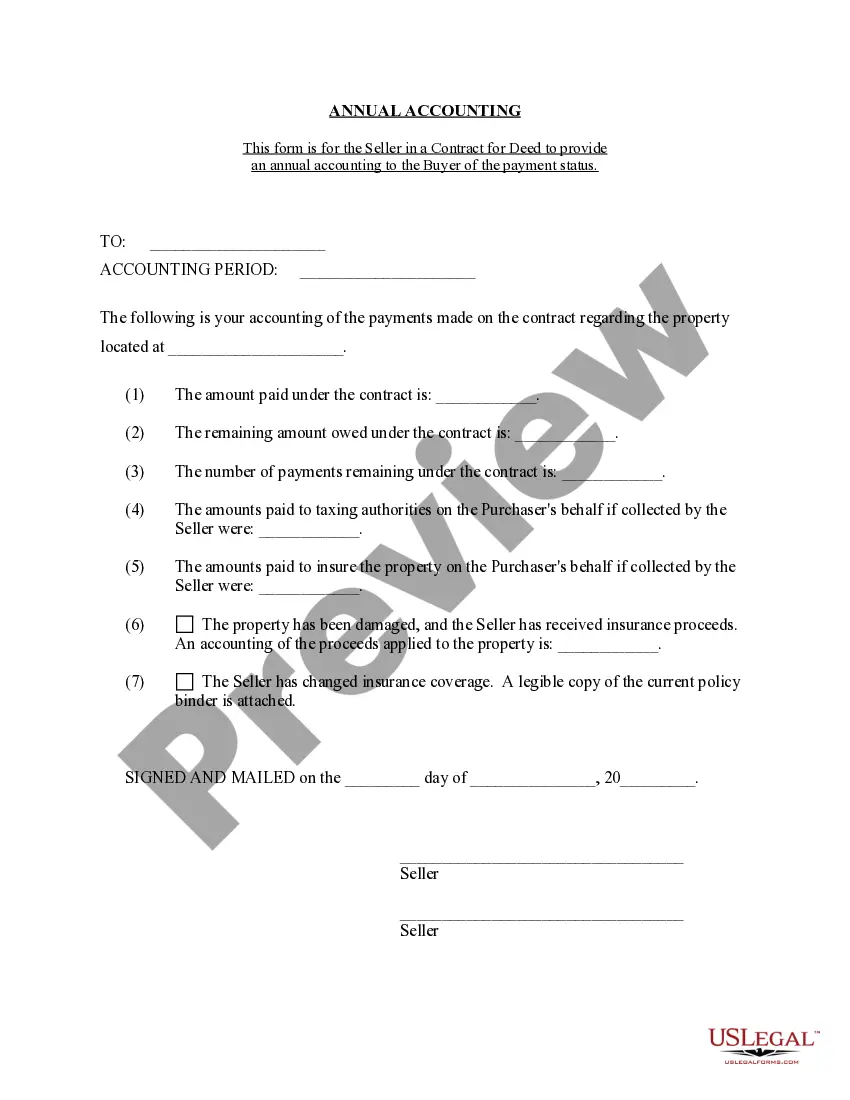

Closed-end transactions involve a fixed amount to be paid back over a period of time such as a note or a retail installment contract.

The Kansas General Disclosures Required By The Federal Truth In Lending Act — Retail InstallmenContractac— - Closed End Disclosures refer to the specific information that must be disclosed to consumers in Kansas when entering into a retail installment contract for a closed-end loan. These disclosures ensure transparency and enable consumers to make informed decisions when borrowing money. Under the Federal Truth in Lending Act (TILL), lenders are obliged to provide specific disclosures to protect consumers from hidden fees, predatory lending practices, and unfair contract terms. The TILL applies to various types of credit transactions, including retail installment contracts for closed-end loans in Kansas. The following are some key general disclosures required by the TILL when entering into a retail installment contract in Kansas: 1. Amount Financed: This disclosure reveals the total amount being borrowed or financed. 2. Finance Charge: The finance charge represents the total cost of credit expressed as a dollar amount. It includes interest, fees, and other charges associated with the loan. 3. Annual Percentage Rate (APR): The APR is a percentage that represents the cost of credit on an annual basis. It includes the interest rate and certain lender fees. The APR helps consumers compare the costs of different loans. 4. Total of Payments: This disclosure illustrates the overall amount the borrower will have paid by the end of the loan term, including the principal amount borrowed and the finance charges. 5. Payment Schedule: The payment schedule outlines the frequency of payments and the total number of payments due over the loan term. 6. Prepayment Penalty: If applicable, this disclosure states whether there is a penalty for repaying the loan before the scheduled term. 7. Late Payment Penalties: If applicable, this disclosure notifies the borrower of any penalties or fees imposed for late payments. 8. Right to Rescind: In certain situations, consumers have the right to cancel the contract within a specified number of days after signing it. This disclosure advises borrowers of this right. It is important to note that these general disclosures may vary slightly depending on the specific terms of the loan and any additional state-mandated requirements. Kansas may also have additional specific disclosures that lenders must provide to consumers when entering into retail installment contracts. By providing these comprehensive disclosures, the Kansas General Disclosures Required By The Federal Truth In Lending Act ensures transparency and protects consumers from misleading or predatory lending practices. It allows borrowers to compare loan offers, understand the total cost of credit, and make informed financial decisions.