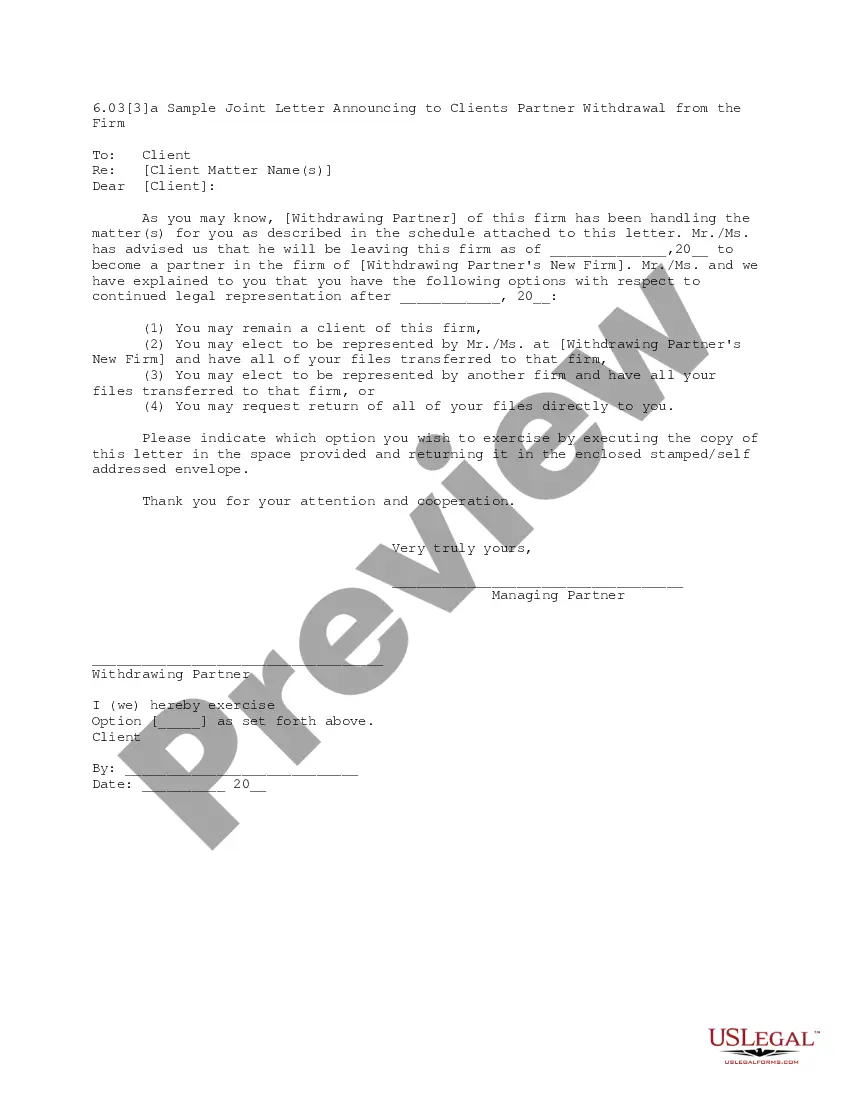

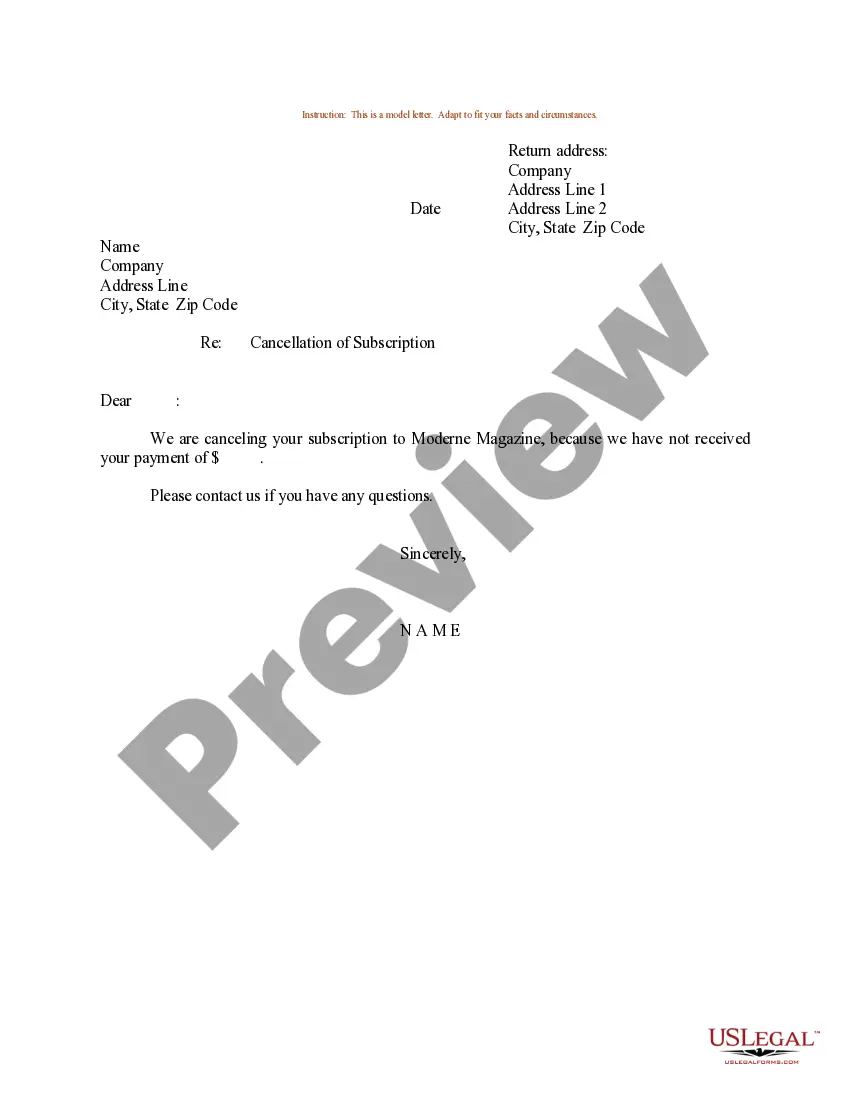

Keywords: Kansas Demand for Payment of an Open Account by Creditor, types, detailed description Title: Understanding the Kansas Demand for Payment of an Open Account by Creditor: Types and Detailed Explanation Introduction: In the state of Kansas, creditors have a legal tool called the Kansas Demand for Payment of an Open Account. It is an important document used to collect outstanding debts from individuals or entities who owe money to a creditor. This article aims to provide a detailed description of what the Kansas Demand for Payment of an Open Account entails, including its types and the process involved. Types of Kansas Demand for Payment of an Open Account by Creditor: 1. Initial Demand Letter: The initial demand letter is the first step a creditor takes in seeking payment for an open account. It notifies the debtor about the outstanding balance and requests immediate payment within a specific timeframe, usually 30 days. This letter acts as a friendly reminder and usually gives the debtor an opportunity to resolve the debt without legal action. 2. Final Demand Letter: If the debtor fails to respond or make payment within the designated timeframe mentioned in the initial demand letter, the creditor may send a final demand letter. This second letter expresses increased urgency and warns the debtor about possible legal consequences if the debt remains unpaid. It is typically the last attempt to settle the debt amicably before taking legal action. 3. Demand for Payment with Threat of Litigation: In cases where previous demands have been ignored, or if the creditor feels the debt is beyond resolution through friendly means, they may issue a demand letter containing a threat of litigation. This letter informs the debtor of the creditor's intention to file a lawsuit if the debt remains