Sometimes, a prior demand by a potential plaintiff for an accounting, and a refusal by the fiduciary to account, are conditions precedent to the bringing of an action for an accounting. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Kansas Demand for Accounting from a Fiduciary

Description

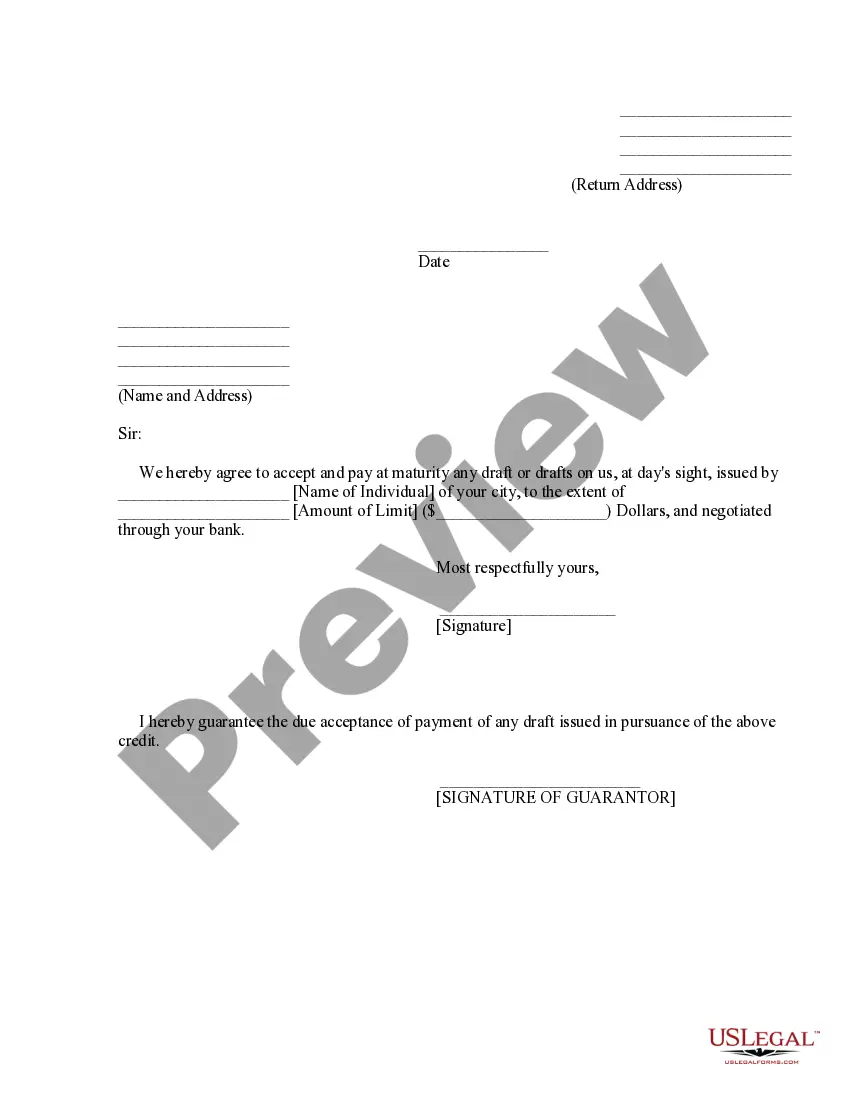

How to fill out Demand For Accounting From A Fiduciary?

Selecting the appropriate legal document template can be a challenge. Clearly, there is an array of templates available online, but how do you locate the legal form you require? Utilize the US Legal Forms website. Their service offers a vast selection of templates, such as the Kansas Demand for Accounting from a Fiduciary, which caters to both business and personal needs. All forms are reviewed by experts and comply with state and federal regulations.

If you are already registered, Log In to your account and click the Acquire button to locate the Kansas Demand for Accounting from a Fiduciary. Use your account to search for the legal forms you may have purchased previously. Navigate to the My documents section of your account to download another copy of the document you need.

