Kansas Owner Financing Contract for Vehicle is a legally binding agreement entered into by a vehicle seller and buyer, used when the buyer chooses to finance the purchase directly from the seller rather than seeking external financing through a traditional lender or bank. This type of contract allows the buyer to make monthly payments to the seller over a defined period of time, typically with interest, until the full purchase price is paid off. The Kansas Owner Financing Contract for Vehicle includes specific details about the vehicle being sold, such as the make, model, year, VIN number, and mileage. It also outlines the total purchase price agreed upon by both parties, along with the down payment (if any) made by the buyer at the time of signing the contract. The contract further includes provisions regarding the payment terms, including the monthly installment amount, the duration of the financing period, and the interest rate charged on the outstanding balance. It is important to note that these terms must comply with the applicable Kansas state laws and regulations governing owner financing contracts for vehicles. Moreover, the Kansas Owner Financing Contract for Vehicle also includes clauses related to default and repossession of the vehicle. In the event that the buyer fails to make the agreed-upon payments, the seller may have the right to repossess the vehicle as a means of recovering the outstanding balance owed. The contract specifies the conditions under which repossession may occur, as well as any additional fees or penalties that may be imposed. While there may be variations in the details of owner financing contracts for vehicles in Kansas, the key types commonly known are: 1. Fixed Interest Rate Contract: This type of contract sets a specific interest rate at the time of signing the agreement, which remains constant throughout the repayment period. 2. Adjustable Interest Rate Contract: In this type of contract, the interest rate is subject to change based on market fluctuations or other predetermined factors. The contract outlines the terms under which the interest rate may be adjusted, such as a specific index or benchmark rate. It is essential for both the buyer and seller to carefully review and understand the terms and conditions outlined in the Kansas Owner Financing Contract for Vehicle before signing. Seeking legal advice or consulting an attorney to ensure compliance with state laws and protection of rights is highly recommended avoiding potential issues or disputes in the future.

Kansas Owner Financed Properties For Sale

Description owner finance cars

How to fill out Kansas Owner Financing Contract For Vehicle?

If you wish to total, acquire, or print out legitimate papers templates, use US Legal Forms, the most important variety of legitimate types, that can be found on the web. Take advantage of the site`s simple and handy research to discover the papers you need. Various templates for enterprise and individual uses are categorized by categories and states, or search phrases. Use US Legal Forms to discover the Kansas Owner Financing Contract for Vehicle in just a couple of clicks.

If you are currently a US Legal Forms client, log in in your account and click on the Download switch to obtain the Kansas Owner Financing Contract for Vehicle. You may also access types you previously acquired in the My Forms tab of your own account.

If you are using US Legal Forms for the first time, follow the instructions under:

- Step 1. Be sure you have chosen the shape for that correct area/region.

