This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

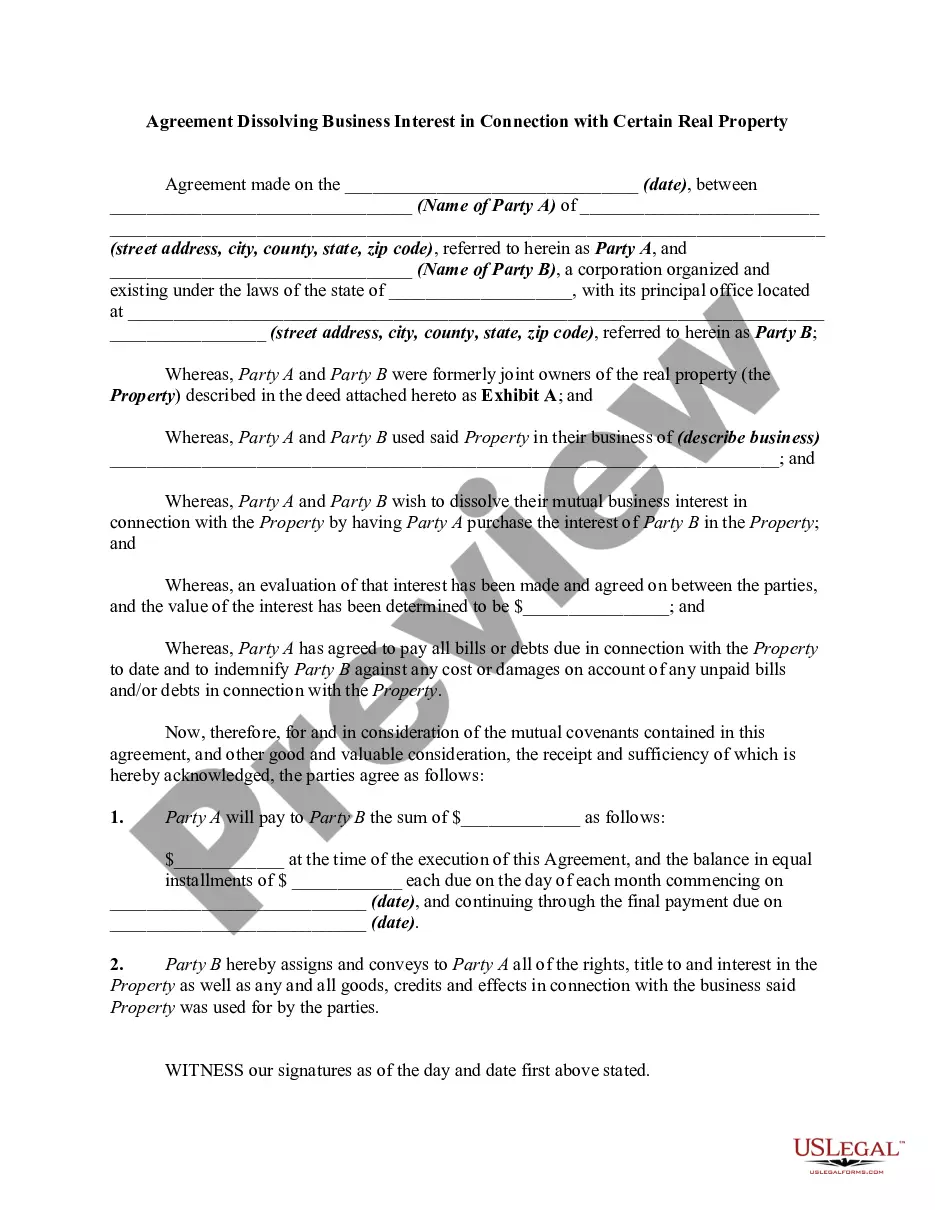

Kansas Agreement Dissolving Business Interest in Connection with Certain Real Property

Description

How to fill out Agreement Dissolving Business Interest In Connection With Certain Real Property?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a wide range of legal form templates that you can download or print.

