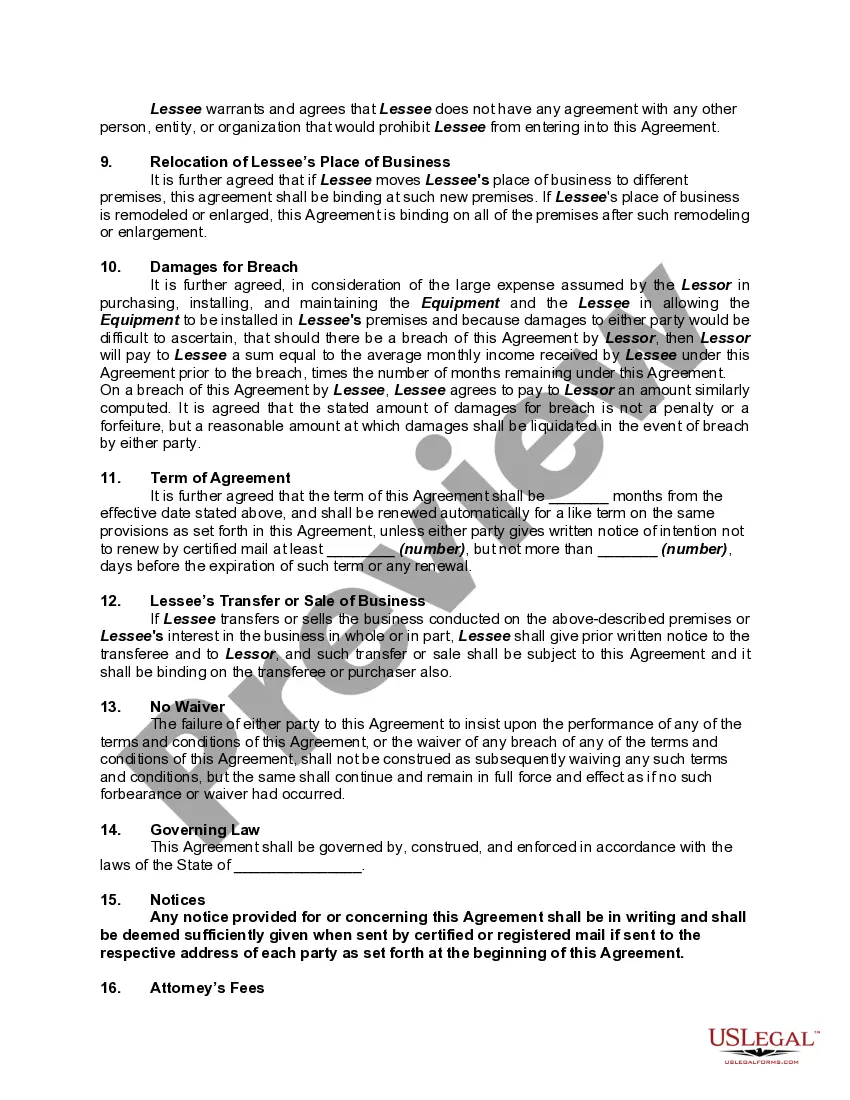

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Kansas Lease of Game or Entertainment Device

