Kansas Disclaimer of Right to Inherit or Inheritance - All Property from Estate or Trust

Description

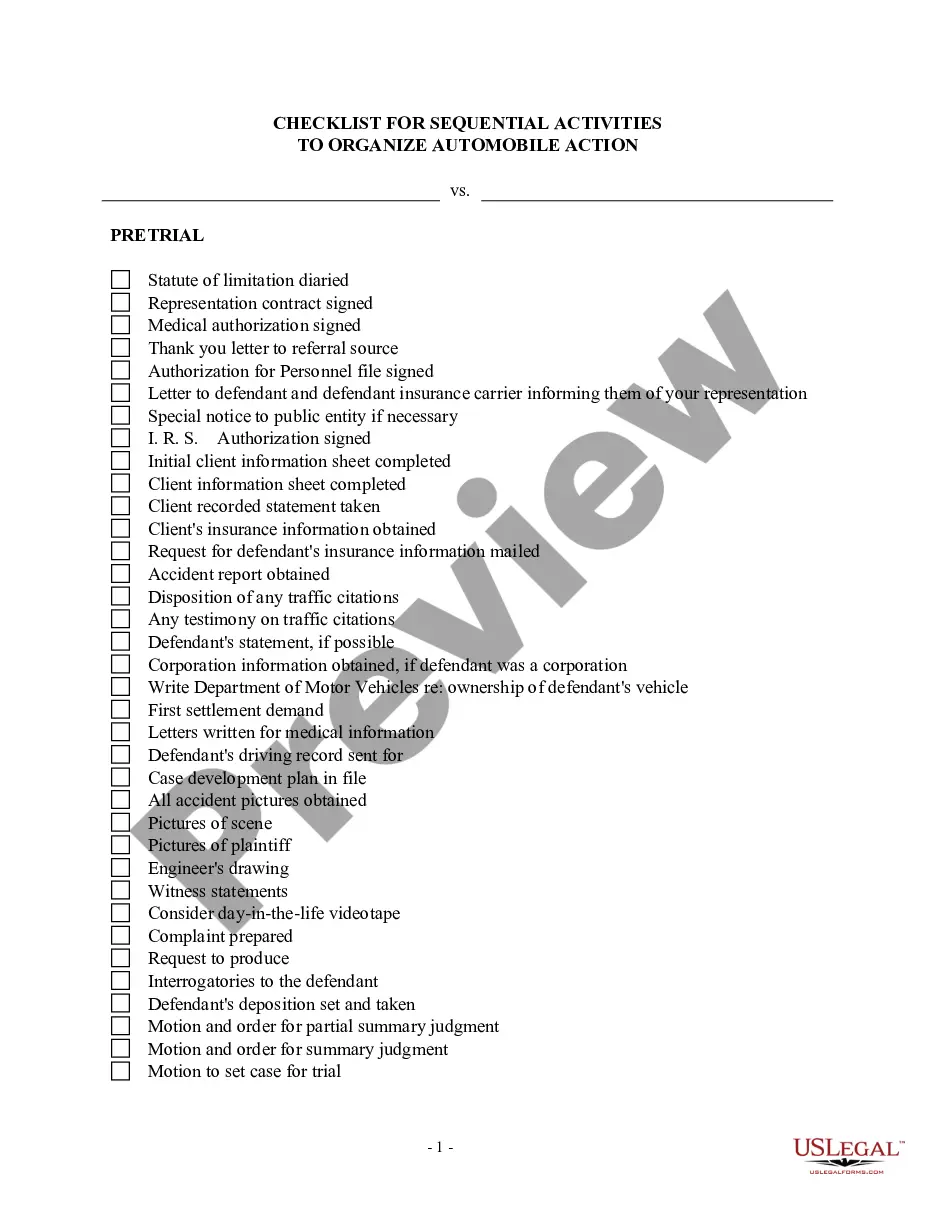

How to fill out Disclaimer Of Right To Inherit Or Inheritance - All Property From Estate Or Trust?

You are able to commit several hours on-line trying to find the legitimate record web template that suits the state and federal demands you want. US Legal Forms gives 1000s of legitimate kinds that are analyzed by experts. It is simple to obtain or print out the Kansas Disclaimer of Right to Inherit or Inheritance - All Property from Estate or Trust from my services.

If you already have a US Legal Forms account, it is possible to log in and then click the Acquire switch. Next, it is possible to total, change, print out, or indicator the Kansas Disclaimer of Right to Inherit or Inheritance - All Property from Estate or Trust. Each and every legitimate record web template you purchase is yours permanently. To get another duplicate of any acquired kind, visit the My Forms tab and then click the corresponding switch.

Should you use the US Legal Forms web site the very first time, keep to the straightforward guidelines under:

- Very first, be sure that you have chosen the right record web template for the region/town of your choosing. Look at the kind outline to ensure you have selected the correct kind. If readily available, use the Review switch to look throughout the record web template at the same time.

- If you wish to get another edition in the kind, use the Search industry to obtain the web template that meets your requirements and demands.

- When you have found the web template you would like, click Purchase now to proceed.

- Choose the prices prepare you would like, type your references, and register for an account on US Legal Forms.

- Total the purchase. You can use your Visa or Mastercard or PayPal account to fund the legitimate kind.

- Choose the format in the record and obtain it to the gadget.

