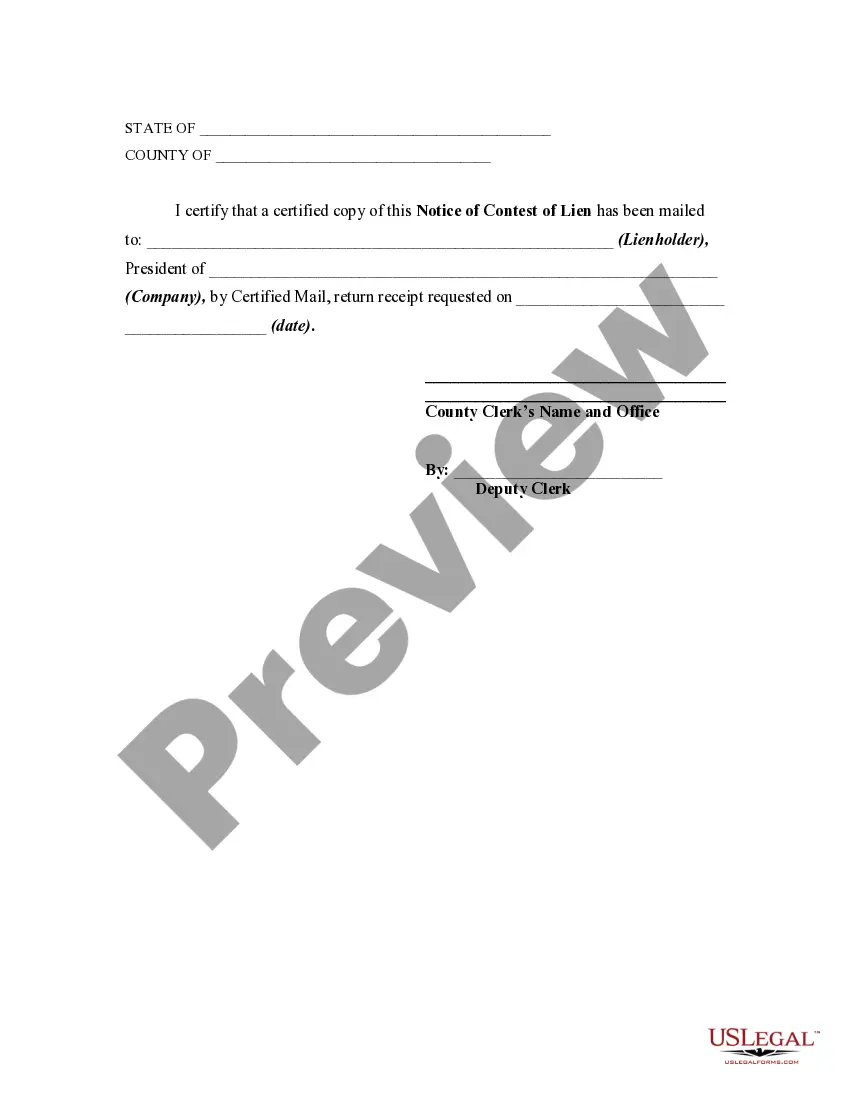

This form is a sample of a notice contesting a lien that has been recorded in the office of the appropriate county official.This form is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

The Kansas Notice of Contest of Lien is a legal document filed by a property owner or party of interest in Kansas to contest the validity or enforceability of a lien placed on their property. This notice is a crucial step in protecting one's rights and challenging the existence of the lien in question. When a lien is imposed on a property in Kansas, it typically occurs due to unpaid debts, contractor disputes, or other financial obligations. However, property owners may believe that the lien was unjustly placed or is inaccurate, in which case they can take action by filing a Notice of Contest of Lien. By filing this notice, the property owner initiates a legal procedure to challenge the lien. It is important to note that the lien holder must be notified about the contest and subsequently given an opportunity to defend and prove the validity of the lien. Failure to contest the lien properly may result in the property owner losing their rights or the ability to challenge it in the future. There are different types of Kansas Notice of Contest of Liens, including: 1. Notice of Contest of Mechanic's Lien: This type of notice is specific to liens filed by contractors, subcontractors, suppliers, or laborers who have worked on a construction project. When a property owner disputes the validity of a mechanic's lien, they can utilize this notice to begin the legal process of contesting it. 2. Notice of Contest of Judgment Lien: If a property owner believes that a judgment lien has been applied incorrectly or inaccurately, they can file a Notice of Contest of Judgment Lien. This document asserts the property owner's objections and requests a hearing to settle the dispute. 3. Notice of Contest of Tax Lien: When a property owner contends that a tax lien has been unjustly or erroneously placed on their property by a government entity, they can submit a Notice of Contest of Tax Lien. This notice challenges the legitimacy of the tax lien and sets the stage for resolving the matter legally. Regardless of the type of Kansas Notice of Contest of Lien, accuracy and adherence to the legal procedures are crucial. It is highly recommended consulting an attorney or legal professional with expertise in lien law to ensure that all necessary steps are taken correctly and within the specified timeframe. By contesting a lien, property owners can protect their interests and safeguard their property rights in Kansas.The Kansas Notice of Contest of Lien is a legal document filed by a property owner or party of interest in Kansas to contest the validity or enforceability of a lien placed on their property. This notice is a crucial step in protecting one's rights and challenging the existence of the lien in question. When a lien is imposed on a property in Kansas, it typically occurs due to unpaid debts, contractor disputes, or other financial obligations. However, property owners may believe that the lien was unjustly placed or is inaccurate, in which case they can take action by filing a Notice of Contest of Lien. By filing this notice, the property owner initiates a legal procedure to challenge the lien. It is important to note that the lien holder must be notified about the contest and subsequently given an opportunity to defend and prove the validity of the lien. Failure to contest the lien properly may result in the property owner losing their rights or the ability to challenge it in the future. There are different types of Kansas Notice of Contest of Liens, including: 1. Notice of Contest of Mechanic's Lien: This type of notice is specific to liens filed by contractors, subcontractors, suppliers, or laborers who have worked on a construction project. When a property owner disputes the validity of a mechanic's lien, they can utilize this notice to begin the legal process of contesting it. 2. Notice of Contest of Judgment Lien: If a property owner believes that a judgment lien has been applied incorrectly or inaccurately, they can file a Notice of Contest of Judgment Lien. This document asserts the property owner's objections and requests a hearing to settle the dispute. 3. Notice of Contest of Tax Lien: When a property owner contends that a tax lien has been unjustly or erroneously placed on their property by a government entity, they can submit a Notice of Contest of Tax Lien. This notice challenges the legitimacy of the tax lien and sets the stage for resolving the matter legally. Regardless of the type of Kansas Notice of Contest of Lien, accuracy and adherence to the legal procedures are crucial. It is highly recommended consulting an attorney or legal professional with expertise in lien law to ensure that all necessary steps are taken correctly and within the specified timeframe. By contesting a lien, property owners can protect their interests and safeguard their property rights in Kansas.