Kansas Affidavit of Domestic Partnership for Employer in Order to Receive Benefits

Description

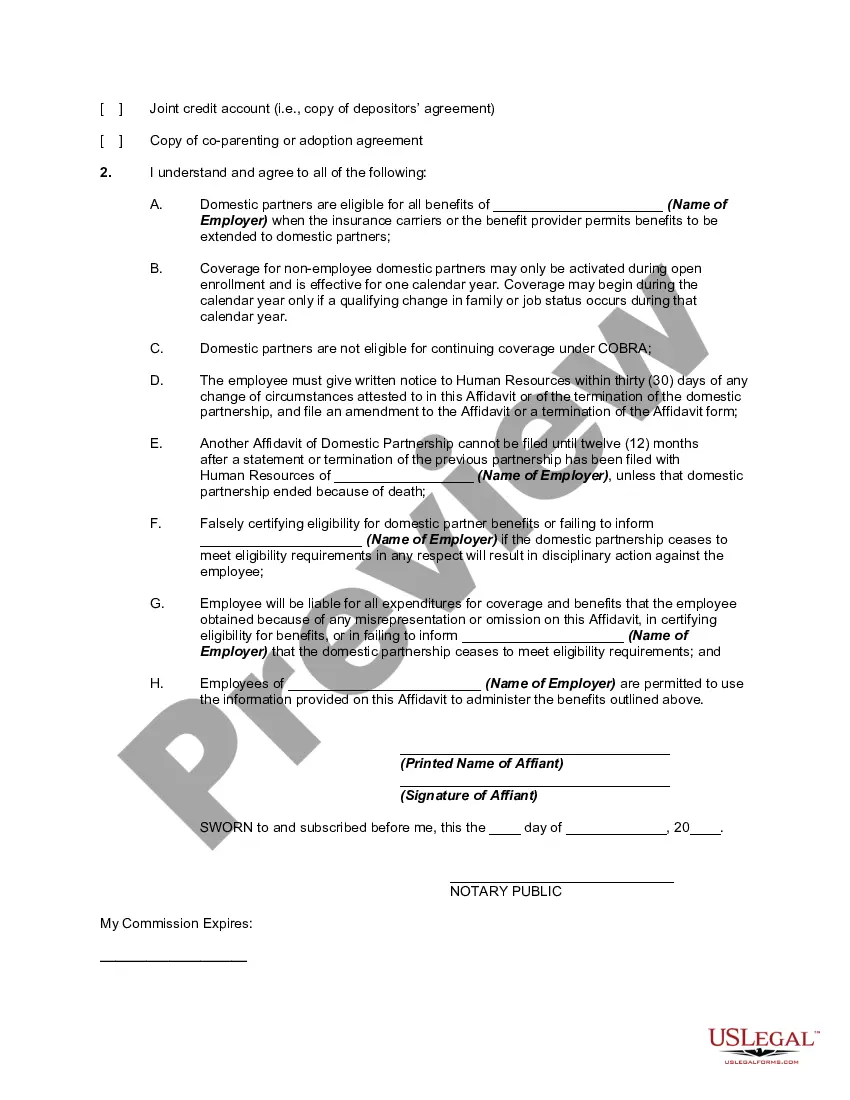

How to fill out Affidavit Of Domestic Partnership For Employer In Order To Receive Benefits?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a broad selection of legal document templates that you can download or create.

Through the website, you can find thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can obtain the latest forms such as the Kansas Affidavit of Domestic Partnership for Employer to Receive Benefits in moments.

If you have an account, Log In to download the Kansas Affidavit of Domestic Partnership for Employer to Receive Benefits from the US Legal Forms library. The Download button will appear on every form you view. You have access to all previously downloaded forms from the My documents section of your account.

Make modifications. Fill out, edit, and print and sign the downloaded Kansas Affidavit of Domestic Partnership for Employer to Receive Benefits.

