Kansas Assignment and Transfer of Stock

Description

How to fill out Assignment And Transfer Of Stock?

US Legal Forms - one of the largest collections of legal documents in the USA - provides a variety of legal document templates that you can download or create.

Using the website, you can access thousands of forms for business and personal use, organized by categories, states, or keywords.

You can find the most recent versions of forms such as the Kansas Assignment and Transfer of Stock in moments.

If the form does not meet your requirements, use the Search field at the top of the screen to find the one that does.

If you are satisfied with the form, confirm your choice by clicking the Purchase now button. Then, select the pricing plan you prefer and provide your details to register for an account.

- If you already hold a subscription, Log In to obtain the Kansas Assignment and Transfer of Stock from the US Legal Forms library.

- The Download button will display on every form you view.

- You can access all previously acquired forms in the My documents section of your account.

- To utilize US Legal Forms for the first time, follow these simple instructions:

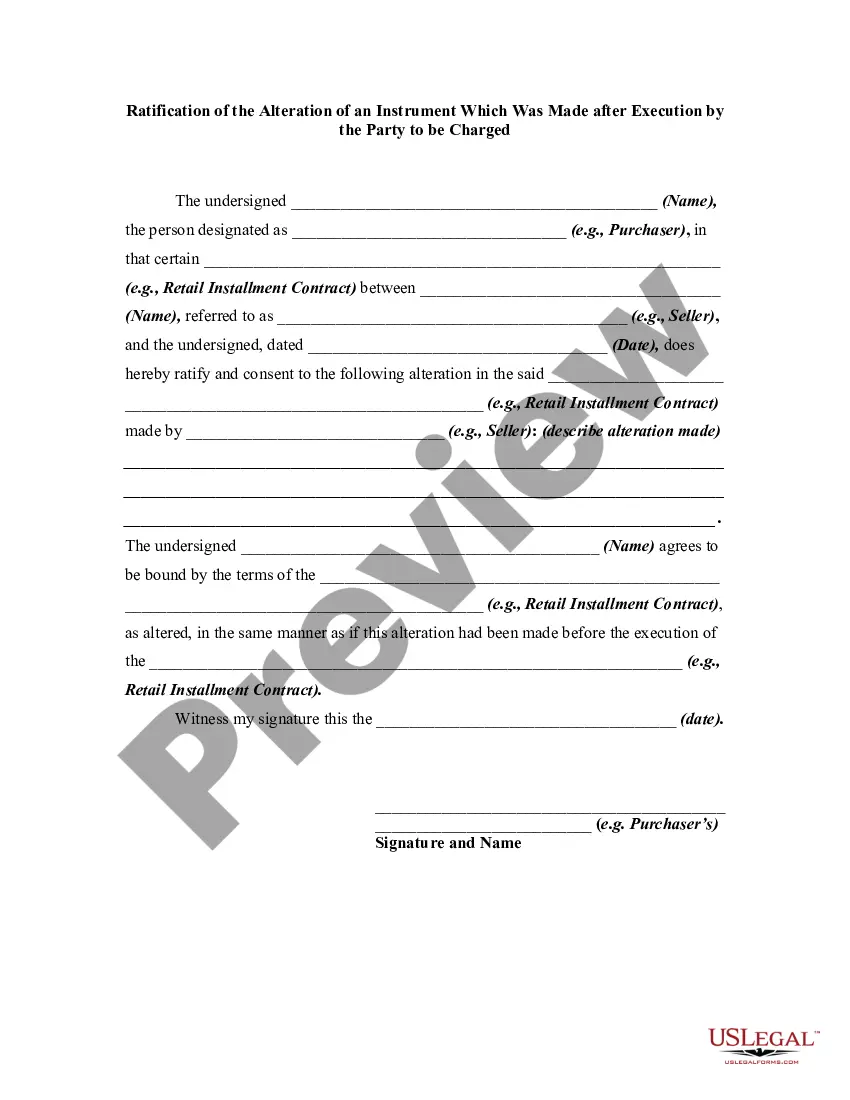

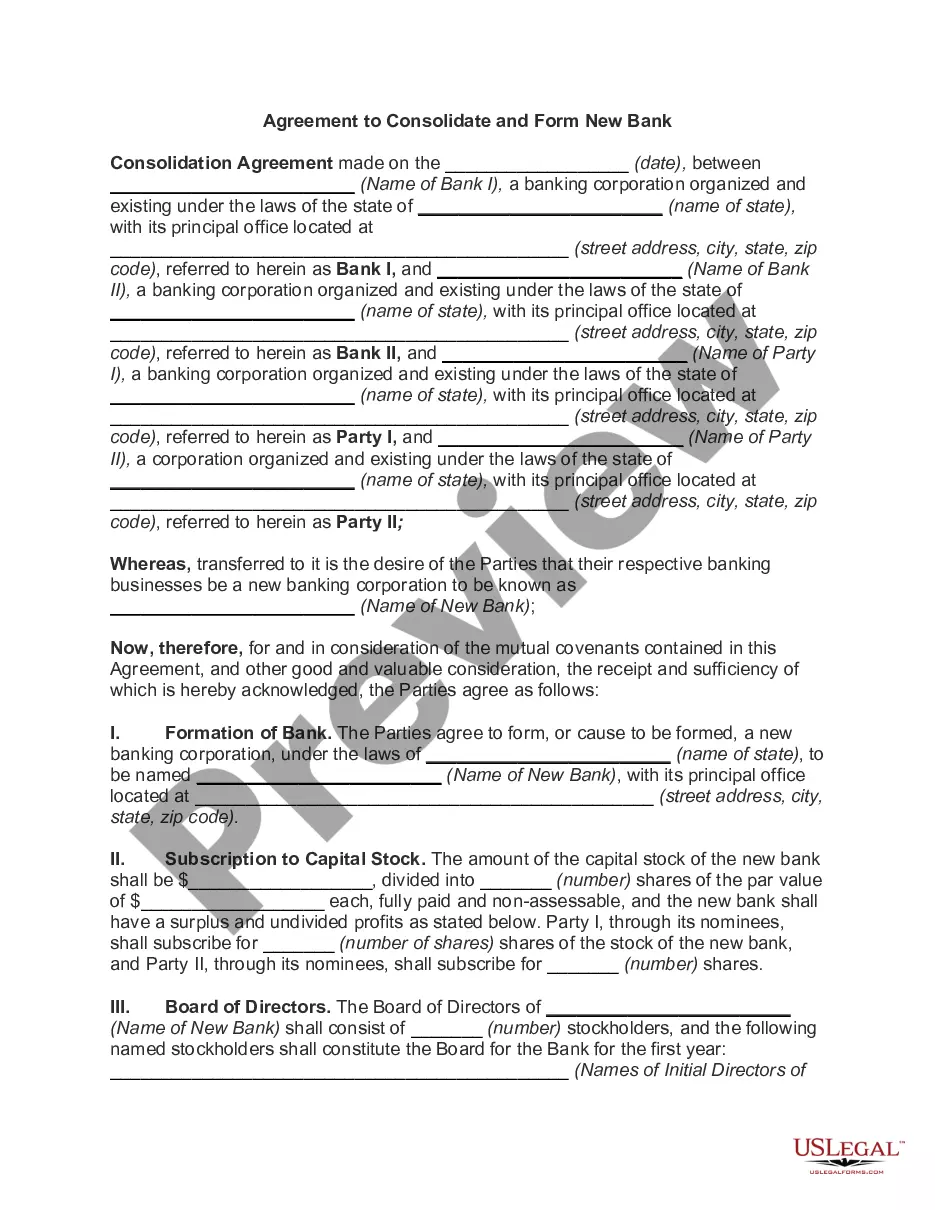

- Ensure you have selected the appropriate form for your city/state. Click the Preview button to review the form's contents.

- Check the form summary to confirm you have selected the correct form.

Form popularity

FAQ

Yes, an assignment is indeed a type of transfer of rights. Specifically, it conveys the entire set of rights from one party to another, as outlined in the Kansas Assignment and Transfer of Stock feature. This distinction is important for anyone involved in legal agreements, as it defines the nature and scope of the rights being transferred.

The Kansas Assignment and Transfer of Stock feature highlights that assignment is the process in which rights are permanently given to another party, typically conveyed through a written agreement. On the other hand, a transfer usually refers to the temporary conveyance of rights, allowing the original party to maintain some control. Grasping these concepts can enhance your understanding of your legal rights.

When it comes to copyright, the Kansas Assignment and Transfer of Stock helps illustrate that a copyright transfer permanently relinquishes ownership of the copyright, whereas an assignment typically grants specific rights to another entity while retaining ownership. Understanding these terms is vital for ensuring the proper protection and use of your creative works.

