A limited review of financial statements is an audit restricted to an examination either for a limited period or of a limited part of the records. A review does not contemplate obtaining an understanding of the entity's internal control; assessing fraud risk; tests of accounting records by obtaining sufficient appropriate audit evidence through inspection, observation, confirmation, or the examination of source documents (for example, cancelled checks or bank images); and other procedures ordinarily performed in an audit. Accordingly, a review does not provide assurance that we will become aware of all significant matters that would be disclosed in an audit. Therefore, a review provides only limited assurance that there are no material modifications that should be made to the financial statements in order for the statements to be in conformity with generally accepted accounting principles.

The definition of nonattest services is very inclusive. It includes, for example, preparation of the client's depreciation schedule and preparation of journal entries even if management has approved the journal entries. I have confirmed these examples directly with the AICPA ethics division. The definition of nonattest services includes preparation of tax returns.

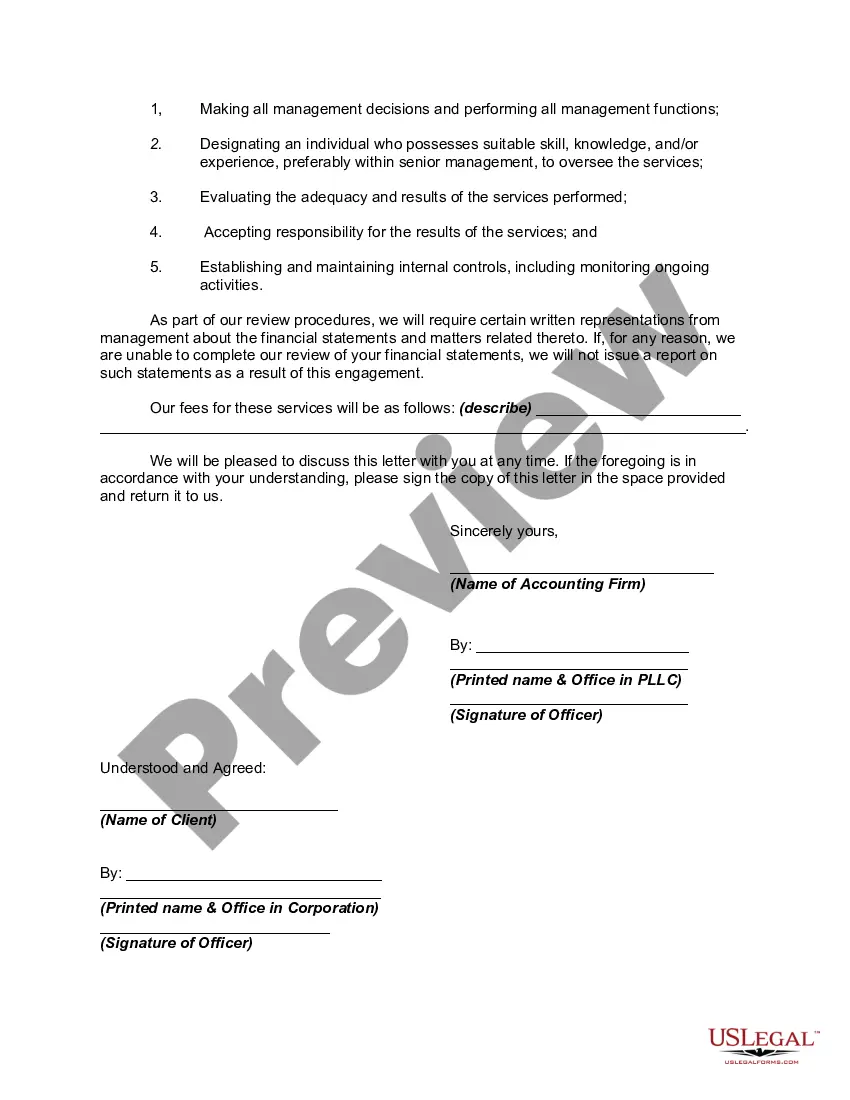

Kansas Engagement Letter for Review of Financial Statements by Accounting Firm: An Overview When it comes to ensuring accuracy and transparency in financial reporting, accounting firms play a vital role by conducting various types of financial engagements. One such engagement is the Review of Financial Statements, which helps assess the reasonableness of financial information presented by an entity. In Kansas, the Engagement Letter serves as a contractual agreement between an accounting firm and its client, emphasizing the scope, responsibilities, and limitations of the review. The Kansas Engagement Letter for Review of Financial Statements by an Accounting Firm typically includes the following key components: 1. Introduction and Identification: The engagement letter begins with an introduction, stating the purpose, date, and parties involved. It identifies the accounting firm, client (such as a business entity or organization), and any additional stakeholders who may rely on the reviewed financial statements. 2. Objective and Scope: This section outlines the objective of the engagement, clarifying that it is a review and not an audit. It explains that the review is primarily aimed at providing limited assurance that the financial statements are free from material misstatements. Limitations on procedures and scope are also defined. 3. Responsibilities of the Accounting Firm: Here, the engagement letter clearly outlines the responsibilities of the accounting firm. This includes planning and performing the review in accordance with applicable professional standards, acquiring an understanding of the entity's internal control relevant to the preparation of financial statements, and conducting analytical procedures to evaluate financial data. 4. Client Responsibilities: This section highlights the client's responsibilities, emphasizing the provision of accurate and complete financial records, unrestricted access to all necessary information, and disclosure of all relevant information. It may also mention required representations from the client, such as management's acknowledgment of its responsibility for the presentation of the financial statements. 5. Timelines and Deliverables: The engagement letter specifies the anticipated timeline for completion of the review, including document submission deadlines, review fieldwork, and the expected date of the report issuance. It also highlights the deliverables, typically comprising a written report expressing limited assurance on the financial statements. Types of Kansas Engagement Letters for Review of Financial Statements: 1. General Kansas Engagement Letter for Review of Financial Statements: This is the most common engagement letter, encompassing reviews of financial statements for a wide range of entities, such as corporations, partnerships, not-for-profit organizations, and governmental bodies. 2. Specialized Kansas Engagement Letter for Review of Financial Statements: Some industries may have specific engagement letter templates tailored to their unique requirements. For instance, there may be specialized engagement letters for healthcare organizations, financial institutions, or manufacturing companies. 