- Make modifications to the record if necessary. You are able to total, change and indicator and print out Kansas Disclaimer of Right to Inherit or Inheritance - All Property from Estate or Trust.

Acquire and print out 1000s of record layouts using the US Legal Forms Internet site, which offers the biggest variety of legitimate kinds. Use skilled and status-specific layouts to take on your organization or specific requires.

Form popularity

FAQ

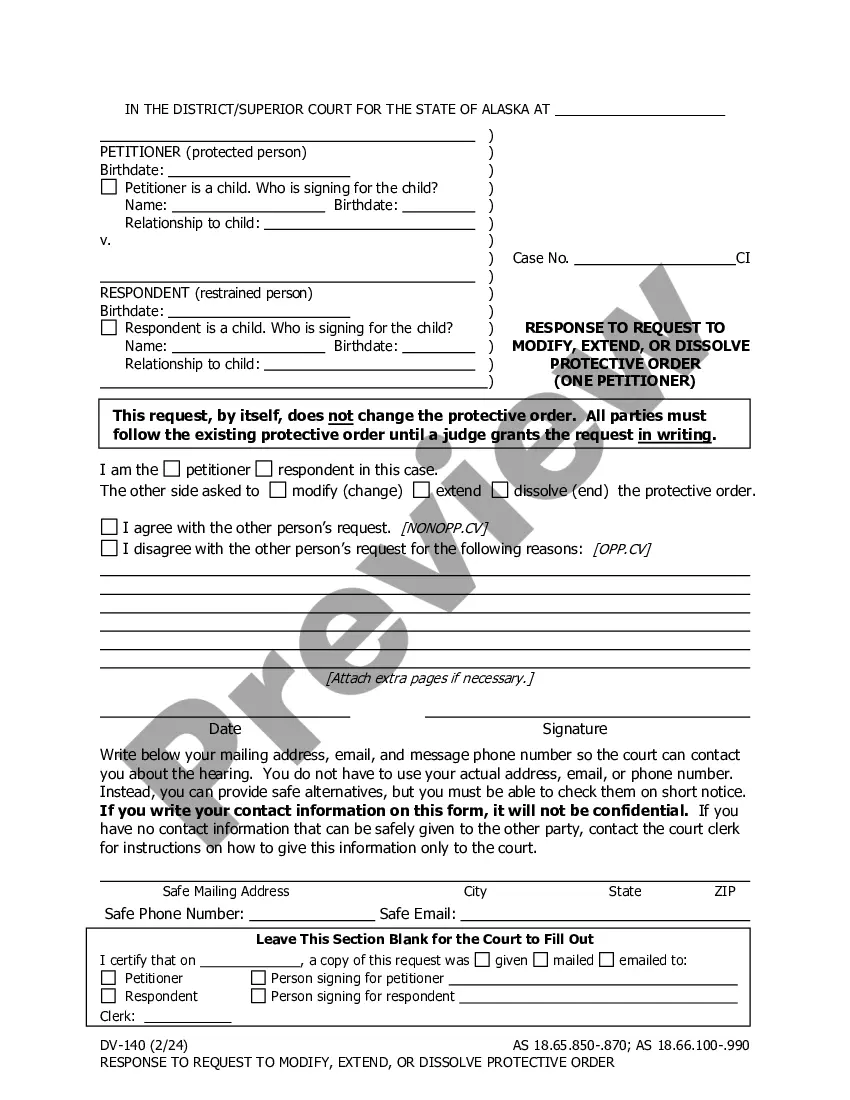

The disclaimer must be in writing: A signed letter by the person doing the disclaiming, identifying the decedent, describing the asset to be disclaimed, and the extent and amount, percentage or dollar amount, to be disclaimed, must be delivered to the person in control of the estate or asset, such as an executor, ...

Estate Tax Qualified Disclaimer A disclaimer must be in writing. The disclaimer must be given to the estate's representative no later than nine months after the decedent's death. The disclaiming person cannot accept the asset or any benefit from the asset.

The information that must be reported on an inheritance disclaimer form includes the name of the person disclaiming the inheritance, the name of the person or entity receiving the inheritance, the relationship of the person disclaiming the inheritance to the deceased, the date of death of the deceased, a description of ...

(d) A disclaimer when filed and recorded or a written waiver of the right to disclaim shall be final, and the disclaimer or waiver cannot be revoked and shall be binding upon the disclaimant or person waiving, the personal representative of the disclaimant or person waiving and all parties claiming the right to ...

For example, if the deceased had significant credit card debt or outstanding medical bills, these debts may be passed on to the beneficiary. In this scenario, it may make sense for the beneficiary to disclaim the inheritance and avoid taking on these financial obligations.

It is an action taken by the beneficiary of an estate or trust to formally give up their right to receive or take a beneficial interest in an asset (or assets) to which they would otherwise be entitled from an estate or trust. A beneficiary can disclaim all or a portion of anything they are earmarked to receive.

Common reasons for disclaiming an inheritance include not wishing to pay taxes on the assets or ensuring that the inheritance goes to another beneficiary?for example, a grandchild. Specific IRS requirements must be followed in order for a disclaimer to be qualified under federal law.

One way for an asset to avoid gift tax liability is if it is a qualified disclaimed gift. The government does not consider a gift or inheritance to be a gift, and it subject to the gift tax if the original recipient refused or disclaimed it.