Kansas Affidavit of Domicile for Stock Transer

Description

How to fill out Affidavit Of Domicile For Stock Transer?

You may spend hours on the web looking for the authorized file web template that meets the federal and state needs you want. US Legal Forms gives thousands of authorized kinds that are reviewed by experts. It is possible to obtain or print the Kansas Affidavit of Domicile for Stock Transer from the services.

If you already possess a US Legal Forms account, you may log in and click on the Download switch. After that, you may complete, modify, print, or sign the Kansas Affidavit of Domicile for Stock Transer. Each and every authorized file web template you acquire is your own forever. To get an additional backup of any acquired form, go to the My Forms tab and click on the related switch.

If you use the US Legal Forms website the very first time, stick to the straightforward recommendations below:

- Initial, ensure that you have chosen the proper file web template for that state/city of your liking. See the form outline to ensure you have selected the right form. If available, make use of the Preview switch to appear from the file web template as well.

- If you would like find an additional version from the form, make use of the Search field to get the web template that meets your requirements and needs.

- After you have discovered the web template you would like, simply click Purchase now to continue.

- Select the pricing plan you would like, key in your qualifications, and sign up for a merchant account on US Legal Forms.

- Complete the transaction. You may use your Visa or Mastercard or PayPal account to cover the authorized form.

- Select the format from the file and obtain it to the system.

- Make adjustments to the file if necessary. You may complete, modify and sign and print Kansas Affidavit of Domicile for Stock Transer.

Download and print thousands of file templates while using US Legal Forms Internet site, which offers the greatest variety of authorized kinds. Use professional and state-specific templates to handle your small business or specific requirements.

Form popularity

FAQ

The order of priority outlined in the succession laws states that parents come first in line after the spouse/children. If there are siblings but no surviving parents, the siblings inherit the entire estate. Half-siblings are entitled to the same share of an estate as any other sibling.

Filing must happen within 6 months after the date of death. Persons having knowledge and access to a will may offer it for probate at any time within the 6 months following the death.

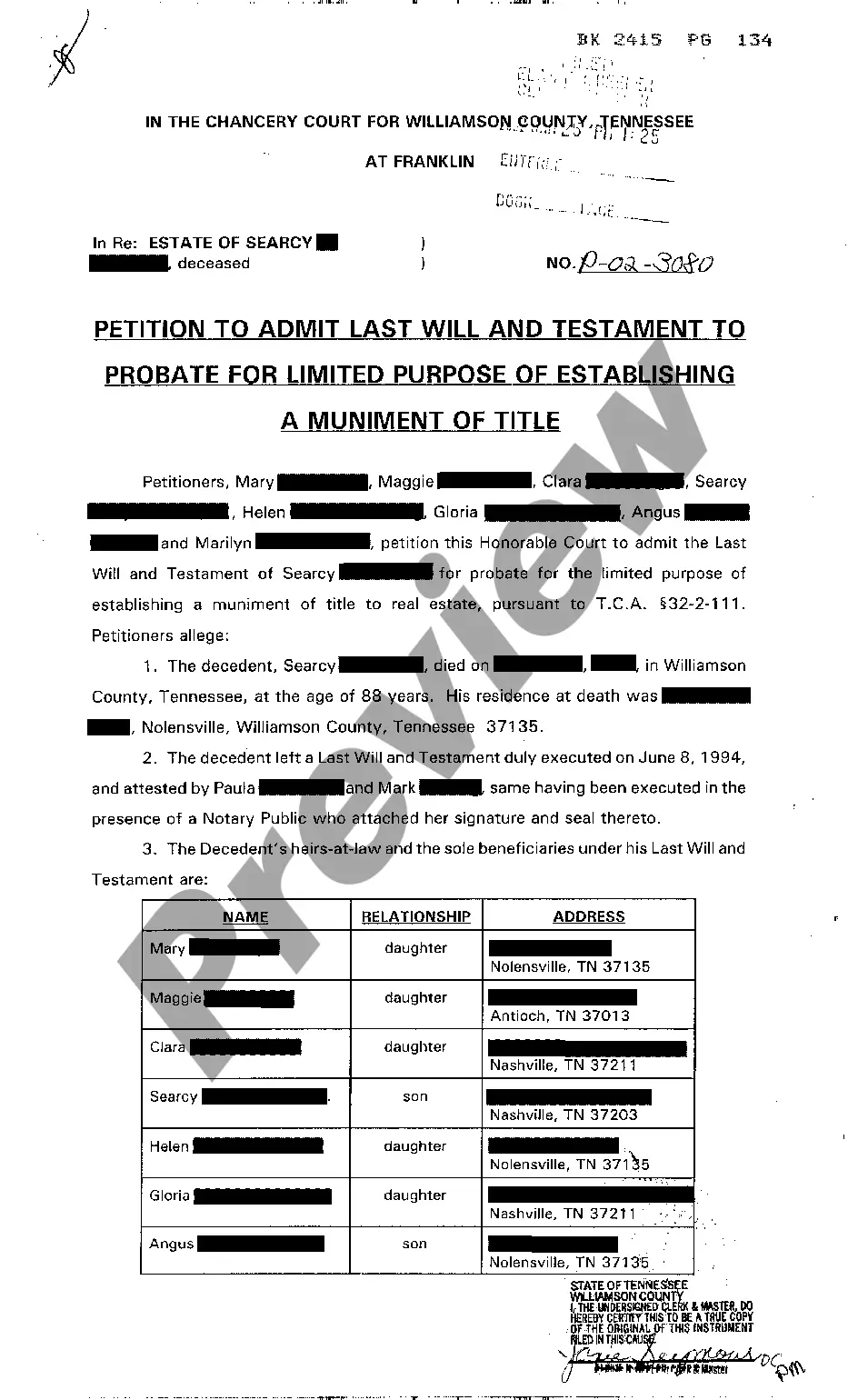

An Affidavit of Domicile is a legal document that you can use to verify the home address of a person who has died. As the executor or administrator of an estate, you are required to produce an Affidavit of Domicile when transferring or cashing in stocks or other investment assets of a deceased person.

This affidavit may be used to obtain the transfer, to a decedent's successor in interest, of certain personal property that would be transferrable to the decedent, without obtaining letters of administration or letters testamentary, where the total value of the estate subject to probate does not exceed $40,000.

An Affidavit of Heirship is a legal document used to establish the heirs of a deceased person and their respective interests in the deceased person's estate when there is no will or when there are uncertainties about the heirs.

Florida Statute §222.17 states that a person can show intent to maintain a Florida residence as a permanent home by filing a sworn Declaration of Domicile with the Clerk of the Courts. You can submit the form with all the requirements by mail or in person at Miami-Dade County Courthouse East.

KS Form 31, which may also referred to as Affidavit Of Death And Heirship, is a probate form in Kansas. It is used by executors, personal representatives, trustees, guardians & other related parties during the probate & estate settlement process.

Knowing where the decedent's domicile (where the decedent had his or her primary residence) was at date of death is key when figuring out where you must probate the assets and what state you must pay taxes to (although real estate is subject to state estate or inheritance tax, if any, in the state in which it's located ...