Each template you added to your account does not expire and is yours indefinitely. Therefore, if you wish to download or print another copy, just go to the My documents section and click on the form you desire. Access the Kansas Affidavit of Domestic Partnership for Employer to Receive Benefits with US Legal Forms, one of the most extensive collections of legal document templates. Utilize thousands of professional and state-specific forms that meet your business or personal needs and requirements.

- If you are using US Legal Forms for the first time, here are simple steps to help you get started.

- Ensure that you have selected the appropriate form for your area/region. Click the Preview button to review the form's details. Check the form description to confirm that you have chosen the right document.

- If the form does not fit your needs, use the Search field at the top of the screen to find one that does.

- If you are satisfied with the document, confirm your choice by clicking the Get now button. Then, select the payment plan you prefer and provide your credentials to create an account.

- Complete the transaction. Use your credit card or PayPal account to finalize the transaction.

- Choose the format and download the form to your device.

Form popularity

FAQ

In New York, you both must be at least 18 years old, not related by blood, and can’t be married to anyone else to register as domestic partners. Additionally, you need to provide proof of a shared residence and joint financial responsibilities. The Kansas Affidavit of Domestic Partnership for Employer in Order to Receive Benefits can help you establish this partnership for employer benefits. Always check the specific registration process in your local jurisdiction.

Your girlfriend may qualify as a domestic partner if you both meet specific criteria, such as being in a committed relationship and sharing a primary residence. Each state has its own guidelines regarding eligibility. In Kansas, you can use the Kansas Affidavit of Domestic Partnership for Employer in Order to Receive Benefits to clarify your partnership for benefits eligibility. Ensure you review local laws for complete details.

To obtain domestic partnership papers, you can visit your state's vital records office or local government website. Many states allow you to apply online or download the necessary forms. In Kansas, you may need to complete the Kansas Affidavit of Domestic Partnership for Employer in Order to Receive Benefits to ensure your benefits eligibility. Using a platform like USLegalForms simplifies this process.

The IRS does not have a specific definition of a domestic partner, but typically recognizes those in committed, exclusive relationships. To qualify, partners usually must provide financial support to each other and share a household. The Kansas Affidavit of Domestic Partnership for Employer in Order to Receive Benefits can serve as documentation when dealing with employers or financial institutions.

Calculating domestic partner imputed income involves determining the fair market value of benefits provided to your partner by your employer. This calculation includes health insurance premiums and other taxable benefits. If you use the Kansas Affidavit of Domestic Partnership for Employer in Order to Receive Benefits, seek guidance from a tax professional to ensure accurate reporting.

To prove a domestic partnership for health insurance, you typically need to submit a valid Kansas Affidavit of Domestic Partnership for Employer in Order to Receive Benefits along with supporting documents. These may include shared leases, joint bank accounts, or insurance policies that name each other as beneficiaries. Check with your employer for specific requirements to ensure you meet their criteria.

Imputed income for a domestic partner refers to the value of benefits that an employer provides to a partner who is not legally recognized as a spouse. When using the Kansas Affidavit of Domestic Partnership for Employer in Order to Receive Benefits, this value may be added to your taxable income. Understanding imputed income is crucial as it affects your overall tax liability.

You may be able to claim your girlfriend as a domestic partner if your state recognizes domestic partnerships. The Kansas Affidavit of Domestic Partnership for Employer in Order to Receive Benefits is an essential document that formalizes your relationship for benefits purposes. To qualify, both partners typically need to share a domestic living arrangement and present proof of their commitment.

Domestic partners in Kansas do not have a married filing status for state tax purposes. Instead, they must file their taxes individually, which may differ from the benefits that married couples receive. However, using the Kansas Affidavit of Domestic Partnership for Employer in Order to Receive Benefits can help in accessing various employer-related benefits, even if tax implications differ from those of marriage.

While domestic partnerships offer various benefits, there can be disadvantages. For instance, partners may face limited recognition outside of specific contexts, such as federal benefits that apply to married couples. It's important to consult resources, including the Kansas Affidavit of Domestic Partnership for Employer in Order to Receive Benefits, to understand the full implications of your partnership and associated limitations.