3. Kansas Engagement Letter for Review of Interim Financial Statements: Interim financial statements cover shorter time periods (e.g., quarterly or semi-annually), providing a snapshot of the entity's financial performance between annual statements. Specific engagement letters may address the review of interim statements separately. In conclusion, the Kansas Engagement Letter for Review of Financial Statements by an Accounting Firm is a crucial document that defines the expectations, responsibilities, and limitations of both the accounting firm and the client. It ensures transparency, strengthens accountability, and promotes the accuracy of financial reporting in various industries across Kansas.Kansas Engagement Letter for Review of Financial Statements by Accounting Firm: An Overview When it comes to ensuring accuracy and transparency in financial reporting, accounting firms play a vital role by conducting various types of financial engagements. One such engagement is the Review of Financial Statements, which helps assess the reasonableness of financial information presented by an entity. In Kansas, the Engagement Letter serves as a contractual agreement between an accounting firm and its client, emphasizing the scope, responsibilities, and limitations of the review. The Kansas Engagement Letter for Review of Financial Statements by an Accounting Firm typically includes the following key components: 1. Introduction and Identification: The engagement letter begins with an introduction, stating the purpose, date, and parties involved. It identifies the accounting firm, client (such as a business entity or organization), and any additional stakeholders who may rely on the reviewed financial statements. 2. Objective and Scope: This section outlines the objective of the engagement, clarifying that it is a review and not an audit. It explains that the review is primarily aimed at providing limited assurance that the financial statements are free from material misstatements. Limitations on procedures and scope are also defined. 3. Responsibilities of the Accounting Firm: Here, the engagement letter clearly outlines the responsibilities of the accounting firm. This includes planning and performing the review in accordance with applicable professional standards, acquiring an understanding of the entity's internal control relevant to the preparation of financial statements, and conducting analytical procedures to evaluate financial data. 4. Client Responsibilities: This section highlights the client's responsibilities, emphasizing the provision of accurate and complete financial records, unrestricted access to all necessary information, and disclosure of all relevant information. It may also mention required representations from the client, such as management's acknowledgment of its responsibility for the presentation of the financial statements. 5. Timelines and Deliverables: The engagement letter specifies the anticipated timeline for completion of the review, including document submission deadlines, review fieldwork, and the expected date of the report issuance. It also highlights the deliverables, typically comprising a written report expressing limited assurance on the financial statements. Types of Kansas Engagement Letters for Review of Financial Statements: 1. General Kansas Engagement Letter for Review of Financial Statements: This is the most common engagement letter, encompassing reviews of financial statements for a wide range of entities, such as corporations, partnerships, not-for-profit organizations, and governmental bodies. 2. Specialized Kansas Engagement Letter for Review of Financial Statements: Some industries may have specific engagement letter templates tailored to their unique requirements. For instance, there may be specialized engagement letters for healthcare organizations, financial institutions, or manufacturing companies. 3. Kansas Engagement Letter for Review of Interim Financial Statements: Interim financial statements cover shorter time periods (e.g., quarterly or semi-annually), providing a snapshot of the entity's financial performance between annual statements. Specific engagement letters may address the review of interim statements separately. In conclusion, the Kansas Engagement Letter for Review of Financial Statements by an Accounting Firm is a crucial document that defines the expectations, responsibilities, and limitations of both the accounting firm and the client. It ensures transparency, strengthens accountability, and promotes the accuracy of financial reporting in various industries across Kansas.