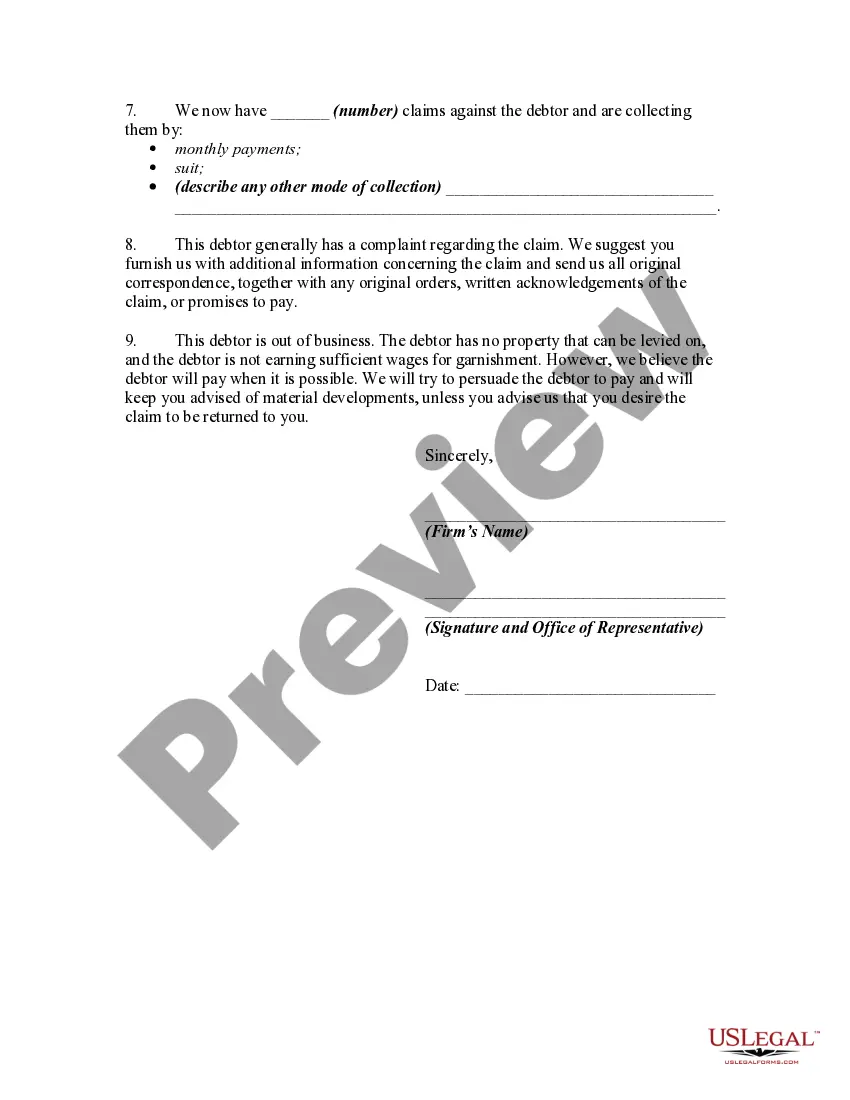

No particular language is necessary for the acceptance or rejection of a claim or for subsequent notices and reports so long as the instruments used clearly convey the necessary information.

Kansas Acceptance of Claim and Report of Experience with Debtor is a legal document used by individuals or businesses to report their experiences with a debtor and confirm the acceptance of a claim in the state of Kansas. This document plays a significant role in documenting financial transactions, addressing disputes, and establishing a debtor's creditworthiness. Keywords: Kansas, Acceptance of Claim, Report of Experience, Debtor, legal document, financial transactions, disputes, creditworthiness. Types of Kansas Acceptance of Claim and Report of Experience with Debtor: 1. Individual Acceptance of Claim and Report of Experience with Debtor: This type of report is filed by individuals who have had financial dealings with a debtor. These individuals can include lenders, suppliers, or anyone who has extended credit to the debtor. 2. Business Acceptance of Claim and Report of Experience with Debtor: Businesses that have had interactions with a debtor can file this report. It is commonly used by companies or organizations to report non-payment of invoices, breaches of contract, or other financial disputes with debtors. 3. Acceptance of Claim and Report of Experience with Debtor by Creditors: This particular report is filed by creditors who have outstanding unpaid debts owed to them by a debtor. It serves as an acknowledgment of the debt owed and provides a detailed account of the debtor's past payment behavior. 4. Acceptance of Claim and Report of Experience with Debtor by Collection Agencies: Collection agencies can utilize this document to report their experiences dealing with a specific debtor. It helps establish the debtor's track record on payment and plays a crucial role in determining their creditworthiness. 5. Acceptance of Claim and Report of Experience with Debtor by Credit Reporting Agencies: Credit reporting agencies often receive reports from creditors, businesses, or collection agencies regarding a debtor's experiences. These reports help compile the debtor's credit history and determine their credit score. In summary, Kansas Acceptance of Claim and Report of Experience with Debtor is a vital legal document used in the state of Kansas to report experiences and accept claims related to debtors. Whether filed by individuals, businesses, creditors, collection agencies, or credit reporting agencies, these reports serve to document financial interactions, address disputes, and evaluate a debtor's creditworthiness.