Research field to obtain the kind that meets your needs and demands.

- Whenever you discover the proper kind, click on Get now.

- Opt for the prices program you desire, complete the specified information to produce your money, and buy the order utilizing your PayPal or Visa or Mastercard.

- Choose a handy file structure and download your backup.

Discover all the papers layouts you might have bought in the My Forms menu. You can obtain a further backup of Kansas Notice of Lien and of Sale of Personal Property Pursuant to Non-Statutory Lien whenever, if necessary. Just select the necessary kind to download or print the papers web template.

Use US Legal Forms, the most substantial assortment of lawful types, in order to save time as well as avoid mistakes. The service delivers appropriately created lawful papers layouts that can be used for a range of reasons. Create your account on US Legal Forms and commence producing your way of life a little easier.

Form popularity

FAQ

If there is a lien shown on the front of the title, a notarized lien release or lien holder consent to transfer the lien is required. If the vehicle is registered jointly with other persons (such as John AND Jane Doe) all persons listed as owners must sign the title.

Any personal property within the vehicle need not be released to the owner thereof until the reasonable or agreed charges for such recovery, transportation or safekeeping have been paid, or satisfactory arrangements for payment have been made, except as provided under subsection (c) or for personal medical supplies ...

Titles that have a lienholder on file will not be issued until there are no liens for the vehicle on record. Vehicles that do not have a lienholder will normally be issued a title in 10 to 40 days after application.

Kansas vehicle owners who borrow money for a car, truck, motorcycle, trailer or another motor vehicle will not receive printed paper titles. Instead, the Division of Vehicles will hold the electronic title until the lien is satisfied.

Understand the Timeline ing to Unified Government Code of Ordinance Chapter 35-Traffic / Article III - Vehicle Towing, property not retrieved 30 days after notice to the registered owner can be sold at auction.

Judgments Last Five Years in Kansas This means that unless the judgment is renewed by the courts, after five years, it will cease to operate as a lien against the defendant's estate.

You will need to complete the Application for Secured/Duplicate/Reissue Title, form TR-720B that includes the following information: vehicle year, make and identification number, owner's name(s) and the current odometer reading. Include appropriate title fee. The title fee in Kansas is $10.

The general public will generally be able to obtain a duplicate title or lien release title on a same day basis (typically within 30 minutes). However, there may be times when the title work takes an extended amount of time to process.