Section 4(2) of the Securities Act of 1933 exempts from the registration requirements of that Act "transactions by an issuer not involving any public offering.” This is the so-called "private offering" provision in the Securities Act. The securities involved in transactions effected pursuant to this exemption are referred to as restricted securities because they cannot be resold to the public without prior registration. They are also sometimes referred to as "investment letter securities" because of the practice frequently followed by the seller in such a transaction, in order to substantiate the claim that the transaction does not involve a public offering, of requiring that the buyer furnish an investment letter representing that the purchase is for investment and not for resale to the general public. The private offering exemption of Section 4(2) of the Securities Act is available only where the offerees do not need the protections afforded by the registration procedure.

Kansas Investment Letter for a Private Sale of Securities

Description

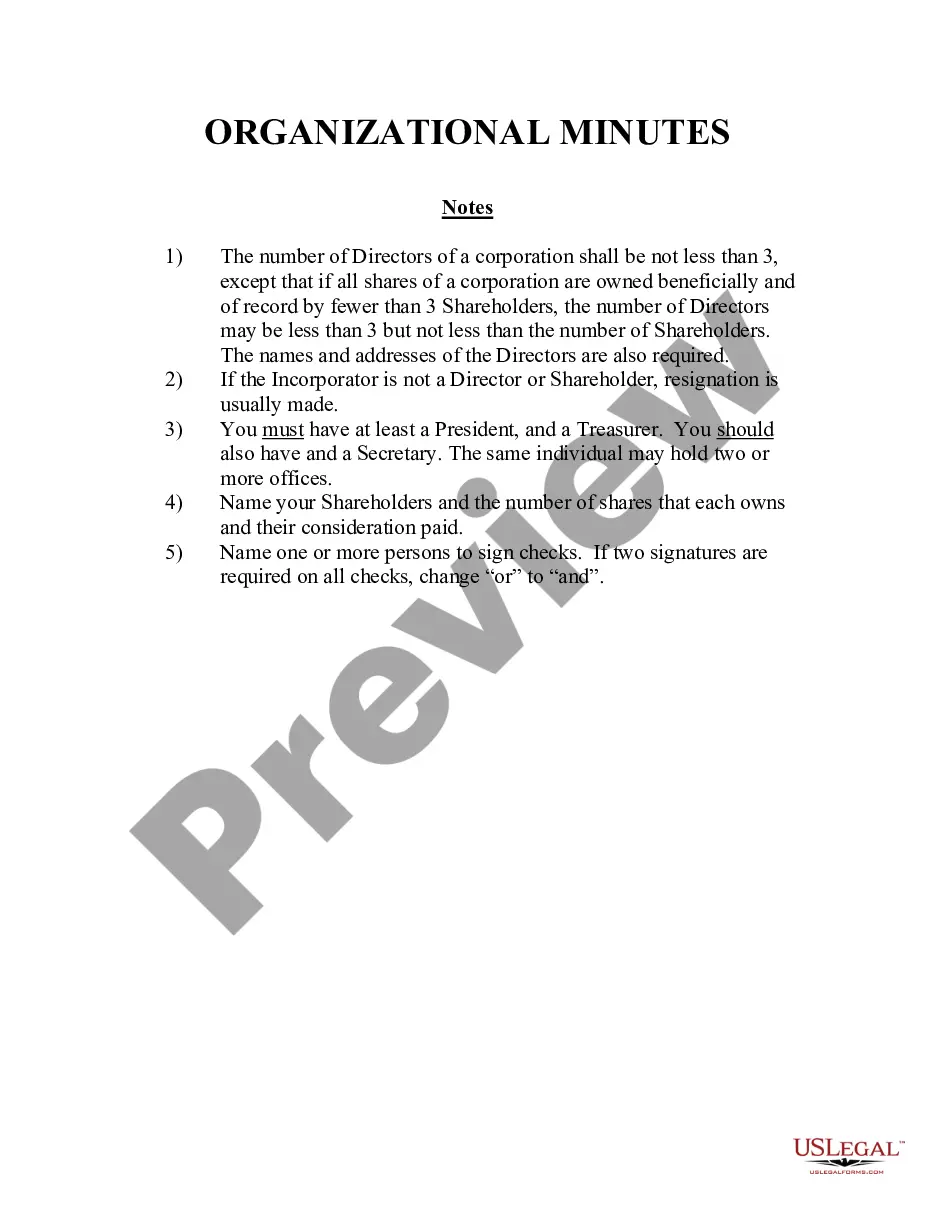

How to fill out Investment Letter For A Private Sale Of Securities?