In the context of intellectual property, the Kansas Assignment and Transfer of Stock feature clarifies that an assignment relinquishes ownership of IP rights to another party, effectively transferring all legal rights. Conversely, a transfer generally allows the original owner to retain some rights while transferring control. Being informed about these distinctions can support better management of your intellectual assets.

The Kansas Assignment and Transfer of Stock feature allows you to understand the nuances between lease assignment and transfer. A lease assignment involves transferring your lease rights to a new tenant, while a lease transfer typically refers to the process where both rights and obligations shift to another party. It’s crucial to comprehend these differences when managing any contractual agreements to avoid future disputes.

Transferring ownership of an LLC in Kansas involves several steps, including checking the operating agreement for any specific procedures, filing the necessary forms, and securing the consent of any members. It’s advisable to ensure all documentation, such as consent and assignment of membership interests, is in place. Utilizing platforms like US Legal Forms can simplify this process, providing templates and guidance tailored for Kansas Assignment and Transfer of Stock to ensure you're compliant with state laws.

The key difference lies in the nature of ownership transfer. An assignment allows rights to be shared while preserving ownership, while a transfer involves relinquishing ownership entirely. In the context of Kansas Assignment and Transfer of Stock, grasping this difference is essential for making informed legal choices and ensuring compliance with relevant regulations.

The assignment of shares refers to the process where a shareholder passes their rights to another individual or entity without transferring actual ownership. This process is significant, particularly in Kansas Assignment and Transfer of Stock, as it allows flexibility in managing shares while retaining original ownership. Understanding this concept can support strategic decision-making for shareholders.

A deed of assignment and transfer of shares is a legal document that formalizes the exchange of shares or rights in stock. It includes pertinent information such as the parties involved, share details, and the nature of the assignment. Utilizing this deed is crucial in Kansas Assignment and Transfer of Stock to ensure legitimacy and adherence to legal standards in stock transactions.

No, an assignment is not necessarily a transfer of ownership. Specifically, in the realm of Kansas Assignment and Transfer of Stock, an assignment grants rights to use or benefit from the shares without transferring full ownership. This understanding helps individuals make informed decisions about their share dealings and manage their rights effectively.