Description

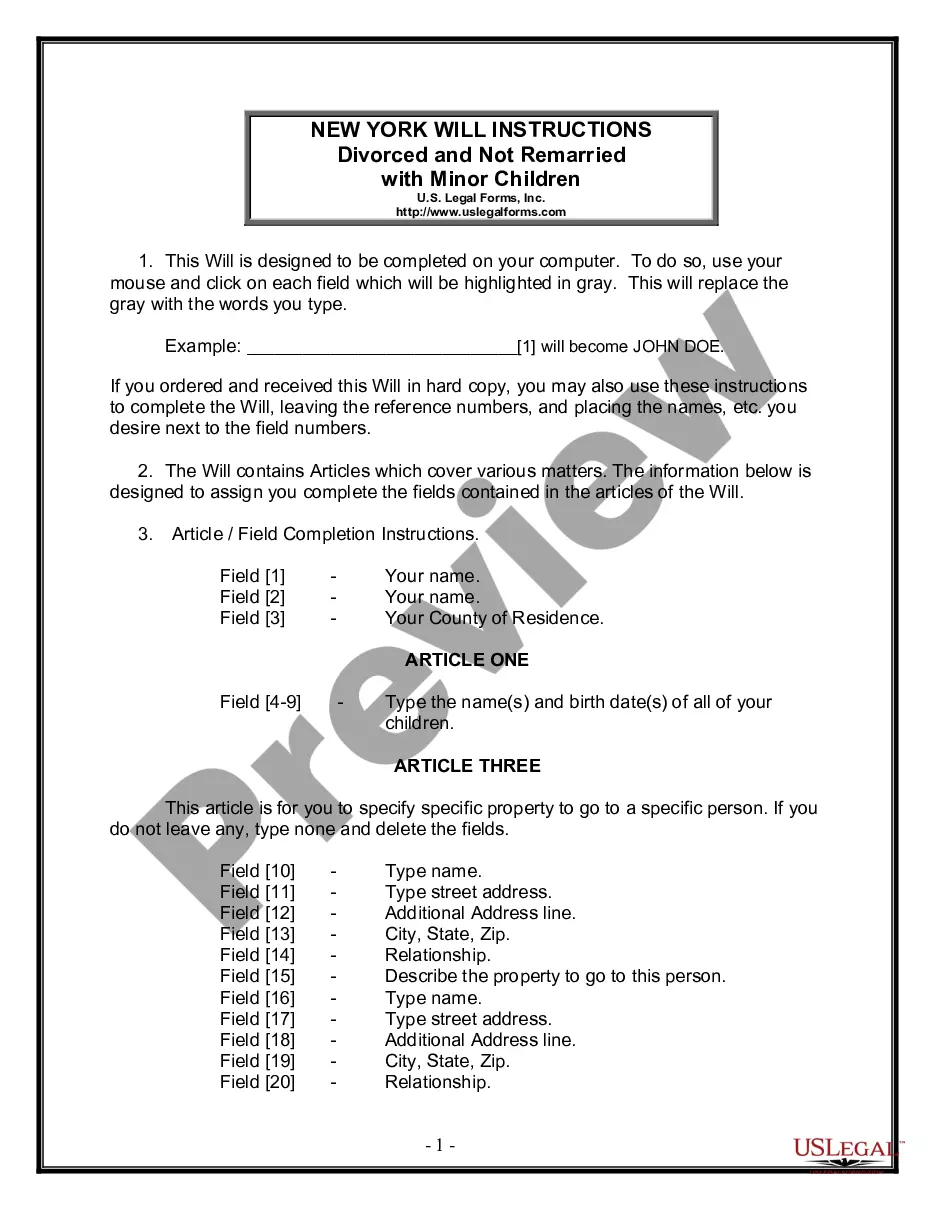

How to fill out Lease Of Game Or Entertainment Device?

If you require to complete, download, or print authentic document templates, utilize US Legal Forms, the largest array of valid forms available online.

Take advantage of the site’s straightforward and convenient search function to find the documents you need.

Various templates for business and personal purposes are organized by categories and states, or by keywords.

Step 4. Once you have found the form you need, click on the Get now button. Choose the payment plan that suits you and provide your information to register for an account.

Step 5. Complete the payment. You may use your credit card or PayPal account to finish the transaction.

- Employ US Legal Forms to get the Kansas Lease of Game or Entertainment Device in just a few clicks.

- If you are already a US Legal Forms customer, Log In to your account and click on the Download button to retrieve the Kansas Lease of Game or Entertainment Device.

- You can also access forms you previously saved in the My documents tab of your account.

- If you are accessing US Legal Forms for the first time, follow these steps.

- Step 1. Ensure you have chosen the form relevant to the correct city/region.

- Step 2. Use the Preview mode to review the content of the form. Don’t forget to check the summary.

- Step 3. If you are not pleased with the document, use the Search field at the top of the screen to find other types in the legal document template.

Form popularity

FAQ

In Kansas, a variety of items and services are exempt from sales tax, including groceries and prescription medications. However, when it comes to leasing game or entertainment devices, you might discover that certain exemptions do not apply. Understanding the nuances of Kansas sales tax exemptions can help you plan effectively. For tailored guidance, US Legal can provide detailed information on what is exempt in your case.

Certain services are exempt from sales tax in Kansas, including most professional services and educational services. However, if the service pertains to game or entertainment devices, it might not qualify for exemption. It’s vital to know which services fall under these rules to avoid any unexpected tax implications. The US Legal platform can help you identify exemptions that apply to your specific situation.

Economic nexus in Kansas refers to the criteria that determine whether a business must collect sales tax based on economic activity, rather than physical presence. If your activities involve leasing a game or entertainment device or generating sales above a certain threshold, you might have economic nexus. Being aware of this requirement is crucial for compliance in various transactions. US Legal can assist you in understanding how economic nexus affects your business operations.

In Kansas, software maintenance services that support game or entertainment devices are generally taxable. This includes updates and troubleshooting measures that keep the software functional. Understanding this aspect of taxation will help you budget accordingly and avoid unexpected tax liabilities. US Legal can provide you with the necessary tools and information to ensure compliance with Kansas tax laws.

In Kansas, Software as a Service (SaaS) can be subject to sales tax depending on the nature of the service. If the service supports the operation of game or entertainment devices, it may indeed attract sales tax. Businesses should assess their offerings carefully and consider seeking professional guidance to ensure they meet Kansas tax regulations accurately. US Legal offers resources that clarify these obligations for businesses engaging in SaaS.

The taxability of software varies by state, including Kansas. In Kansas, software remains taxable when it is purchased, licensed, or used to access games or entertainment devices. To navigate the complexities of software taxation, particularly if you operate within multiple states, relying on expert resources can simplify your compliance and reporting duties. US Legal provides valuable insights on tax obligations for software nationwide.

Kansas retailers compensating use refers to the tax that sellers must collect on items sold to customers in the state. If you lease a game or entertainment device in Kansas, it's essential to understand how this tax impacts your business. This tax ensures that retailers contribute to state revenue, which is significant for local services. To streamline the process, consider using the US Legal platform for clear guidance on compliance.

Some individuals and entities may be exempt from Kansas income tax, including certain organizations and low-income earners. If you are leasing a Kansas Lease of Game or Entertainment Device, understanding your income tax responsibilities is crucial. Specific categories, such as non-profit organizations, may qualify for exemptions under Kansas law. Consulting with tax professionals or legal advisers can provide clarity on your specific situation.

In Kansas, certain items and transactions qualify for tax-exempt status, including specific types of leases. For instance, if a Kansas Lease of Game or Entertainment Device is used for a tax-exempt entity or an approved purpose, it may qualify as tax-exempt. Knowing what counts as tax-exempt can prevent unnecessary tax expenses. It is wise to consult the Kansas Department of Revenue or a tax professional for personalized advice.

In Kansas, the lease tax typically applies to rental transactions, including items such as the Kansas Lease of Game or Entertainment Device. The tax rate can vary, and it is crucial to know the specifics for your situation. Familiarizing yourself with leasing regulations will save you time and frustration. For detailed guidance, consider checking resources on regulations or consulting with a tax expert.