Are you presently in a situation where you require documents for either business or personal purposes almost all the time.

There are numerous legal document templates available online, but finding versions you can rely on is challenging.

US Legal Forms provides a vast selection of form templates, including the Kansas Investment Letter for a Private Sale of Securities, which are designed to meet state and federal regulations.

Once you obtain the right form, click on Purchase now.

Select the payment option you prefer, fill in the necessary information to create your account, and pay for your order using your PayPal or credit card. Choose a convenient file format and download your copy. Access all the document templates you have purchased from the My documents menu. You can download another copy of the Kansas Investment Letter for a Private Sale of Securities at any time, if needed. Simply click on the desired form to download or print the document template. Utilize US Legal Forms, the most comprehensive collection of legal forms, to save time and avoid errors. The service offers professionally prepared legal document templates that can be used for various purposes. Create your account on US Legal Forms and start making your life a bit easier.

- If you are already familiar with the US Legal Forms site and possess an account, just Log In.

- After that, you can download the Kansas Investment Letter for a Private Sale of Securities template.

- If you do not have an account and wish to start using US Legal Forms, follow these guidelines.

- Select the form you need and ensure it corresponds to the correct state/region.

- Utilize the Review button to evaluate the form.

- Examine the description to make sure you have selected the correct form.

- If the form does not match your needs, utilize the Search field to find the form that suits your requirements.

Form popularity

FAQ

The two primary types of blue sky laws are the Securities Act of 1933 and the Securities Exchange Act of 1934 at the federal level, while each state has its own versions. These laws focus on protecting investors through registration and disclosure of information regarding securities. In Kansas, local regulations will complement these federal laws. If you're preparing a Kansas Investment Letter for a Private Sale of Securities, having a solid grasp of both sets of laws will help you remain compliant and secure.

Blue sky fees are the costs associated with registering securities with state regulators. These fees vary by state, and they can include application fees, filing fees, and other administrative costs. Being aware of blue sky fees is crucial for anyone planning to promote or sell securities in Kansas. Incorporating a Kansas Investment Letter for a Private Sale of Securities into your investment plan means understanding these potential costs upfront.

Under blue sky laws, various securities, including stocks, bonds, and certain investment contracts, typically require registration. Additionally, the individuals or firms selling these securities usually must also be registered as broker dealers. To ensure transparency in the marketplace, these regulations help protect investors from fraud. If you're involved in a Kansas Investment Letter for a Private Sale of Securities, it's important to know what is required for compliance.

The blue sky law in Kansas is a set of regulations designed to prevent securities fraud and protect investors in the state. It establishes guidelines for the registration, sale, and disclosure of securities, ensuring that all transactions are transparent and above board. As an investor or issuer in Kansas, understanding these laws can help you navigate the investment landscape more effectively. With the right Kansas Investment Letter for a Private Sale of Securities, you'll ensure that you're compliant with local regulations.

To register as a broker dealer in Kansas, you must submit an application to the Kansas Office of the Securities Commissioner. This process involves providing essential documentation, fees, and meeting certain qualifications. After your application is reviewed and approved, you can legally operate as a broker dealer. Utilizing resources like uslegalforms can simplify this process, especially if you're working on a Kansas Investment Letter for a Private Sale of Securities.

Blue sky laws cover the sale of securities within a state, including rules around registration, disclosure, and reporting requirements. These laws aim to ensure that investors receive adequate information about the financial products they consider. In Kansas, blue sky laws also govern who can legally sell securities and under what conditions. If you're seeking a Kansas Investment Letter for a Private Sale of Securities, adhering to these regulations is imperative for your protection.

Certain securities may be exempt from blue sky laws, such as government securities, bank-issued securities, and some private placements. These exemptions allow specific types of investments to bypass registration requirements, streamlining the process for investors and issuers alike. However, it's important to confirm the exemptions specific to Kansas. A knowledgeable provider like uslegalforms can help clarify the exemptions related to your Kansas Investment Letter for a Private Sale of Securities.

In legal terms, 'blue sky' refers to state laws designed to protect investors from fraudulent securities offerings. These laws create a framework to regulate the sale and issuance of securities within a state, including Kansas. Understanding blue sky laws is essential for anyone involved in investments, as they safeguard your interests. For a Kansas Investment Letter for a Private Sale of Securities, being aware of these laws is crucial to ensure compliance.