Gift taxes are taxes that supplement the Estate Tax. Gift taxes are placed on gifts given away to any person while you are still living, so that you may not avoid estate taxes by making gifts of your estate. You may give up to $12,000 a year in cash or assets to an unlimited number of people each year without incurring gift tax liability, but the gifts must have no conditions attached. Married couples can give, as a couple, a $24,000 gift per year to as many people as they want. Under federal tax law, gifts totaling more than $12,000 to one person in one year are considered a taxable gift and generate a potential gift tax. It does not matter if you give one $13,000 gift or 13 gifts of $1,000 each, or one gift of $12,000 and a "birthday gift" of $1,000.

Gifts beyond the $12,000 limit (there is an exception for gifts that are directly paid by the gift giver for tuition and medical expenses) are considered "taxable gifts." Taxable gifts create liability for a gift tax. But gift tax is not due to be paid until you give away over $1,000,000 in your lifetime.

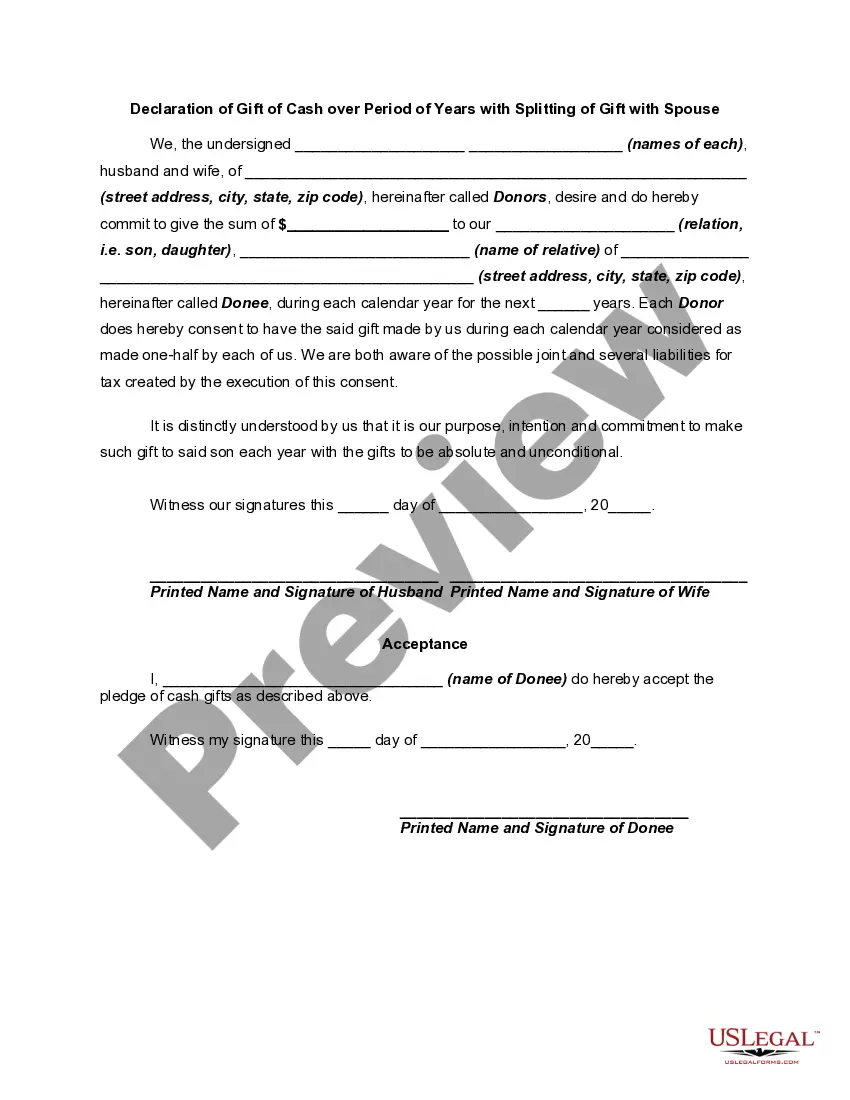

Kansas Declaration of Gift of Cash over Period of Years with Splitting of Gift with Spouse is a legal document that enables individuals to make monetary gifts over a specified period while also allowing for the splitting of the gift with their spouse. This declaration serves as a powerful tool for Kansas residents who want to give financial support to their loved ones while taking advantage of certain tax benefits. The Kansas Declaration of Gift of Cash over Period of Years with Splitting of Gift with Spouse can be categorized into various types, including: 1. Unconditional Gift Splitting: This type of declaration enables individuals to split the gift with their spouse without any specific conditions or restrictions. It allows for an equal division of the monetary gift, providing flexibility for both spouses to individually decide how to utilize the gifted funds. 2. Time-based Gift Splitting: In this scenario, the declaration allows for the splitting of the gift over a specific period of years. This approach ensures that the gift is distributed incrementally, offering a reliable and predictable source of financial support for both individuals and their spouses. 3. Conditional Gift Splitting: This type of declaration involves the inclusion of certain conditions or restrictions on the splitting of the gift with a spouse. These conditions may relate to the nature of the expenditures, specific purposes for the gifted funds, or limitations on the timing of distributions. Such conditions can provide additional control and accountability for the individuals making the gift. 4. Tax-Advantaged Gift Splitting: The Kansas Declaration of Gift of Cash over Period of Years with Splitting of Gift with Spouse can also incorporate tax advantages. By utilizing this declaration, individuals can potentially reduce their overall tax liability through the strategic splitting of the gift with their spouse. The Kansas Declaration of Gift of Cash over Period of Years with Splitting of Gift with Spouse is a valuable legal instrument for Kansas residents who want to provide financial assistance to their loved ones while considering tax implications. It affords flexibility, control, and potential tax advantages, making it an attractive option for those who wish to support their spouses financially.Kansas Declaration of Gift of Cash over Period of Years with Splitting of Gift with Spouse is a legal document that enables individuals to make monetary gifts over a specified period while also allowing for the splitting of the gift with their spouse. This declaration serves as a powerful tool for Kansas residents who want to give financial support to their loved ones while taking advantage of certain tax benefits. The Kansas Declaration of Gift of Cash over Period of Years with Splitting of Gift with Spouse can be categorized into various types, including: 1. Unconditional Gift Splitting: This type of declaration enables individuals to split the gift with their spouse without any specific conditions or restrictions. It allows for an equal division of the monetary gift, providing flexibility for both spouses to individually decide how to utilize the gifted funds. 2. Time-based Gift Splitting: In this scenario, the declaration allows for the splitting of the gift over a specific period of years. This approach ensures that the gift is distributed incrementally, offering a reliable and predictable source of financial support for both individuals and their spouses. 3. Conditional Gift Splitting: This type of declaration involves the inclusion of certain conditions or restrictions on the splitting of the gift with a spouse. These conditions may relate to the nature of the expenditures, specific purposes for the gifted funds, or limitations on the timing of distributions. Such conditions can provide additional control and accountability for the individuals making the gift. 4. Tax-Advantaged Gift Splitting: The Kansas Declaration of Gift of Cash over Period of Years with Splitting of Gift with Spouse can also incorporate tax advantages. By utilizing this declaration, individuals can potentially reduce their overall tax liability through the strategic splitting of the gift with their spouse. The Kansas Declaration of Gift of Cash over Period of Years with Splitting of Gift with Spouse is a valuable legal instrument for Kansas residents who want to provide financial assistance to their loved ones while considering tax implications. It affords flexibility, control, and potential tax advantages, making it an attractive option for those who wish to support their spouses financially.