If you are a new user of US Legal Forms, here are simple instructions for you to follow: First, ensure you have selected the correct form for your city/state. You can preview the form by using the Review option and read the form summary to confirm that it meets your requirements. If the form does not satisfy your needs, use the Search feature to find the appropriate form. Once you are confident the form is correct, click the Buy now button to purchase the form.

US Legal Forms is the premier repository of legal documents where you can find a variety of document templates. Use the service to acquire well-crafted paperwork that adheres to state regulations.

- Choose the pricing plan that suits you and provide the required information.

- Create your account and complete the transaction using your PayPal account or credit card.

- Select the file format and download the legal document template to your device.

- Fill out, modify, print, and sign the downloaded Kansas Demand for Accounting from a Fiduciary.

Form popularity

FAQ

Kansas does not automatically grant extensions; however, it accepts federal extensions that you may apply for. If you are a fiduciary needing more time, it's important to file for a federal extension to avoid penalties. This is particularly relevant when preparing for a Kansas Demand for Accounting from a Fiduciary, as ensuring your financial records are in order is key. Make sure to stay informed about your responsibilities to avoid complications.

The fiduciary extension in Kansas allows fiduciaries additional time to fulfill their tax obligations. Generally, fiduciaries can request this extension through the IRS, which is accepted at the state level. This is beneficial when managing a Kansas Demand for Accounting from a Fiduciary, as it provides more time to ensure accuracy and compliance. Always be mindful of deadlines once the extension expires.

Yes, Kansas follows federal extension guidelines, allowing fiduciaries and individuals to extend their filing deadlines. With a federal extension, you gain additional time to prepare your taxes without facing immediate penalties. This is particularly helpful when dealing with complex financial matters related to a Kansas Demand for Accounting from a Fiduciary. Always check for the most current regulations to ensure compliance.

The fiduciary duty of accounting requires fiduciaries to provide a complete and accurate account of their financial management. This includes reporting income, expenses, and distributions to beneficiaries. If you are a beneficiary, understanding this duty is vital, especially when considering a Kansas Demand for Accounting from a Fiduciary. Transparency ensures trust and can help in resolving disputes.

Yes, Kansas does accept federal extensions for trusts. If you're managing a trust and need more time to file taxes, you can use the federal extension to avoid late penalties. This is particularly valuable when preparing a Kansas Demand for Accounting from a Fiduciary. Always ensure you stay updated on the latest regulations to maintain compliance.

In Kansas, the statute of limitations for breach of fiduciary duty is generally two years from the date the breach was discovered or should have been discovered. This timeline is crucial for anyone considering a Kansas Demand for Accounting from a Fiduciary. If you suspect a breach, it’s important to act swiftly to protect your rights. Consulting with a legal expert can provide guidance tailored to your situation.

Yes, if you are a fiduciary responsible for a trust or estate that generates income in Kansas, you typically need to file a Kansas return. This ensures compliance with state tax laws and protects you from potential legal issues. Addressing these returns is vital when fulfilling a Kansas Demand for Accounting from a Fiduciary, making it essential to stay informed.

The filing requirement for a fiduciary return typically arises when the estate or trust has sufficient income that necessitates reporting under IRS guidelines. Generally, if the income reaches $600, the fiduciary must file. Being aware of these requirements can help you meet the needs highlighted in a Kansas Demand for Accounting from a Fiduciary.

Form 1041 must be filed by estates and trusts that have generated income of $600 or more during the tax year. Additionally, any trust with a beneficiary who is a non-resident alien must also file this form. Understanding this requirement is essential for managing your obligations under the Kansas Demand for Accounting from a Fiduciary.

Fiduciary accounting income includes various sources such as interest earned, dividends received, rental income, and capital gains. It may also include other earnings specified under applicable laws. Ensuring you accurately report these elements is vital when responding to a Kansas Demand for Accounting from a Fiduciary.