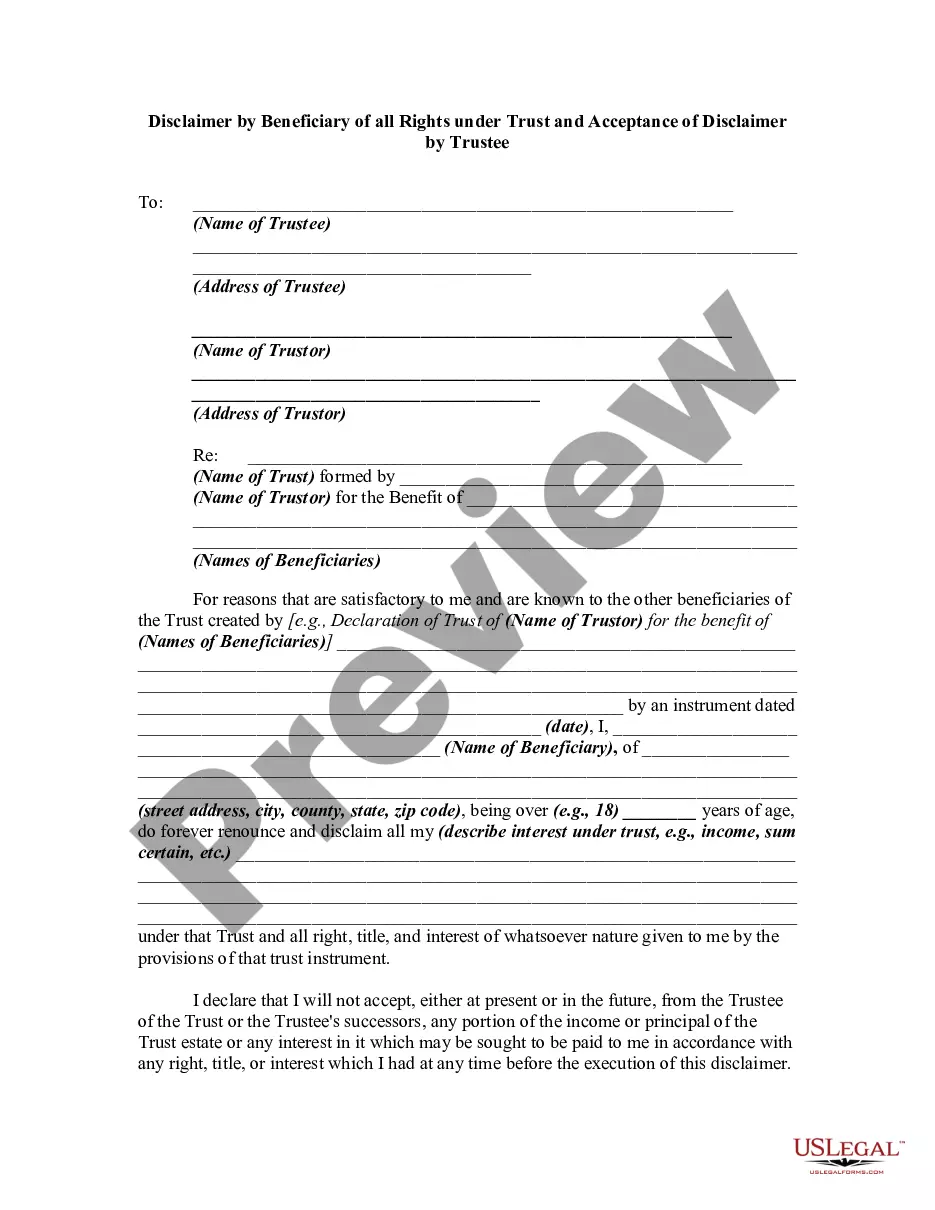

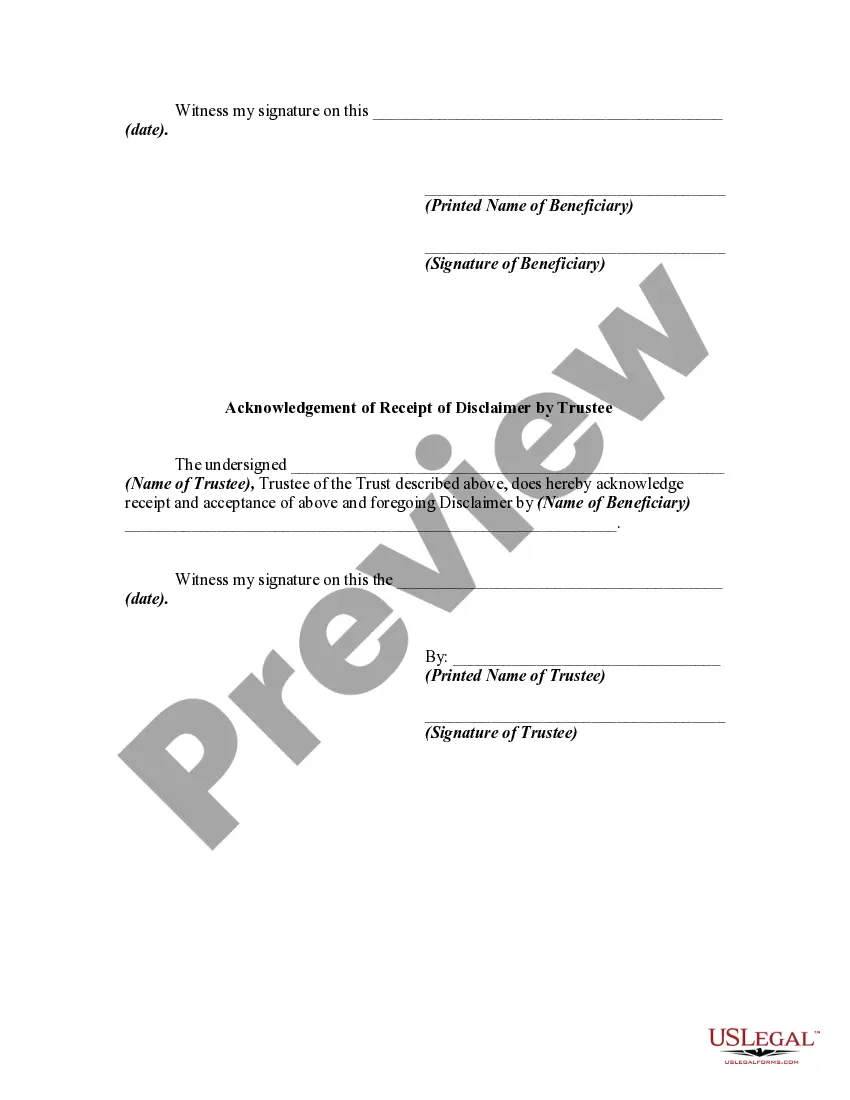

A disclaimer is a denial or renunciation of something. A disclaimer may be the act of a party by which be refuses to accept an estate which has been conveyed to him. In this instrument, the beneficiary of a trust is disclaiming any rights he has in the trust.

Kansas Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee

Description

How to fill out Disclaimer By Beneficiary Of All Rights Under Trust And Acceptance Of Disclaimer By Trustee?

Finding the appropriate valid document template might be challenging.

Clearly, numerous designs are available online, but how do you find the genuine form you need.

Utilize the US Legal Forms website. The platform provides a vast array of templates, such as the Kansas Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee, which can be utilized for business and personal purposes.

When the form does not meet your requirements, use the Search field to find the correct form. Once you are sure that the form is appropriate, click on the Buy now button to purchase the form. Select the pricing plan you require and enter the necessary information. Create your account and complete the transaction using your PayPal account or credit card. Choose the file format and download the legal document template onto your device. Complete, revise, and print out the acquired Kansas Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee.

- All forms are reviewed by experts and comply with state and federal regulations.

- If you are already registered, Log In to your account and click on the Acquire button to obtain the Kansas Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee.

- Use your account to search for the legal forms you have purchased previously.

- Go to the My documents tab in your account and retrieve another copy of the documents you need.

- If you are a new user of US Legal Forms, here are straightforward instructions to follow.

- First, ensure you have selected the right form for your location. You can preview the form using the Review feature and check the form description to confirm it is suitable for you.

Form popularity

FAQ

A disclaimer clause may be found within a will or trust document stating that a beneficiary can refuse their inheritance. This clause is essential for executing a Kansas Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee. Such a clause provides clarity on the process and obligations, helping to prevent future uncertainties regarding the acceptance or rejection of assets.

An example of a disclaimer of inheritance rights might occur when an individual receives a substantial inheritance from a family member. If they choose to disclaim their portion using a Kansas Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee, the share can then be redirected to alternate beneficiaries, effectively altering the inheritance distribution without legal disputes.

A primary downside of a disclaimer trust is the potential loss of inherited assets, which may not be reversible once the disclaimer is executed. Additionally, if the beneficiary does not fully understand the implications, they might inadvertently affect themselves or other heirs. It is crucial to consider these factors and consult with professionals when using a Kansas Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee to ensure informed decisions.

