When you cannot make your monthly credit card payment, the worst thing you can do is to simply let the bill go unpaid. Your creditor can charge you a late fee, raise your interest rate, and report the late payment to the credit bureaus. If you cannot pay the minimum, consider writing your credit card company and explaining your situation to them. Many creditors will extend your due date, waive the late fee, and continue reporting a "current" payment status to credit bureaus.

Kansas Letter to Credit Card Company Seeking to Lower Payments Due to Financial Difficulties

Description

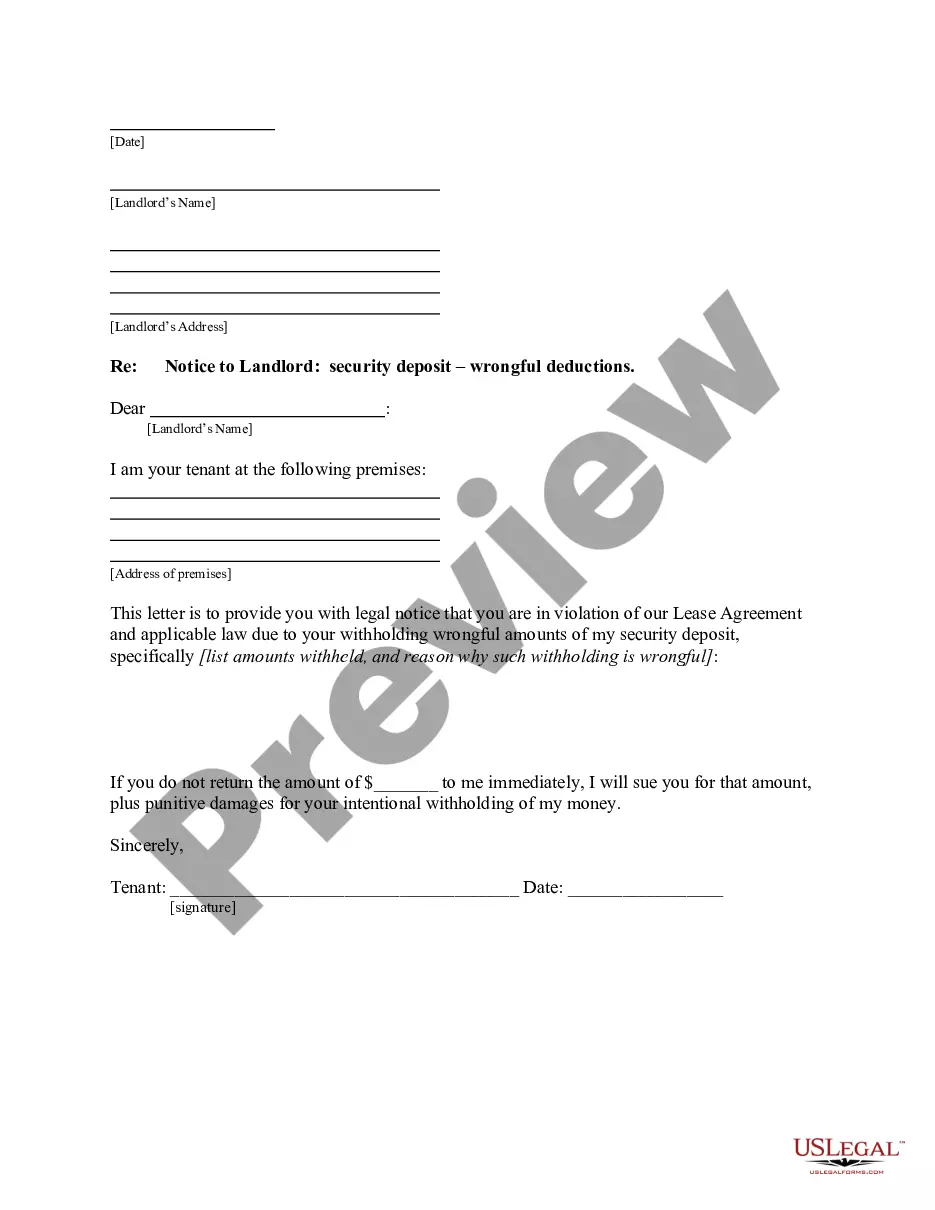

How to fill out Letter To Credit Card Company Seeking To Lower Payments Due To Financial Difficulties?

