Kansas Sample Letter for Tax Deeds

Description

How to fill out Sample Letter For Tax Deeds?

Are you presently in a circumstance where you require documents for various organizations or individuals on a regular basis.

There are numerous legal document templates available online, but finding reliable ones is not easy.

US Legal Forms offers thousands of document templates, such as the Kansas Sample Letter for Tax Deeds, which are designed to comply with federal and state regulations.

Once you have the correct document, click Get now.

Choose the pricing plan you want, fill in the required information to create your account, and complete the payment using your PayPal or Visa or Mastercard.

- If you are already familiar with the US Legal Forms website and have an account, just Log In.

- Then, you can download the Kansas Sample Letter for Tax Deeds template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the document you need and ensure it is for the correct area/state.

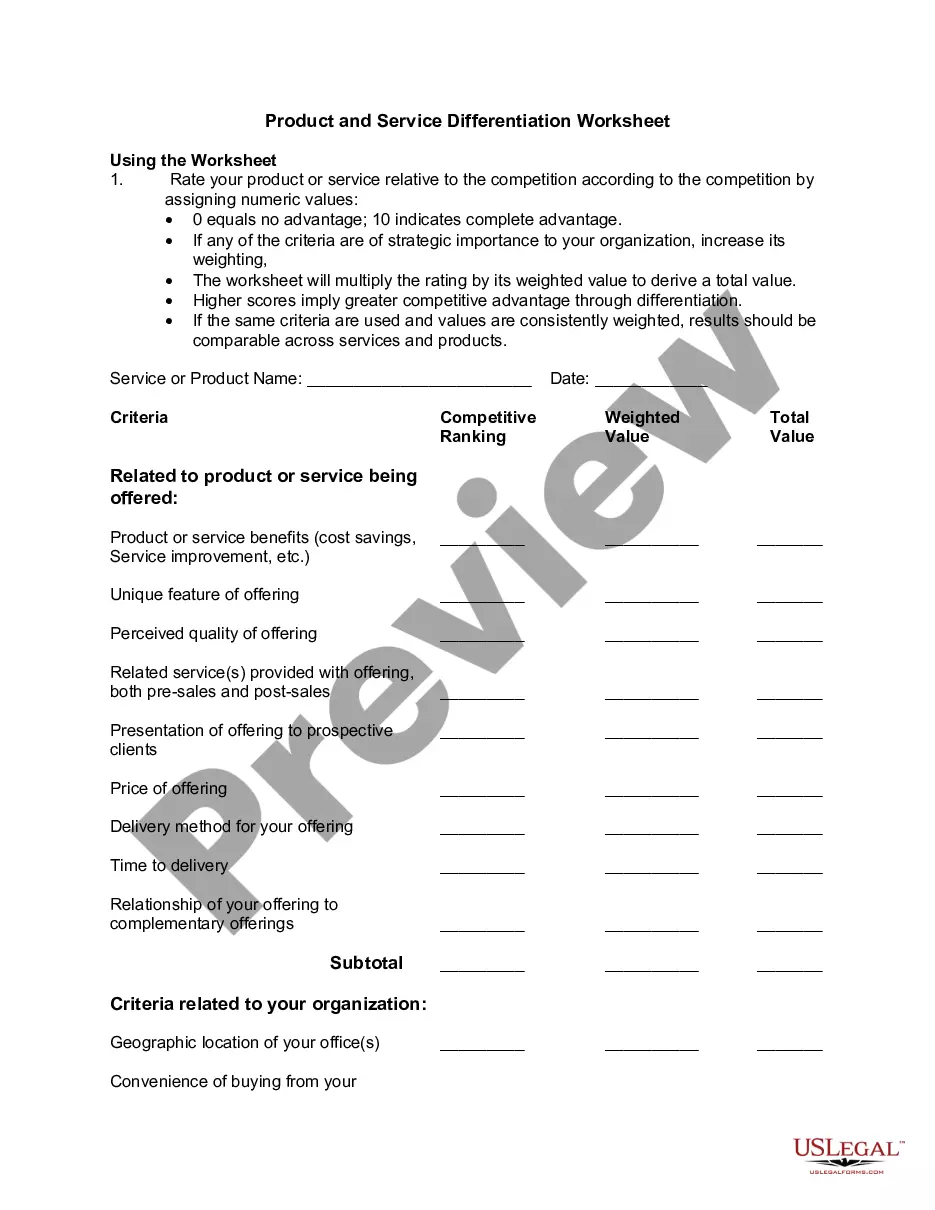

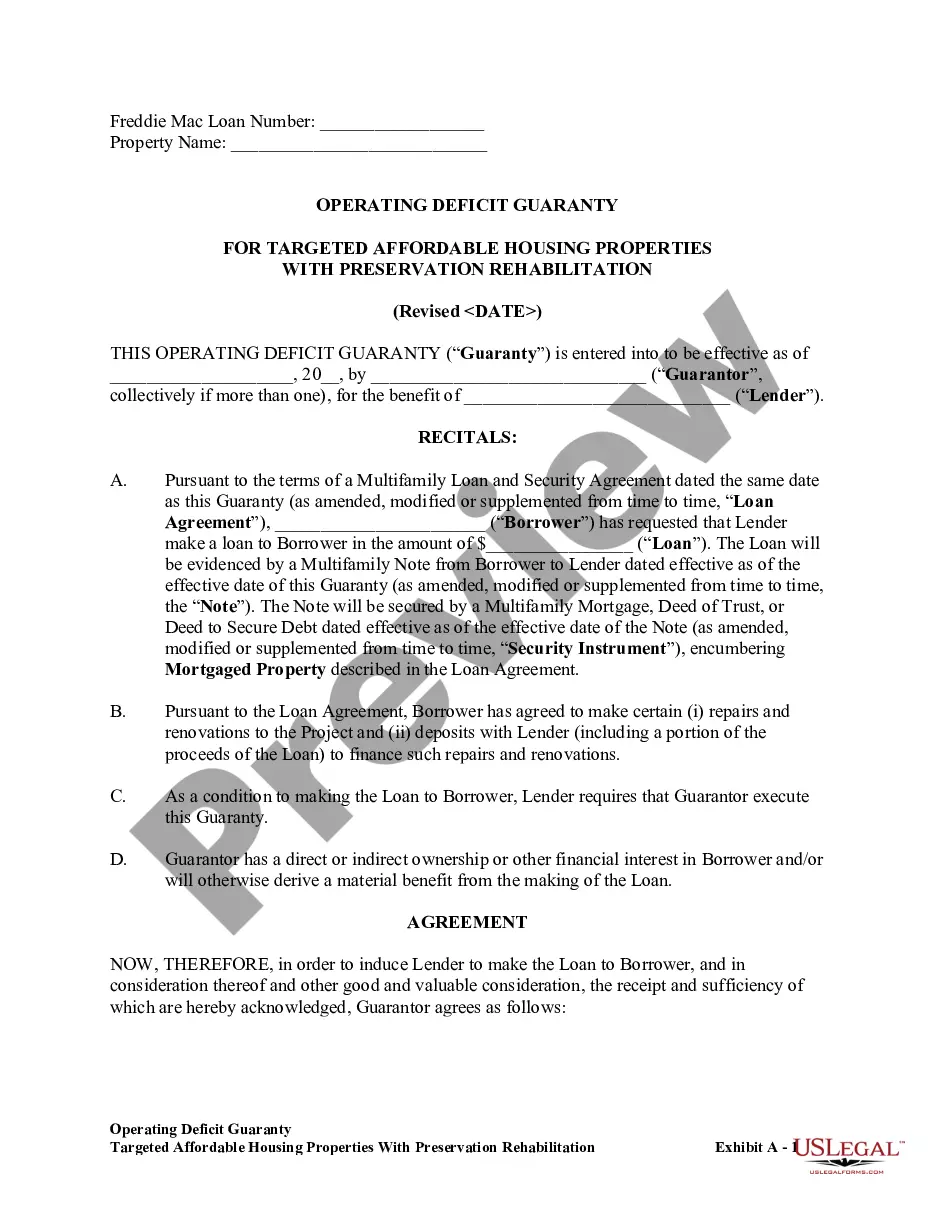

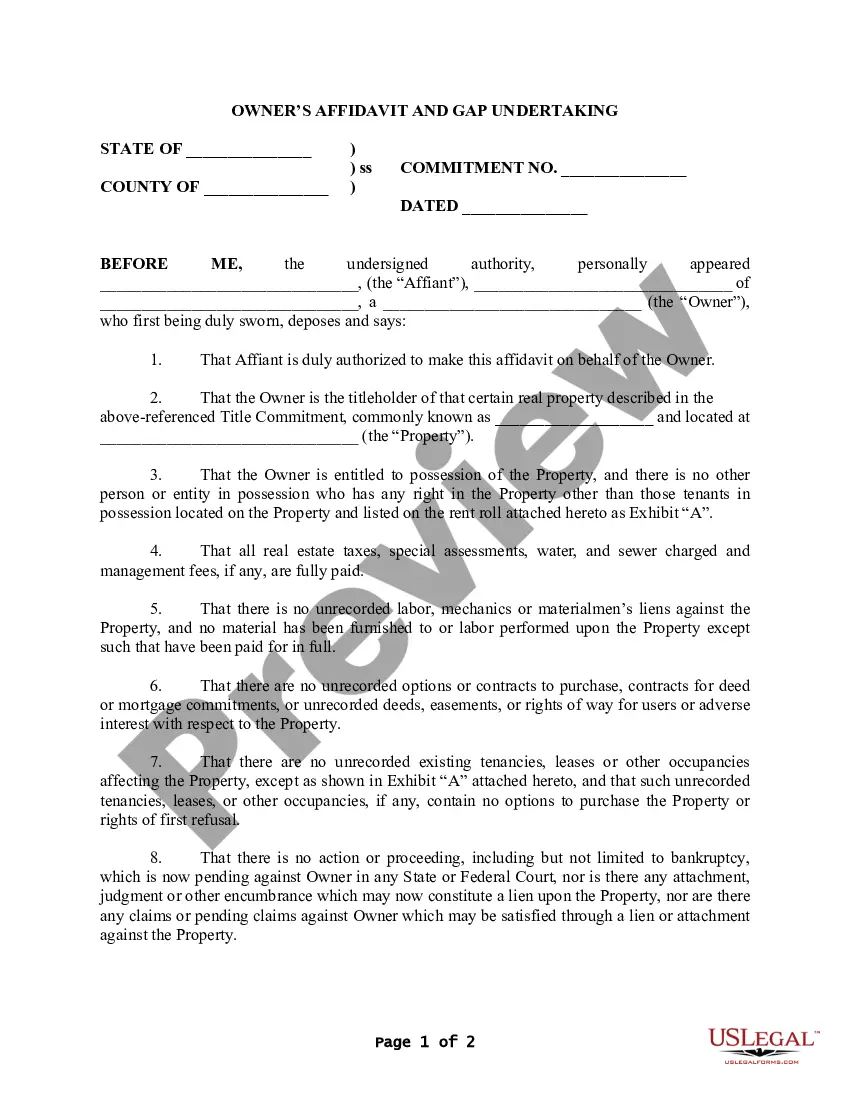

