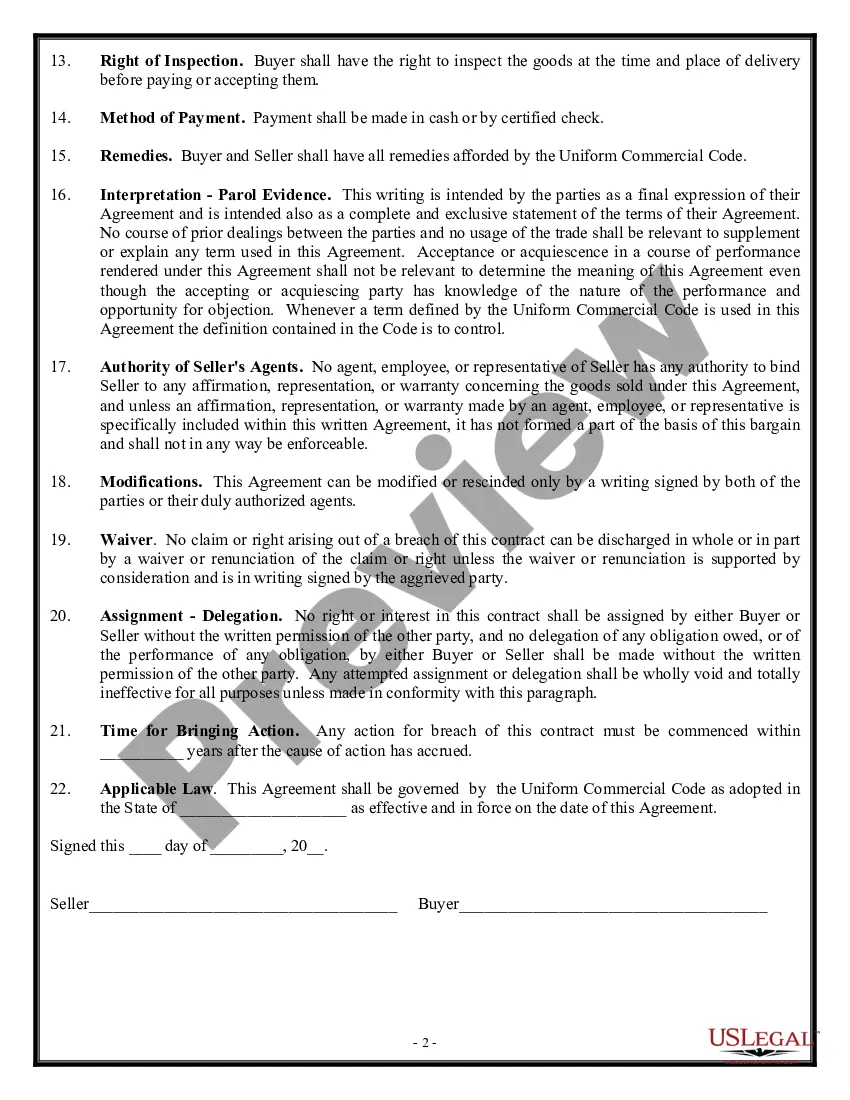

Kansas Contract - Sale of Goods

Description

How to fill out Contract - Sale Of Goods?

Finding the appropriate authentic document template can be quite a challenge. Clearly, there are many templates available online, but how can you obtain the authentic document you need.

Utilize the US Legal Forms website. The platform offers numerous templates, including the Kansas Contract - Sale of Goods, that can be utilized for both business and personal needs.

All of the forms are verified by experts and comply with state and federal regulations.

Once you have confirmed that the form is correct, click the Buy now button to obtain the document. Choose the pricing plan you wish and enter the necessary information. Create your account and complete the purchase using your PayPal account or credit card. Select the file format and download the legal document template to your device. Complete, edit, print, and sign the obtained Kansas Contract - Sale of Goods. US Legal Forms is indeed the largest collection of legal documents from which you can find various document templates. Use the service to acquire professionally crafted documents that meet state regulations.

