Kansas Letter to Foreclosure Attorney - Payment Dispute

Description

How to fill out Letter To Foreclosure Attorney - Payment Dispute?

You may commit hrs on the web looking for the authorized record template that fits the state and federal demands you want. US Legal Forms supplies a huge number of authorized varieties that happen to be reviewed by pros. It is possible to download or printing the Kansas Letter to Foreclosure Attorney - Payment Dispute from my support.

If you have a US Legal Forms profile, you may log in and then click the Download switch. After that, you may complete, change, printing, or indication the Kansas Letter to Foreclosure Attorney - Payment Dispute. Each authorized record template you purchase is the one you have for a long time. To obtain an additional copy for any purchased form, check out the My Forms tab and then click the corresponding switch.

If you use the US Legal Forms website for the first time, stick to the straightforward instructions beneath:

- Initially, make sure that you have selected the right record template to the state/metropolis of your choosing. Read the form explanation to make sure you have picked the right form. If available, make use of the Preview switch to appear from the record template at the same time.

- In order to get an additional version in the form, make use of the Lookup area to find the template that suits you and demands.

- Upon having discovered the template you want, click Get now to proceed.

- Choose the prices program you want, key in your accreditations, and sign up for a merchant account on US Legal Forms.

- Complete the deal. You may use your Visa or Mastercard or PayPal profile to purchase the authorized form.

- Choose the format in the record and download it to the system.

- Make alterations to the record if necessary. You may complete, change and indication and printing Kansas Letter to Foreclosure Attorney - Payment Dispute.

Download and printing a huge number of record themes utilizing the US Legal Forms web site, which provides the most important selection of authorized varieties. Use specialist and status-certain themes to tackle your business or individual demands.

Form popularity

FAQ

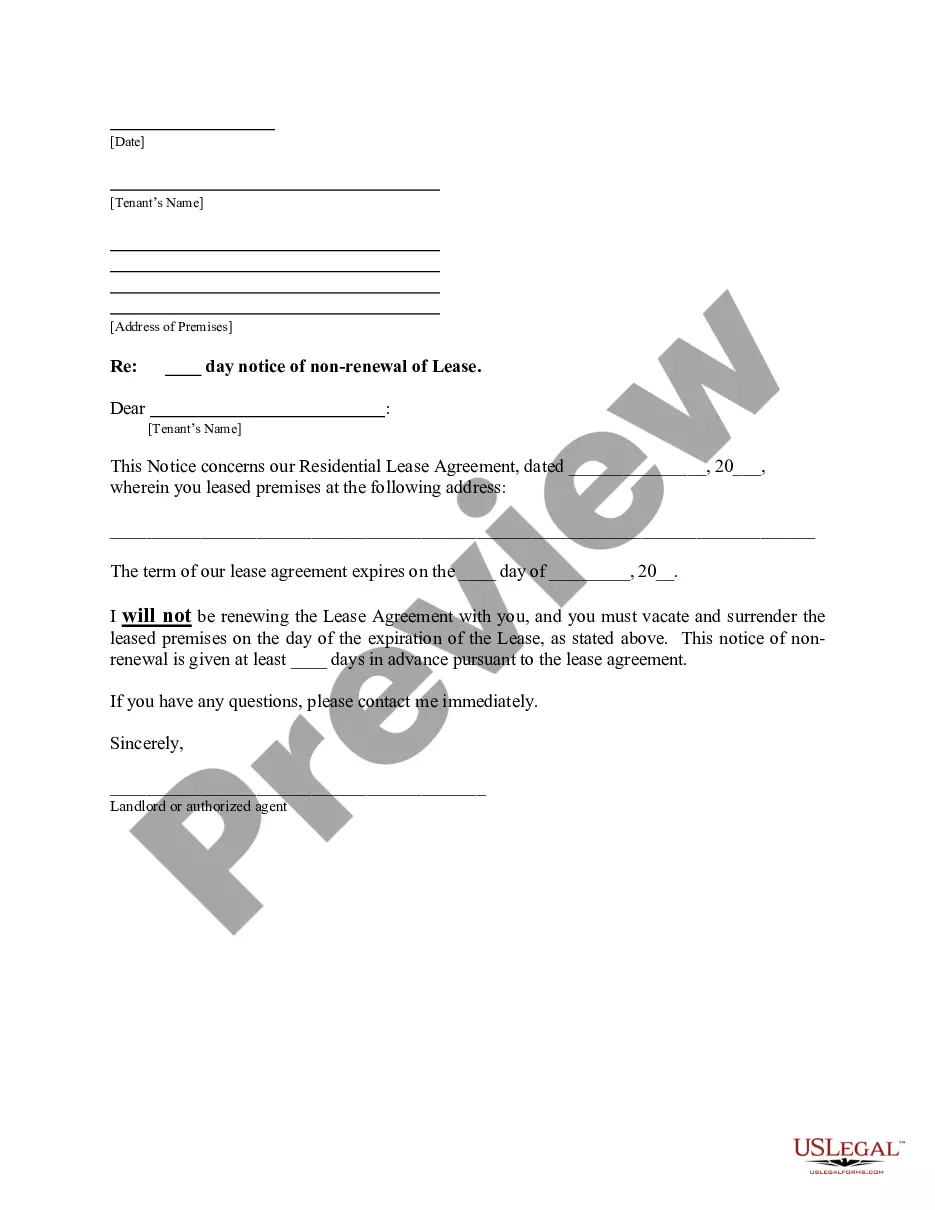

In Kansas, lenders may foreclose on a mortgage in default by using the judicial foreclosure process. The judicial process of foreclosure, which involves filing a lawsuit to obtain a court order to foreclose, is used when no power of sale is present in the mortgage or deed of trust.