Locating the appropriate authentic document format can be rather challenging.

Clearly, there is a multitude of templates accessible online, but how do you obtain the genuine form you need.

Utilize the US Legal Forms website. This service provides an extensive array of templates, such as the Kansas Letter to Credit Card Company Requesting Reduction of Payments Due to Financial Issues, which can be utilized for both business and personal purposes.

You can view the form using the Preview button and check the form description to confirm it is suitable for you.

- All templates are verified by experts and comply with federal and state regulations.

- If you are already registered, Log In to your account and click on the Obtain button to access the Kansas Letter to Credit Card Company Requesting Reduction of Payments Due to Financial Issues.

- Use your account to browse the legal templates you have previously acquired.

- Navigate to the My documents section of your account and obtain another copy of the document you need.

- If you are a new user of US Legal Forms, here are some straightforward instructions to follow.

- First, ensure you have selected the correct form for your city/county.

Form popularity

FAQ

When writing a letter explaining financial hardship, briefly summarize your current economic situation. Provide context for your difficulties, such as job loss or medical expenses, to help the recipient understand your position. Clearly request any modifications or assistance you seek from the company. A Kansas Letter to Credit Card Company Seeking to Lower Payments Due to Financial Difficulties can serve as a template to guide your writing.

To write a settlement letter to a credit card company, begin by clearly stating your intention to settle your debt for less than the full amount. Include relevant details like your account number and any financial documents to support your claim. Express the reasons for your offer and propose a specific settlement amount. Using a Kansas Letter to Credit Card Company Seeking to Lower Payments Due to Financial Difficulties can help convey your situation effectively.

To write a successful hardship letter, start with a clear subject line indicating its purpose. Be honest about your situation, providing essential details such as your income and expenses. Clearly request the specific relief you seek, and ensure that your tone is respectful and professional. Crafting a Kansas Letter to Credit Card Company Seeking to Lower Payments Due to Financial Difficulties with these elements can increase your chances of getting a favorable response.

Yes, you can ask your credit card company to lower your payment if you are facing financial difficulties. It is advisable to approach them with a well-crafted letter explaining your situation. By using a Kansas Letter to Credit Card Company Seeking to Lower Payments Due to Financial Difficulties, you can effectively communicate your need for temporary relief or reduced payment plans.

To write a hardship letter to credit card companies, start by clearly stating your current financial situation. Include details such as your income, expenses, and any recent changes that have affected your ability to make payments. Conclude by respectfully requesting a specific adjustment, such as a lower payment or temporary relief. This Kansas Letter to Credit Card Company Seeking to Lower Payments Due to Financial Difficulties should be concise and truthful.

A sample letter for a settlement offer should include your contact information, details of the debt, and your proposed settlement amount. Explain your financial difficulties and the reason for your offer. You can use the Kansas Letter to Credit Card Company Seeking to Lower Payments Due to Financial Difficulties as a framework for creating a compelling settlement proposal.

To write a letter to clear debt, outline the details of your financial situation and the specific debt you wish to address. Clearly request a resolution, such as a settlement or payment plan that fits your current circumstances. Using a Kansas Letter to Credit Card Company Seeking to Lower Payments Due to Financial Difficulties can help ensure your message is professional and effective.

To write a good debt settlement letter, clearly state the amount you are offering to settle the debt. Include supporting information about your financial hardships and express a willingness to cooperate. A Kansas Letter to Credit Card Company Seeking to Lower Payments Due to Financial Difficulties can guide you in making your information concise and persuasive.

A debt settlement letter should clearly outline your offer to settle the debt for less than the full amount. Include your financial situation in the letter, such as income and hardships, to justify your offer. Use a Kansas Letter to Credit Card Company Seeking to Lower Payments Due to Financial Difficulties as a template to ensure you present your case effectively.

When explaining hardship to creditors, be straightforward about your circumstances. Detail the financial difficulties you are experiencing and how they impact your ability to make payments. Use a Kansas Letter to Credit Card Company Seeking to Lower Payments Due to Financial Difficulties to communicate your need for assistance or a modified payment plan.