This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Kansas Agreement to Extend Debt Payment

Description

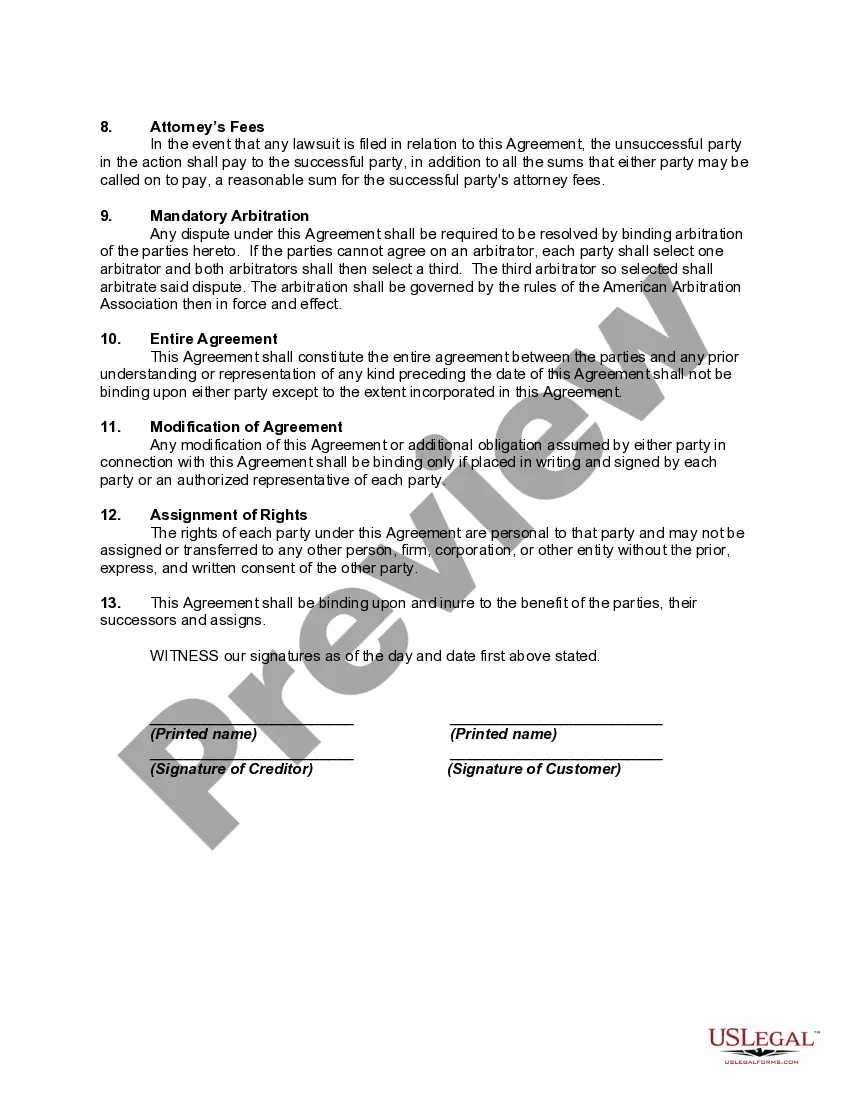

How to fill out Agreement To Extend Debt Payment?

You have the capability to invest hours online searching for the legal document template that complies with the state and federal requirements you need.

US Legal Forms provides a vast array of legal documents that are evaluated by professionals.

You can conveniently obtain or create the Kansas Agreement to Extend Debt Payment through our services.

If available, utilize the Review option to look through the document template as well.

- If you already possess a US Legal Forms account, you can Log In and select the Download option.

- Afterward, you can complete, modify, print, or sign the Kansas Agreement to Extend Debt Payment.

- Each legal document template you acquire is yours permanently.

- To retrieve another copy of any acquired form, visit the My documents tab and choose the relevant option.

- If you are using the US Legal Forms site for the first time, adhere to the simple instructions below.

- First, ensure that you have selected the correct document template for the county/city of your choice.

- Review the form description to confirm you have selected the right form.

Form popularity

FAQ

Kansas does not provide an automatic extension for debt payments without a formal request. If you anticipate needing extra time, the Kansas Agreement to Extend Debt Payment allows you to apply for an extension through a straightforward application process. Taking proactive steps can help you avoid penalties and manage your finances effectively.

Kansas does not mandate that residents request an extension for debt payments; however, you may want to consider the Kansas Agreement to Extend Debt Payment if you need additional time. This option can ease your financial burden by allowing more time to manage payments. It's important to evaluate your financial situation and apply for an extension if necessary.

An agreement to temporarily suspend debt payments is often referred to as a forbearance agreement. This type of arrangement allows borrowers to pause their payments for a specified time due to financial hardships. If you are considering a Kansas Agreement to Extend Debt Payment, a forbearance can be a useful option to manage your finances, providing relief during challenging periods.

UCCC stands for the Uniform Consumer Credit Code, which sets the standard for consumer credit in Kansas and other states. The UCCC provides guidelines that protect borrowers from unfair practices while ensuring lenders comply with regulations. Familiarity with the UCCC is vital when entering a Kansas Agreement to Extend Debt Payment, as it outlines your rights and responsibilities.

In Kansas, debts generally become uncollectible after a specific period, which is typically seven years. This timeframe starts from the date of the last payment, and understanding this can help you navigate your finances. If you have a Kansas Agreement to Extend Debt Payment, it's critical to be aware of this limit to avoid unexpected collections after the statute of limitations lapses.

The Kansas Uniform Consumer Credit Code (UCCC) is a set of laws designed to regulate credit practices in Kansas. It aims to protect borrowers by ensuring fair lending practices and transparency in agreements. Understanding the Kansas UCCC is essential for anyone entering a Kansas Agreement to Extend Debt Payment, as it governs the terms and conditions of consumer credit transactions.

Kansas does not provide an automatic extension for state tax filings as federal taxes do. You must file a request for an extension before the original due date. Utilizing a Kansas Agreement to Extend Debt Payment can offer you an extended timeline to manage your tax payments effectively.

Yes, Kansas accepts federal extensions for corporations. However, it is essential to understand that these extensions generally only apply to federal income tax returns. If you need additional time for state tax obligations, consider a Kansas Agreement to Extend Debt Payment to ensure compliance with local regulations.

40V is the form used for making extension payments on ansas individual income taxes. It serves as a means to ensure your payment is processed correctly during the extension period. By utilizing the ansas Agreement to Extend Debt Payment, you can better navigate the requirements and ensure your tax payment is handled efficiently.

To make an extension payment, complete the necessary Kansas tax form and submit it along with your payment to the Kansas Department of Revenue. Ensure you include all required information to avoid delays. The Kansas Agreement to Extend Debt Payment gives you the roadmap to secure the extension while keeping your tax obligations in check.