A contract is based upon an agreement. An agreement arises when one person, the offeror, makes an offer and the person to whom is made, the offeree, accepts. There must be both an offer and an acceptance. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

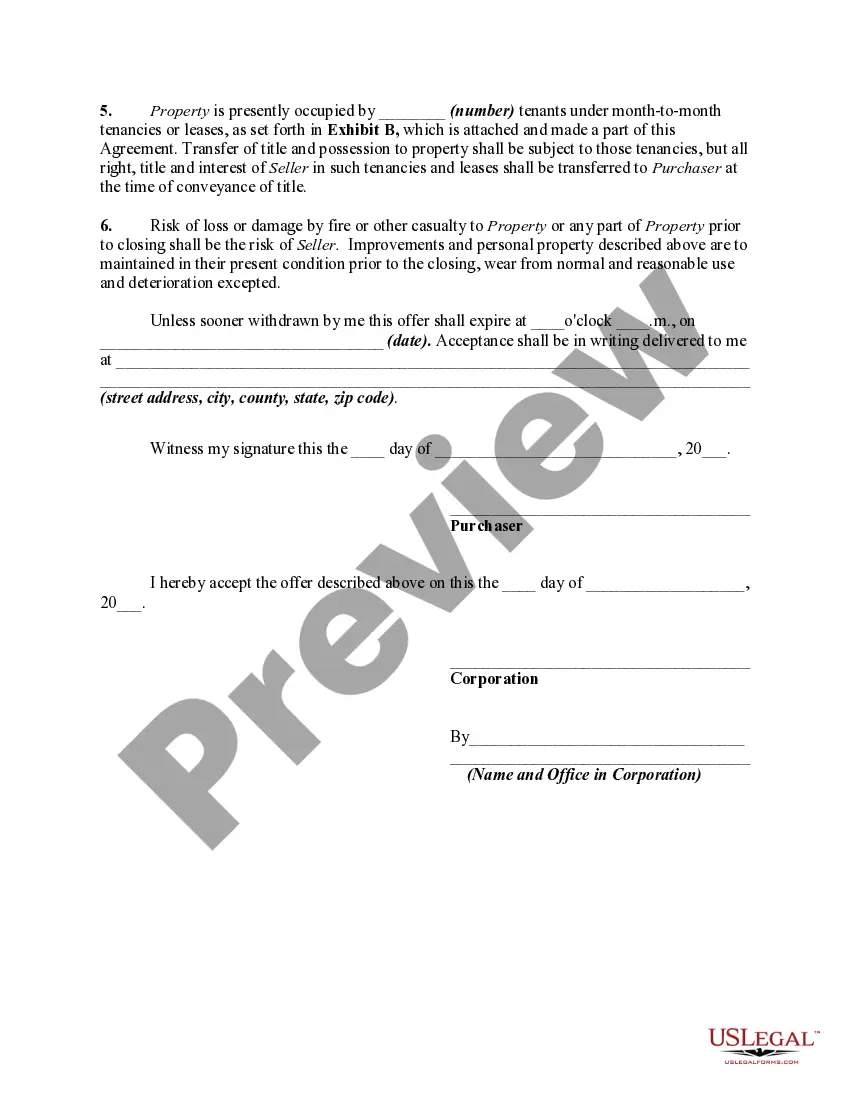

Title: A Comprehensive Guide to Kansas Offer to Purchase Commercial Property: Types and Guidelines Introduction: In Kansas, the Offer to Purchase Commercial Property is a legally binding document that outlines the terms and conditions for acquiring a commercial property. This detailed description will explore the various types of Kansas offer to purchase commercial property, providing valuable insights into the process and essential guidelines. Whether you are a buyer or a seller, understanding these details is crucial for a successful transaction. Types of Kansas Offer to Purchase Commercial Property: 1. Standard Offer to Purchase: — A straightforward offer that includes essential terms, such as purchase price, property description, and closing date. — Buyers can include contingencies for inspections, financing, or other requirements. — Sellers have the option to negotiate the terms before accepting the offer or proposing counteroffers. 2. Contingent Offer to Purchase: — This type of offer is contingent upon certain conditions being met before the sale is finalized. — Common contingencies include property inspections, financing approval, or the sale of the buyer's existing property. — Sellers have the choice to accept the contingent offer, reject it, or propose modifications based on specific conditions. 3. Multiple Offer to Purchase: — In a competitive market, multiple buyers may submit offers simultaneously. — The seller carefully evaluates each offer on the basis of price, terms, and contingencies. — The seller may accept the highest offer or engage in negotiations with potential buyers to secure the best deal. Guidelines for Preparing a Kansas Offer to Purchase Commercial Property: 1. Property Information: — Accurately describe the property, including address, size, zoning classification, and any notable features or improvements. — Include the legal description or a reference to the recorded deed. 2. Purchase Price and Payment Terms: — Clearly state the proposed purchase price and specify the down payment amount. — Mention the financing terms, including the mortgage amount, interest rate, and proposed loan terms. 3. Closing Date and Deposit: — Specify the desired closing date and the deadline for the buyer to provide the earnest money deposit. — Typically, earnest money is 1-5% of the purchase price and shows the buyer's commitment to the deal. 4. Contingencies: — Outline any necessary contingencies, such as property inspections, surveys, or obtaining legal or environmental clearances. — Define the duration and conditions under which the buyer can nullify the contract based on these contingencies. 5. Terms and Conditions: — Include provisions regarding the transfer of title, possession, prorated taxes, and any other agreements reached between the parties. — Address any seller concessions, reimbursements, or repair obligations. 6. Signatures and Binding Agreement: — Both the buyer and seller should sign the offer, making it legally binding. — Consult with an attorney or real estate professional to ensure compliance with Kansas laws and regulations. Conclusion: Navigating the Kansas Offer to Purchase Commercial Property can be complex, but understanding the different types and following the guidelines outlined in this description will help streamline the process. Whether you are buying or selling commercial property in Kansas, careful attention to detail is crucial to protect your interests and ensure a successful