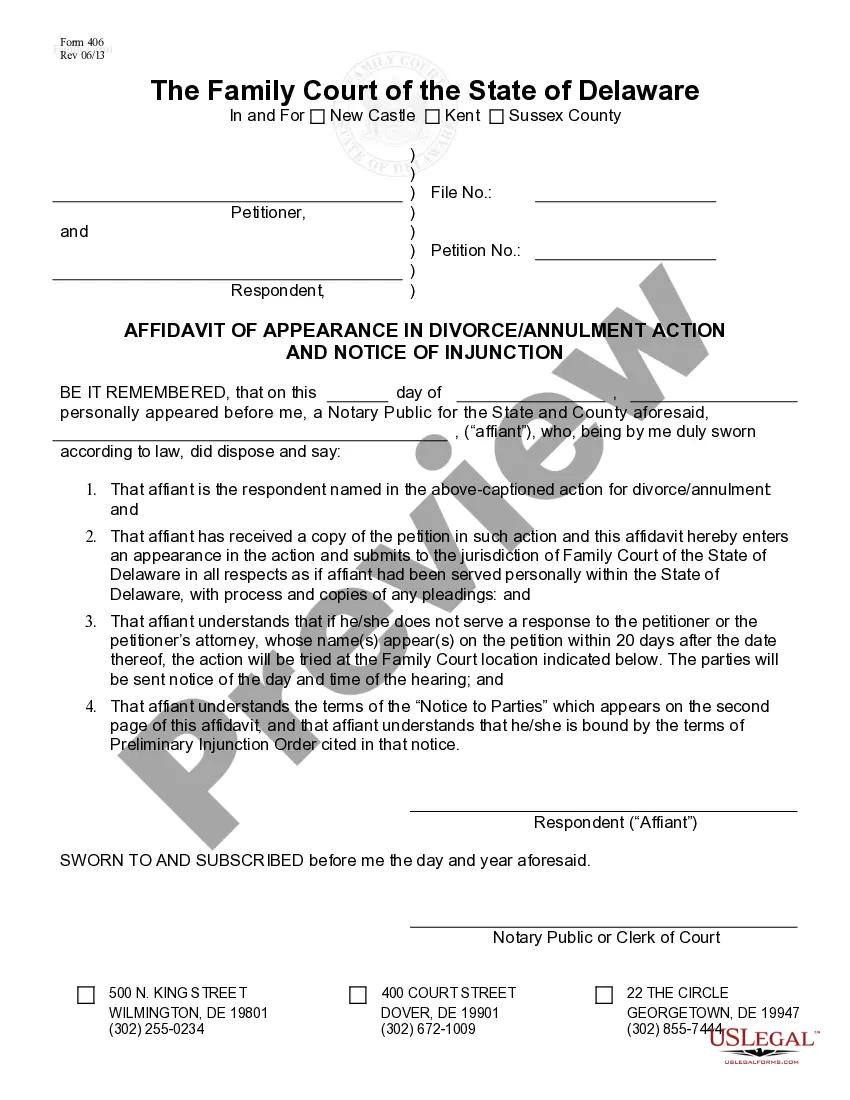

This form is a generic for filing an affidavit that is to be filed with a court. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Kansas Affidavit or Proof of Income and Property - Assets and Liabilities

Description

How to fill out Affidavit Or Proof Of Income And Property - Assets And Liabilities?

Are you presently in a scenario where you require documentation for both professional or personal purposes almost every day.

There are numerous valid document templates available online, but finding ones you can trust is challenging.

US Legal Forms offers thousands of template options, such as the Kansas Affidavit or Proof of Income and Property - Assets and Liabilities, designed to comply with federal and state requirements.

After locating the right form, click on Buy now.

Select the pricing plan you desire, fill out the necessary information to create your account, and complete the purchase using your PayPal or credit card.

- If you are already acquainted with the US Legal Forms website and hold an account, simply sign in.

- Once logged in, you can download the Kansas Affidavit or Proof of Income and Property - Assets and Liabilities template.

- If you do not have an account and wish to utilize US Legal Forms, follow these steps.

- Find the template you require and confirm it aligns with the correct city/state.

- Utilize the Preview button to review the document.

- Check the summary to make sure you have selected the correct template.

- If the document does not meet your needs, use the Search field to locate the form that suits your requirements.

Form popularity

FAQ

If you earn income in Kansas, you will likely need to file a Kansas income tax return. This obligation applies unless your income falls under the exemption thresholds set by the state. By filing a return, you ensure compliance with Kansas tax laws and avoid potential penalties. The Kansas Affidavit or Proof of Income and Property - Assets and Liabilities can provide essential documentation to support your filing process.

Yes, Kansas does offer e-filing options for state tax returns. Choosing to e-file can streamline your submission process, providing you with instant confirmation of your filing. It’s an efficient way to manage your tax responsibilities and can also make it easier to include documents like the Kansas Affidavit or Proof of Income and Property - Assets and Liabilities. Check the Kansas Department of Revenue website for more details on available e-filing options.

In Kansas, the minimum income that is taxable usually depends on your filing status. For most individuals, if your income exceeds the standard deduction for your status, you are obligated to file a return. This threshold can vary annually, so it’s important to verify the current figures with state resources. Utilizing the Kansas Affidavit or Proof of Income and Property - Assets and Liabilities can help you assess your income accurately.

Certain individuals may be exempt from filing a Kansas state tax return. Typically, this includes those whose income falls below Kansas's minimum taxable income threshold. Additionally, if you receive income solely from sources that do not require filing—like certain retirement benefits—you may not need to file. Always consider using the Kansas Affidavit or Proof of Income and Property - Assets and Liabilities to clarify your status.

Yes, you typically need to file a Kansas state tax return if you earn income in the state. The Kansas Affidavit or Proof of Income and Property - Assets and Liabilities may be required to ensure accurate reporting. It’s crucial to assess your income level and filing status to confirm your obligation. If you earn above the minimum threshold, filing becomes essential to comply with state regulations.

A domestic relations affidavit in Kansas is a legally binding document that outlines a person's financial status during domestic disputes. This affidavit usually covers income, expenses, assets, and liabilities, allowing the court to assess financial responsibilities accurately. By using the Kansas Affidavit or Proof of Income and Property - Assets and Liabilities, you can present your financial information clearly and concisely.

In court, domestic relations refers to legal matters concerning family issues, such as divorce, child custody, and support. These cases often require the submission of financial information through tools like the Kansas Affidavit or Proof of Income and Property - Assets and Liabilities. Understanding domestic relations can help you navigate the legal landscape more effectively.

A domestic relations affidavit serves to provide the court with a detailed overview of an individual's financial situation during divorce or custody proceedings. It helps establish the financial capabilities of each party, which can influence decisions on support and asset distribution. Completing the Kansas Affidavit or Proof of Income and Property - Assets and Liabilities can be a crucial step in ensuring fair outcomes in your case.

A qualified domestic relations order (QDRO) in Kansas is a legal decree that divides retirement benefits between divorcing spouses. This order ensures that a portion of one spouse's retirement benefits is given to the other as part of property settlement. Understanding the implications of a QDRO is essential when dealing with the Kansas Affidavit or Proof of Income and Property - Assets and Liabilities.

Completing a domestic relations financial affidavit involves providing comprehensive information about your finances, including current income, monthly expenses, and assets. You should accurately fill out the Kansas Affidavit or Proof of Income and Property - Assets and Liabilities, ensuring that all sections reflect your true financial status. By using this form, you can streamline your filing process and fulfill court requirements effectively.