- Use the Preview button to review the form.

- Check the details to confirm you have selected the right document.

- If the document isn’t what you are searching for, use the Lookup field to find the form that suits your needs.

Form popularity

FAQ

The Department of Revenue may place a lien on the property of any delinquent taxpayer. The lien attaches on November 1 of the year in which the taxes are levied. After the lien is filed, as much of the property as is necessary to pay the taxes may be seized and sold to the county.

If property taxes remain delinquent past the notification stages, the property is submitted to the Tax Sale and the property owner can no longer redeem their property. The Tax Sale date is then determined and advertised. The public will be allowed to bid on the properties in the sale on that determined date.

Almost all Missouri counties, other than Jackson County and St. Louis City, sell tax liens. This means that when you bid at a Missouri tax auction, you are not buying a deed to the property, instead you a buying the right to collect the tax amount from the property owner.

Tax deed states with no redemption period are called ?redeemable deed? states. These states are Connecticut, Georgia, Rhode Island, Tennessee and Texas. Purchasing in a redeemable state can be very productive, and financial success is realistic if you follow the system Ted has outlined in his course material.

Some tax deed states like Kansas sell a redeemable tax deed.

When real estate ownership changes, a deed is the legal document that transfers the ownership. What if I lose my deed? If your deed is misplaced or lost, a copy may be obtained from the Register of Deeds Office for a fee of $1 per page.

Deeds for properties subject to a federal lien will not be issued until the expiration of the federal redemption period, and then only if there has been no redemption. The redemption period for a federal tax lien is 120 days from the date of the sale.

Obtain a State of Kansas Tax Clearance Request Online - Click here to complete an application through our secure website. Return to the website the following day to retrieve your "Certificate of Tax Clearance". Applications must be submitted by 5pm Monday ? Friday in order to be available the following business day.