Kansas Equipment Lease is a contractual agreement between two parties, where one party (the lessor) gives another party (the lessee) the right to use specific equipment in exchange for regular lease payments. This type of lease is commonly used in various industries across Kansas, providing businesses with an efficient and cost-effective way to access necessary equipment without the financial burden of purchasing it outright. There are multiple types of Kansas Equipment Leases available, tailored to meet the diverse needs of businesses. Some of the most common types include: 1. Fixed-Term Equipment Lease: This lease spans a predetermined period, typically ranging from one to five years. The lessee agrees to make regular payments for the equipment's use throughout the agreed-upon term. 2. Operating Equipment Lease: This type of lease is often suitable for businesses that require equipment on a short-term or seasonal basis. Operating leases allow companies to use equipment without the long-term commitment, as they can return the equipment once the lease term expires. 3. Master Equipment Lease: A master lease provides a flexible structure that allows lessees to add or replace equipment as needed, without requiring the creation of a new lease agreement for each addition or replacement. 4. Municipal Equipment Lease: Specifically designed for government entities or municipalities, this lease allows them to lease equipment necessary for public services, such as police vehicles, fire trucks, or road construction machinery. 5. Fair Market Value (FMV) Lease: In this type of lease, the lessee has the option to buy the equipment at the end of the lease term for its fair market value. This flexible option is suitable for businesses that are uncertain about their long-term equipment needs. Kansas Equipment Leases serve a wide range of industries, including agriculture, construction, transportation, healthcare, manufacturing, and more. This lease arrangement covers various equipment types like commercial vehicles, heavy machinery, medical devices, farm equipment, IT infrastructure, and office technology. When entering a Kansas Equipment Lease agreement, it is crucial to carefully consider factors such as lease terms, payment schedules, equipment maintenance responsibilities, early termination options, and potential penalties for damages or late payments. Additionally, lessees should ensure the lease complies with state and federal regulations applicable to the specific industry. Businesses operating in Kansas value equipment leasing for the financial flexibility it provides, as it allows them to conserve capital, manage cash flow, and stay technologically updated without incurring significant costs. By partnering with trustworthy lessors and understanding the specific terms and conditions, businesses can leverage Kansas Equipment Leases to optimize operational efficiency and drive growth.