unpaid by a specified deadline. It serves as a strong warning to prompt payment, as legal action can result in further costs and legal consequences for the debtor. Detailed Description of the Kansas Demand for Payment of an Open Account Process: 1. Identification of the Debtor: The creditor must accurately identify the debtor, along with their contact information, in the demand letter. This ensures the document reaches the intended recipient and serves as evidence of notification in case of legal action. 2. Description of the Open Account: The demand letter should provide specific details about the open account, including the outstanding balance, the date when the account became due, and any interest or fees accrued. This information helps the debtor understand the debt they need to address. 3. Payment Deadline: The demand letter must clearly specify the deadline by which the debtor needs to make payment. The Kansas law generally grants creditors a reasonable period, usually 30 days, for the debtor to fulfill their obligations. 4. Legal Consequences: To enforce the seriousness of the demand letter, it may include a section outlining the potential legal consequences if the debt remains unpaid. This serves as a deterrent and may encourage the debtor to take immediate action. 5. Record keeping: The creditor should maintain copies of all correspondence, including the demand letter, for documentation purposes. This is crucial evidence in case legal proceedings become necessary. Conclusion: The Kansas Demand for Payment of an Open Account is a powerful tool for creditors to collect debts from debtors who have failed to meet their financial commitments. Understanding the types of demand letters and the process involved allows both creditors and debtors to navigate their obligations effectively, either by resolving the debt amicably or preparing for potential legal action.