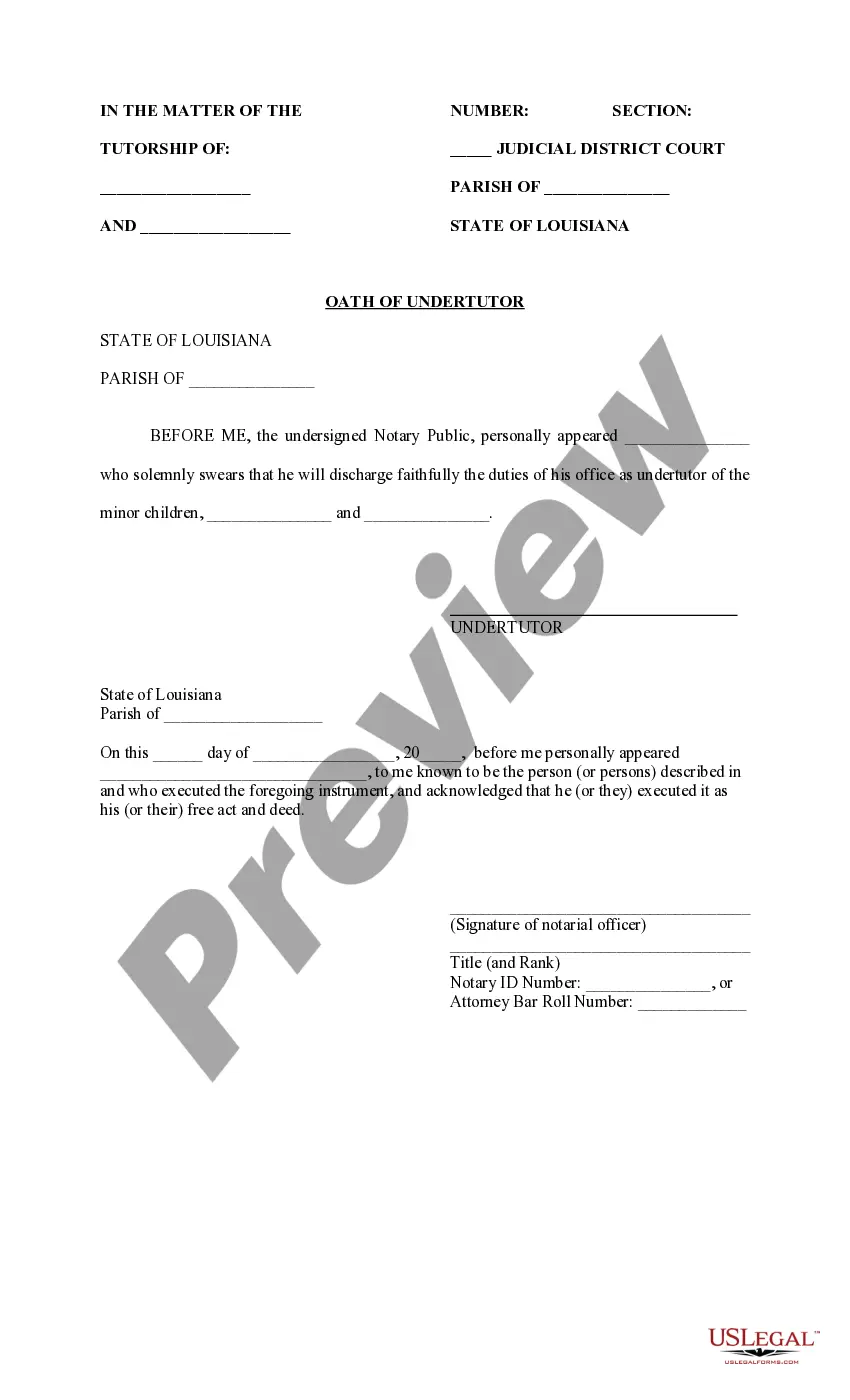

- Step 2. Take advantage of the Review solution to check out the form`s information. Never forget about to learn the outline.

- Step 3. If you are not satisfied using the kind, take advantage of the Search field on top of the display screen to find other types of the legitimate kind design.

- Step 4. Upon having found the shape you need, click the Acquire now switch. Pick the prices strategy you like and add your credentials to sign up on an account.

- Step 5. Procedure the purchase. You can use your charge card or PayPal account to perform the purchase.

- Step 6. Choose the file format of the legitimate kind and acquire it on the system.

- Step 7. Full, revise and print out or sign the Kansas Owner Financing Contract for Vehicle.

Every legitimate papers design you purchase is your own for a long time. You possess acces to each and every kind you acquired inside your acccount. Select the My Forms area and pick a kind to print out or acquire again.

Be competitive and acquire, and print out the Kansas Owner Financing Contract for Vehicle with US Legal Forms. There are many specialist and state-certain types you can utilize to your enterprise or individual needs.

Form popularity

FAQ

The monthly payment for a $30,000 car over 60 months depends on the interest rate. If you secure a Kansas Owner Financing Contract for Vehicle, you might encounter different rates based on your credit score and the lender's terms. For example, with a 5% interest rate, the payment would be approximately $566 per month. Always calculate potential payments to ensure that your financing suits your budget.

To get your own financing for a car, start by assessing your credit score and financial situation. Next, explore lenders who offer Kansas Owner Financing Contracts for Vehicle, as they may provide personalized terms tailored to you. Collect all necessary documentation, such as proof of income and identification, to streamline the application process. After securing financing, you can confidently shop for your vehicle within your budget.

Yes, you can get your own car financing. Many lenders offer various financing options to consumers, which include the Kansas Owner Financing Contract for Vehicle. This method can suit your unique needs and may be a better fit for your budget. Exploring multiple financing pathways helps you find the most advantageous terms.

To finance a car from a private owner, first negotiate the terms of the sale and agree on financing terms. It's beneficial to create a Kansas Owner Financing Contract for Vehicle that outlines all agreements made. Utilize resources like US Legal Forms to help draft a solid contract, ensuring both parties are legally protected during the transaction.

Writing an owner finance contract requires you to include essential details like the vehicle description, the buyer and seller information, payment terms, and any warranties or guarantees. It is wise to consult resources like US Legal Forms for templates and guidance, ensuring your contract complies with Kansas laws. By documenting everything clearly, you establish a secure transaction.

Transferring ownership of a vehicle in Kansas involves signing over the car title, completing a bill of sale, and submitting the necessary documents to the DMV. Make sure to include the buyer's and seller's information, vehicle details, and any liens that may exist. Check local requirements to ensure compliance. This process can relate significantly to the terms established in your Kansas Owner Financing Contract for Vehicle.

Setting up an owner financing contract involves drafting a comprehensive agreement that outlines the terms of repayment, interest rates, and other stipulations. You can use resources like USLegalForms to create a legally binding document tailored to your needs. Make sure to include all details related to the vehicle and the financing terms. This contract is a cornerstone of the Kansas Owner Financing Contract for Vehicle.

Filing a lien on a vehicle in Kansas requires completing a Vehicle Lien Statement. Make sure to enter accurate details about the vehicle and the lienholder. Once you have the form filled out, submit it to the DMV along with the necessary fees. Proper documentation is vital in a Kansas Owner Financing Contract for Vehicle, ensuring that all parties are protected.

To file a lien in Kansas, you will need to complete the appropriate lien form, which you can often find on the Kansas DMV website. Gather the required information, such as the vehicle identification number (VIN) and the details of the vehicle owner. Next, submit the form along with any applicable fees to your local DMV office. This process is an essential step in establishing a Kansas Owner Financing Contract for Vehicle.

In Texas, both parties do not need to be present to transfer a vehicle title, but it's highly recommended for clarity. The seller must complete the title transfer documentation, while the buyer should ensure they have the proper documents for registration. Transferring a title correctly avoids future complications in ownership disputes. If you are considering transactions involving a Kansas Owner Financing Contract for Vehicle, understanding these nuances can be beneficial.

Interesting Questions

More info

We don't want to send you out there and charge you for documents, although if your lawyer offers documents on your behalf, we are happy to do that for you.