transaction. Always seek professional advice to ensure adherence to Kansas real estate laws and to make informed decisions throughout the process.Title: A Comprehensive Guide to Kansas Offer to Purchase Commercial Property: Types and Guidelines Introduction: In Kansas, the Offer to Purchase Commercial Property is a legally binding document that outlines the terms and conditions for acquiring a commercial property. This detailed description will explore the various types of Kansas offer to purchase commercial property, providing valuable insights into the process and essential guidelines. Whether you are a buyer or a seller, understanding these details is crucial for a successful transaction. Types of Kansas Offer to Purchase Commercial Property: 1. Standard Offer to Purchase: — A straightforward offer that includes essential terms, such as purchase price, property description, and closing date. — Buyers can include contingencies for inspections, financing, or other requirements. — Sellers have the option to negotiate the terms before accepting the offer or proposing counteroffers. 2. Contingent Offer to Purchase: — This type of offer is contingent upon certain conditions being met before the sale is finalized. — Common contingencies include property inspections, financing approval, or the sale of the buyer's existing property. — Sellers have the choice to accept the contingent offer, reject it, or propose modifications based on specific conditions. 3. Multiple Offer to Purchase: — In a competitive market, multiple buyers may submit offers simultaneously. — The seller carefully evaluates each offer on the basis of price, terms, and contingencies. — The seller may accept the highest offer or engage in negotiations with potential buyers to secure the best deal. Guidelines for Preparing a Kansas Offer to Purchase Commercial Property: 1. Property Information: — Accurately describe the property, including address, size, zoning classification, and any notable features or improvements. — Include the legal description or a reference to the recorded deed. 2. Purchase Price and Payment Terms: — Clearly state the proposed purchase price and specify the down payment amount. — Mention the financing terms, including the mortgage amount, interest rate, and proposed loan terms. 3. Closing Date and Deposit: — Specify the desired closing date and the deadline for the buyer to provide the earnest money deposit. — Typically, earnest money is 1-5% of the purchase price and shows the buyer's commitment to the deal. 4. Contingencies: — Outline any necessary contingencies, such as property inspections, surveys, or obtaining legal or environmental clearances. — Define the duration and conditions under which the buyer can nullify the contract based on these contingencies. 5. Terms and Conditions: — Include provisions regarding the transfer of title, possession, prorated taxes, and any other agreements reached between the parties. — Address any seller concessions, reimbursements, or repair obligations. 6. Signatures and Binding Agreement: — Both the buyer and seller should sign the offer, making it legally binding. — Consult with an attorney or real estate professional to ensure compliance with Kansas laws and regulations. Conclusion: Navigating the Kansas Offer to Purchase Commercial Property can be complex, but understanding the different types and following the guidelines outlined in this description will help streamline the process. Whether you are buying or selling commercial property in Kansas, careful attention to detail is crucial to protect your interests and ensure a successful transaction. Always seek professional advice to ensure adherence to Kansas real estate laws and to make informed decisions throughout the process.