An example of a disclaimer trust often arises when a parent establishes a trust for their children. If one child decides they do not want their share, they can formally disclaim it using a Kansas Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee. This enables the remaining siblings to inherit their intended shares without legal complications.

A common example of a disclaimer trust involves a situation where a beneficiary does not wish to accept their share of a deceased relative's trust. In this case, the beneficiary can utilize a Kansas Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee to forgo their inheritance. This ensures that the assets pass directly to the next designated beneficiary, promoting an efficient distribution.

Individuals may choose to disclaim a trust to avoid potential tax liabilities or complications associated with the trust's assets. By executing a Kansas Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee, they can relinquish their rights without impacting other beneficiaries. This action allows for a smoother transition of trust assets to intended recipients.

Yes, a beneficiary of a trust can indeed disclaim their inherited interests. This process, known as the Kansas Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee, allows individuals to refuse certain rights or benefits. It's important to follow specific legal requirements to ensure the disclaimer is valid and effective. Utilizing platforms like USLegalForms can simplify the process by providing the necessary documents and guidance to help you through it.

In Kansas, the time limit for a disclaimer is generally nine months from the date the beneficiary becomes aware of their interest in the trust. It is crucial to act within this timeframe to ensure that the disclaimer is valid. Failing to file a disclaimer within the allotted time may result in the beneficiary being legally bound to accept the trust benefits. To simplify this process, consider using resources from uslegalforms, which can help you meet all necessary legal requirements.

The statute 21 5406 in Kansas pertains to criminal offenses, potentially affecting how disclaimers are processed under trust law. Although this statute addresses criminal misconduct, its implications can ripple into trust management when a beneficiary is implicated in wrongdoing. Understanding this statute is necessary for beneficiaries to navigate their rights and responsibilities effectively. For detailed guidance, it’s often helpful to review related legal documents available through platforms like uslegalforms.

In Kansas, a trustee of a disclaimer trust can be an individual or an institution, such as a bank or trust company. The trustee is responsible for managing the trust according to its terms and in the best interests of the beneficiaries. Choosing a qualified trustee is vital to ensure proper handling of the assets and compliance with the Kansas Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee. You can consult resources like uslegalforms to find suitable trustees.