Kansas Demand for Payment of an Open Account by Creditor

Description

How to fill out Kansas Demand For Payment Of An Open Account By Creditor?

You are able to devote hours on-line attempting to find the lawful papers design which fits the federal and state demands you require. US Legal Forms supplies 1000s of lawful kinds which are examined by specialists. It is possible to acquire or printing the Kansas Demand for Payment of an Open Account by Creditor from the assistance.

If you currently have a US Legal Forms accounts, you can log in and click the Acquire key. Next, you can total, edit, printing, or signal the Kansas Demand for Payment of an Open Account by Creditor. Each and every lawful papers design you buy is your own property for a long time. To obtain yet another duplicate for any obtained kind, check out the My Forms tab and click the related key.

If you use the US Legal Forms site the first time, follow the straightforward directions below:

- Initial, be sure that you have selected the right papers design for your region/city of your choosing. Browse the kind explanation to ensure you have picked out the correct kind. If offered, use the Review key to search through the papers design as well.

- In order to discover yet another version of your kind, use the Lookup industry to find the design that meets your requirements and demands.

- Upon having located the design you want, click on Get now to move forward.

- Select the costs prepare you want, type your accreditations, and register for a free account on US Legal Forms.

- Total the financial transaction. You can use your bank card or PayPal accounts to fund the lawful kind.

- Select the format of your papers and acquire it to your system.

- Make modifications to your papers if possible. You are able to total, edit and signal and printing Kansas Demand for Payment of an Open Account by Creditor.

Acquire and printing 1000s of papers themes making use of the US Legal Forms site, that offers the biggest assortment of lawful kinds. Use specialist and status-particular themes to deal with your small business or specific needs.

Form popularity

FAQ

Medical Debt Statute of Limitations StateStatute of LimitationsKansas5 YearsKentucky10 YearsLouisiana10 YearsMaine6 Years45 more rows ?

When your available balance isn't enough to pay for an item and the bank elects to pay it anyway, that's an overdraft. And you may be charged a $29 fee for each overdraft.

Written agreements, promissory notes, or contracts have a statute of limitations period of five (5) years in Kansas. Implied, non-written, or expressed obligations or liabilities have a statute of limitations period of no more than three (3) years in the state of Kansas.

NSF fees are capped by state laws, which typically range from $20 to $40 per transaction.

Pursuant to Kansas law, you may require a fee of up to $30 for each check that is returned. The added fee must be paid, along with the full amount of the check, within seven days of receiving notice of the returned check.

FDCPA ? Fair Debt Collection Practices Act Prohibits third-party debt collectors from employing deceptive or abusive conduct in the collection of consumer debts incurred for personal, family or household purposes. This Act does not pertain to financial institutions that collect debt that they originated.

The bank sends the customer a message indicating that a check has been returned unpaid "due to non-sufficient funds" in the account. Depending on the bank, this fee can be between $25 and $40 for each bad check.

Because banks don't want you to overdraw your account, NSF fees are quite high?most Canadian financial institutions charge around $45 per transaction.