Subject: Understanding Kansas State Tax Commission Notice — Sample Letter and Its Types Dear [Recipient's Name], I hope this letter finds you well. I am writing to provide you with detailed information regarding the Kansas State Tax Commission Notice and provide a sample letter for your reference. This notice is an important communication from the Kansas State Tax Commission regarding your state taxes and requires your attention. Understanding its implications and taking appropriate action is crucial for compliance with the state's tax laws. A Kansas State Tax Commission Notice is typically sent to taxpayers to communicate important information about their state taxes, such as changes in tax assessments, delinquent tax payments, discrepancies or errors in tax filings, or requests for additional information. It serves as a formal notification that requires prompt action to rectify any issues highlighted in the notice. Below, you will find a sample letter that can be used as a template or reference when responding to a Kansas State Tax Commission Notice: [Your Name] [Your Address] [City, State, ZIP] [Date] [Recipient's Name] [Recipient's Position] [Kansas State Tax Commission] [Address] [City, State, ZIP] Subject: Response to Kansas State Tax Commission Notice — [Notice Number] Dear [Recipient's Name], I am writing in response to the Kansas State Tax Commission Notice, received on [date], which pertains to [briefly describe the subject of the notice]. I appreciate the opportunity to address the matters brought forth in the notice and ensure compliance with the state's tax regulations. [Proceed to explain your understanding of the notice and the specific issues highlighted. Provide any supporting documentation or information requested, if applicable.] [Outline your action plan or proposed steps to resolve the issue, including any necessary corrections, payments, or additional information required.] [Express your willingness to cooperate and/or request assistance if needed.] I kindly request that you acknowledge the receipt of this letter and provide further instructions, if necessary. I believe prompt resolution of these matters is crucial, and I would appreciate your cooperation in clarifying any uncertainties that may arise during the process. If you require any further documentation or have any additional questions or concerns, please do not hesitate to contact me directly at [your phone number] or [your email address]. Thank you for your attention to this matter. I look forward to your prompt response. Sincerely, [Your Name] [Your Contact Information] While the content of the Kansas State Tax Commission Notice may vary based on the specific issue at hand, several types can be mentioned, such as: 1. Tax Assessment Notice: This type of notice informs taxpayers about changes in their assessed tax amounts, potentially due to changes in income, valuations, tax credits, or other relevant factors. 2. Delinquent Tax Notice: Sent to taxpayers who have failed to pay their state taxes by the due date, this notice typically warns about penalties, interest charges, or potential legal action if the tax remains unpaid. 3. Notice of Tax Filing Discrepancies: This notice indicates inconsistencies or errors in the taxpayer's filed tax return and requests supporting documents or explanations to rectify the discrepancies. 4. Request for Additional Information Notice: This type of notice seeks additional documentation or data to support information provided in the tax return, focusing on specific areas like deductions, credits, or expenses. 5. Audit Notice: An audit notice is issued when the Kansas State Tax Commission selects a taxpayer's return for a thorough examination to ensure compliance with tax laws and regulations. Please note that the sample letter provided above should be tailored to your specific circumstances and the content of the notice you receive. It is advisable to seek professional advice or consult the Kansas State Tax Commission directly to ensure accurate compliance with their requirements. Wishing you a resolution to any tax matters you may be facing. Sincerely, [Your Name]