Judicial States: Connecticut, Delaware, Florida, Hawaii, Illinois, Indiana, Iowa, Kansas, Kentucky, Louisiana, Maine, New Jersey, New Mexico, New York, North Dakota, Ohio, Oklahoma, Pennsylvania, South Carolina, Vermont, and Wisconsin.

Redemption period 3-12 months 3 months if less than 1/3 of the first mortgage indebtedness has been paid - 12 months if less than 1/3 of the first mortgage indebtedness is still due and owing. The period for mortgage balances in between is left up to the court to establish.

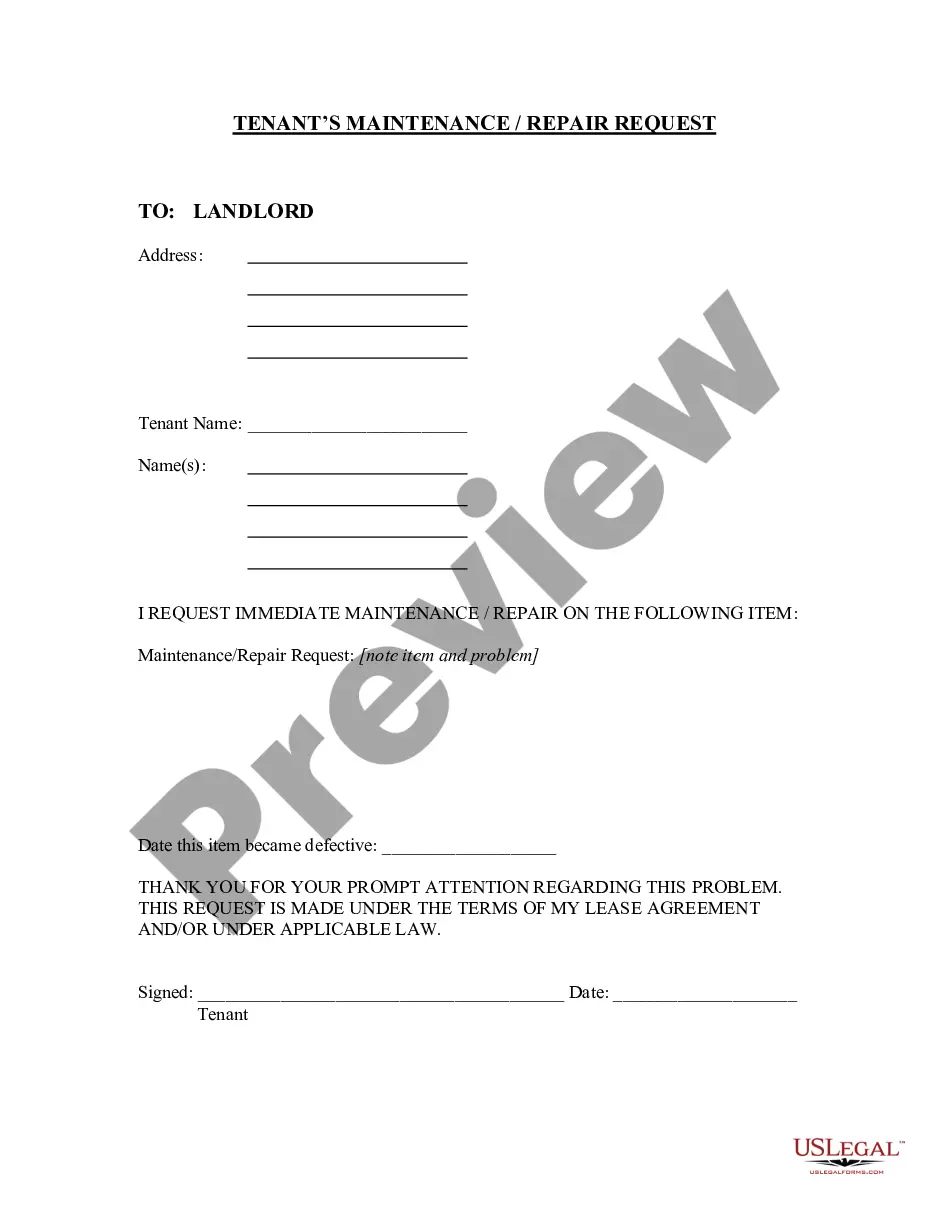

Put your name, address, phone number, loan number, and date on the top of the letter. List the name and address of your lender. information about any money you have saved for a workout agreement. Tell the lender you are working with a foreclosure counselor and include their name and agency.

Redeeming the Property One way to stop a foreclosure is by "redeeming" the property. To redeem, you have to pay off the full amount of the loan before the foreclosure sale.

Again, most residential foreclosures in Missouri are nonjudicial. Here's how the process works. The lender or trustee must: mail a foreclosure sale notice to you (the borrower) at least 20 days before the sale date and.

Redemption period 3-12 months 3 months if less than 1/3 of the first mortgage indebtedness has been paid - 12 months if less than 1/3 of the first mortgage indebtedness is still due and owing. The period for mortgage balances in between is left up to the court to establish.