By using the site, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords.

You can acquire the most recent forms such as the Kansas Agreement Terminating Business Interest Related to Specific Real Estate in moments.

If the form does not meet your needs, utilize the Search field at the top of the screen to find one that does.

Once you are satisfied with the form, confirm your selection by clicking the Purchase now button. Then, choose the pricing plan you prefer and provide your details to register for the account.

- If you have a membership, Log In and download the Kansas Agreement Terminating Business Interest Related to Specific Real Estate from the US Legal Forms library.

- The Download option will be visible on every form you view.

- You can access all previously downloaded forms in the My documents section of your account.

- If you are new to US Legal Forms, here are simple instructions to help you get started.

- Make sure you have selected the correct form for your state/region.

- Click the Preview option to view the form's content.

Form popularity

FAQ

To register an LLC in Kansas, start by choosing a unique name that adheres to state guidelines. You then need to file Articles of Organization with the Kansas Secretary of State, and this may involve creating a Kansas Agreement Dissolving Business Interest in Connection with Certain Real Property if your LLC concerns property interests. Once your application is approved, remember to obtain any necessary licenses and permits to operate legally.

To dissolve a nonprofit in Kansas, you need to follow specific steps to ensure compliance with state laws. First, you should hold a meeting to get approval from your board and members for the dissolution. Next, file the necessary paperwork with the Kansas Secretary of State, which may include a Kansas Agreement Dissolving Business Interest in Connection with Certain Real Property if applicable. Finally, make sure to settle any debts and distribute remaining assets according to your nonprofit's bylaws.

To cancel your sales tax identification number in Kansas, follow the guidelines set forth by the Kansas Department of Revenue. You must file a final sales tax return and indicate your intention to cancel the ID. If your cancellation relates to real estate interests, incorporating a Kansas Agreement Dissolving Business Interest in Connection with Certain Real Property may be required. The US Legal Forms platform can offer the forms and support needed for this task.

Closing a Kansas sales tax account requires submitting a last return to the Kansas Department of Revenue. Be sure to summarize all taxable sales and confirm it is your final submission. If your business closure pertains to any real estate interests, consider completing a Kansas Agreement Dissolving Business Interest in Connection with Certain Real Property. US Legal Forms can assist you with the necessary documents for a smooth closure.

If you need to back out of sales tax obligations in Kansas, it's important to properly notify the tax authority. First, ensure you file all required final returns. In some cases, you may need to draft a Kansas Agreement Dissolving Business Interest in Connection with Certain Real Property, especially if real estate is involved. Utilizing the US Legal Forms platform can streamline this process and help you meet legal requirements.

To close your Kansas sales tax account, visit the Kansas Department of Revenue's website to obtain the appropriate forms. You will need to fill out a final return and indicate the closure. If your closure involves real property interests, a Kansas Agreement Dissolving Business Interest in Connection with Certain Real Property may be necessary. For detailed instructions, the US Legal Forms platform can provide the essential documents.

To close your sales tax account in Kansas, you must file a final tax return and indicate that this is your last return. This process ensures that you report all taxable sales accurately. Additionally, you may need to submit a Kansas Agreement Dissolving Business Interest in Connection with Certain Real Property if your business is linked to real estate transactions. If you need assistance, consider using the US Legal Forms platform for clear guidance.

Dissolving a business in Kansas involves several steps, including notifying relevant stakeholders and filing necessary documents with the state. You'll want to prepare a Kansas Agreement Dissolving Business Interest in Connection with Certain Real Property if your business holds real property. Such an agreement can facilitate clear ownership transition, protect your rights, and streamline the overall dissolution process.

