Unless the continuation of a trust is necessary to carry out a material purpose of the trust (such as tax benefits), the trust may be terminated by agreement of all the beneficiaries if none of them is mentally incompetent or underage (e.g., under 21 in some states). However, termination generally cannot take place when it is contrary to the clearly expressed intention of the trustor. In the absence of a provision in a trust instrument giving the trustee power to terminate the trust, a trustee generally has no control over the continuance of the trust.

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

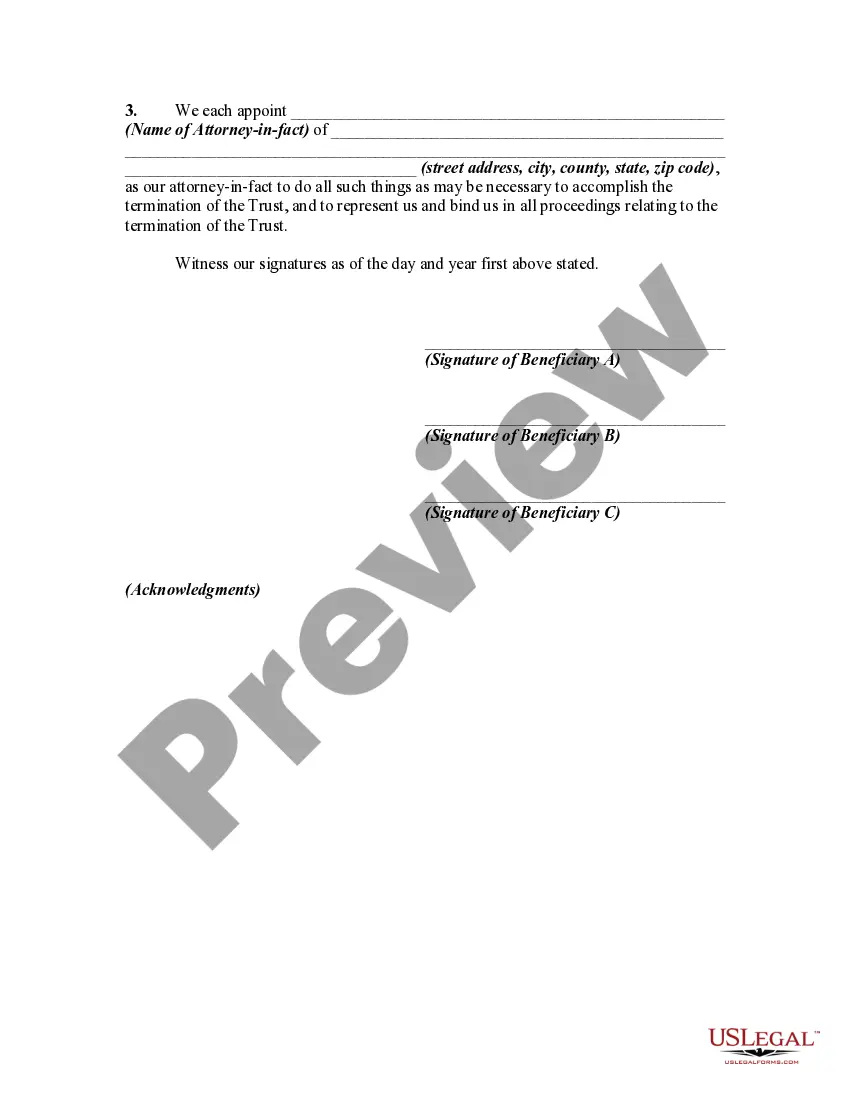

Kansas Agreement Among Beneficiaries to Terminate Trust is a legal document that allows beneficiaries of a trust in Kansas to come together and terminate the trust before its intended expiration or distribution date. This agreement provides a means for beneficiaries to collaborate and agree upon the early termination of the trust, ensuring that the trust assets are disbursed according to their wishes. The Kansas Agreement Among Beneficiaries to Terminate Trust serves various purposes and may have different variations based on specific circumstances. These variations include: 1. Irrevocable Trust Termination: This type of agreement is designed for beneficiaries of an irrevocable trust who want to terminate the trust before its designated time. It requires unanimous consent from all beneficiaries and might involve determining how the trust assets will be distributed among them. 2. Partial Trust Termination: In certain cases, the beneficiaries may only want to terminate a portion of the trust while leaving the remaining assets intact. This type of agreement allows beneficiaries to specify which portion of the trust they wish to terminate and how the assets in that portion should be distributed. 3. Total Trust Termination: This agreement addresses the complete termination of the trust, including all its assets and provisions. It enables beneficiaries to collectively agree on the termination and provides a framework for the division and distribution of the trust assets among them. Key elements that should be included in a Kansas Agreement Among Beneficiaries to Terminate Trust are: a. Introduction: Begin the agreement with a clear statement identifying it as a termination agreement among beneficiaries of a specific trust and include the date of execution. b. Trust Identification: Provide detailed information about the trust, such as the trust's name, date of establishment, and the names of the settler(s) or granter(s) who established the trust. c. Beneficiary Consents: Ensure that all beneficiaries involved in the termination agreement provide explicit written consent agreeing to the early termination of the trust. This demonstrates unanimous approval and eliminates any potential disputes. d. Asset Division: Outline how the trust assets will be divided among the beneficiaries upon termination. Specify the percentage or specific assets each beneficiary will receive, considering any specific requests or distributions mentioned in the trust document. e. Trustee's Duties: Address the responsibilities and duties of the trustee during the termination process, including the distribution of assets, closing the trust accounts, and any necessary tax filings. f. Governing Law: State that the agreement will be governed by Kansas law, ensuring compliance with applicable state regulations and guidelines for trust termination. g. Signatures: Include a section for all beneficiaries to sign and date the agreement, indicating their acceptance and consent to terminate the trust. In conclusion, a Kansas Agreement Among Beneficiaries to Terminate Trust allows beneficiaries to collectively decide on the early termination of a trust. By generating such an agreement, beneficiaries can ensure that the trust's assets are distributed according to their desires, providing a clear framework for the termination process and addressing the various types of trust termination scenarios that may occur.