Kansas Equipment Lease - Detailed

Description

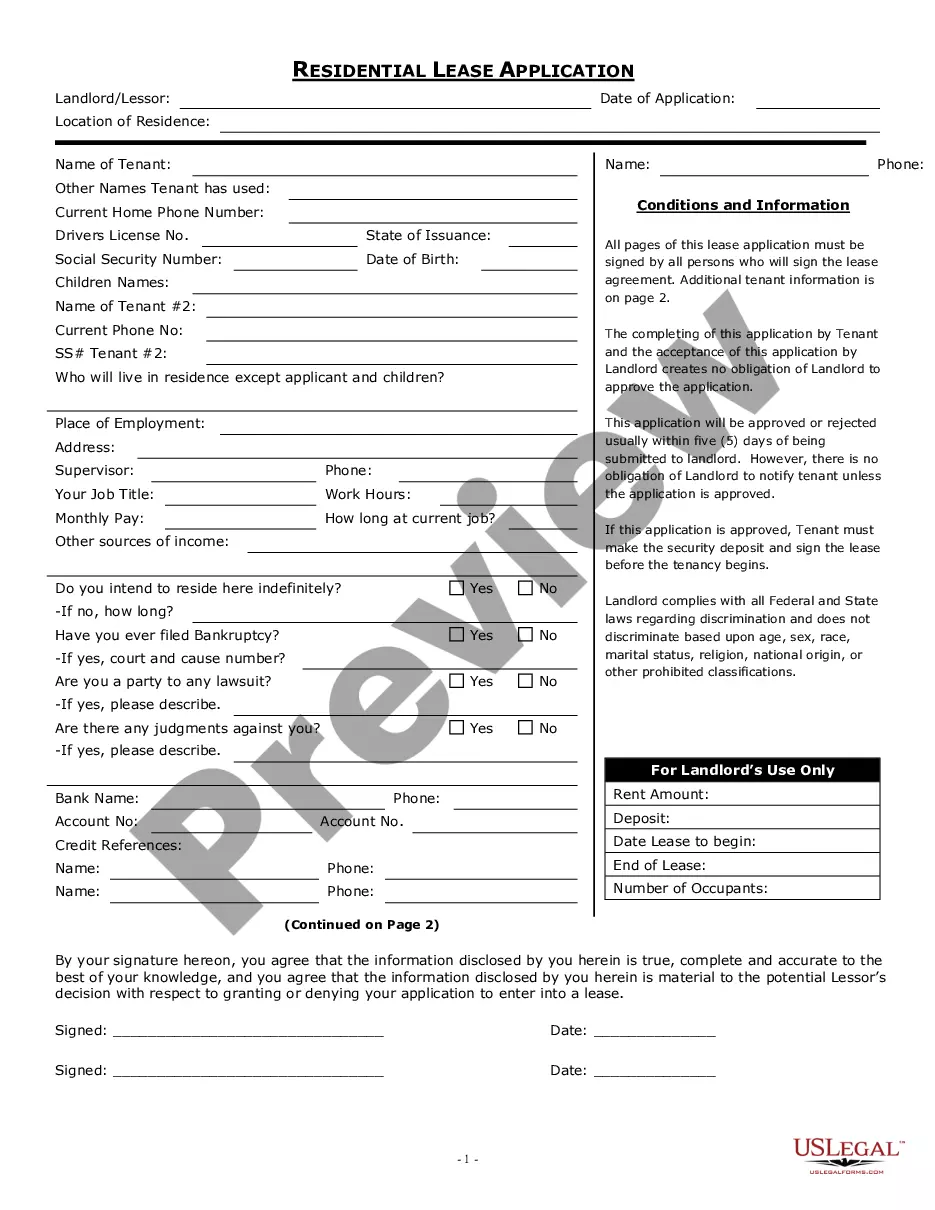

How to fill out Kansas Equipment Lease - Detailed?

US Legal Forms - one of the largest collections of legal documents in the USA - provides a broad selection of legal template records that you can download or print.

By using the website, you can access thousands of documents for business and personal needs, organized by categories, states, or keywords.

You can find the latest versions of forms such as the Kansas Equipment Lease - Detailed in a matter of seconds.

If the form does not meet your needs, use the Search field at the top of the page to find a suitable one.

If you are satisfied with the form, confirm your choice by clicking the Purchase now button, then select your preferred pricing plan and provide your details to register for an account.

- If you have a monthly subscription, Log In and download Kansas Equipment Lease - Detailed from the US Legal Forms collection.

- The Download button will be visible on every template you view.

- You have access to all previously saved documents in the My documents section of your account.

- To use US Legal Forms for the first time, here are simple steps to get started.

- Ensure you have chosen the correct template for your region/county.

- Click the Review button to see the details of the form.

Form popularity

FAQ

To structure an effective equipment lease, start with an outline that includes key components, such as lease duration, rent payment details, and equipment maintenance. Define the responsibilities of both the lessor and lessee to eliminate ambiguity. Crafting a well-structured Kansas Equipment Lease - Detailed protects your investment and fosters a reliable leasing relationship.

Equipment rental can be highly profitable, especially if you choose high-demand items and maintain quality service. Factors like market trends and competition significantly influence the profitability of your equipment rental business. By optimizing your offerings and forming a solid Kansas Equipment Lease - Detailed, you can maximize your investment returns.

Creating an equipment rental agreement starts with gathering all pertinent information, including the parties involved and equipment details. Clearly outline the rental terms, payment structure, and maintenance obligations to avoid misunderstandings. A comprehensive approach to your Kansas Equipment Lease - Detailed will safeguard your interests throughout the rental period.

Yes, you can type up your own rental agreement, provided you include all necessary legal elements. Make sure to clearly define the terms, such as rental duration, payment details, and maintenance responsibilities. A well-crafted rental agreement ensures compliance and protects both parties, making your Kansas Equipment Lease - Detailed effective and enforceable.

To lease equipment to your LLC, start by drafting a formal agreement that specifies the terms, responsibilities, and duration of the lease. Ensure the document outlines the payment schedule and penalties for late payments. It’s essential to document the transaction correctly to maintain your legal protection and benefits under a Kansas Equipment Lease - Detailed.

As mentioned earlier, at the end of a Kansas Equipment Lease - Detailed, you have options regarding the equipment's fate. You may return it, buy it, or possibly renew the lease. Each option carries different financial implications, so it’s wise to consider what best fits your business strategy.

The structure of equipment leasing generally includes the lease duration, payment schedule, and maintenance responsibilities. In a Kansas Equipment Lease - Detailed, the terms can vary based on the type of equipment and the lessor's policies. Understanding these elements helps businesses plan their financial commitments effectively.

Exiting a Kansas Equipment Lease - Detailed can be complex, but several strategies may help. Review your lease terms for any possible early termination clauses. You may also negotiate with the lessor or consider subleasing the equipment, depending on the agreement’s provisions.

Equipment leasing is a financing option for acquiring equipment while keeping your capital flexible. With a Kansas Equipment Lease - Detailed, businesses can obtain essential tools for operations without the burden of high initial costs. This approach facilitates growth and allows companies to stay competitive.

In a finance lease, the lessor retains ownership of the equipment throughout the lease term. The lessee, however, has the right to use the equipment as agreed, and may have options to buy it at the end of the lease. Understanding ownership terms is vital for those considering a Kansas Equipment Lease - Detailed to avoid confusion and ensure compliance.

Interesting Questions

More info

The best thing about Kansas is that it takes care of its business. The state has strong safety regulations that protect travelers and drivers. The state also offers a reliable and safe infrastructure for business, and Kansas has a well-developed and efficient system for registering new businesses. Kansas has a clean and stable political system that protects civil rights and liberties. The state has a friendly and inviting environment, where neighbors are willing to lend a helping hand. And the state is affordable — many other states with the same demographics, economy, and population can only dream of offering the same quality of life as Kansas. Kansas Case Text Home > State Map > Search Laws Search Find law in Kansas, click on your city or zip code to locate details of legal agreements and leases.