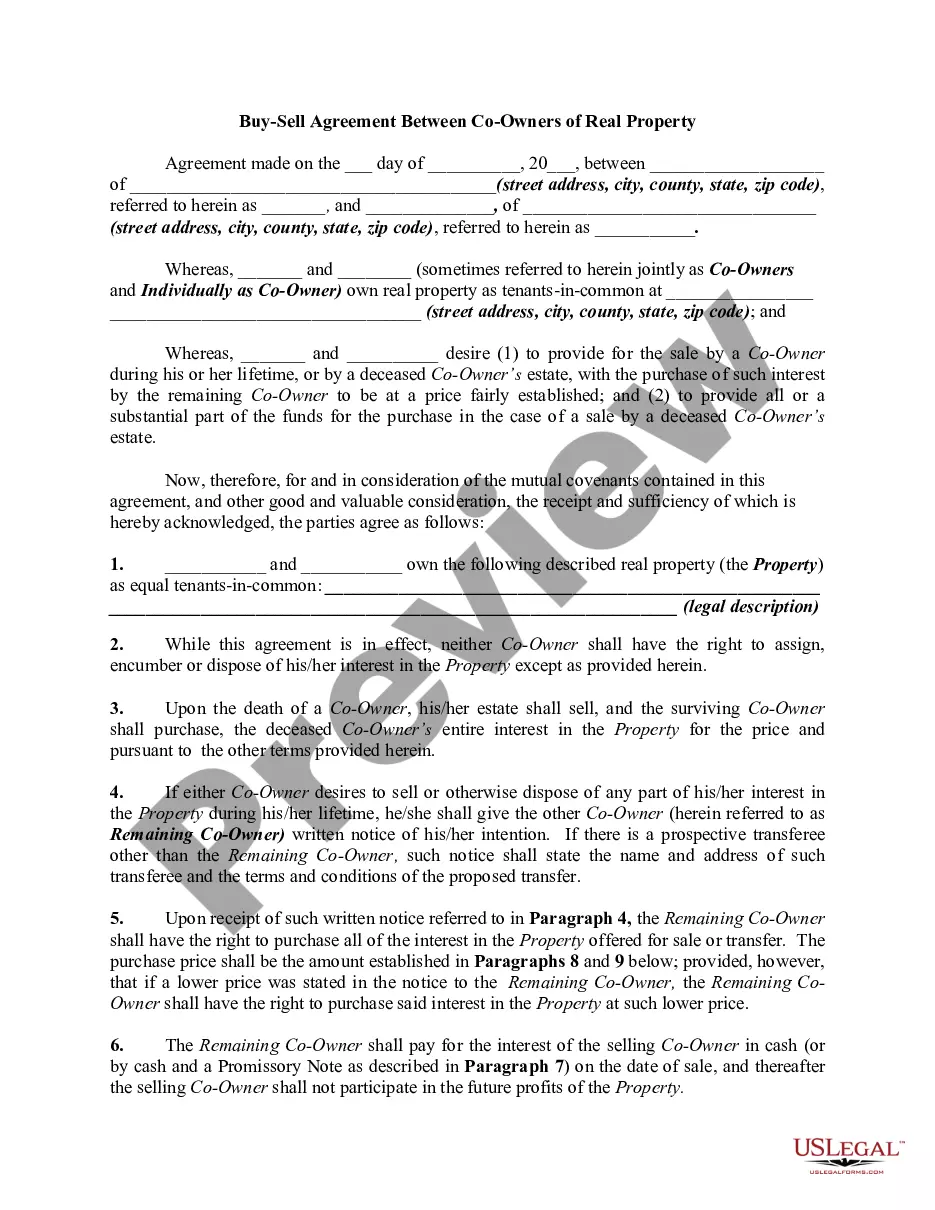

Removing a partner from an LLC in Kansas requires following the procedures outlined in your operating agreement. If this isn’t clear, a Kansas Agreement Dissolving Business Interest in Connection with Certain Real Property may help delineate ownership and operational changes. It's wise to consult legal resources to ensure compliance with Kansas laws and to protect your interests.

To dissolve a business in Kansas, you typically need to follow specific steps, including filing a Certificate of Dissolution with the Secretary of State. You may also need to address any outstanding debts and obligations. Additionally, consider drafting a Kansas Agreement Dissolving Business Interest in Connection with Certain Real Property to clarify the handling of any associated assets.