- If you are already registered, Log In to your account and click the Download button to retrieve the Kansas Contract - Sale of Goods.

- Use your account to browse the legal documents you have acquired previously.

- Navigate to the My documents section of your account and download another copy of the document you need.

- If you are a new user of US Legal Forms, here are simple instructions to follow.

- First, ensure you have selected the correct document for your location/state. You can review the form using the Review button and read the document description to confirm it is suitable for you.

- If the document does not fulfill your requirements, use the Search field to locate the appropriate form.

Form popularity

FAQ

Typically, the six conditions that form a legally binding contract include offer, acceptance, consideration, capacity, legality, and intention to create legal relations. In Kansas Contract - Sale of Goods, understanding these principles is essential to enforce rights and obligations. Awareness of these conditions helps in drafting effective contracts that prevent conflicts. Engaging with a resource like uslegalforms can ensure your contracts meet necessary criteria.

Conditions in contracts establish the obligations that each party must fulfill for the agreement to be valid. These can include specific actions or events required to trigger, modify, or terminate the contract. In a Kansas Contract - Sale of Goods, conditions protect all parties involved by clearly outlining the terms of the sale. Understanding these conditions can prevent misunderstandings and disputes.

Conditions in a contract for sale of goods refer to specific clauses that outline the responsibilities and rights of the parties involved. These conditions can be conditional upon the delivery of goods, quality requirements, or timing of payment. In the context of a Kansas Contract - Sale of Goods, clear conditions improve transactional clarity. They ensure both parties understand the expectations tied to the sale.

The five conditions essential for a valid contract are mutual agreement, consideration, capacity, legality, and intention. In the realm of a Kansas Contract - Sale of Goods, these conditions ensure that both parties understand their rights and obligations. Furthermore, they help prevent disputes and foster a transparent agreement. It is crucial to meet these requirements for a contract to be enforceable.

The consumer compensating use tax in Kansas is levied on items purchased out of state that are brought into Kansas for use. If you engage in a Kansas Contract - Sale of Goods that involves such purchases, you need to be aware of this tax. It ensures that when consumers buy goods online or elsewhere, they contribute to the state's revenue similarly to local purchases. Understanding this tax can help you avoid unforeseen liabilities and plan your transactions wisely.

The CR 16 form in Kansas is an official document that allows buyers to claim exemption from sales tax on purchases made for agricultural use. When entering into a Kansas Contract - Sale of Goods that falls under this exemption, using the CR 16 correctly is crucial to avoid tax liabilities. You’ll need to provide accurate information about both the buyer and the sale. Using platforms like uslegalforms can simplify the process of obtaining and filing the proper forms.

In Kansas, several categories of buyers are exempt from sales tax, including certain nonprofit organizations, government agencies, and businesses purchasing items for resale. If you're engaging in a Kansas Contract - Sale of Goods, knowing who qualifies for these exemptions can ease the financial burden on your operations. Keeping this information at your fingertips can enhance your business's efficiency. Always consult the latest regulations or experts to ensure compliance.

Yes, Kansas participates in the Streamlined Sales Tax (SST) initiative, which aims to simplify sales and use tax collection. This means that if you're dealing with a Kansas Contract - Sale of Goods, you may benefit from a more straightforward sales tax process. The SST framework helps businesses by providing consistent rules across participating states. Understanding this can help you better navigate sales tax obligations.

In Kansas, agricultural exemptions apply to items used directly in agricultural production, such as seeds, livestock, and feed. If you’re involved in a Kansas Contract - Sale of Goods and sell qualifying agricultural products, you may be able to exempt those sales from sales tax. This exemption supports the agricultural community by reducing costs associated with farming activities. Being aware of the qualifying items can lead to significant savings for your business.

A CR16 is a form used in Kansas to claim sales tax exemption for certain sales, particularly for agricultural purposes. When completing a Kansas Contract - Sale of Goods that qualifies for this exemption, sellers must ensure the CR16 is filled out properly. This form helps streamline the sales process, allowing farmers and related businesses to benefit from tax savings. By understanding its purpose, you can better manage your agricultural transactions.