An escrow account refers to an account held in the name of the borrower which is returnable to the borrower on the performance of certain conditions.

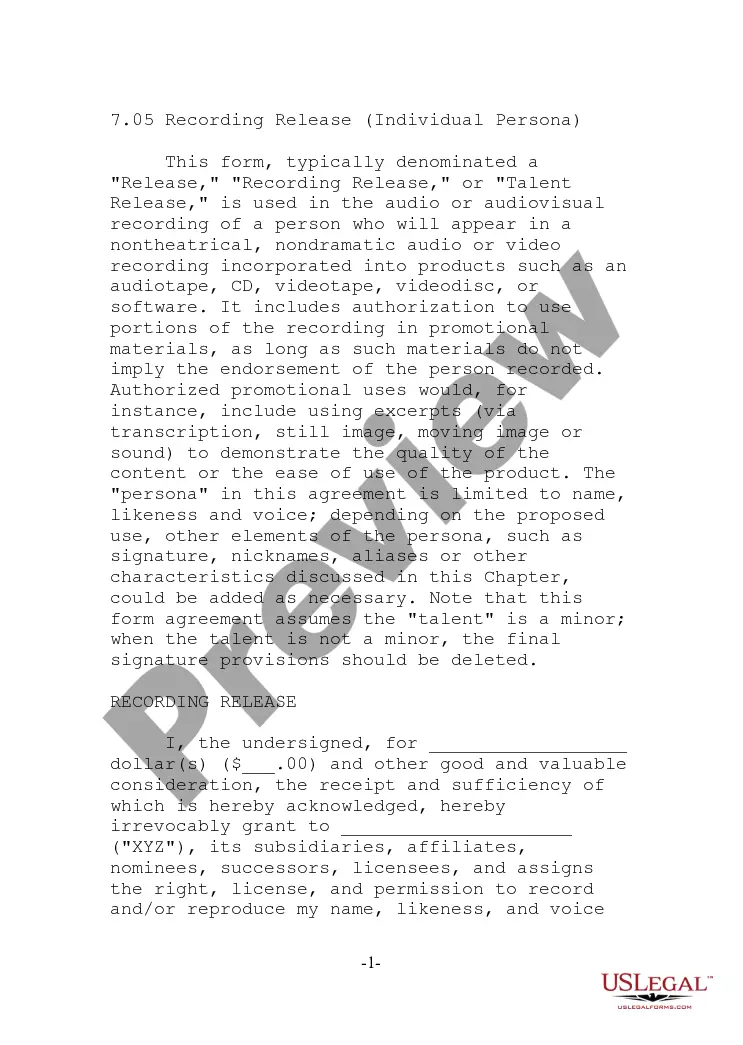

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

The Kansas Agreement for Direct Payment of Taxes, Assessments, and/or Insurance and Waiver of Escrow to be held by Lender is a legal document that outlines the arrangement between a borrower and a lender regarding the payment of taxes, assessments, and/or insurance premiums related to a property. This agreement is commonly used in mortgage transactions in the state of Kansas. Under this agreement, the borrower agrees to directly pay the taxes, assessments, and/or insurance premiums related to the property, instead of having the lender collect these funds into an escrow account. This means that the borrower is responsible for making these payments on time and in full. By waiving the escrow account, the borrower retains control over these funds and gains flexibility in managing their own financial obligations. The Kansas Agreement for Direct Payment of Taxes, Assessments, and/or Insurance and Waiver of Escrow to be held by Lender helps simplify the mortgage process and may be beneficial for borrowers who prefer greater control over their finances. It enables borrowers to potentially save money on escrow-related costs and allows them to have a direct relationship with the tax authorities, assessment agencies, and insurance providers. However, it's important to note that there are potential risks associated with opting for this agreement. If the borrower fails to make timely or complete payments for taxes, assessments, or insurance premiums, they may face penalties, liens, or even foreclosure. Therefore, it is crucial for borrowers to thoroughly understand their financial capabilities and obligations before entering into this agreement. Although the main concept of the Kansas Agreement for Direct Payment of Taxes, Assessments, and/or Insurance and Waiver of Escrow to be held by Lender remains consistent, there may be variations or additional clauses depending on the specific lending institution or circumstances. Examples of different types or variations of this agreement may include: 1. Kansas Agreement for Direct Payment of Property Taxes: This agreement solely focuses on the direct payment of property taxes by the borrower. 2. Kansas Agreement for Direct Payment of Assessments: This variation of the agreement specifically addresses the direct payment of assessments levied on the property, such as special assessments for improvements or community association fees. 3. Kansas Agreement for Direct Payment of Insurance Premiums: This type of agreement pertains to the direct payment of insurance premiums, ensuring that the borrower maintains adequate insurance coverage without involving an escrow account. It's crucial for borrowers to carefully review and understand the terms and conditions of their specific agreement, as it will dictate their responsibilities and obligations concerning the payment of taxes, assessments, and/or insurance premiums. Seeking legal or financial advice may be beneficial to ensure that the agreement aligns with the borrower's financial goals and capabilities.The Kansas Agreement for Direct Payment of Taxes, Assessments, and/or Insurance and Waiver of Escrow to be held by Lender is a legal document that outlines the arrangement between a borrower and a lender regarding the payment of taxes, assessments, and/or insurance premiums related to a property. This agreement is commonly used in mortgage transactions in the state of Kansas. Under this agreement, the borrower agrees to directly pay the taxes, assessments, and/or insurance premiums related to the property, instead of having the lender collect these funds into an escrow account. This means that the borrower is responsible for making these payments on time and in full. By waiving the escrow account, the borrower retains control over these funds and gains flexibility in managing their own financial obligations. The Kansas Agreement for Direct Payment of Taxes, Assessments, and/or Insurance and Waiver of Escrow to be held by Lender helps simplify the mortgage process and may be beneficial for borrowers who prefer greater control over their finances. It enables borrowers to potentially save money on escrow-related costs and allows them to have a direct relationship with the tax authorities, assessment agencies, and insurance providers. However, it's important to note that there are potential risks associated with opting for this agreement. If the borrower fails to make timely or complete payments for taxes, assessments, or insurance premiums, they may face penalties, liens, or even foreclosure. Therefore, it is crucial for borrowers to thoroughly understand their financial capabilities and obligations before entering into this agreement. Although the main concept of the Kansas Agreement for Direct Payment of Taxes, Assessments, and/or Insurance and Waiver of Escrow to be held by Lender remains consistent, there may be variations or additional clauses depending on the specific lending institution or circumstances. Examples of different types or variations of this agreement may include: 1. Kansas Agreement for Direct Payment of Property Taxes: This agreement solely focuses on the direct payment of property taxes by the borrower. 2. Kansas Agreement for Direct Payment of Assessments: This variation of the agreement specifically addresses the direct payment of assessments levied on the property, such as special assessments for improvements or community association fees. 3. Kansas Agreement for Direct Payment of Insurance Premiums: This type of agreement pertains to the direct payment of insurance premiums, ensuring that the borrower maintains adequate insurance coverage without involving an escrow account. It's crucial for borrowers to carefully review and understand the terms and conditions of their specific agreement, as it will dictate their responsibilities and obligations concerning the payment of taxes, assessments, and/or insurance premiums. Seeking legal or financial advice may be beneficial to ensure that the agreement aligns with the borrower's financial goals and capabilities.