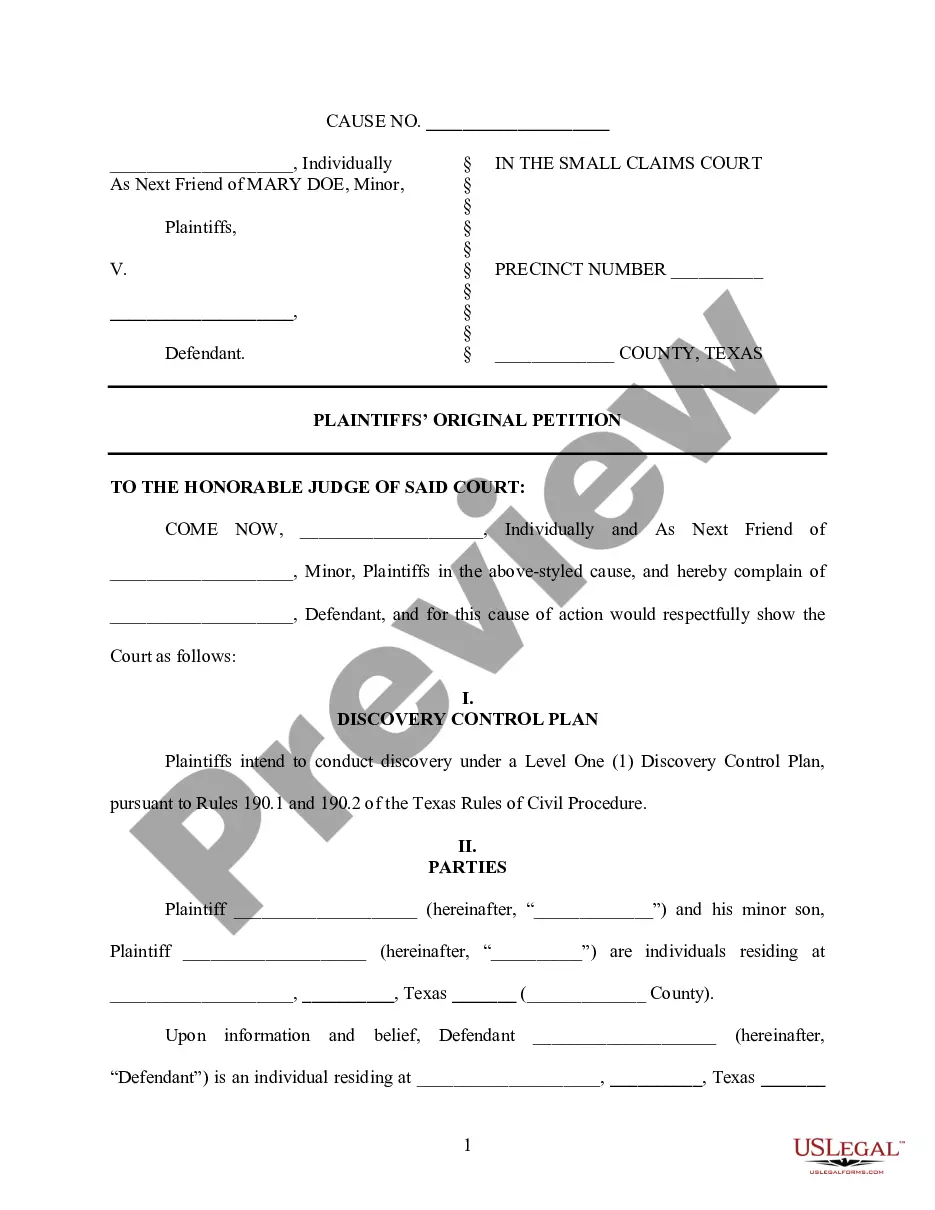

Kansas Sample Letter concerning State Tax Commission Notice

Description

How to fill out Kansas Sample Letter Concerning State Tax Commission Notice?

Are you currently inside a placement that you need paperwork for sometimes enterprise or individual uses virtually every time? There are a variety of lawful file templates available on the net, but getting versions you can rely isn`t effortless. US Legal Forms offers 1000s of kind templates, much like the Kansas Sample Letter concerning State Tax Commission Notice, that are published to satisfy federal and state specifications.

When you are currently informed about US Legal Forms site and get your account, basically log in. Following that, you are able to acquire the Kansas Sample Letter concerning State Tax Commission Notice template.

If you do not come with an account and need to begin using US Legal Forms, abide by these steps:

- Get the kind you require and make sure it is for your appropriate area/state.

- Utilize the Review key to analyze the form.

- Browse the description to ensure that you have chosen the proper kind.

- When the kind isn`t what you`re looking for, use the Research field to get the kind that meets your requirements and specifications.

- Once you obtain the appropriate kind, just click Get now.

- Choose the rates strategy you desire, complete the desired details to produce your account, and purchase the transaction utilizing your PayPal or charge card.

- Choose a convenient data file format and acquire your duplicate.

Locate all the file templates you might have purchased in the My Forms food list. You may get a more duplicate of Kansas Sample Letter concerning State Tax Commission Notice at any time, if needed. Just go through the necessary kind to acquire or produce the file template.

Use US Legal Forms, the most substantial variety of lawful kinds, to save efforts and steer clear of faults. The services offers expertly created lawful file templates that you can use for an array of uses. Produce your account on US Legal Forms and initiate creating your life easier.

Form popularity

FAQ

A clearance certificate will allow you, as the legal representative, to distribute assets without the risk of being personally responsible for unpaid amounts the person who died, estate, trust, or corporation might owe to the CRA. Your financial institution or lawyers may also ask you for a clearance certificate.

If you have a tax debt, the Kansas Department of Revenue will send you a bill and may contact you by phone, in person or by a recorded message.

If you have a tax debt, the Kansas Department of Revenue will send you a bill and may contact you by phone, in person or by a recorded message.

If you have a State of Kansas Tax Warrant that means the Kansas Department of Revenue (KDOR) believes you owe delinquent taxes. You must contact the KDOR to resolve the tax issue.

A certificate issued by most states generally to certify that a taxpayer has filed all tax returns due and paid all taxes and certain other amounts owed as of the date of the certificate. A tax clearance certificate must be requested on a state by state basis.

A Certificate of Tax Clearance is a comprehensive review to determine and ensure that the applicant's account is in current compliance with all applicable: Kansas tax laws administered by the director of taxation within the Kansas Department of Revenue.

Appeal Process Steps If the taxpayer disagrees with the notice, an appeal letter must be sent to the department within 60 days requesting an informal conference. This request must identify the objections to the assessment or refund denial. The taxpayer is notified of the receipt of the request.