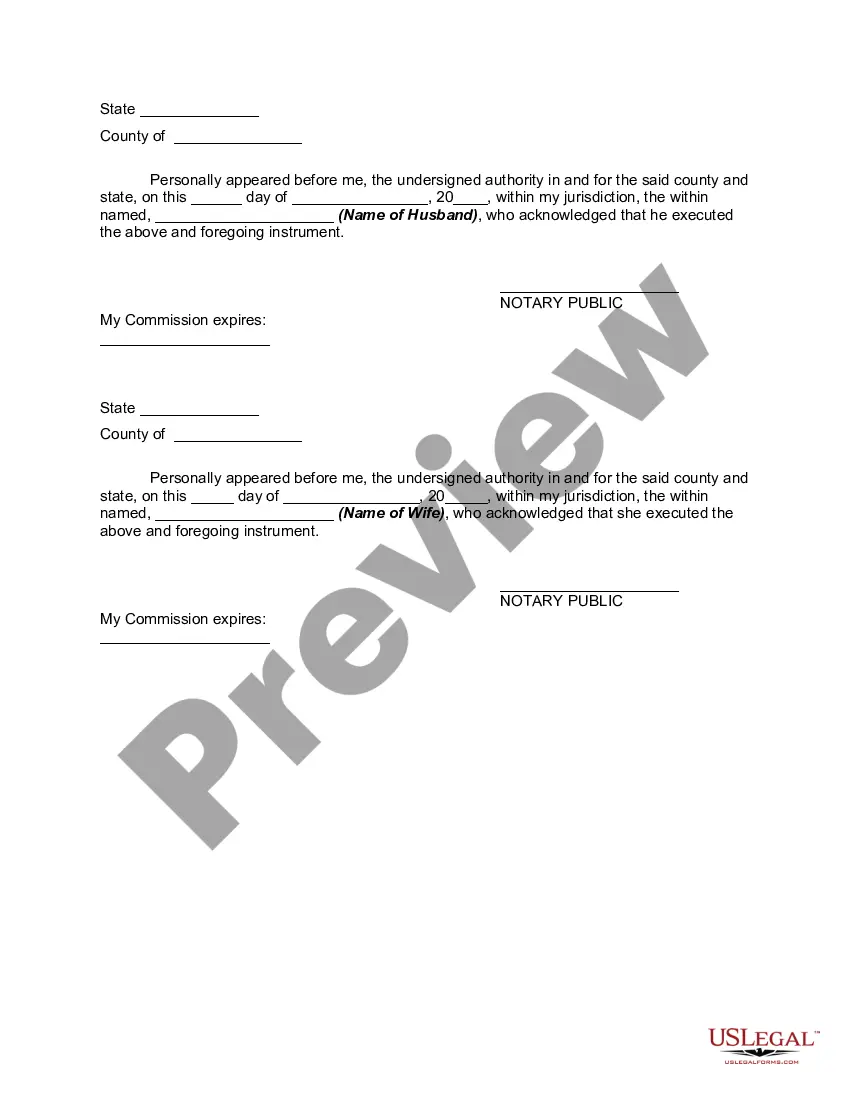

A Transmutation Agreement is a marital contract that provides that the ownership of a particular piece of property will, from the date of the agreement forward, be changed. Spouses can transmute, partition, or exchange community property to separate property by agreement. According to some authority, separate property can be transmuted into community property by an agreement between the spouses, but there is also authority to the contrary.

A Kansas Transmutation or Postnuptial Agreement to Convert Community Property into Separate Property refers to a legal document that allows married individuals in Kansas to change the character of their jointly owned property from community property to separate property. This can be significant when it comes to estate planning, asset protection, or division of property in case of divorce. A transmutation agreement in Kansas can be applicable in various scenarios, such as when one spouse receives an inheritance, a gift, or wants to protect specific assets acquired before or during the marriage. By converting a community property into separate property, the spouse obtaining ownership gains exclusive control over that asset, and it will no longer be considered as a shared marital asset. One of the primary purposes of Kansas Transmutation or Postnuptial Agreement to Convert Community Property into Separate Property is the protection of assets. This agreement helps ensure that individual assets remain separate throughout the marriage, maintaining their original ownership and character even in the event of a divorce. There are different types of Kansas Transmutation or Postnuptial Agreement to Convert Community Property into Separate Property, including: 1. Inheritance Transmutation Agreement: This type of agreement allows a spouse who inherits assets or property during the marriage to convert them into separate property. It ensures that the inherited property remains solely owned by the inheriting spouse and won't be subject to division in the event of a divorce. 2. Gift Transmutation Agreement: When one spouse receives a significant gift during the marriage, they might want to protect it from being considered community property. A gift transmutation agreement can be used to convert the gifted asset into separate property, maintaining its exclusivity and protecting it from potential claims by the other spouse. 3. Pre-existing Property Transmutation Agreement: If one spouse enters a marriage with significant assets, they can use this type of agreement to convert their pre-existing property into separate property. By doing so, they can safeguard their original assets from being subject to division in case of a divorce. In conclusion, a Kansas Transmutation or Postnuptial Agreement to Convert Community Property into Separate Property is a legal tool that allows married individuals to convert jointly owned community property into separate property. This can have significant implications in terms of asset protection, estate planning, and property division. Different types of transmutation agreements, such as inheritance, gift, and pre-existing property transmutations, cater to specific circumstances and serve as a means to secure assets and maintain their separate nature within a marital relationship.